Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

Markets today enjoyed an end-of-week boost as encouraging inflation data in the US and the eurozone suggested the Federal Reserve and the European Central Bank were having some success in their battle to restrain rising prices.

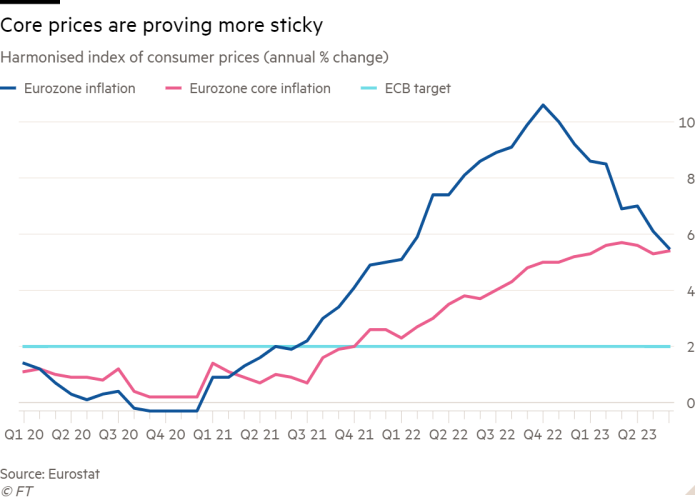

Eurozone inflation eased more than expected to 5.5 per cent in June, the lowest since the start of last year, although the news was tempered by a small (but still less than forecast) increase in the core measure.

The annual headline rate fell from 6.1 per cent in May, while the core reading, which excludes volatile items such as energy and food, rose from 5.3 per cent to 5.4 per cent.

The data follows a few days of hawkish comments from ECB policymakers, who have been convinced by stubbornly high inflation in the UK that they need to maintain their aggressive stance on raising interest rates.

“We have seen what happened in the UK and we don’t want the same thing to happen to us,” said one. “It is better to sound a little more hawkish and be prudent about how fast inflation will fall than to be caught out by a negative surprise, which is a problem for a central bank.”

Their mission to get core inflation back to their 2 per cent goal is complicated by the varying rate of progress across the single currency bloc. Spain, Belgium and Luxembourg all fell below target for the first time in over a year and France hit its lowest level in 15 months but inflation in Germany, the eurozone’s biggest economy, accelerated from 6.3 per cent to 6.8 per cent thanks to a surge in transport prices after the government cut subsidies for bus and train travel.

Caveats still abound. Tight labour markets and increases in eurozone wages, especially in the labour-intensive services sector, could still wreck progress, ECB chief Christine Lagarde warned earlier this week. Deputy head of the IMF Gita Gopinath added to the debate on Monday, saying that central banks had to accept the “uncomfortable truth” that they may have to tolerate a longer period of inflation above their 2 per cent target to avert a financial crisis.

Meanwhile across the Atlantic, new data showed the core personal consumption expenditures index, the Fed’s preferred measure of inflation which strips out volatile food and energy items, rose by 0.3 per cent last month, taking the annual rate down to 4.6 per cent from 4.7 per cent in April.

Despite nagging fears about the stubborn core figure in the eurozone, investors took the US and European figures as a double dose of good news, giving them hope that, finally, global interest rates might be approaching their peak.

Need to know: UK and Europe economy

UK energy regulator Ofgem is to crack down on power station owners gaming the electricity system to make “excessive profits”.

British households pulled a record £4.6bn from banks and building societies in May, suggesting more consumers are looking for higher interest elsewhere and tapping their savings to maintain living standards. New data this morning confirmed real household disposable income fell in the first three months of the year.

Need to know: Global economy

China passed a new law deepening President Xi Jinping’s control over external relations and strengthening his legal basis for “countermeasures” against western threats to national and economic security. Manufacturing activity shrank for the third consecutive month, adding to pressure on the country’s policymakers.

US companies fear they will be next to experience a wave of legal challenges to their diversity initiatives after the Supreme Court ruled against affirmative action in university admission programmes.

Pakistan reached agreement with the IMF on a $3bn rescue plan to stave off the threat of default.

María Corina Machado, the most popular contender to challenge Venezuelan president Nicolás Maduro in elections next year, warned that another victory for Maduro would further destabilise a region already facing waves of migration from the country’s economic collapse.

Need to know: business

Bankers’ fees have hit a near-decade low as dealmaking dries up thanks to higher interest rates, stricter antitrust enforcement and geopolitical tensions.

The largest US banks would lose $541bn in a hypothetical doomsday economic scenario but still have enough capital to absorb the losses, according to Federal Reserve stress tests. As long as banks match or exceed Fed requirements, they are free from restrictions on how much capital they can put towards shareholder dividends and stock buybacks.

Many of Europe’s leading companies signed an open letter criticising the EU’s proposed Artificial Intelligence Act, arguing that it will “harm competitiveness and technological sovereignty without effectively tackling the challenges we are and will be facing.”

The new Twitter chief executive Linda Yaccarino is preparing measures to lure back advertisers including a video ads service, wooing more celebrities and raising headcount.

Merlin, Europe’s largest theme park operator with attractions in 25 countries, is back in profit thanks to the return of international tourism.

A Big Read looks at the Chinese carmakers gearing up for a sales drive in Europe, using their expertise in electric vehicles to take advantage of the continent’s coming ban on the sale of new petrol and diesel cars.

Science round up

The Bill & Melinda Gates Foundation and Wellcome Trust are to fund a $550mn large-scale clinical trial of what would be the world’s first new tuberculosis vaccine for more than a century.

Insilico Medicine began the first human trials of a drug designed by artificial intelligence. The biotech is one of a new generation of companies aiming to revolutionise drug development and capitalise on a $50bn market opportunity.

Antarctic sea ice hit a record low for the month of June, increasing calls from scientists to intensify research and monitoring of the Earth’s polar ice caps.

UK chancellor Jeremy Hunt rejected claims that talks over rejoining the EU’s Horizon research programme were foundering after criticism from scientists that the delay was damaging the country’s aspirations to be a science superpower. Public policy editor Peter Foster writes that the clock is ticking to get something done before Europe’s long summer break and the next round of Horizon projects comes up for funding in September.

The EU has started looking into geoengineering, a contested technology that involves manipulating the weather to fight climate change.

Brussels has ignored calls from businesses and campaign groups to set binding targets to prevent soil erosion and pollution, a sign of the EU’s increased hesitancy to follow through on environmental laws that are part of its green agenda.

Controversy is growing about the validity of behavioural science, a field that has risen to prominence over the past 15 years and whose findings in areas such as decision-making and team-building in business are widely put into practice.

Something for the weekend

Try your hand at the range of FT Weekend and daily cryptic crosswords.

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Some good news

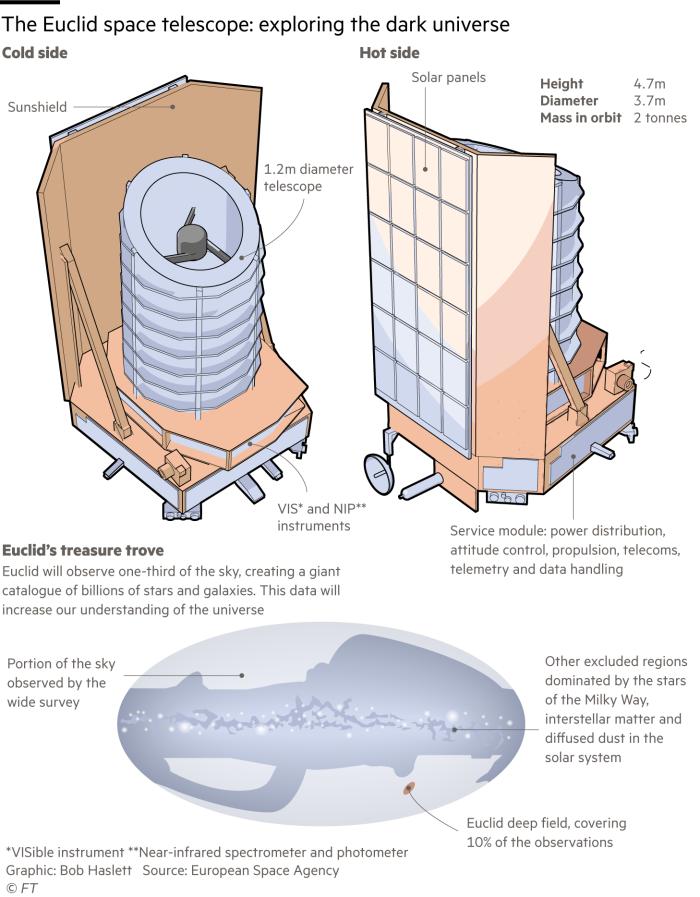

Europe’s €1.4bn ‘Euclid’ space telescope, set for launch on Saturday, will map billions of galaxies across the cosmos, providing observations for scientists trying to solve the mystery of the “dark universe”.

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you