This article is an online version of our Scoreboard newsletter. Sign up here to get the newsletter sent straight to your inbox every Saturday

Deep in one of the most desirable areas of London, an exclusive private members’ club offered tennis fans a glimpse of the stars set to light up Wimbledon next week. Defending champion Novak Djokovic beat American rival Frances Tiafoe at the Giorgio Armani Tennis Classic at the Hurlingham Club, a favoured haunt for Conservative party fundraisers.

Although just a warm-up, Djokovic looks ready to extend his record of 23 Grand Slams, unless Spain’s Carlos Alcaraz can step up for the next generation. We have a full preview of this year’s tournament here.

This week we take a look at a Hollywood investment into Renault’s F1 racing outfit, and bring you the inside track on Nike’s changing approach to big chain retail. Do read on — Samuel Agini, sports business reporter

Send us tips and feedback at [email protected]. Not already receiving the email newsletter? Sign up here. For everyone else, let’s go.

F1’s Alpine brings in storytelling consortium

Hot on the heels of Wrexham’s fairytale promotion back to the English football league, Hollywood duo Ryan Reynolds and Rob McElhenny are making a new foray into the world of sport.

The pair are among a group of investors buying a 24 per cent stake in Formula One team Alpine, the Renault-backed racing franchise, though it’s unclear how much money the two actors are actually putting in.

The incoming shareholders include RedBird Capital, owner of AC Milan, and a new offshoot called Otro Capital run by former RedBird executives. Creed-star Michael B. Jordan (a minor investor in Premier League team Bournemouth) and Main Street Advisors are coming in too.

The valuation of $900mn marks a new high for F1 and puts it on a par with some big European football deals. The price has been pushed up by F1’s booming popularity in the US, and also the sport’s new spending caps that have put a lid on costs.

Netflix series Drive to Survive may have set the wheels in motion, but with F1 recently adding both Miami and Las Vegas to its global line-up of host cities, the sport is laying down some long-term foundations stateside.

Reynolds clearly has an eye for a good investment (read our profile of him here). He sold his Aviation Gin brand to Diageo for $600mn, and T-Mobile is awaiting approval to buy Mint Mobile in a deal that would net the Canadian actor around $300mn. Both those wins are partly thanks to the marketing savvy deployed by Maximum Effort, his agency.

In announcing the stake sale, Alpine made it clear what it was after: partners who could build a global audience with smart campaigns. RedBird is trying to do that with AC Milan, selling Italy’s fashion capital alongside its football team.

Reynolds and McElhenny have successfully done it too — albeit on a different scale — with Wrexham. The little Welsh club now has 1.4mn followers on TikTok and close to 1mn on Instagram, while the team will play Manchester United and Chelsea on its upcoming US tour. That’s all thanks to Welcome to Wrexham, the Disney TV show fronted by the two actors.

Alpine hasn’t won an F1 championship since 2006. But one lesson from Wrexham is that a team doesn’t have to be good to attract big sponsors and global fans. It just needs a good tale to tell, ideally to a new, untapped audience.

The challenge now for the investors in Alpine will be coming up with a compelling storyline in a sport that is seriously lacking in twists as Red Bull leaves everyone else in the dust.

Nike is coming back to big retail chains

A funny thing happened on Wall Street in June: the chief executives of two massive US retail chains, Macy’s and DSW, quietly told investors they would be bringing back Nike products to their stores later this year.

Nike is “one of the most important brands for our customer”, said Macy’s CEO Jeffrey Gennette on June 1. “We had lots of customers that were disappointed that we didn’t carry it over the past year.”

The announcement was something of a surprise, and seemed to contradict Nike’s prolonged, much-publicised, and controversial strategy of focusing on selling directly to the consumer.

In 2017, Nike said it would begin trimming its network of retail partners from some 30,000 accounts to just 40. At the time, the sneaker giant was hoping to drive higher-margin sales on its website, through proprietary apps such as SNKRS, and in Nike-owned stores.

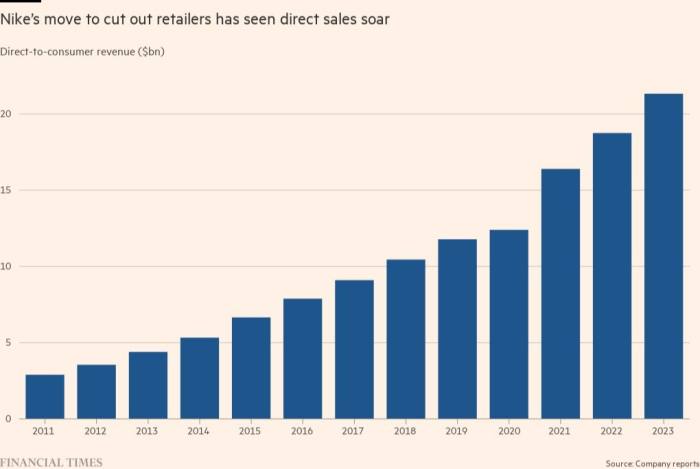

The strategy, initially called the Consumer Direct Offense, has been successful: Nike’s direct sales have grown from about 15 per cent of annual revenues in 2017 to more than 40 per cent in its fiscal 2023, which ended in May. Some $21.3bn in Nike sales came from consumer transactions directly through the company’s own stores, apps, or website in the financial year just ended.

But the pivot has not been so kind to other retailers, some of which had relied on Nike goods for their own success. It put several independent, “mom and pop” stores out of business, while others said Nike’s sales switch had compromised sneaker culture hubs that had fostered the brand for decades.

That’s why some retail analysts were curious about the Macy’s and DSW announcements. Beth Goldstein, a footwear industry analyst at Circana, told Scoreboard that in the US, family footwear retailers (like DSW) and major department stores (like Macy’s) have been losing market share for several years as consumer preferences shifted during the pandemic.

When quizzed why Nike was reviving its relationship with Macy’s and DSW, and what that said about the brand’s retail strategy, chief executive John Donahoe insisted it was an “evolution of the same marketplace strategy . . . driven by the consumer”. He noted that “multi-brand” chains “help us serve distinct consumers or price points”.

Nike’s direct to consumer push isn’t without its own challenges: freight costs, foreign currency exchange rates, and product markdowns have all weighed on margins, despite its overall success at selling directly to consumers.

Donahoe told analysts on the company’s earnings call this week that it still intends to focus first and foremost on its own direct selling channels, followed by “neighbourhood authenticators” — local stores in select districts that lend Nike credibility in sport or culture, and lastly chain retailers.

Even so, big chain stores will be hoping the return of Nike goods can help lift their floundering fortunes.

Highlights

-

Lionel Messi or Cristiano Ronaldo — who is the true GOAT? Simon Kuper talks you through the numbers on the latest Scoreboard video.

-

The ATP, which runs the men’s tennis tour, is the latest big global sports body to hold talks with Saudi Arabia over potential co-investments, its chief told the FT.

-

Fenway Sports Group has signed up to enter a Boston-based team in TGL, the new virtual golf league backed by Tiger Woods and Rory McIlroy. The competition is due to launch in January.

-

Racism, sexism and elitism are “deeply rooted” in English cricket, according to an independent report released this week. The commission that produced it also called for a new independent regulator for the sport.

-

The Ryder Cup has turned to Roc Nation, the talent agency set up by rapper Jay-Z, to boost its profile among young people.

Final hurdle

Every point counts at the European Athletics Team Championships, so when Belgium’s 100m hurdler got injured, shot putter Jolien Boumkwo stepped in. Hats off pic.twitter.com/QQsy9dyl6Q

— James Dart (@James_Dart) June 24, 2023

We’ve probably all seen football matches where a goalkeeper gets injured and an outfield player has to don the gloves. But what happens in athletics when one of the team is out of action?

The Belgians at the European Athletics Team Championships faced this exact situation last weekend when their 100m hurdler was forced to drop out. But fear not, shot-putter Jolien Boumkwo was ready for the challenge. She finished the race in 32 seconds, 19 seconds behind the rest of the pack. But she bagged a single point for the team simply by crossing the line.

“I was really excited to see how many seconds or minutes I did during the race,” Boumkwo told CNN after checking the clock. “It was less than [one minute] so I’m proud of myself!”

Scoreboard is written by Josh Noble, Samuel Agini and Arash Massoudi in London, Sara Germano, James Fontanella-Khan, and Anna Nicolaou in New York, with contributions from the team that produce the Due Diligence newsletter, the FT’s global network of correspondents and data visualisation team

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here