The throngs of cheering football fans have long gone, but reminders of Qatar’s giddy moment on the global stage still dot Doha seven months on.

There are the spectacular stadiums that hosted last year’s World Cup, most of which are waiting to be either downsized or repurposed; one into a wedding complex, others into mall and hotel parks.

Along the corniche that was transformed into a fan zone during the tournament, hoarding boards promoting the football festival remain in place. A Fifa World Cup 2022 sculpture sits in the bay, dhows moored on the tranquil Gulf waters providing its backdrop.

It is as if Qatar is clinging to the last vestiges of the tournament as it ponders how to top its success in becoming the first Arab or Muslim state to host one of the planet’s biggest sporting events.

Qatar’s leaders insist there is no hangover. They are working on the next stage of the gas-rich state’s development, they say, the wealth and ambition that helped secure the World Cup undimmed. They describe their desire to create a “knowledge-based economy” and carve out a role as an “international problem solver”. There is talk of a bid for the 2036 Olympics.

But some already fret that there appears to have been too little thought as to exactly what comes next. For 12 years, preparations for the World Cup sucked up much of the Gulf state’s focus. It spent more than $200bn on infrastructure, while batting away an endless stream of criticism over its treatment of migrant workers and contested allegations that it bought the World Cup — as well as surviving regional crises.

Doha became a giant building site, bustling with activity. Today, with a state-of-the-art metro, highways, hotels and apartment towers completed, there are just a few pockets of construction left. Lonely cranes hang over those buildings waiting for completion; the congestion that clogged roads has eased. Doha has a sleepy feel while neighbouring Saudi Arabia and the United Arab Emirates enjoy petrodollar-fuelled booms.

“The last six months have been really deflating, a lot of people witnessed the high moment, and it was always hard to imagine Doha being as exciting for people, but as far as the outlook for the future, there’s no clear sense of direction yet,” says Tarik Yousef, senior fellow at the Qatar-based Middle East Council on Global Affairs. “What is Qatar’s plan?”

How Qatar answers that question will become a case study in whether the World Cup can be transformative over the longer term — as Qataris insist — and if Doha can use it to elevate the Gulf state’s standing on the international stage after a turbulent decade.

The challenge, analysts say, is avoiding complacency and convincing foreign investors that the state of 3mn people, just 400,000 of whom are Qataris, should be an investment destination of choice. And the ability of the small nation, which has garnered a reputation as a both a maverick and a mediator over the years, to navigate the region’s fractious relationships could prove critical to what happens next.

“The World Cup is a start, not an end,” says Sheikh Mohammed bin Abdulrahman al-Thani, who holds the dual roles of prime minister and foreign minister.

‘Everything is in place’

Qatar has long sought to punch above its weight on the world stage, but has spent much of the past decade at odds with its larger neighbours.

Years of friction culminated in 2017 with Saudi Arabia and the UAE accusing Qatar of supporting Islamists, being too close to Iran and using the Doha-based Al Jazeera satellite TV network to amplify radical voices. They led a regional embargo, severing diplomatic and transport links with Doha. Bahrain and Egypt followed suit.

After a period of regional de-escalation, Qataris believe the nation has emerged stronger from the experience, with Doha regaining its swagger, its confidence further boosted by the World Cup success.

Building on that will rest on the shoulders of Sheikh Mohammed who the emir, Sheikh Tamim bin Hamad al-Thani, promoted to the premiership in March as part of a reshuffle intended to “inject new blood”, a senior official says.

With more than 80 per cent of the local labour force employed in the public sector, and all Qataris benefiting from a generous cradle-to-grave welfare system, the leadership is keen to guard against lethargy and to foster productivity, the official says.

“We need to build on the success of the World Cup — that’s why you see the recent changes in the government,” he says. “The infrastructure is ready, the roads, the port . . . everything is in place.”

Described as the “chief executive” to the “chairman” emir, Sheikh Mohammed, 42, is tasked with spearheading the next phase of Qatar’s development.

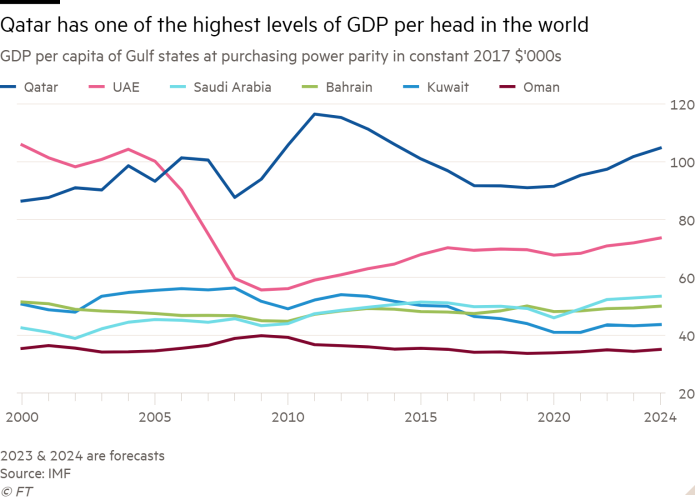

He will have significant resources at his disposal. As one of the world’s top exporters of liquefied natural gas (LNG) and among its richest nations in per capita terms, Doha has vast financial means to throw behind its ambitions. Last year, it posted a budget surplus of $24bn, its highest in years, despite spending heavily on the World Cup.

Qatar’s gas revenues are likely to swell further. Gas is in increasing demand since last year’s energy crisis, triggered by Russia’s invasion of Ukraine. Doha is in the midst of a massive $30bn expansion of its domestic production capacity.

Most of its surpluses are expected to be diverted to the Qatar Investment Authority, the estimated $450bn sovereign wealth fund that made a name for itself during and after the 2008/9 global financial crisis, investing billions of dollars in western companies including Credit Suisse, Barclays and Sainsbury’s, while snapping up trophy assets such as Harrods, the British department store.

Now the QIA is beefing up its resources to manage the next anticipated petrodollar windfall. Its staff numbers have swelled from about 350 five years ago to more than 500, and it plans to add another 200 by 2025.

Domestically, Sheikh Mohammed talks of leveraging Doha’s financial firepower and the new infrastructure to develop niche areas in sectors such as healthcare, energy, logistics and education.

The idea is to capitalise state entities, including special investment zones such as the Qatar Science and Technology Park, and to lure foreign companies with promises of investing alongside them. Doha is already in discussions with Volkswagen, in which the QIA holds a significant stake, for the German automaker to manufacture new technologies, officials say.

“Our aim is to welcome more and more foreign companies by increasing the incentives for them to come. Co-investing in partnerships is one of the ways we’re doing this,” says Sheikh Mohammed. “This is the process we’re going through and the World Cup certainly helped us make our case to new partners.”

Officials also hope the World Cup will boost tourism — groups of Argentines now visit Doha to trace the steps of their victorious captain, Lionel Messi — as it seeks to become a magnet for family-oriented tourists and those attracted to Qatar’s world-class museums.

Yet across the Gulf, previous attempts to diversify economies have often floundered. Over the past two decades Qatar invested heavily in education and culture, but its plans to create a financial centre struggled to gain critical mass.

“The challenge in setting up a technology park isn’t in the vision or commitment, but in the delivery,” Yousef says. “The underlying development conundrum of the last 30 years remains unresolved: how do you create genuine diversification when your primary source of income is a commodity-based export that accrues to the state?”

Today, Qatar is operating in an increasingly competitive environment as Saudi Arabia, which dwarfs Qatar, and the UAE, the region’s business hub, pursue their own ambitious plans. Qatari officials say they will not seek to compete with the Gulf’s larger powers.

“We have a similar economic structure [as other Gulf states] but when you look at Qatar, the approach is different — we are trying to be very specialised and targeted,” Sheikh Mohammed says.

But there is already a regional battle for talent and foreign investment that is heating up. Questions about just how sustainable the recent detente is also linger.

Both Saudi Arabia and the UAE are led by assertive leaders — Crown Prince Mohammed bin Salman and Sheikh Mohammed bin Zayed al-Nahyan, respectively — who were at the forefront of the embargo.

“The relationship between Sheikh Tamim and Mohammed bin Salman seems very strong,” says Kristian Coates Ulrichsen, a Gulf expert at Rice University’s Baker Institute for Public Policy, citing a public, warm embrace between the pair at the World Cup. “But you can’t take anything for granted, so how do you live and plan with that in mind?”

Keep your friends close

Few are more cognisant of the risks of regional tumult than Sheikh Tamim, who ascended to the throne in 2013 after his father, Sheikh Hamad, made the surprise decision to abdicate.

Within weeks of taking over, aged 33, he was being warned by Kuwait that neighbours were working against him. The following year, the first diplomatic crisis erupted as Saudi Arabia, the UAE, Bahrain and Egypt withdrew their ambassadors from Doha.

Three years later, the quartet imposed their embargo. Initially they appeared to have the backing of then-US President Donald Trump, despite Doha being home to the US’s biggest military base in the region, Al Udeid.

Relations have warmed since the embargo was lifted in early 2021. Riyadh and Abu Dhabi have also moved to normalise relations with their arch rival Iran, easing regional tensions. But in Doha, some officials are still not certain whether the detente with Iran is strategic or tactical. And the scars of their neighbours’ hostility remain raw.

“We’ve faced many crises over the years in our region, there’s always a risk for a new crisis,” says the senior official. “Our aim is to ensure stability in our region and maintain these relations with our neighbours.”

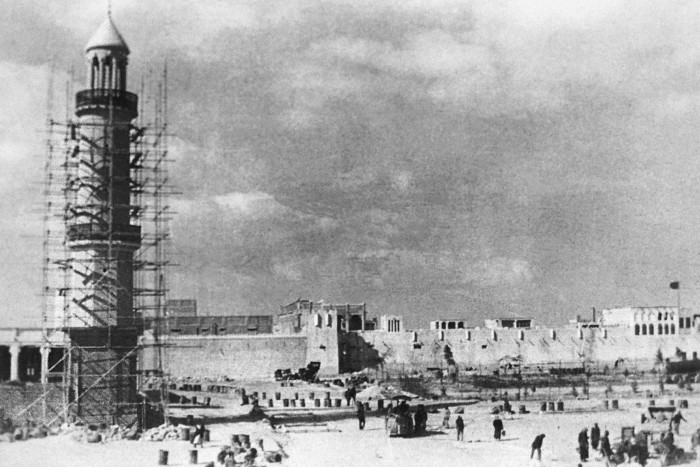

Sheikh Hamad, who oversaw Qatar’s transition from desert backwater to gas powerhouse, drove an increasingly assertive foreign policy agenda that was often deemed counter to the interests of other Gulf states.

It was particularly apparent following the 2011 Arab uprisings, when Doha sought to increase its influence and backed Islamist groups from Egypt to Syria — and faced contested accusations of supporting radical groups in the latter’s civil war. By the time Sheikh Tamim ascended the throne, Qatar had few friends in the neighbourhood and testy relations with Washington.

Qataris and analysts say the new emir is more conservative than his flamboyant father and pivoted to a more measured foreign policy.

“He’s got his own people around him and they appear to have centralised a lot of the decision making in the royal court and they are moving forward on their terms,” Ulrichsen says.

Sheikh Tamim has focused on strengthening Qatar’s relationship with the US and Europe, notably the UK. He has also boosted Doha’s defences, with Qatar’s arms spending surging from $1.9bn in 2010 to $15.4bn last year, according to the Stockholm International Peace Research Institute. It has bought fighter jets from the US, Britain and France and American air defences.

The strategy, officials say, is to build a domestic deterrent to threats while its roles as global LNG supplier and mediator ensure it remains relevant to more powerful partners.

Officials talk of pursuing a balanced foreign policy, one that is anchored in its partnership with Washington. Doha expects to renew the US’s lease for Al Udeid base for another 10 years from 2024.

“The first line of defence for Qatar as a small country is their diplomacy and making sure they have strong strategic partnerships with many countries including the US,” says an Arab official.

Shifting dynamics in the region appear to have played to Qatar’s benefit. The US’s chaotic withdrawal from Afghanistan in 2021 underlined Doha’s worth as an American ally able to negotiate with its enemies after the Taliban seized power. Qatar, which has hosted a Taliban office since 2013, was instrumental in the evacuation of Afghans who worked for the US and coalition entities, as well as others vulnerable to reprisals.

It has since become a hub for western officials covering Afghanistan, with many embassies relocating to Doha and Sheikh Mohammed acting as a conduit for Washington to engage with the Taliban.

Last year, US president Joe Biden upgraded Qatar to a “major non-Nato ally”. And as one of the few countries with good relations with the US and Iran, Doha plays a role relaying messages between the Biden administration and the Islamic regime.

Yet Qatar still hedges. As well as maintaining its ties with Iran, it has close relations with Turkey and commercial ties with Russia and China. It is also willing to differentiate itself from some of its neighbours: as well as the Taliban, it hosts an office for Hamas, the Palestinian militant group; it has resisted the recent Saudi-led Arab re-engagement with Syrian president Bashar al-Assad; and does not consider the Muslim Brotherhood a terrorist organisation.

Mehran Kamrava, professor of government at Georgetown University Qatar, says ensuring Qatar remains relevant to global powers “is a type of survival strategy”.

“The way you emphasise your relevance is by having a world class airline; being a logistics and transport hub; being involved in regional mediation efforts and getting a reputation as a peacemaker in a troubled area,” he says.

The country’s gas riches, Kamrava adds, gives it the resources needed “to ensure their relevance”.

They have also helped Qatar deepen relations from east to west, and in Doha there is a palpable sense of vindication over its decision to expand production from the North Field, the world’s largest natural gasfield which it shares with Iran, as the war in Ukraine ramped up demand for LNG.

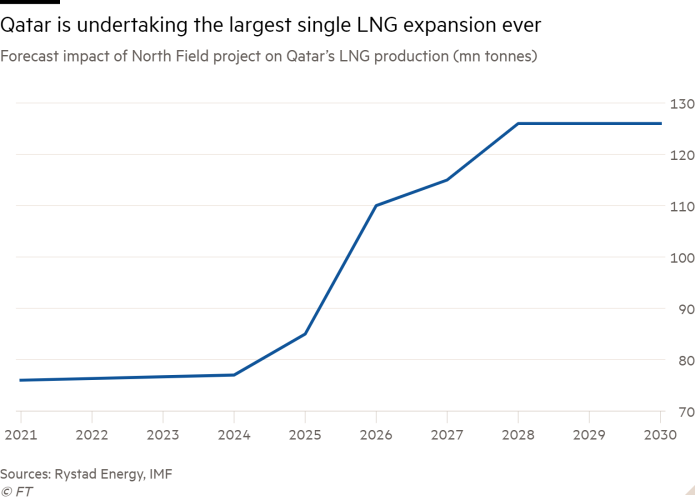

It announced the project in 2017, months before the regional embargo and at a time when much of the world was shifting away from fossil fuels. The project will raise Qatar’s LNG annual production capacity from 77mn tonnes to 126mn tonnes by 2027 — equivalent to almost a third of the total global LNG demand last year.

China, Germany and Bangladesh have signed long-term agreements to secure LNG cargoes from new production when it comes online. Other European countries have been slower to sign up, but Saad al-Kaabi, the energy minister, says he will seal similar deals with the UK, France and Italy this year.

“You will never get rid of gas,” Kaabi says. “Gas is a destination fuel [for the green transition], whether we like it or not.”

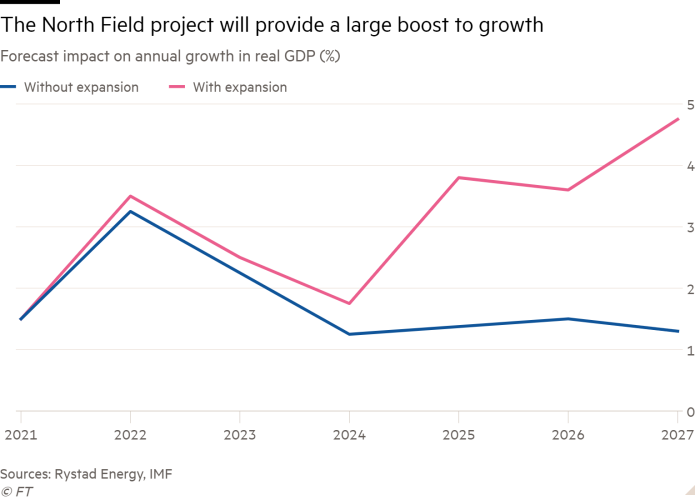

The IMF says that by 2027 the LNG expansion is expected to raise real GDP by 5.7 per cent cumulatively, and add around 3.5 per cent of GDP in export receipts per year. It all feeds into the mood of confidence in Doha. The risk, however, is “they once again fall into the trap of overextending themselves beyond their capabilities,” says Kamrava.

“They have their swagger back. They mounted a very successful World Cup, they came through the blockade stronger and are less reliant on their neighbours commercially,” he adds. “The question is, will this translate into hubris which is untenable in the long run?”

Data visualisation by Keith Fray