Receive free Casino Guichard-Perrachon SA updates

We’ll send you a myFT Daily Digest email rounding up the latest Casino Guichard-Perrachon SA news every morning.

Shares in French food retailer Casino tumbled as much as 37 per cent on Thursday after the heavily indebted group said it would convert up to €1.5bn of secured debt into equity, warning that its shareholders would be “massively” diluted by the move.

Casino said between €1bn and €1.5bn of its assets in secured debt investments — on top of €3.5bn in unsecured debt — would be converted into equity in order to reach a debt structure “compatible” with cash flow generation laid out in its 2023-2025 business plan. Supermarket group Rallye “will no longer control” Casino, it said.

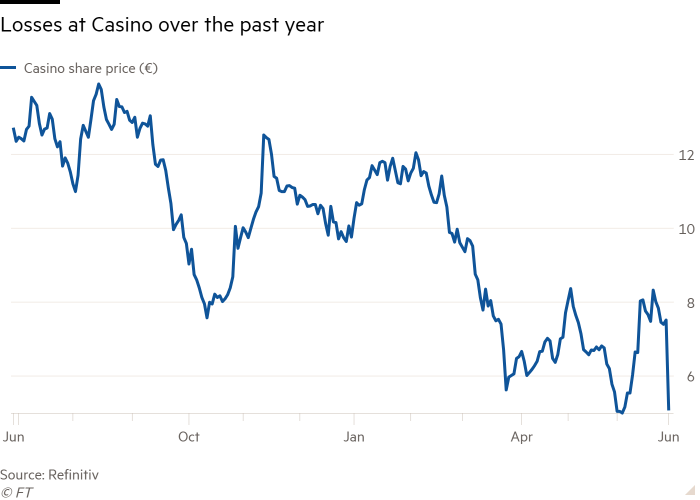

Casino’s shares, which recovered slightly to trade 32 per cent lower at midday, have almost halved since the start of the year, Refinitiv data shows. The company, which is France’s sixth biggest food group by market share, has for months been in talks with creditors to restructure its multibillion euro debt pile.