Receive free Bank of America Corp updates

We’ll send you a myFT Daily Digest email rounding up the latest Bank of America Corp news every morning.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Twice this week, we’ve gotten strong economic data followed by a stocks and yields bounce. On Tuesday, it was durable goods orders; yesterday, it was upwardly revised GDP and falling jobless claims. If these are any indication, today’s personal consumption spending numbers should be strong, too. This cycle’s still got gas in the tank. Email us: [email protected] and [email protected].

Unhedged will be off Monday and Tuesday for Independence Day. In the meantime, listen to Rob and Ethan talk commercial real estate on the latest episode of the Unhedged podcast. A transcript is available at the link, for those who like consuming audio content with their eyes.

BofA vs JPMorgan

Two years ago, I wrote a piece for Unhedged called “B of A buys tons of bonds, JPMorgan does not”. The piece pointed out that both banks had enjoyed a huge inflow of deposits, far exceeding attractive lending opportunities, and had decided to use the cash very differently. Between mid-2020 and mid-2021, Bank of America added $470bn of mortgage-backed securities and Treasuries, hoping to capture a bit of additional yield. JPMorgan, on the other hand, mostly just let the cash accumulate.

At the time, BofA CEO Brian Moynihan emphasised his team was not wagering on interest rates. He said:

Deposits have crossed $1.9tn and the loans are $900mn and change. And that difference has got to be put to work . . . we’re not timing the market or betting. We just sort of deploy it when we’re sure it’s really going to be there.

JPMorgan, on the other hand, said it was timing the market and betting. Here is CFO Jeremy Barnum:

Our central case from an economic perspective is for a very robust recovery, and that’s pretty much a consensus, a view between us, our research team, the Fed, et cetera. And that view is associated with higher inflation, along the lines of the Fed’s own target for higher inflation. All those things together, it’s an outlook that’s associated with higher rates, all else equal. And so, in light of all that, we do remain happy to stay patient [and hold cash] here . . .

Two years later, the results of JPMorgan’s bet are in. They have won it. Rates have risen, a lot. That cash they held on to now yields a lot more than those bonds which they didn’t buy, and which BofA did. And so BofA, not JPMorgan, was the subject of this story in the FT yesterday:

Bank of America is bearing the cost of decisions made three years ago to pump the majority of $670bn in pandemic-era deposit inflows into debt markets at a time when bonds traded at historically high prices and low yields.

The moves left BofA, the second-largest US bank by assets, with more than $100bn in paper losses at the end of the first quarter . . .

“Brian Moynihan has done a phenomenal job in handling the bank’s operations,” said Dick Bove, a veteran bank analyst who is the chief strategist at boutique broker Odeon Capital. “But if you look at the bank’s balance sheet, it’s a mess.”

Ouchie. Is Bove being completely fair, though? BofA says it has a policy of not trying to outsmart the bond market. It just tries to put money where it knows it can make an acceptable return at the rates the market throws at it. By definition, that means sometimes it will out-earn, and sometimes it will under-earn, the prevailing rate environment. It out-earned in 2020-21; now its under-earning.

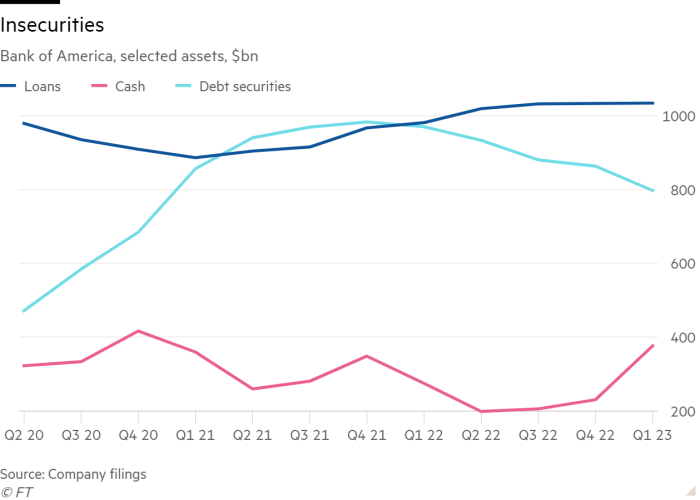

For context, here is a chart of loans, cash and securities at BofA since the pandemic began. Note the big rise in securities in ‘20 and early ‘21, while the cash pile goes sideways-to-down:

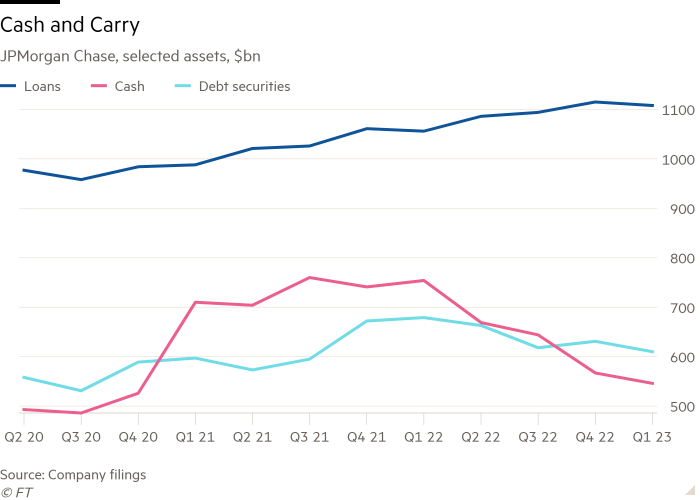

Now look at JPMorgan, letting cash build in those years:

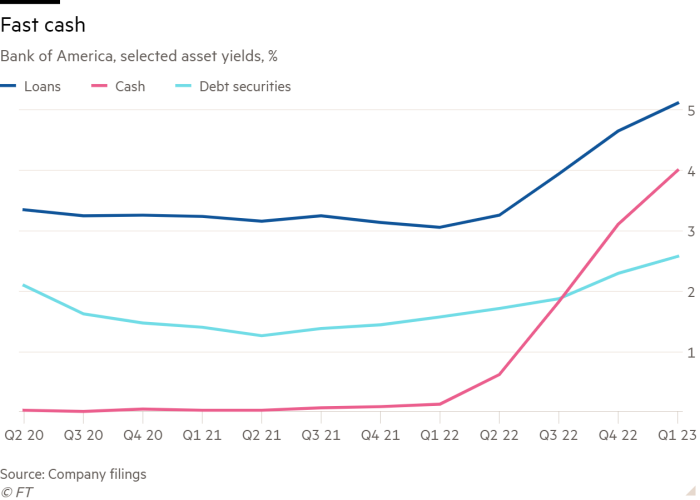

Here, meanwhile, is what yields on those assets have done (these are BofA’s numbers, but JPMorgan’s are almost identical). In order of desirability, cash and bonds have flipped:

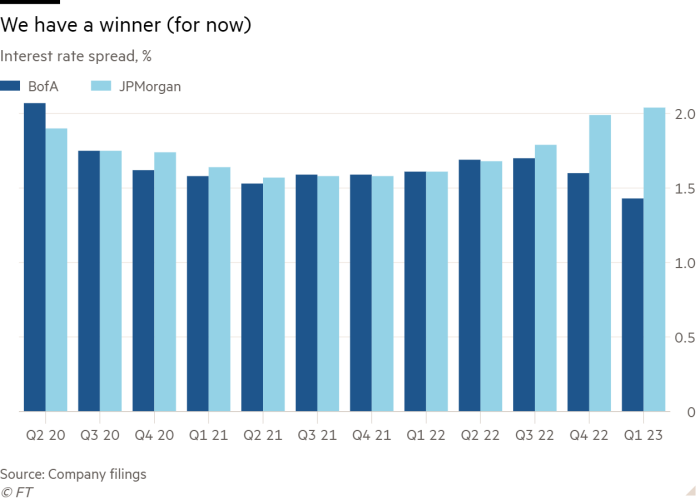

To be clear, BofA will never have to realise those losses. It has loads of capital and liquidity to fall back on. This is an earnings problem. It is stuck with a bunch of long-term securities earning 2ish per cent in a 4 per cent world. Largely as a result, its interest spread (asset yields minus funding costs) was 1.43 per cent in the first quarter, 18 basis points lower than a year ago. Higher deposit costs are chewing into margins because its asset portfolio isn’t adjusting to the rates environment fast enough. JPMorgan’s spread was 2.04 per cent last quarter, 43bp wider than a year earlier:

BofA’s problem will not last for ever. As the charts above show, BofA’s $800bn securities portfolio is rolling off at a decent clip, and its yield is rising slowly. Still, this is not a pretty situation. The only question is whether to think of the bank’s leadership as dumb or unlucky.

As Barnum pointed out two years ago, it didn’t take a genius to see that higher rates were likely; it was the consensus view. But BofA kept growing its bond portfolio for another six months. Moynihan says he was not betting. JPMorgan might respond that a bank’s balance sheet is always a bet on rates of one kind or another. And that is true. These bets are not won or lost in one quarter or year, however. The question is who makes the best risk-adjusted returns over an entire economic cycle. BofA’s plodding approach to capital allocation looks awful now. But banking, done properly, is a very long game.

One good read

Insisting inflation must fall to 2 per cent “is a profoundly conservative political argument dressed in the garb of economic necessity”, writes Adam Tooze, in a rebuttal to Martin Wolf’s recent column. Our two cents: talk about flexible inflation targets isn’t so radical when inflation is running at 4 per cent, as it is in the US. At the UK’s 9 per cent, it just sounds premature.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

The Lex Newsletter — Lex is the FT’s incisive daily column on investment. Sign up for our newsletter on local and global trends from expert writers in four great financial centres. Sign up here