Receive free Companies updates

We’ll send you a myFT Daily Digest email rounding up the latest Companies news every morning.

This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Scapegoating gets its name from ancient Israel. Here, according to the Book of Leviticus, a goat was driven out to die in the wilderness in atonement for the sins of the community.

UK banks at present feel a bit like that goat. Imagine. One moment you are quietly eating grass or distributing credit. The next, you have been dumped on the shores of the Dead Sea or on the naughty step of the Financial Conduct Authority.

These are places no self-respecting goat or bank chief executive aspires to be.

It is fair to note that banks take a cut in transmitting the higher base rates that punish Britons for inflation. Scapegoats derived no personal benefit from the sins of the community.

But Lex believes the political attack on UK banks is both contrived and belated. To comment on this or any other aspect of Lex, please email me at [email protected].

Many critics of the banks blithely mismatch durations in comparing interest rates. They might, for example, cite a charge of 6.5 per cent on a two-year mortgage fix with returns of just 2.5 per cent on an instant access savings account.

Better to compare the two-year fix with a two-year savings account paying a heftier 4.9 per cent.

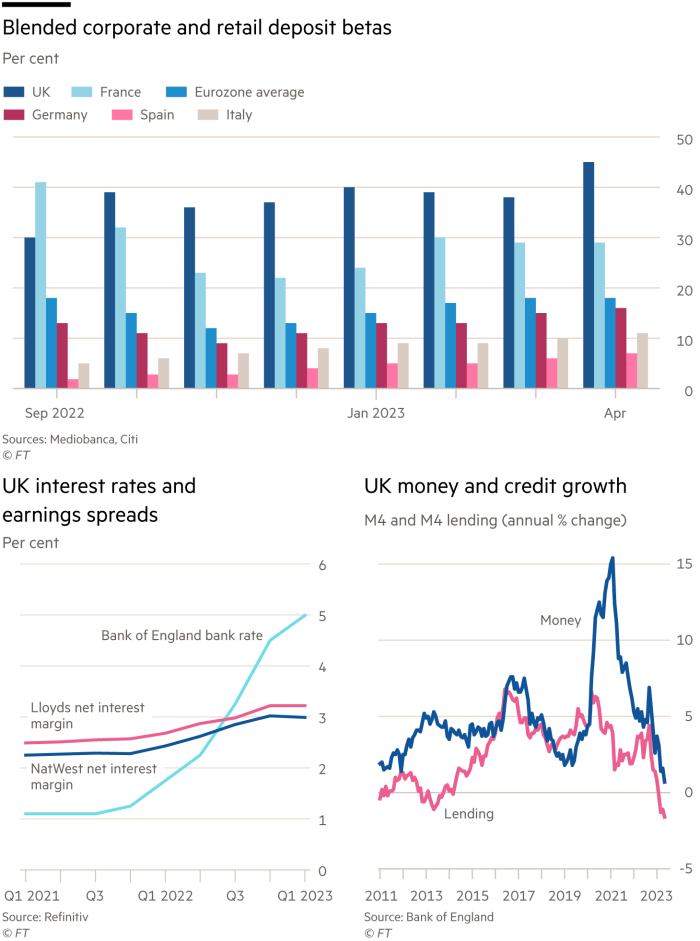

Meanwhile, Lex reckons net interest margins, a handy measure of the benefit banks derive from rising rates, are peaking. Deposit betas, which encapsulate the proportion of rate increases passed on to savers, are already 40 per cent in the UK. That is double the figure for the eurozone, which is playing catch-up with the UK and US on raising rates.

These charts help tell the story:

Rising rates are certainly not leaving challenger bank OSB Group fat and happy. The fear of further rate rises is prompting its mortgage holders to replace expired fixes with fresh ones more swiftly. That is reducing profits from default variable rate charges.

The disproportionate reaction of shares — down 28 per cent by noon on Friday — points to deeper worries. OSB’s specialisations include subprime borrowers and buy-to-let landlords. Both groups are vulnerable at present. In the latter case, the real victims will be cash-strapped tenants whose rental charges are rising.

The cost of living crisis means UK supermarkets are enduring their own trek through political badlands. Chancellor Jeremy Hunt ticked them off last month for supposedly indulging in “greedflation” — pushing prices up more than inflation.

Lex discerned a subtler form of opportunism in quarterly numbers from J Sainsbury this week. The grocer credited rising market share to the success of its Nectar loyalty card. Since April, membership has jumped by a tenth to about 11mn.

Discounts mean more to customers when household budgets are squeezed. In return for doling out discounts, Sainsbury’s not only locks in higher volumes but also receives valuable customer data.

Supermarkets qualify as defensive rather than cyclical stocks, a distinction we examined in this week’s Lex Populi column for private investors.

Currys, which held its final dividend this week, might count as a cyclical stock. Consumers are more likely to splash out on electronic goods when interest rates are low and the economy is booming.

The group’s more fundamental issue is that it is menaced with the obsolescence to which retailers are especially prone. Online-only competitors can sell at cheaper prices than a company with a large retail estate. Revenues have been flat for the past seven years, according to S&P CIQ data, which means they are falling in real terms.

Rounding off Lex’s litany of inflationary woe, the “cost of thriving” is becoming unaffordable for many middle-class Americans. They occupy a social bracket akin to the skilled working class of the UK.

American conservative pundit Oren Cass benchmarked the price of such reasonable aspirations as a nutritious diet and a three-bedroom dwelling against the median male income. This was the dispiriting result:

Live long and prosper

The chances of this cohort ever affording a decent annuity are sadly low. But for wealthier folk on both sides of the Atlantic, annuities have become much better value thanks to higher interest rates. Demand is therefore surging, according to insurers such as Legal & General of the UK.

Annuities pay out agreed amounts as long as beneficiaries can fend off the Grim Reaper. These contracts therefore lumber insurers with hefty, variable long-term risks and a big appetite for capital.

Stock market investors are accordingly a lot less excited about the annuities boom than corporate finance directors. The latter now have an opportunity to offload legacy final salary pension scheme liabilities at an affordable cost.

Chancellor Jeremy Hunt would like to channel some of the corresponding assets, estimated at £1.3tn, into favoured areas of the economy. To Lex, this whiffs of “financial repression”, which involves ministers commandeering private capital for their own purposes. Readers agreed, judging from your comments.

Alternative asset managers like insurers a lot more than the stock market does. Insurers throw off steady cash flows that can be used for funding other investments. Apollo of the US and its annuities business Athene is one oft-cited example. But the real progenitor of the wheeze is Warren Buffett, the world’s most famous investor.

Brookfield did implicit homage to the Sage of Omaha this week. The Canadian alternatives giant agreed to buy annuities group American Equity Investment Life for $4.3bn.

Lex revelled in the irony: a disgruntled Brookfield boss resigned from AEL’s board without telling chief executive Anant Bhalla in November. Now Brookfield is paying top dollar for the business Bhalla has built up.

Brookfield will hopefully garner greater credit as an owner than Cinven has at Eurovita. The Italian insurer has been rescued after crashing into administration. The UK private equity group stumped up additional capital previously. But the amount fell short of expectations. European regulators will scrutinise insurance buyouts more closely as a result.

The Musk slips

No business round-up is complete without a dispatch from the Elonisphere. Elon Musk is the boss of Tesla, a prominent socialist and an all-round entertainer. He makes more appearances in the business pages than the party-going Hadid sisters do in gossip sections. But I will keep it brief.

-

Meta launched a social media app called Threads this week competing directly with Twitter, the app Musk has damaged with his ownership. Threads will feed off Meta’s Instagram service. It is therefore an easy win for owner Mark Zuckerberg, who can probably beat Musk in a cage fight too.

-

Musk is doing better in electric vehicles. It is almost as if that is the thing he should concentrate on. Tesla is delivering record volumes of cars and Volkswagen is planning to adopt Tesla’s North American Charging Standard, which may become universal. This underlines the EV maker’s primacy in its field.

-

Chinese rivals such as BYD will take a big chunk of the market at lower price points. But there is something very fishy going on at Xpeng. Its G6 electric SUV is garnering plenty of pre-orders. However, its shares have fallen steeply and short interest is a dismaying 12 per cent of the free float as this chart illustrates:

Things I have enjoyed this week

Robert Shrimsley is a funny writer. This week he riffed hilariously on Wes Anderson’s latest film Asteroid City. The column pastiches the quirky, downbeat mood of a Wes Anderson movie rather than the director’s typical plot devices. It does not at any point provide the signpost “This is a pastiche”.

Both tricks are very hard to pull off.

I am reading Revolucion by Arturo Pérez-Reverte, a rip-roaring historical novel about the 1910 Mexican revolution. This is an easy way of learning some Mexican history alongside some Spanish vocabulary for explosives.

You never know when either might come in handy.

Enjoy your weekend,

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here