Receive free Nato updates

We’ll send you a myFT Daily Digest email rounding up the latest Nato news every morning.

Good morning. The US and Germany are resisting pressure from other allies to show greater support for Ukraine’s eventual membership of Nato, just days before the military alliance’s leaders meet in Lithuania.

Washington and Berlin have backed a form of words for the summit’s concluding statement that does not fully endorse a “pathway” to Nato membership, let alone invite Kyiv to join once the war is over — as demanded by Ukraine’s staunchest supporters in eastern Europe.

Other members of the alliance were caught off-guard by the “conservative” US and German stance, officials briefed on the talks told the Financial Times.

On Sunday, US president Joe Biden doused Kyiv’s hopes of a breakthrough on membership, saying that he did not think Ukraine was ready.

“I think we have to lay out a rational path for Ukraine to be able to qualify to get into Nato,” Biden told CNN. It was “premature” to “call for a vote . . . now”, he added “because there’s other qualifications that need to be met, including democratisation and some of those issues”.

Those pushing for a clear pathway for Kyiv’s membership argue that anything less would imply that Nato was ignoring Ukraine’s pleas for postwar protection under the alliance’s Article 5 mutual-defence clause, and would help Russia’s leader Vladimir Putin achieve one of his stated goals of the invasion: to block the country’s entry to the alliance.

Here’s what else I’m keeping tabs on today:

-

Economic data: China publishes its June consumer price index and producer price index, while Japan releases trade balance figures from May.

-

Results: Taiwanese chipmaker TSMC provides its June sales update.

-

Biden’s UK visit: The US president will meet UK prime minister Rishi Sunak and King Charles III before heading to Lithuania for a key Nato summit.

Five more top stories

1. US controls on investment into China would only target sensitive national security sectors, Janet Yellen has told her counterparts in Beijing. The US Treasury secretary emphasised the potential for ongoing trade and economic co-operation during a four-day visit aimed at putting a “floor” under the turbulent US-China relationship.

2. Sequoia Capital’s China unit is drawing up plans to expand into Singapore, putting it in competition with another arm of the venture capital group as the firm divides into three amid rising geopolitical tensions. Read more on Sequoia China’s push into Singapore.

3. US president Joe Biden called out “extreme” members of Israeli prime minister Benjamin Netanyahu’s cabinet, accusing them of being “part of the problem” in the occupied West Bank. Read more on Biden’s unusually frank comments on the Israeli government.

4. South Korean exports to Russia of motor lubricants that can be used in tanks, armoured cars and other military vehicles more than doubled last year. The surge came after western oil majors scaled back their Russian operations following Vladimir Putin’s invasion of Ukraine.

-

Related: Austrian energy group OMV will continue to import Russian gas, its chief executive has said, even though the company has secured back-up contracts to fully cover its import needs from other sources.

5. A flaw in Revolut’s payment system in the US allowed criminals to steal more than $20mn of its funds over several months last year before the company could close the loophole. The incident, which has not yet been disclosed publicly, is likely to add further pressure to the highly valued fintech while it awaits a banking licence in the UK.

News in-depth

France and Germany are leading a fightback against a China-supported push to harvest battery metals from the seabed, warning that large-scale commercial mining in the deep seas could do lasting harm. Negotiations begin on Monday on whether to lay down the first operating guidelines for the deep-sea mining industry, amid fears that shortages of battery metals like copper and cobalt could scupper electrification plans around the world.

We’re also reading . . .

Chart of the day

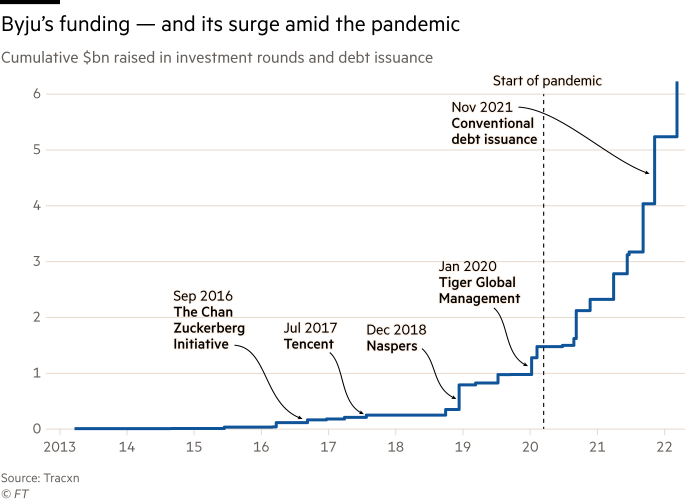

Indian online education start-up Byju’s was a big winner during Covid-19 lockdowns, which made online learning services seem indispensable. Byju Raveendran pulled in $2.5bn during that period, but the company’s eponymous founder is now earning low marks from investors as the affairs of what was once the world’s most valuable edtech have descended into chaos.

Take a break from the news

China’s film censorship process has been tightened under President Xi Jinping. Domestic indie films are required to adhere to core socialist values, prohibiting any film “undermining ethnic unity” and “harming national dignity”. Now, directors are trying to find ways to operate without a state-sanctioned “dragon seal” of approval.

Additional contributions by Tee Zhuo and Leah Quinn

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here