Receive free Mergers & Acquisitions updates

We’ll send you a myFT Daily Digest email rounding up the latest Mergers & Acquisitions news every morning.

Wachtell, Lipton, Rosen & Katz is known for its sky-high fees, and Wall Street has long been intrigued by the question of how the corporate law firm is structured. Thanks to Elon Musk’s litigiousness, we can now get a look.

The FT and others reported on Friday that Musk’s X Corp, the holding company for Twitter, sued Wachtell over its fee — now disclosed to be $90mn — for representing Twitter’s previous board.

Musk is unsurprisingly displeased with the firm as it sought to force the billionaire to close the $44bn deal last year. The complaint calls the fee “unconscionable”, and in effect claims Wachtell ripped off Twitter with the help of the exiting board.

But what’s most interesting is a series of documents from the 2022 dispute that provide a rare glimpse into how Wachtell does business.

Wachtell, which usually sits first or second in the American Lawyer Magazine’s average profit per partner rankings ($7.3mn in 2022), is known for paying its staff like bankers. That is, rather than simply billing by the hour, the firm charges a “success” fee from clients for a deal closed, or a lawsuit won.

As it happens, Wachtell references banker fees outright when negotiating its payouts.

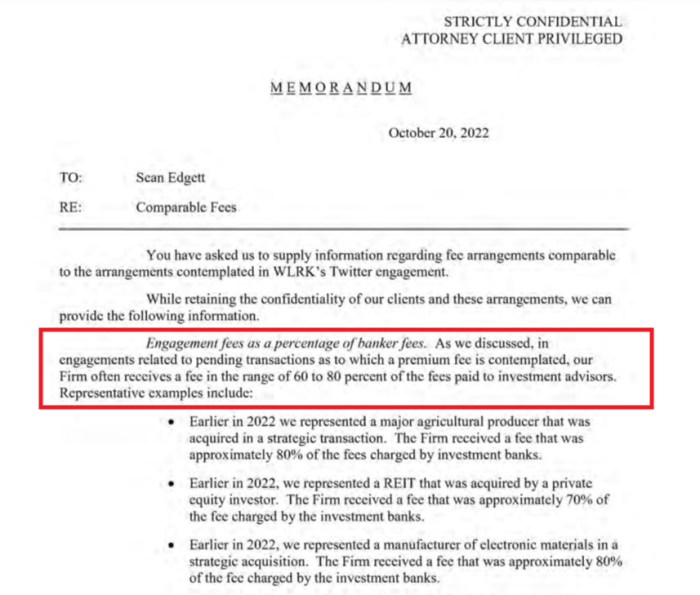

In late October, as Musk finally agreed to close the deal, Wachtell negotiated its success fee with Twitter’s management and board and shared this document showing comparables:

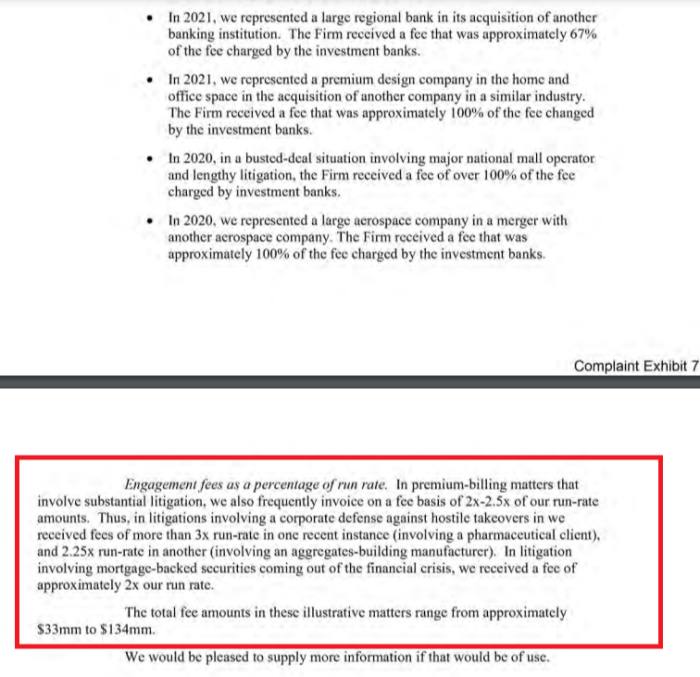

When a closed M&A transaction was not the relevant benchmark, the firm got double or triple its “run rate”, or a multiple of whatever hourly billings implied:

In the first ~4 months Wachtell had been engaged to fight Musk, it billed a total of $26.6mn worth of hours, according to the complaint. Based on that rate, for the final month of the case the total hours billed were on track to be around $35mn.

While the final fee was 2.5 times that amount, it did fit with the comps Wachtell shared. Twitter’s bankers JPMorgan and Goldman Sachs were paid $133mn together, including $113mn structured as a success fee paid only if the Musk buyout closed.

In other words: The $90mn total was 68 per cent of the bankers’ fees, in line with the 60 to 80 per cent it said it had historically charged.

There are some complicating circumstances, however. Wachtell’s fee comps cite M&A negotiations with subsequent deal litigations, but it was only involved in Twitter’s Delaware court fight, not the deal negotiation. (This led to Wachtell awkwardly sliding into the inboxes of Twitter’s lawyers last June in order to pitch its services).

While Wachtell will surely offer its side of the argument, we should note a couple of things. First, Musk has an ongoing habit of trying to avoid payments to workers, landlords and vendors. Second, company directors benefit from a “business judgment rule” that protects them from liability if they make careful decisions in good faith, regardless of the outcome of those decisions.

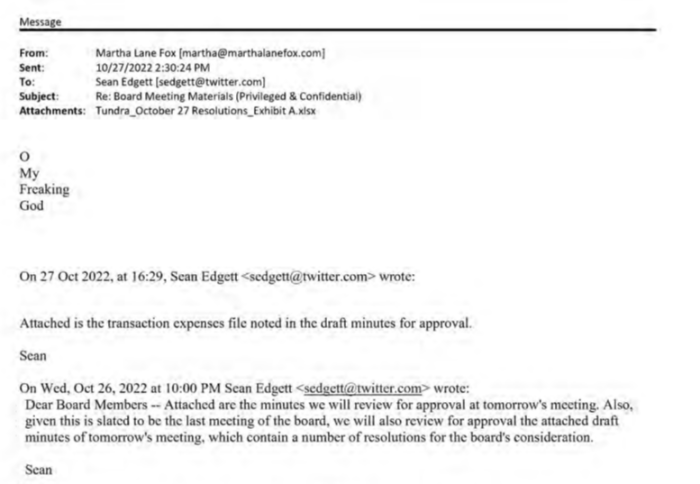

Multiple documents in the Musk-via-X Corp filing show the board’s deliberations in approving the Wachtell fee — that $90mn was $5mn less than what Wachtell had pencilled in — in the frenzied days prior to closing in late October.

One director was at least initially startled, though:

Of course, $90mn does seem like a lot, even for a case that required the attention of dozens of elite lawyers for 5 months.

In the complaint, Musk’s lawyers argue that Twitter was paying several other law firms for what they describe as a “relatively straightforward breach of contract dispute” where:

. . . there were not novel or difficult questions of law involved, nor did the litigation require any special skills beyond that which Twitter could have procured by paying hourly rates to many other reputable law firms with experience litigating in the Delaware Chancery Court, including those hired to work alongside Wachtell.

It’s an interesting argument, considering that if Musk had chosen to honour the deal he signed, there would have been no occasion to hire Wachtell in the first place.

And Wachtell has a sales pitch to back up its price: it is expensive, but its lawyers get results in must-win situations, and that makes them worth the premium. If the Twitter deal had been restruck and, instead of getting $54.20 per share, the price was cut to $35.00 per share, that would have cost Twitter shareholders $15bn.

And if the deal totally collapsed and Twitter’s shares fell to $20? Shareholders would have been out $26bn. $90mn could seem like a reasonable insurance policy, in retrospect.

Indeed, Musk himself must appreciate Wachtell’s work as much as anyone, after signing and then failing to back out of what appears to be a disaster of a deal.

Find the full filing here.

Further reading:

— FT profile of Bill Savitt, Wachtell’s lawyer representing previous Twitter board