Filing ITR (Income Tax Return) is the primary responsibility for any individual who is earning. Individuals who are salaried or self-employed, Hindu Undivided Family (HUF), MNCs or firms are bound to file their ITR.

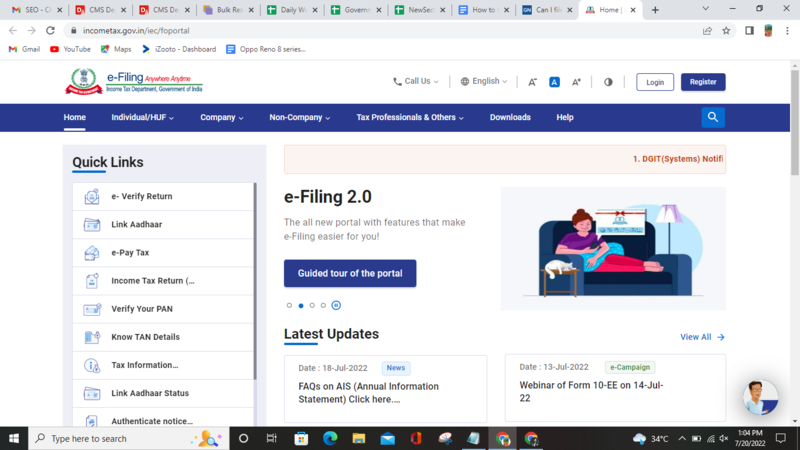

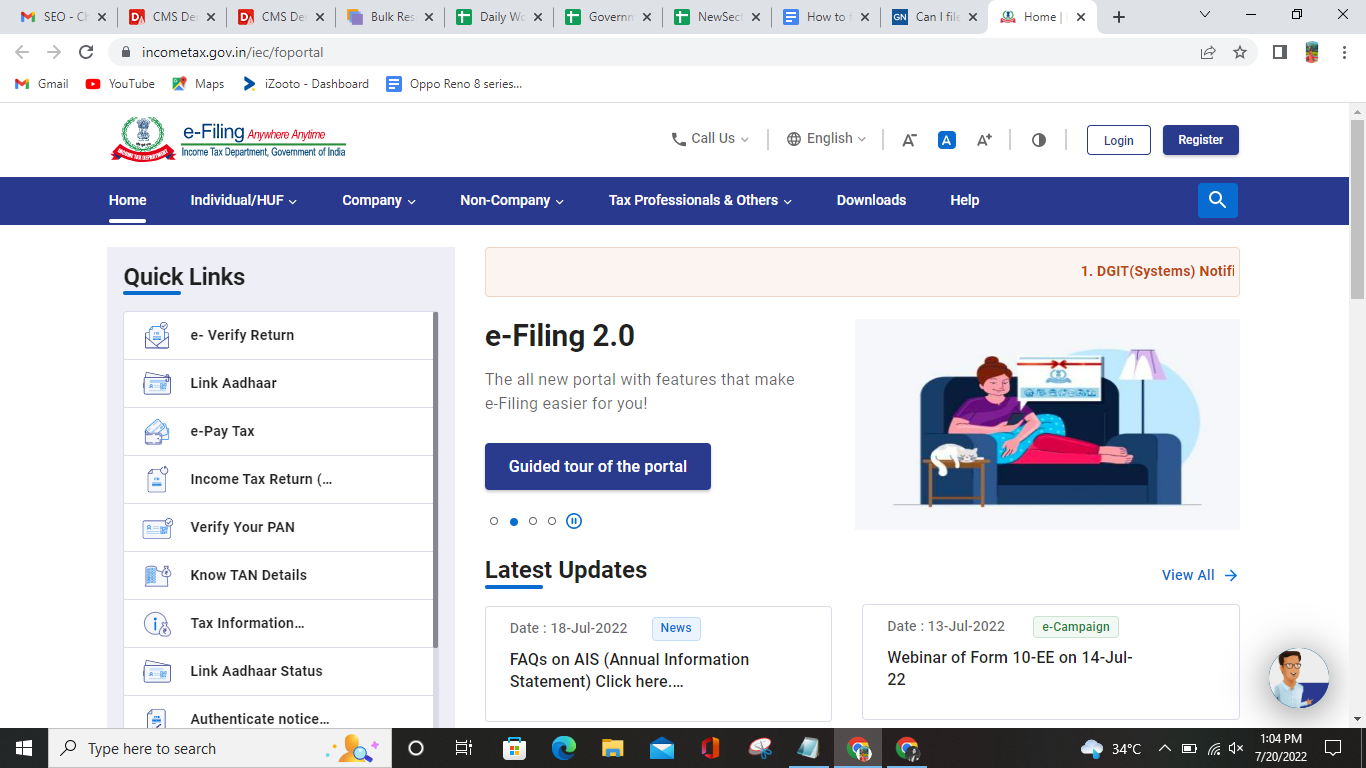

A taxpayer can file the ITR online on the e-portal of the income tax department. And, this e-filing process is quick, easy, and can be completed front anywhere and anytime.

Log in to the official website of the income tax department

Go to the e-file option and click on the option ‘Prepare and Submit ITR Online’.

Select the form that applies to you and the assessment year.

Fill in the details and click on the ‘Submit’ button.

Upload a Digital Signature Certificate (DSC), if available and applicable. Now, click on ‘Submit’.

On successful submission without DSC, your Income Tax Return Verification Form (ITR-V) would be displayed on the screen. Click on the link and download the ITR-V.

What happens if a taxpayer hasn’t filed ITR?

In case an individual forgets to file ITR, then he/she may attract a penalty of Rs 10,000. Delaying in filing the ITR can also make individuals liable to pay the interest amount to the government.

Who is eligible to file an ITR?

- Individuals whose annual income is above Rs 2.5 lakhs

- Senior citizens whose annual income is above Rs 3.5 lakhs

- Super senior citizens whose annual income is above Rs 5 lakhs

- It is mandatory for companies and firms to file ITR irrespective of their ROI (Return on Investment)

- NRIs who have made above Rs 2.5 lakhs in India

- Foreign companies doing business in India

Why is it a must for individuals to file an ITR?

Filing ITRs on time helps individuals in loan sanctions, allowing them to claim tax when required and others. It helps as both an income and address proof for people. ITRs also help in getting quick visa processing and prompt approval on it.

FacebookTwitterLinkedin