In case you missed it: The chief executives behind Microsoft’s planned $75bn acquisition of Activision made a last-ditch attempt to save the deal this week in the face of US government objections that could result in its annulment as early as next week.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

The trouble at Thames Water

-

M&A fees hit a near-decade low

-

The insider trading charges tied to Trump’s Spac

Thames Water swims against the current

The UK has seen its share of asset liability mismatches, such as this past autumn’s liability driven investment crisis and the perennial woes of its property funds. But a new financial sinkhole has emerged in large water utilities serving cities like London.

Thames Water, the UK’s largest water utility, is facing financial ruin, burdened by an overleveraged balance sheet that has been bludgeoned by the impact of higher interest rates and a poorly-conceived matching of inflation-based debt payments versus incoming cash.

The once stable utility that mainly serves London and the south-east of England, and was privatised in 1989 by Margaret Thatcher’s government, has fallen into dire financial health with the government scrambling to avoid its potential collapse.

DD has chronicled the retreat of banks from the UK after Brexit, the trend of companies moving their listings to markets in Europe and North America. Now, there’s something else in the water.

The FT’s Will Louch, Robert Smith and Gill Plimmer offer a detailed look at how a safe and stable critical infrastructure asset has been transformed over decades into a financial headache.

The most pressing issues can be summed up as follows: Thames Water’s owners are reluctant to pump money into the utility when its previous owners pulled out too much cash by loading its balance sheet with debt.

Thames Water had expected current investors, including Ontario Municipal Employees Retirement System and the UK’s Universities Superannuation Scheme pension fund, to pump £1.5bn of new equity into the business to boost its “financial resilience”.

But those hopes were dashed when just £500mn came forward, leaving a shortfall.

Cash flowed the other way under its prior owner, Macquarie. Earlier this week, DD dove into the Australian investment giant, which pioneered the infrastructure investment industry by buying assets being privatised by governments — often using debt.

It bought Thames Water for £4.8bn in 2006. By the time Macquarie fully exited in 2017, it had taken out £2.7bn in dividends and £2.2bn in loans. Meanwhile, the debt on the utility’s balance sheet had nearly tripled to £10.8bn.

Current shareholders may not fare so well, though. In addition to a debt pile that stands at about £16bn, Thames Water is dealing with a financial mismatch.

The group’s debt is linked to inflation, meaning interest payments go up with inflation. It has justified that by pointing out that customer bills are also linked to inflation — unfortunately it’s the wrong kind.

Debt is linked to the retail prices index, which is at a historically wide premium, whereas customers’ bills are tied to the consumer prices index adjusted for housing costs, which has risen less quickly. That has created a negative spread. Whoops!

(Alphaville breaks down the convoluted balance sheet in detail.)

The government is hoping City troubleshooter Sir Adrian Montague, who was named the utility’s new chair on Thursday, can shore up liquidity.

But, there is a risk it drowns under debt and financial mismanagement and there is already talk of nationalisation.

Bankers forage for fees in an M&A desert

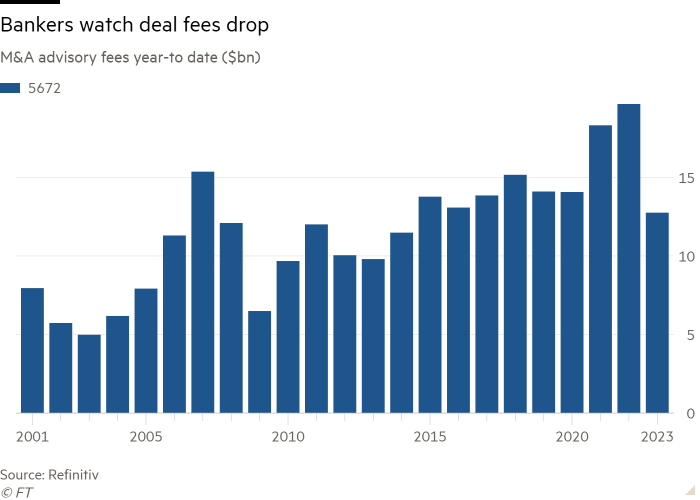

A prolonged slump in mergers and acquisitions is hitting bankers where it hurts: their pockets.

Fees earned by investment banks for advising on M&A dropped to their lowest level in the first half of the year in almost a decade, driving job cuts across the ranks of dealmakers.

Rising interest rates, stricter antitrust enforcement and geopolitical tensions are among the factors making it more difficult to get big transactions over the line. Or, as Latham & Watkins partner David Walker put it: “There’s a lot of headwinds.”

Global M&A fell 38 per cent to $1.3tn in the first half of the year, the lowest deal volume since the start of the pandemic in 2020.

That hasn’t stopped investors and companies from getting deals done, but it has forced dealmakers to get creative as some turn to transactions like carve outs or unsolicited bids to achieve their targets.

The carve-out of a consumer unit from healthcare multinational Johnson & Johnson marked the largest US initial public offering in almost 18 months, for example, while a hostile approach from Swiss-based commodity trader Glencore to buy Canada’s Teck Resources for $23bn triggered one of the mining industry’s largest takeover battles in decades.

Other bright spots have included energy, technology and healthcare.

Even in these doldrums there is some room for optimism. Dealmaking rose slightly during the second quarter compared with the first, which was the slowest start to the year in a decade.

And M&A volumes have held up compared with earlier prolonged slowdowns following the dotcom crash and the global financial crisis.

“If this is the trough right now, I’d take this as a trough in any cycle because activity just hasn’t stopped,” said Oliver Lütkens, BNP Paribas’ co-head of advisory for Europe, the Middle East and Africa.

Digital World Acquisition Corp struggles to make Spacs great again

DD readers undoubtedly remember the blank-cheque boom of 2020 and 2021 when everyone seemed to have a special purpose acquisition company.

The listing of Digital World Acquisition Corporation got lost in the noise during the boom years, mostly for lack of a big name attached to the Spac. But it made a big splash when it announced a notable target in October 2021: Trump Media & Technology Group, a “rival” to Big Tech set up by the former US president.

DWAC shares shot up from about $10 to a peak of approximately $175 following the announcement, but there was heavy trading in the company’s warrants even before news of the deal broke.

Prosecutors seem to think they’ve found at least a few sources of that trading activity. On Thursday, the US attorney in Manhattan brought insider trading charges against three businessmen, including a former DWAC board member. The Securities and Exchange Commission soon followed with its own claim.

According to the allegations, Bruce Garelick, who was a board member and therefore received non-public information on the progress of DWAC’s deal with TMTG, had passed information on to brothers Michael and Gerald Shvartsman and encouraged them to trade the company’s warrants.

A lawyer for the Shvartsmans declined to comment, and a lawyer for Garelick did not immediately respond to a request for comment.

DD’s Mark Vandevelde and Ortenca Aliaj profiled Michael Shvartsman last year when his investment company Rocket One Capital, of which Garelick was chief strategy officer, was named in filings as one of the companies a federal grand jury in New York was asking for information about.

One of the interesting details in the SEC’s complaint is that Garelick had referred to DWAC as “the Trump Spac” in an email to potential investors in June 2021, months before the Spac had formally listed on the stock exchange. Under SEC guidelines, blank-cheque companies shouldn’t have a target in mind before listing, or be in discussions with any companies about a deal.

Garelick couldn’t contain his excitement about the transaction. “Wild possibility you might get a kick out of,” he told his daughter. “Your dad might be named to the ‘Trump Media Group’s Board of Directors’.”

He was less complimentary about DWAC, however, characterising his potential seat on its board of directors as “a front-row seat babysitting job”.

While the Shvartsmans are alleged to have made $22.8mn from illicit trades with Garelick’s help, he told an unrelated individual who asked if he had “made out like a bandit” following the jump in the share price that he had to “restrict” himself on what he could buy, the SEC’s claim states.

“Took one for the team,” Garelick later added.

Job moves

-

Germany’s Aareal Bank has proposed to elect former UniCredit boss Jean Pierre Mustier to its supervisory board following the impending departures of board member Sylvia Seignette and chair Hermann Wagner when their current terms expire.

-

Rothschild & Co has hired Goldman Sachs’ Eva Maria Wiecko as head of equity markets solutions for Germany and Austria, per Reuters.

Smart reads

Couples therapy The Financial Times explains how UBS plans to strip back Credit Suisse’s investment bank in an effort to keep its rival’s past scandals at bay.

Tech gets trippy Drugs such as ketamine and magic mushrooms are becoming a corporate norm in Silicon Valley, leaving companies to grapple with their employees’ new habits, The Wall Street Journal reports.

North Korean love story FT Magazine chronicles the tale of two North Korean defectors in love and the shadow network of escape routes that reunited them.

News round-up

Morgan Stanley board considers next CEO while Gorman clears the decks (Reuters)

Casino shares tumble on debt-to-equity conversion plan (FT)

Colombian tycoon and Abu Dhabi’s Sheikh Tahnoon seek global reach for Nutresa (FT)

Renault delays EV business listing as it raises profit guidance (FT)

KPMG and PwC fined over Eddie Stobart audits (FT)

Microsoft and Nvidia join $1.3bn fundraising for Inflection AI (FT)

Jefferies: chlorophyll thrills cost a lot of lettuce on Wall Street (Lex)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Francesca Friday, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to [email protected]

Recommended newsletters for you

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here