Receive free Water Services Regulation Authority UK updates

We’ll send you a myFT Daily Digest email rounding up the latest Water Services Regulation Authority UK news every morning.

Even though referencing The Rime of the Ancient Mariner twice in a week is a strange look for a financial blog, we’re going to open this piece with a “water, water, every where” joke.

People tend to remember “…nor any drop to drink” as Coleridge’s next line, but because we’re talking about a business crisis, the quatrain’s alternative, “…And all the boards did shrink” may be more appropriate.

Thames Water is drowning (or not!) in debt, raising the possibility of some kind of nationalisation-with-Conservative-characteristics in the coming days. The timing is especially difficult as AMP8 — a new and likely investment-heavy regulatory period — looms. “For Thames to lose its CEO at such a crucial time is suboptimal,” deadpans Investec.

It’s also the boiling point (🥁) of an increasingly heated public debate about water utilities in the UK: outrage of sustained dividend payment at a time when water companies have been allowing infrastructure to crumble and pumping raw sewage into Britain’s waterways and seas has not won the sector a lot of fans. As Barclays put it in a March note:

Through a combination of tighter returns, under-investment and dividends in recent decades, gearing has steadily risen above regulatory assumptions and operational performance remains lacklustre… Ofwat is in the difficult position of needing to improve both the financial resilience of the incumbents as well as the quality of service given to consumers (including maintaining affordability).

The read-across for the sector from, uh, Water-gate is not great. In a note this morning, Jefferies analysts said:

[This] newsflow is likely to raise broader questions about past regulatory robustness, financing and ownership structures for the sector. We note that Ofwat has already recently changed the cash lock-up trigger credit rating to BBB/Baa2 (with negative outlook), from BBB-/Baa3 (with negative outlook), effective from 1 April 2025. This came alongside a change to dividend policy licenses, which we feel highlights ongoing scrutiny on financing and dividends in the sector. When combined with the growing need to balance environmental capex and affordability, it makes for a heightened regulatory environment, which we feel justifies our argument that water companies should trade at valuations close-to-nil premium.

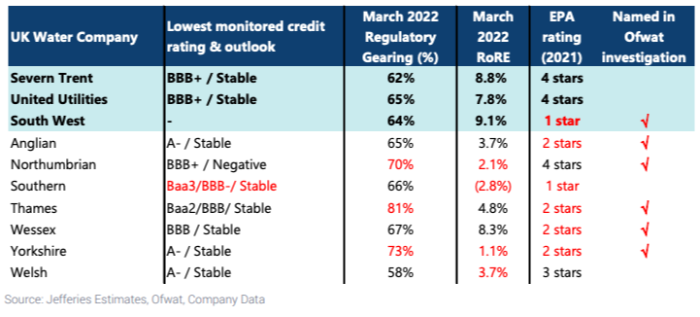

In a March note, they provided a helpful breakdown of the various debt situations of the various major water companies:

Here’s the full sectoral gearing breakdown based on FTAV manually copying numbers from an Ofwat PDF:

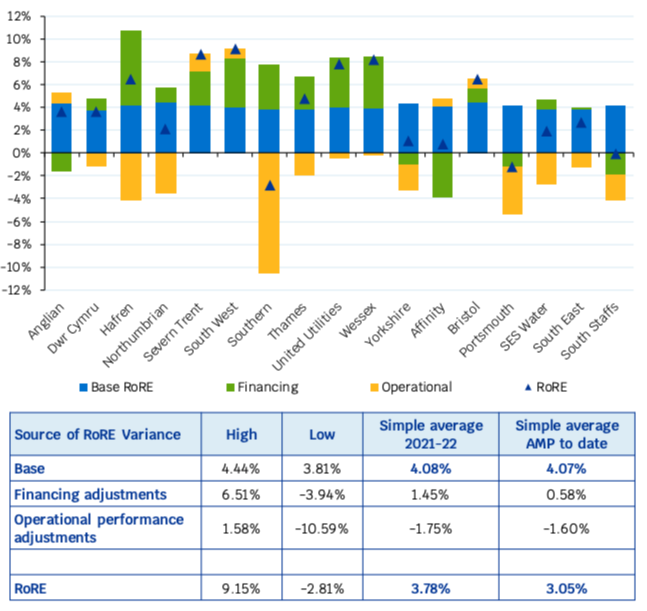

RoRE is return on regulatory equity, which regulator Ofwat says “measures the returns (after tax and interest) that companies have earned by reference to the notional regulated equity, where regulatory equity is calculated from the RCV and notional net debt (62.5% of RCV)”. There’s a nice breakdown of where these returns are coming from in Ofwat’s latest financial resilience report:

Thames Water is the obvious standout in terms of levels of gearing, but it’s not totally exceptional — second-and-third-placed Yorkshire and Northumbrian are both less indebted, but are earning less.

Southern is also notable because of its credit rating. Ofwat recently changed its rules so that a BBB/Baa2 rating with negative outlook will trigger its cash lock-up threshold, at which point the company would need express permission from the regulator to transfer or lend money or assets — including dividends.

On top of this, there are new environmental rules — spurred, in part, by the whole raw sewage thing — that force water companies to align their dividend policy with performance for customers and the environment.

As Jefferies said in March:

We view Southern & Thames Water as most at risk due to low credit ratings (Southern’s lowest monitored rating is below the BBB/negative outlook threshold). When we factor in environmental performance (with EPA rating as proxy), we see some risk on South West (PNN), Anglian, Wessex & Yorkshire Water.

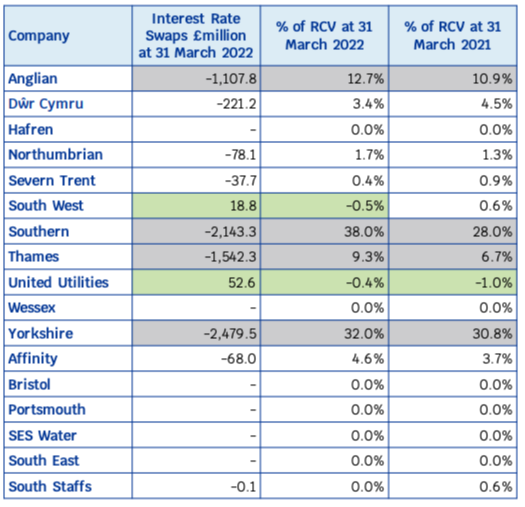

In the cases of Southern and Yorkshire, future history may note they are nursing big paper loses from their inflation-linked swap portfolios:

From a customer perspective, performance pressure seems like a great thing, but given the poor environmental ratings shared across several of the more geared players, it adds to the danger that — as has happened with Thames Water — investors may see limited value in supporting these companies if they begin to teeter.

At Citi analysts pointed out this morning, Thames Water may be the canary in the coalmine for a wider run of refinancing nightmares:

Many elements of the story are idiosyncratic – including the extent of index-linked debt and the regulated nature of cash flows. However, this example does speak to a broader risk across UK corporate space associated with such a dramatic change in rates. We continue to see insolvencies as an important driver of slack through the second half of the year.

As for the listed companies in the set — Pennon, Severn Trent and United Utilities — Investec’s Martin Young reckons they’re healthy enough that it’s a good time to buy the drips:

Each of these three companies has regulatory gearing broadly in line with Ofwat’s 60% notional gearing for PR19, a level that looks set to fall to 55% in PR24… We view the listed cohort as better placed, and suggest that despite elevated levels of scrutiny and broader media narrative, the recent fall in RCV premia presents an entry point.

Thames Water was the standout worst of a not-entirely-glorious bunch — a flood of similar crises may not be coming. That may be small comfort in Whitehall, and it also might be entirely wrong. Tricky business, monopolies.