A hidden ‘treasure trove’ of American homes are being bought and sold on a secret property market – where contracts are exchanged before ‘For Sale’ signs even go up.

Experts say the number of properties being sold this way is on the rise as nervous owners seek to avoid their homes languishing on Zillow for months on end.

The trend is being driven by an uncertain open market, which has been hammered by rising mortgage rates and plunging property prices in recent weeks.

Luxury real estate agent Scott Ehrens, from Palm Springs, said: ‘The market has been so on fire for the last two years that there’s been no reason for sellers to go off-market because they knew they could get a good price.

‘But it’s definitely becoming more of a thing now as sellers and realtors are scared of putting houses up for sale and them not selling right away.’

Jen Naye Hermann and her husband Matt, both 35, were exhausted of constant house bidding wars when they sought the help of a property buying agent

The Hermanns had a budget of $800,000 and wanted somewhere by the North Shore. They are pictured with their dream home

The so-called ‘secret’ market involves buyers seeking out their dream properties and contacting the owners direct – via cold calls, handwritten notes or even messages on social media – to see if they’re willing to sell.

Alternatively, they may enlist the help of a buying agent – specialist realtors who usually command a fee typically worth up to 5 percent the property purchase price.

Often these agents have an insider knowledge of the area and know which owners might be interested in selling.

The trend benefits sellers who are increasingly worried about the so-called ‘digital footprint’ of their home, which shows how long their property has been on the market. When homes have been listed for too long, many owners feel pressured to slash the asking price.

Meanwhile for buyers, it can help them avoid aggressive – and costly – bidding wars for properties.

This was the incentive for Jen Naye Hermann and her husband Matt, both 35. The couple had started looking for a home in 2022 but were quickly exhausted by constant bidding wars.

They were seeking to escape downtown Chicago in favor of a more relaxed lifestyle on the North Shore after the pandemic, as they could work remotely full-time.

Luxury real estate agent Scott Ehrens, from Palm Springs, said a cooling property market is making owners nervous about selling on open channels

They had a budget of $800,000 and were looking for a home large enough for their two children – Archie, one, and four-year-old Emmie.

‘We must have looked around 20 properties but there was nothing that was right,’ Jen said.

‘When working with a buying agent we managed to find a four-bedroom home that hadn’t been on sale since the 90s.

‘The agent got around 2.5 percent commission but it was so worth it to us. It meant we didn’t have to compete with other buyers.’

For decades, buying off-market has been a well-established route for America’s wealthiest.

Ehrens said that rich sellers often don’t want lots of people traipsing through their homes for viewings.

‘In some of these homes, the art in the house is more valuable than the property itself,’ he told Dailymail.com.

But now more and more middle-income families are co-opting the trend as they become disillusioned with the turbulent open market.

The property market exploded during the pandemic as lockdown left homeowners wanting bigger homes with more outdoor space. Figures from Redfin show that the average house price shot up 26 percent in the year to May 2021.

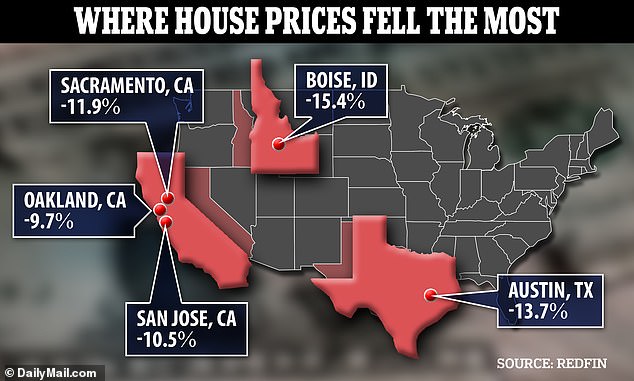

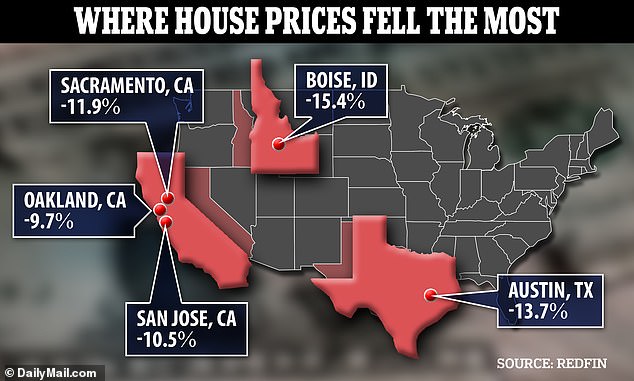

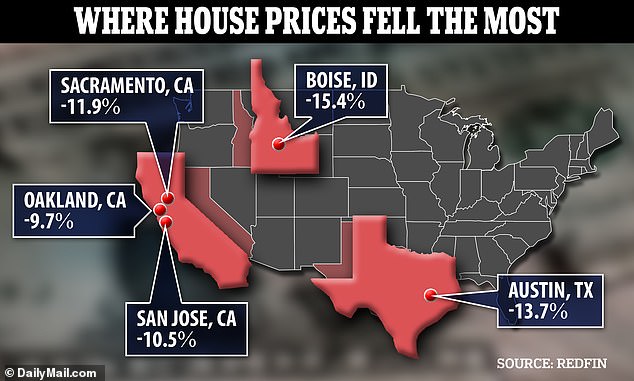

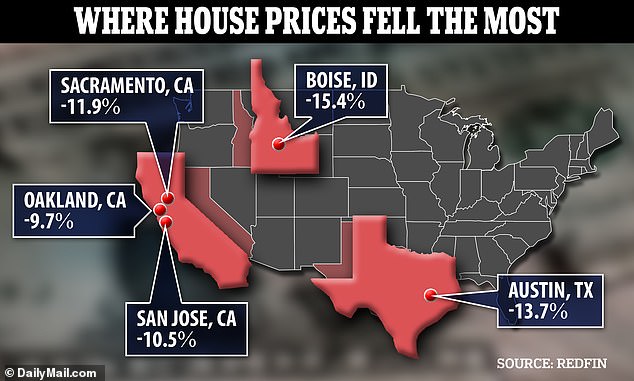

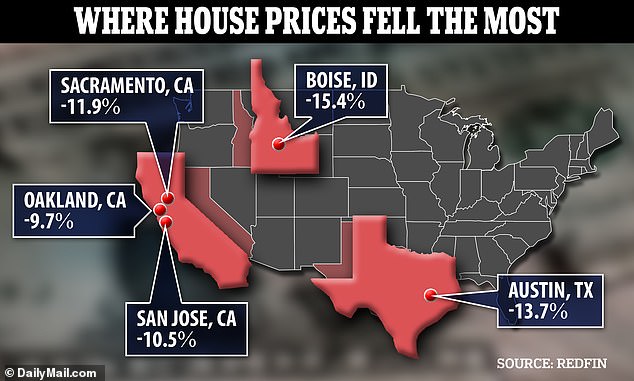

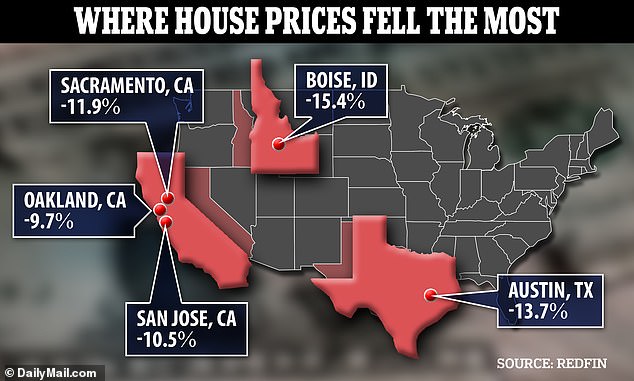

However in recent months a ‘correction’ has started to take place, with house prices suffering their biggest annual decline since 2012.

Higher borrowing costs has stifled buyer activity, which has in turn discouraged sellers from listing their homes, further straining inventory.

Drake Johnson, 27, and his wife Shelby, 32, were house hunting during the market peak last year when they decided to look off-market

The couple snapped up a property in North Carolina for $100,000 after learning it was going up for foreclosure

Drake Johnson, 27, and his wife Shelby, 32, were house hunting during the market peak in 2021 when they decided to consider alternative channels.

Drake, a real estate agent in North Carolina, began researching homes that were going for foreclosure in his area.

From there, he cold-called owners and asked if he could take the properties off their hands.

‘A lot of people hung up on me,’ Drake told Dailymail.com. ‘But we eventually found somebody who sold it to us for $100,000.

‘The property was a mess when we bought it. But we renovated it all and now we couldn’t be happier.’

Drake has also found dozens of properties for his clients by buying off-market.

‘I’ve done direct mail, mass texting, mass calling and Facebook ads to find these houses off-market,’ he said.

The Johnsons spent over a year tearing the property apart and renovating it. Pictured: the kitchen now

‘The property was a mess when we bought it. But we renovated it all and now we couldn’t be happier,’ Drake said

House prices suffered their biggest annual drop since 2012, according to data from brokerage Redfin

Similarly Ashley Farrell says she has found clients properties by contacting potential sellers on Instagram and even posting handwritten notes to them.

‘I was sitting with a buyer once who pulled up Google Earth, pointed to a home and said “that’s my dream home”,’ she said.

‘It wasn’t on the market and never had been since the 80s. But he’s now the proud owner – all thanks to a handwritten note.’

But other experts urge caution before buying a home this way.

Real estate expert Michael Winkler, who owns Sell Home Today, said: ‘Off-market channels are a bit like a hidden treasure trove of properties that only a select few have access to.

‘But when you’re buying a home this way, you’re essentially taking a bit of a risk, as you may not have access to all the information you would if you were buying a home listed on the public market.

‘Without the same level of transparency and information that you would have when purchasing a publicly-listed home, there is certainly a greater level of uncertainty involved.’

Source: | This article originally belongs to Dailymail.co.uk