Receive free Chinese politics & policy updates

We’ll send you a myFT Daily Digest email rounding up the latest Chinese politics & policy news every morning.

Good morning. Today’s scoop is on a “diplomatic note” sent by China to developing nations urging them to oppose a tax on shipping emissions and stronger targets for decarbonising one of the world’s most polluting industries.

Beijing distributed the note to developing countries as they prepared for a critical meeting at the UN’s International Maritime Organization in July, according to four people present at IMO discussions. The lobbying effort comes days after France rallied 22 allies behind a shipping emissions levy.

China warned that “an overly ambitious emission reduction target will seriously impede the sustainable development of international shipping, significantly increase the cost of the supply chain and will adversely impede the recovery of the global economy”, according to a document seen by the Financial Times.

The note also criticised wealthy nations for setting “unrealistic” goals with “significant” financial costs. It said a shipping emissions tax was “a disguised way by developed countries to improve their own market competitiveness”. Wealthy nations have not agreed a price for the emissions levy.

The efforts by China, the world’s biggest exporter which also has a large state-owned shipping industry, have deepened concerns over a lack of progress on decarbonising a fuel-intensive sector that delivers up to 90 per cent of traded goods globally, according to the OECD.

By the end of next week the IMO has committed to strengthening its ambition, which has long been criticised by environmental campaigners as weak, to halve annual shipping emissions from their 2008 levels by 2050.

Here’s what else I’m keeping tabs on today:

-

Chinese manufacturing data: The Caixin Manufacturing purchasing managers’ index (PMI) is expected to come in at exactly 50 according to a Bloomberg poll of economists, straddling the PMI threshold between expansion and contraction. Other large economies, including the G7 nations, will also release PMI figures.

-

Canada: Financial markets are closed to mark Canada Day.

-

Sport: Wimbledon, the British grand slam tennis tournament, begins in London.

Five more top stories

1. President Emmanuel Macron and his top ministers are to meet to respond to the unrest that has shaken France after a fifth night of looting and rioting sparked by the fatal police shooting of a teenager. Paris authorities are set to deploy 7,000 extra police officers in the capital after the home of the mayor of the suburb L’Haÿ-les-Roses was attacked on Saturday night. Read more about Macron’s response to the crisis.

2. China has tapped western-trained banker Pan Gongsheng to lead the country’s central bank, a move that is expected to provide some market certainty as Xi Jinping overhauls oversight of the financial sector. Pan, who has a reputation as a financial risk firefighter, will replace Guo Shuqing in the role of Communist party chief at the People’s Bank of China.

3. Tesla delivered a record number of vehicles in the second quarter, beating expectations and demonstrating the value of price cuts earlier this year. The electric vehicle maker cut prices of its cars to help boost demand, with chief executive Elon Musk saying affordability was the problem. Here are more details on Tesla’s second-quarter results.

-

Related: Elon Musk sparked a backlash from Twitter users after he said the social media platform that he bought for $44bn in December was putting temporary limits on the number of posts they can view.

4. The world’s largest active bond fund manager says markets are too optimistic about central banks’ ability to dodge a recession as they battle inflation in the US and Europe. Daniel Ivascyn, chief investment officer at Pimco, which manages $1.8tn of assets, said the market is “too confident in the quality of central bank decisions.” Read the full interview with Ivascyn.

5. Scott Bok, the chair and chief executive of Greenhill & Co, is set to collect as much as $78mn in payouts as a result of the boutique bank’s $550mn sale to Japan’s Mizuho Financial Group. A securities filing published on Friday revealed the Japanese bank agreed to pay more than double Greenhill’s stock price in the deal announced in May.

The Big Read

During his three decades in power, Belarus president Alexander Lukashenko has argued that he can be loyal to Moscow while also safeguarding his country’s sovereignty. But that claim has come to appear increasingly thin, especially to his critics, who accuse him of being a puppet of Russian president Vladimir Putin. Western sanctions have left Belarus even more reliant on Russia’s economy and the risk of outright dependency now hangs over the economy.

We’re also reading . . .

Chart of the day

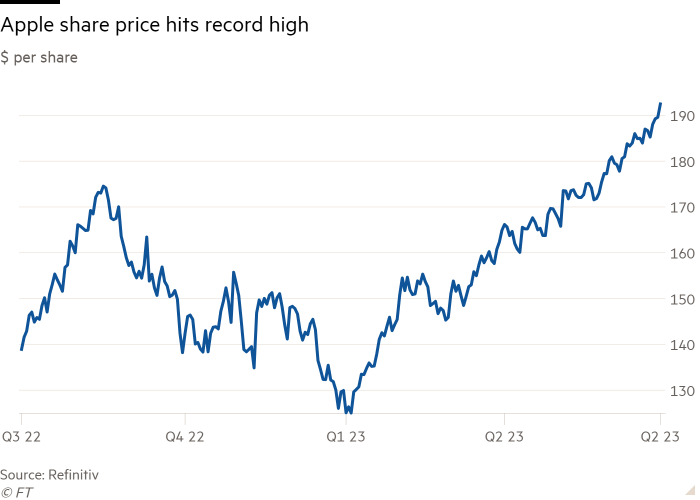

Apple’s market valuation closed above $3tn for the first time as its shares hit a record high on Friday and the wider technology sector rallied. Shares in the company rose 2.3 per cent to $193.97 on the final trading session for June, while the tech-focused Nasdaq Composite index gained 1.4 per cent to notch for its best start to a calendar year since 1983.

Take a break from the news

Republican presidential candidate Chris Christie sits down with Edward Luce for Lunch with the FT to discuss his mission to stop Donald Trump returning to power. “Trump wants to be Putin in America,” Christie said. “That’s what he really wants. He wants to be a dictator.”

Additional contributions by Gordon Smith and Grace Ramos

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here