When Gary Nagle became chief executive of Glencore two years ago, the world was still gripped by the Covid-19 pandemic, and the Swiss mining company had just signed a deal to expand its ownership of a giant thermal coal mine in Colombia, Cerrejón.

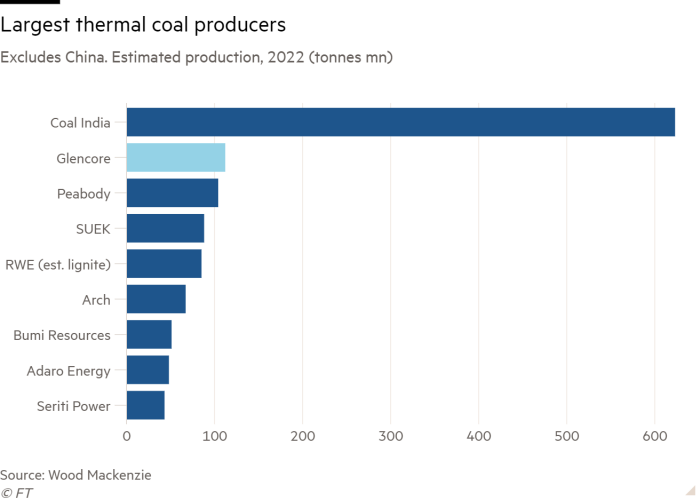

Nagle, who was 46 at the time, had previously run Glencore’s coal business, and the Cerrejón deal negotiated by his predecessor Ivan Glasenberg proved to be one of the most profitable mining deals of all time. Coal prices soared after Russia’s full-scale invasion of Ukraine, and in 2022 coal accounted for more than half of Glencore’s record profits.

But now Nagle, who cut his teeth in coal mining, may be about to do something that would have been unthinkable when he took office: spin off Glencore’s coal business. That would leave behind a sizeable metals mining, processing and trading business, with nickel, cobalt and copper mines stretching from Canada to the Congo.

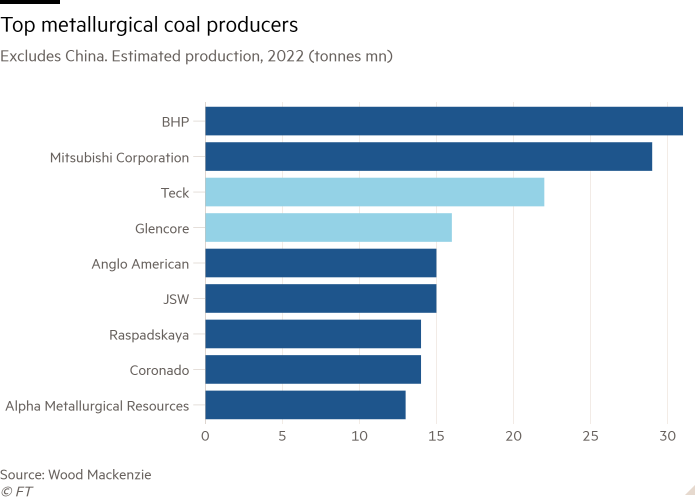

Under a proposal earlier this year, Glencore offered to buy in cash the metallurgical coal business of Teck Resources, merge that with its own thermal coal business, then spin out the new coal behemoth on the New York Stock Exchange.

“We would create what would definitely be the world’s best coal company,” he said in a recent interview in London at a Melbourne Mining Club event. “It would have assets in Canada, in Colombia, in South Africa and Australia . . . and it would also be represented across the different qualities [of coal].”

The negotiations with Teck are ongoing, and if those talks fail then Glencore might not spin out its coal unit.

Nagle started his 23-year career at Glencore in the coal business, rising to become the head of coal just prior to his appointment as CEO.

Although some shareholders have questioned Glencore’s coal strategy, and a growing number of them are uncomfortable with the company’s climate plans, Nagle is not afraid to defend coal.

“There is a role for coal, both steam coal and met [metallurgical] coal, in the world, as the world decarbonises,” he said. “Steam [thermal] coal is needed to provide the baseload energy needs of today,” he added, while metallurgical coal is used for steelmaking as the substitute technologies are not yet available.

Glencore’s emissions are larger than many countries: it emitted 380mn tonnes of carbon dioxide equivalent last year (including both direct emissions from operations, and indirect emission from sales of coal and other products). That’s nearly on par with the UK’s emissions (417mn tonnes last year) and greater than that of Spain.

If the deal to purchase Teck’s coal business succeeds, the combined company’s production would rise to 131mn tonnes a year of both met and thermal coal, flirting with the coal production “cap” of 150mn tonnes that Glencore set for itself.

Nagle said that target was only meant to apply to Glencore’s existing business. He added that Glencore’s thermal coal production would be phased down in line with the company’s emissions targets, which target a 15 per cent reduction by 2026, relative to the 2019 baseline.

For shareholders, views on Nagle’s plan are divided. One shareholder, Bluebell Capital, wrote to the board last month demanding Nagle’s resignation, saying the proposed coal deal made a mockery of Glencore’s climate goals.

“Glencore has demonstrated no intention to accelerate the transformation into a world-class pure player in green economy transition metals, but rather the intention is to become the undisputable leader in coal (thermal and steel),” wrote the shareholder.

Other shareholders are more supportive, saying Nagle is the right person to lead a coal spinout because of his background.

“It’s a very important step, and he has the experience to know how to do it,” said George Cheveley, portfolio manager at asset manager Ninety One. “There is a window of opportunity here [to spin out coal] and I think they should take it.”

Many shareholders and analysts believe Glencore’s share price valuation is depressed by its coal holdings, because coal companies trade at much lower multiples than other mining companies.

“The rest of the business is very focused on base metals, and transition metals. And there is an element in which one is holding the other back,” added Cheveley.

Nagle has been expanding some areas of the metals business, including with an investment earlier this year in low-carbon alumina refining.

Glencore is the world’s fourth-largest producer of copper, producing just over 1mn tonnes a year, and has plans to increase its production further.

Nagle has also been growing the recycling business, which accounts for less than 1 per cent of Glencore’s earnings before interest, taxes, depreciation and amortisation, but which he expects will grow significantly.

“Customers are coming to us and saying, before you offer us primary metal, do you have recycled metal for us,” said Nagle. “As mining companies, we love running around the world and digging all these big holes . . . but ultimately we can’t just keep doing that. Our responsibility is also to recycle.”

The company also bid repeatedly for all of Teck Resources, both the coal and the metals business, which would have greatly increased its copper production, though those approaches were rebuffed.

Many analysts expect Nagle’s focus on growing the metals and recycling side of the business, while spinning out coal, will lead to more deals down the line.

“Glencore has been the most aggressive [in pursuing deals], among the major miners,” said Chris LaFemina, mining analyst at Jefferies. “They have a clean balance sheet, which gives them the opportunity . . . Previously they were limited by their balance sheet, and now that constraint is no longer there.”

He added that the timing was optimal for base metals deals, due to the combination of temporarily weak prices for metals such as copper, but strong projections for longer-term demand.

As Glencore goes on the hunt for more deals — and continues the coal discussions with Teck that would lead to a spin-off of its coal business — the future company could take a very different shape to the present one.

Nagle himself said he was not sure what the company would look like in five or 10 years’ time. “What Glencore looks like, we don’t know. Not everything is in our control.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here