Receive free Media updates

We’ll send you a myFT Daily Digest email rounding up the latest Media news every morning.

Supplying the financial industry with data feeds, analytical tools, research and news is big business. Well, at least one of those is big.

The latest report from Burton Taylor estimates that the financial-information industry generated $37.3bn of revenues in 2022. Bloomberg and the London Stock Exchange’s Refinitiv dominated, together accounting for about two-thirds of total spending. The rest is controlled by a smattering of smaller companies like S&P Global and FactSet.

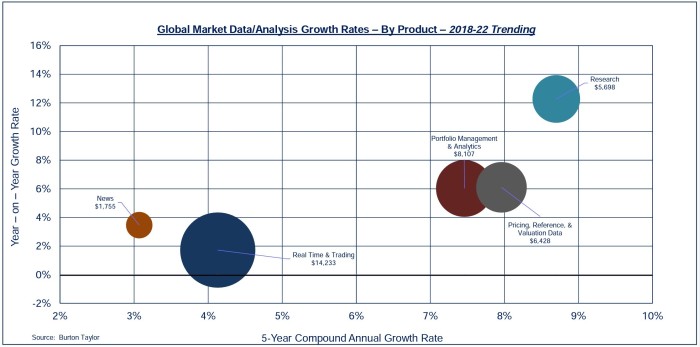

Most of the segments are growing at a respectable clip. Providing financial data and analytics makes for a steady (if unglamorous) career compared to actually working in the industry.

But there’s one big exception when it comes to size and growth:

In case you blinked and missed it, financial news only generated $1.7bn of revenues last year.

In other words: News has easily been the slowest-growing part of the broader industry over the past five years, despite all the attention it generates (find someone who loves you as much as journalists love writing about other journalists).

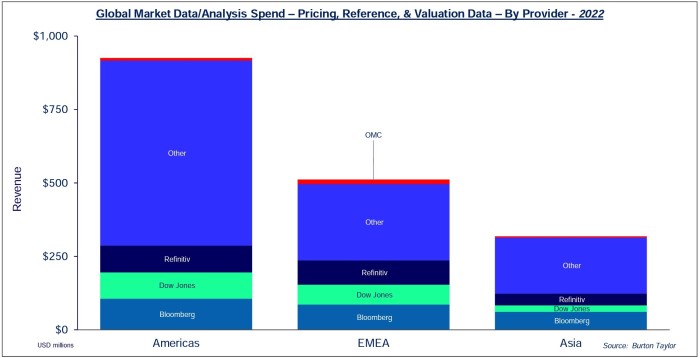

The news providers included in this data are primarily outlets like Bloomberg, Dow Jones and Refinitiv newswires, along with niche media like Argus. One bright spot is that the market for financial news is less concentrated than the broader financial-information industry, judging by Burton Taylor’s estimates (which it derives from talking with the mostly private companies, and are said to be pretty accurate).

That said — and perhaps we’re clutching at straws here — the Burton Taylor numbers probably underestimate the importance of news to these businesses.

For example, Bloomberg Media is said to generate about $500mn of revenues a year, but the value of its journalists is their ability to supply market-moving stories to its terminal. If Bloomberg News was shut down tomorrow it might not lose a single terminal sale immediately, but, like the clock function on your phone, it adds to the value of the overall package and you’d miss it if it was gone.

It’s probably a similar story elsewhere, especially at places like Argus Media, which provide benchmark and pricing data. News revenues are difficult to cleanly disaggregate. We hope.

And let’s face it, at least the financial news world is still growing, even at a sluggish pace. The rest of the news business is properly in the poop, sadly.

Further reading:

— Bloomberg is contemplating life without its founder