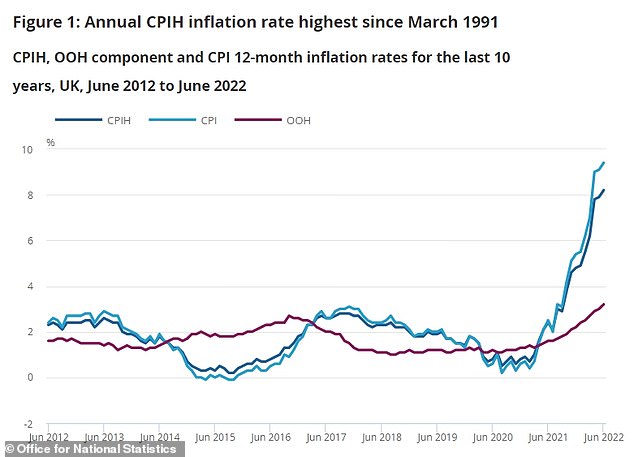

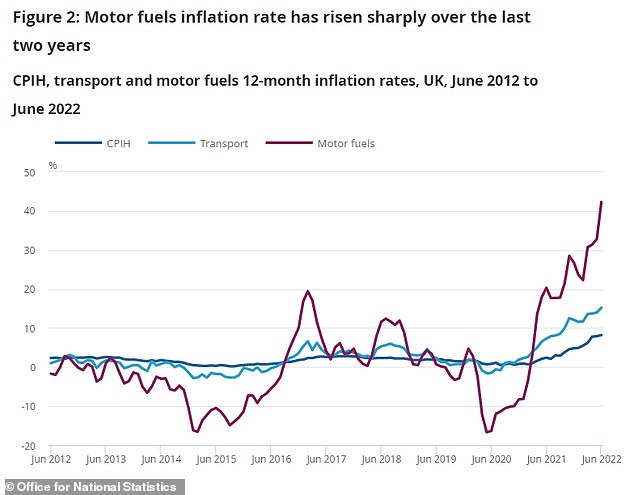

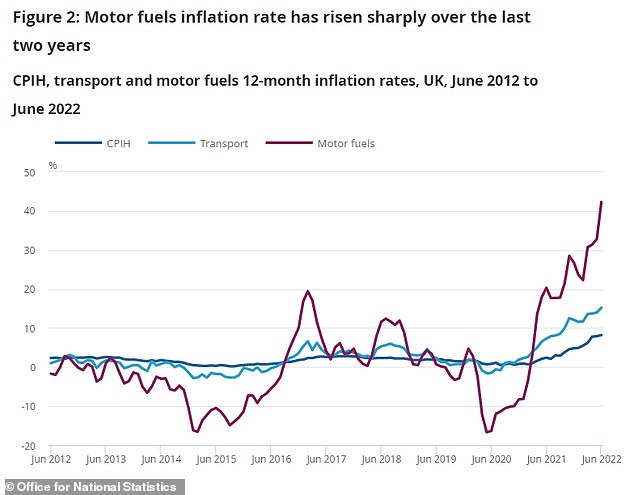

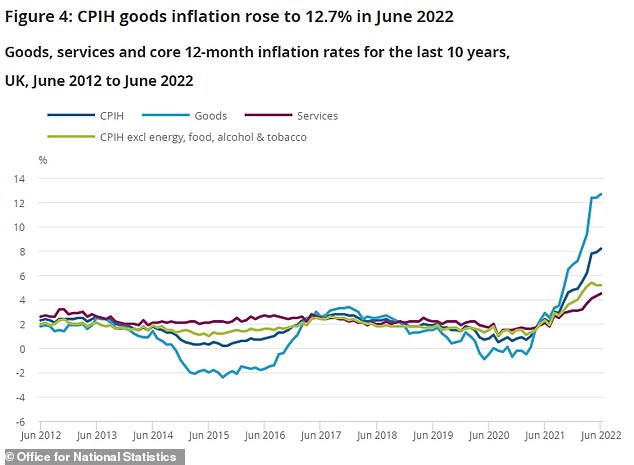

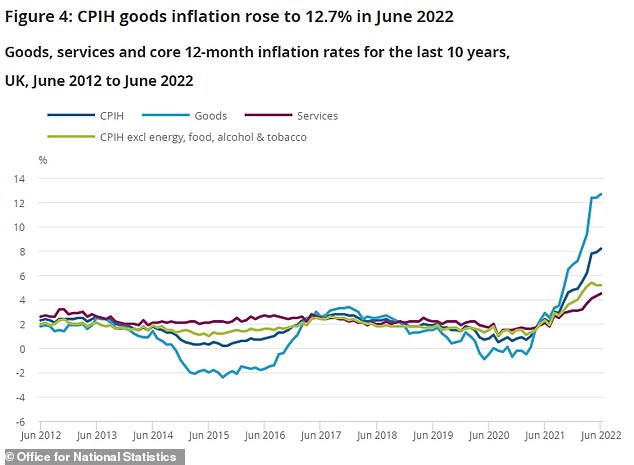

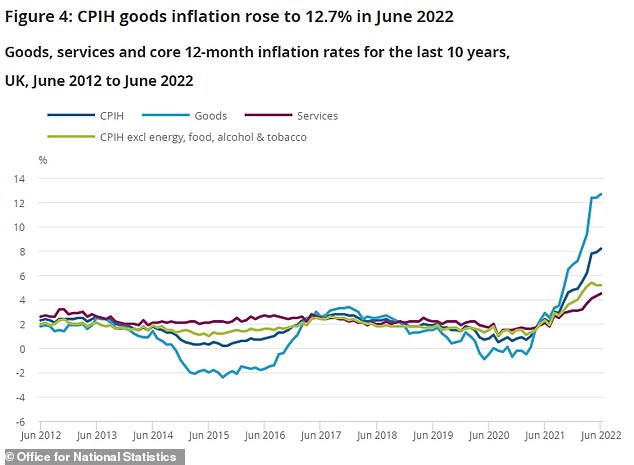

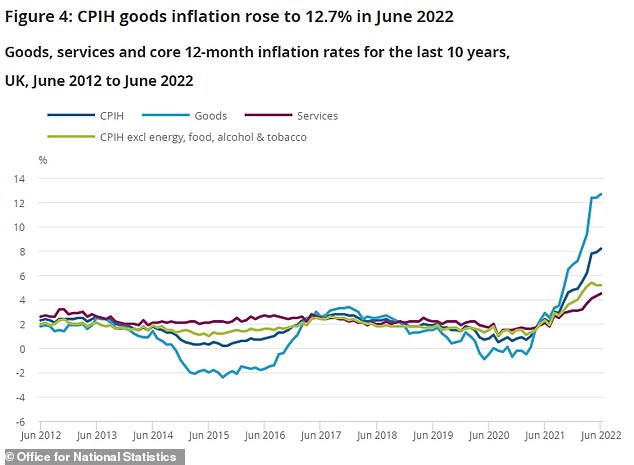

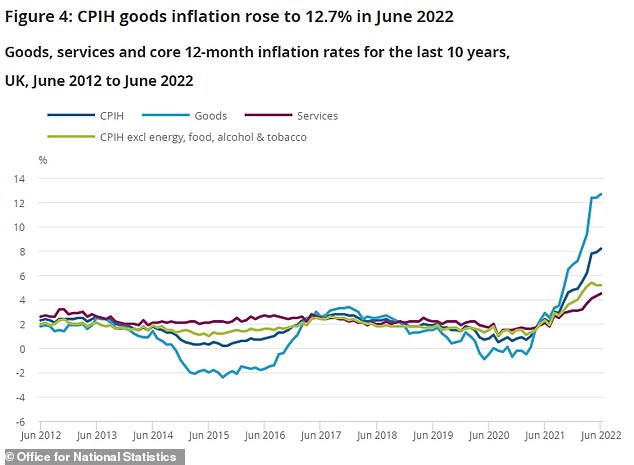

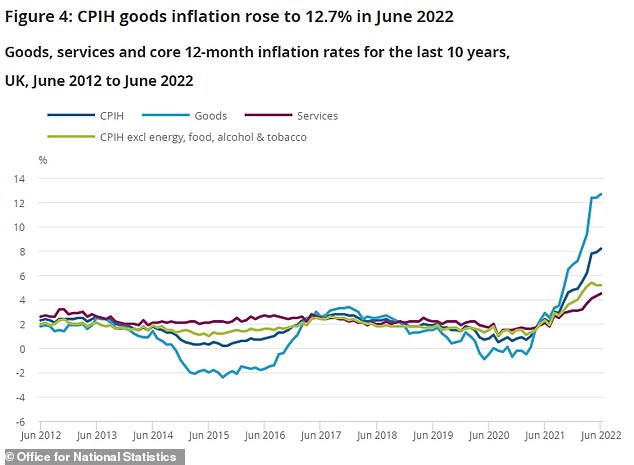

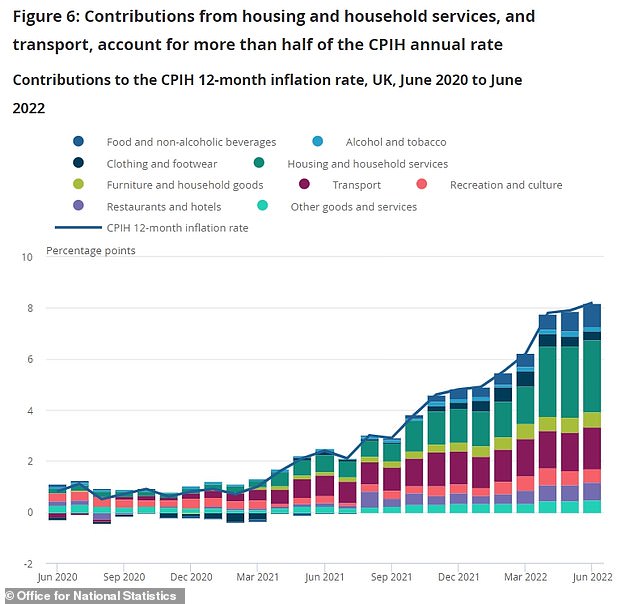

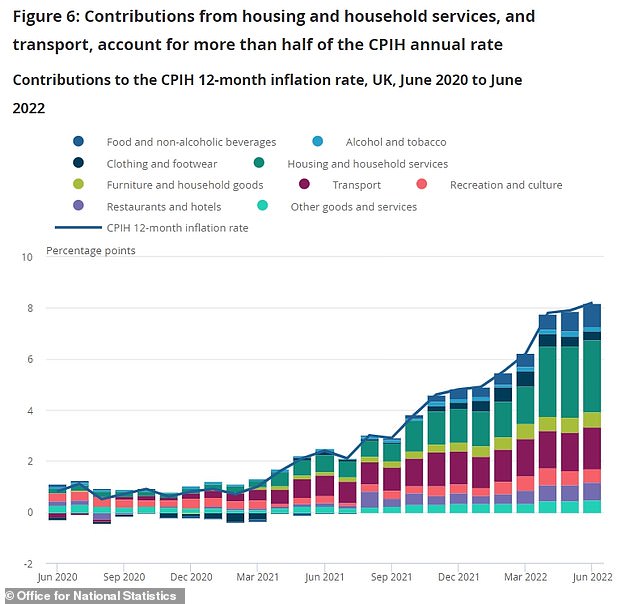

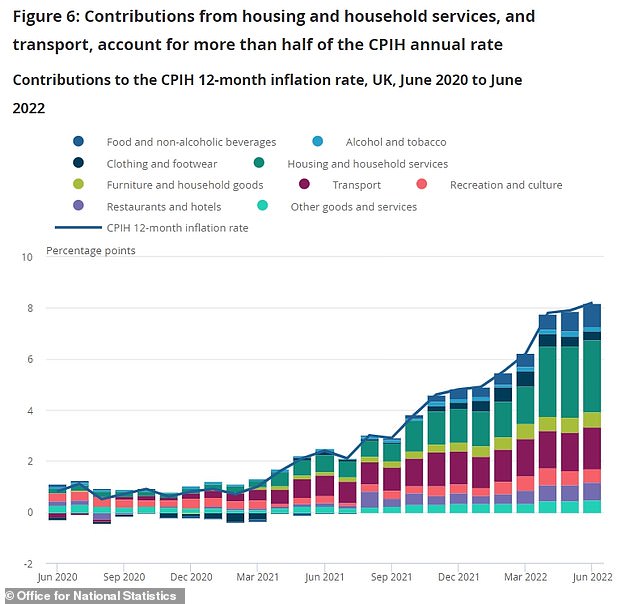

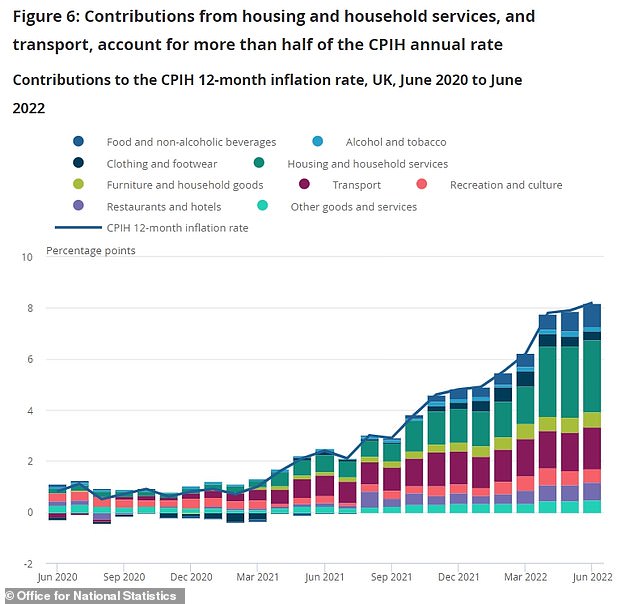

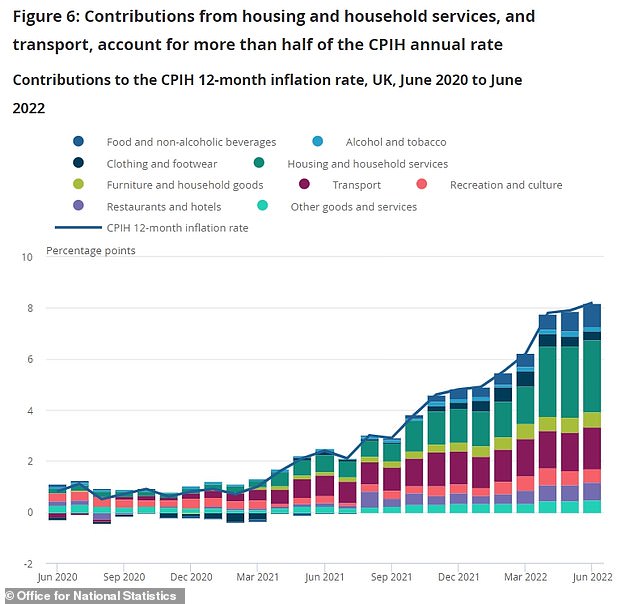

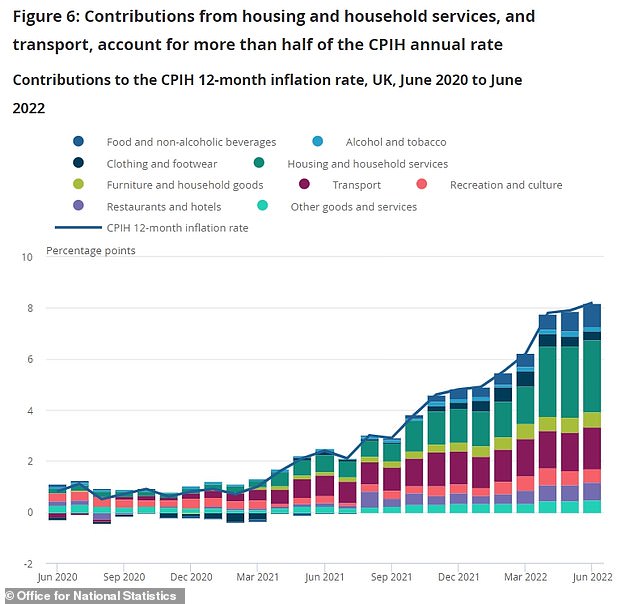

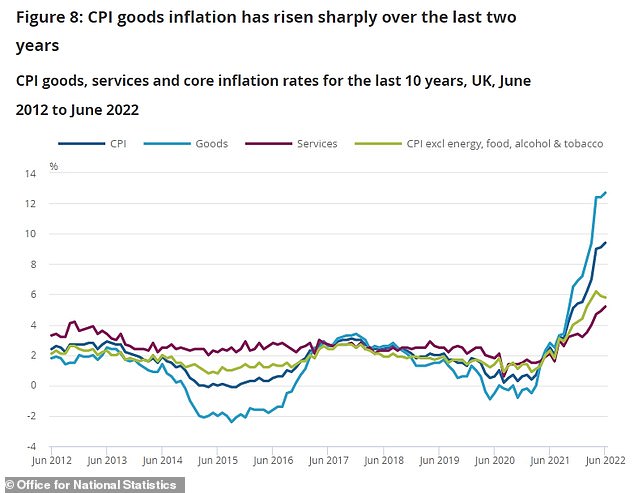

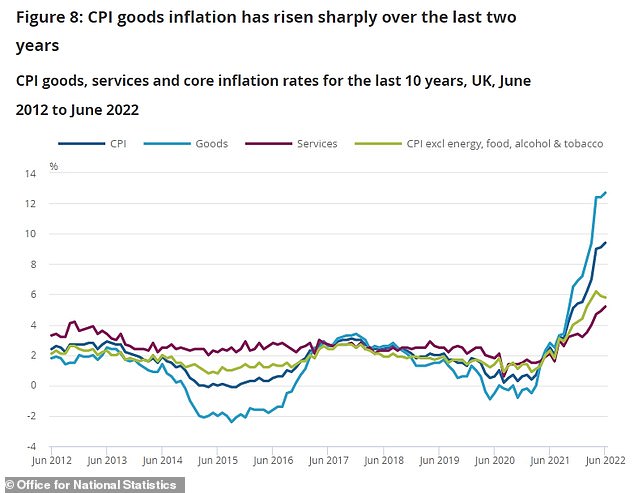

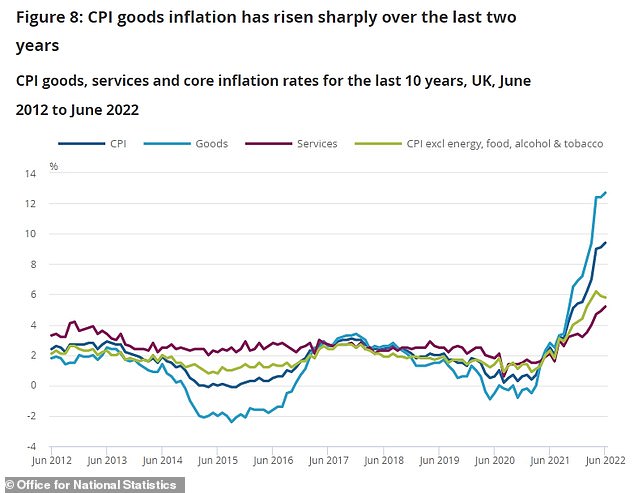

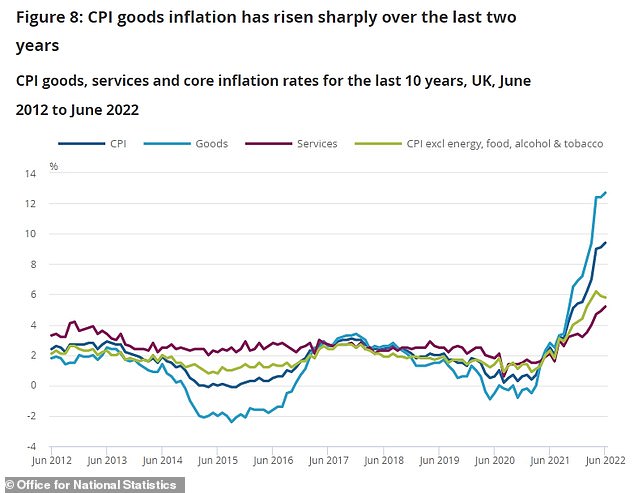

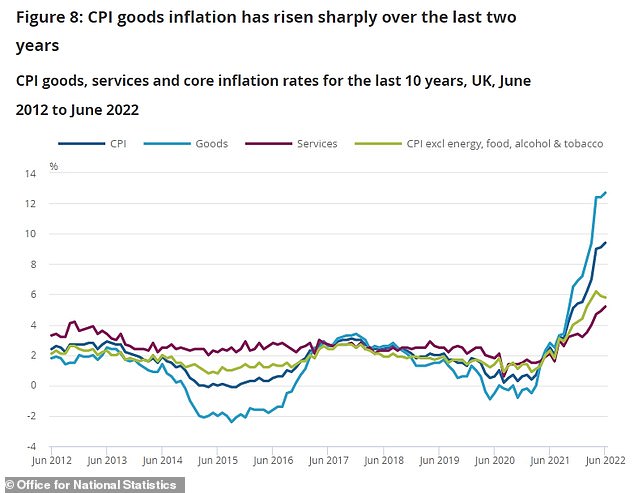

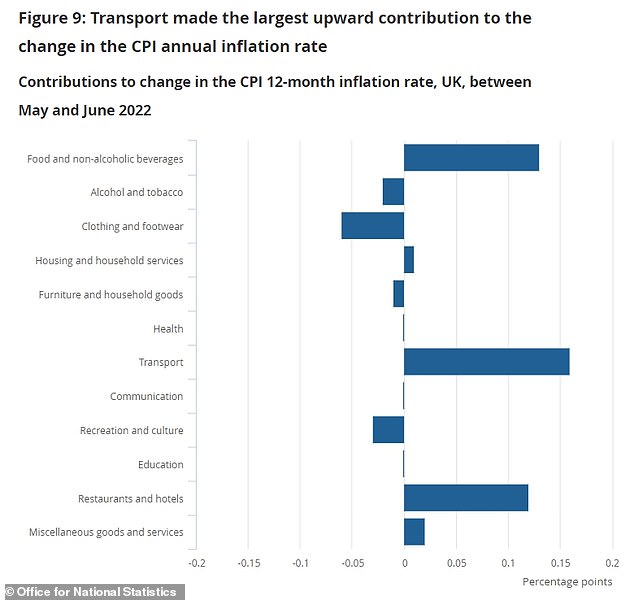

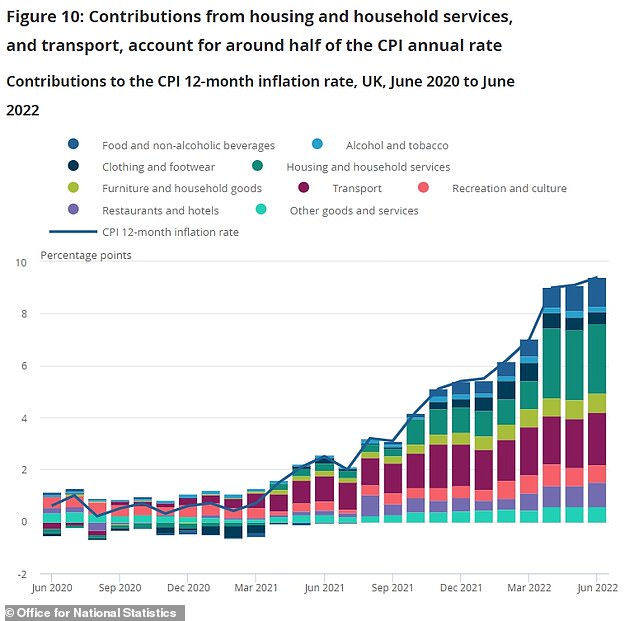

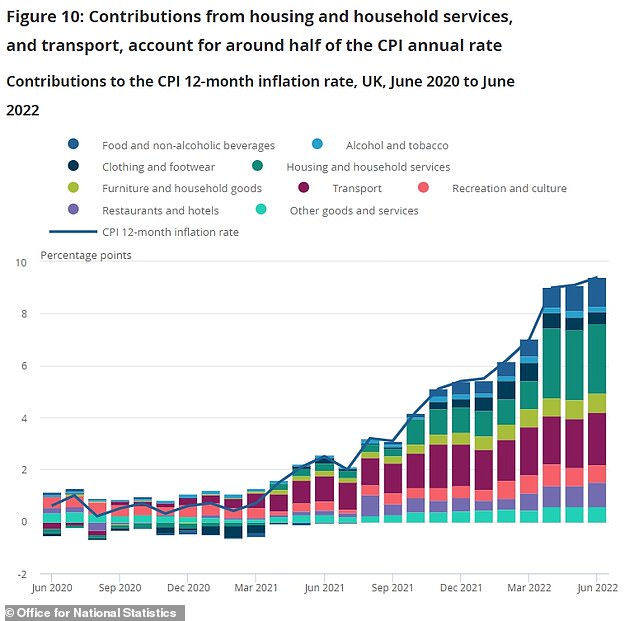

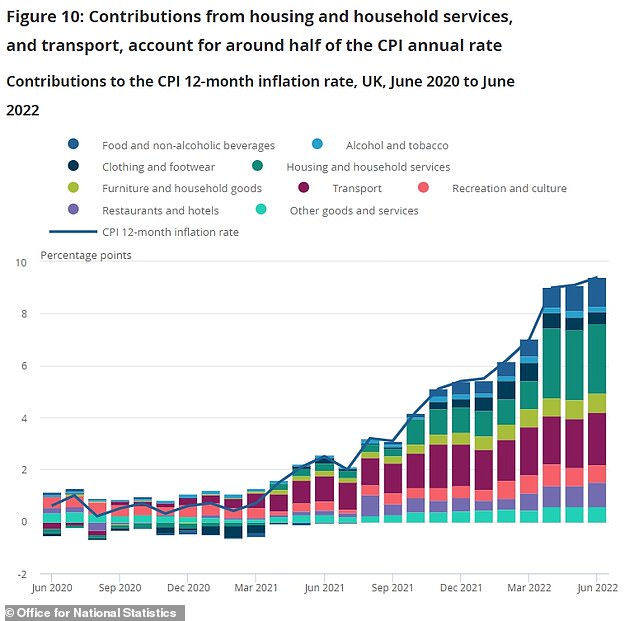

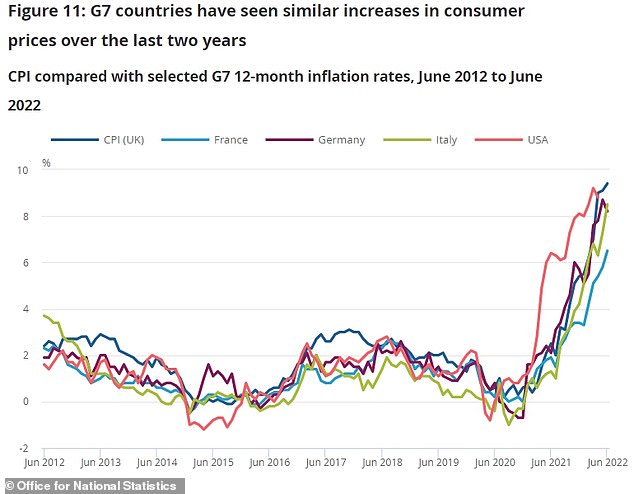

The rate of Consumer Prices Index inflation rose to 9.4 per cent in June from 9.1 per cent in May, the Office for National Statistics has said.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), said: ‘Annual inflation again rose to stand at its highest rate for over 40 years.

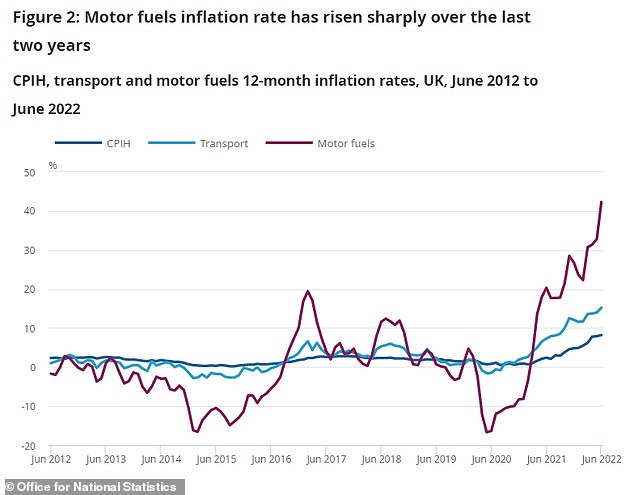

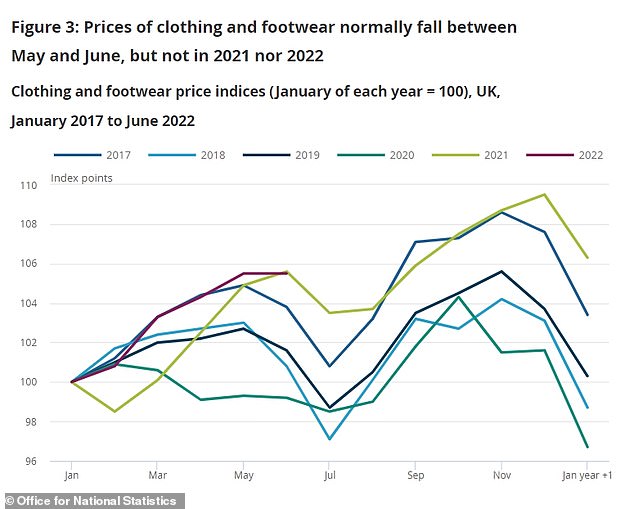

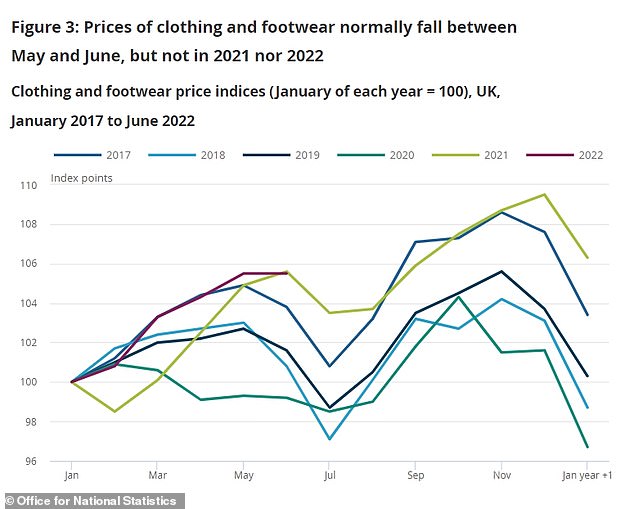

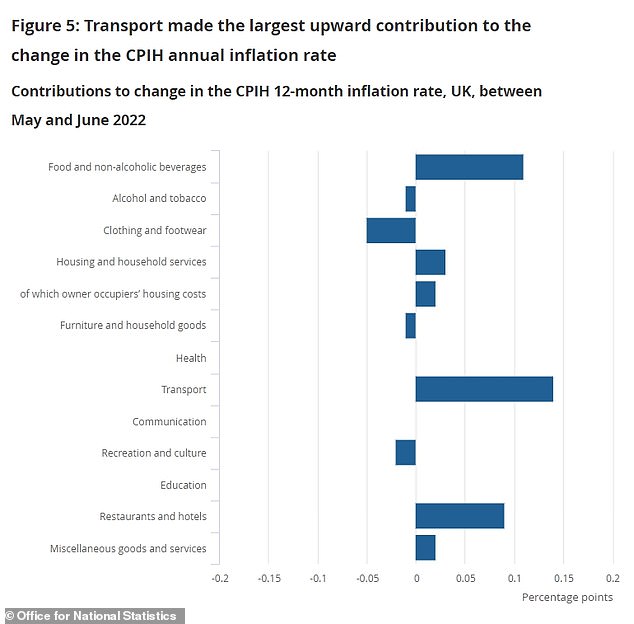

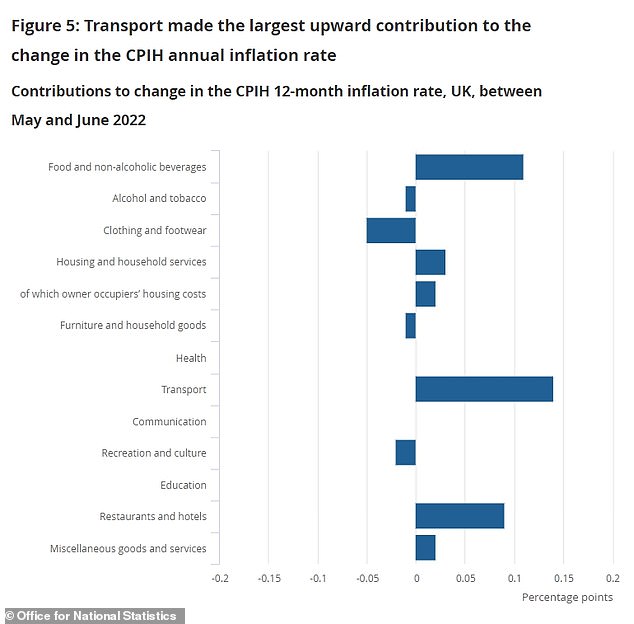

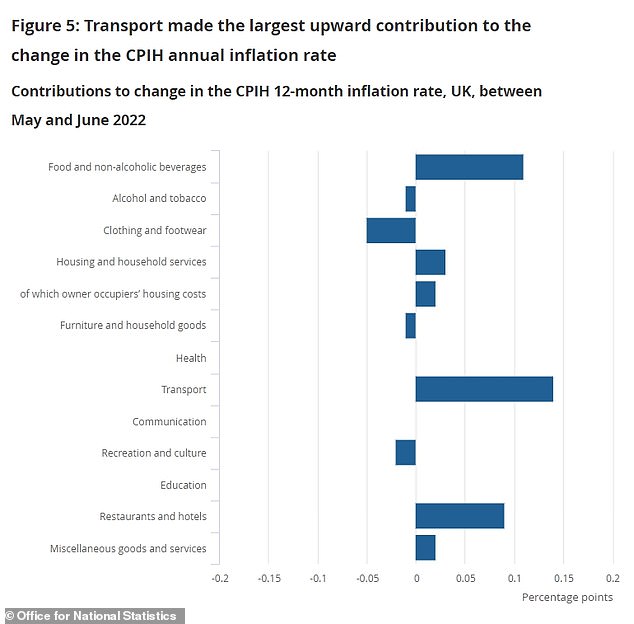

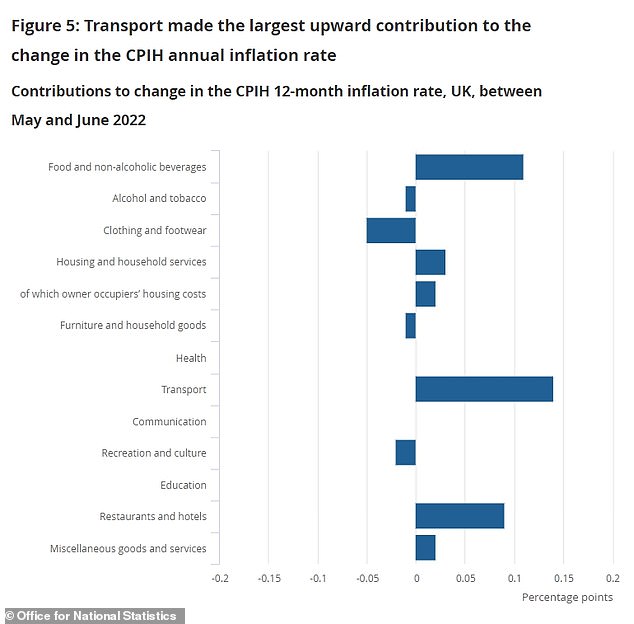

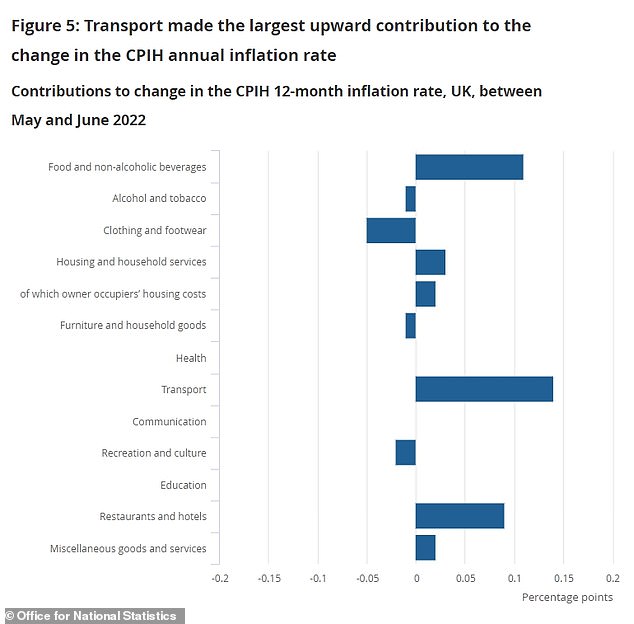

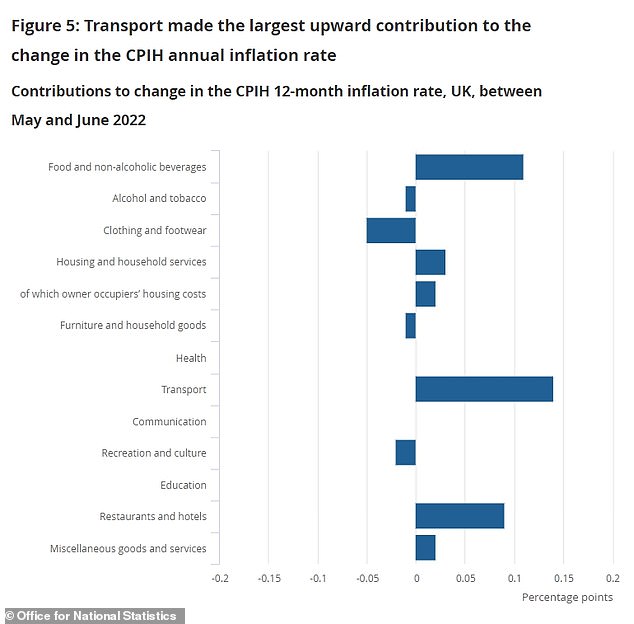

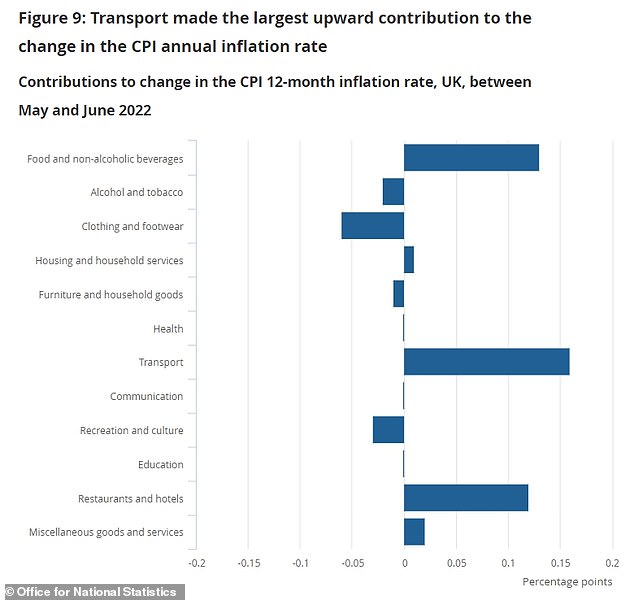

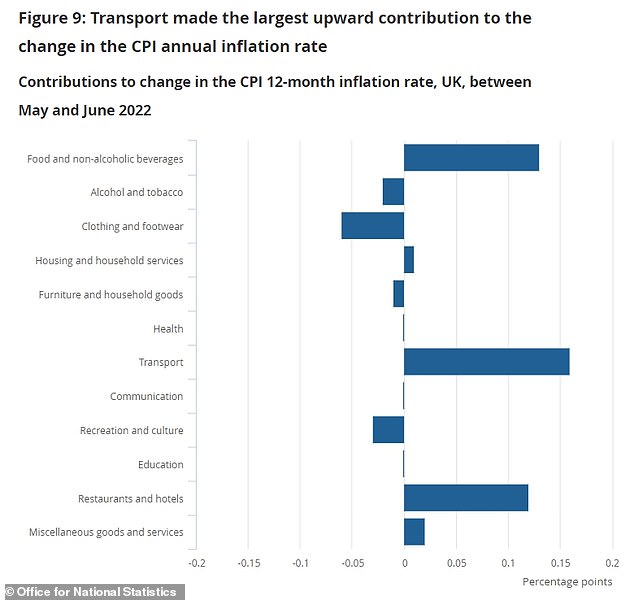

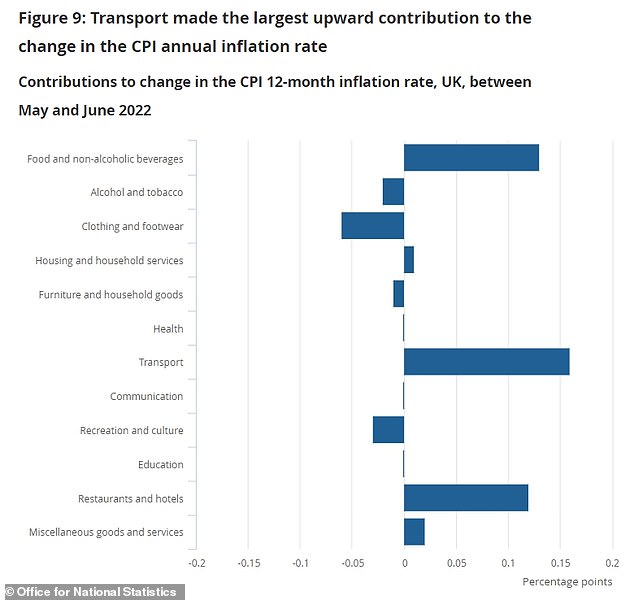

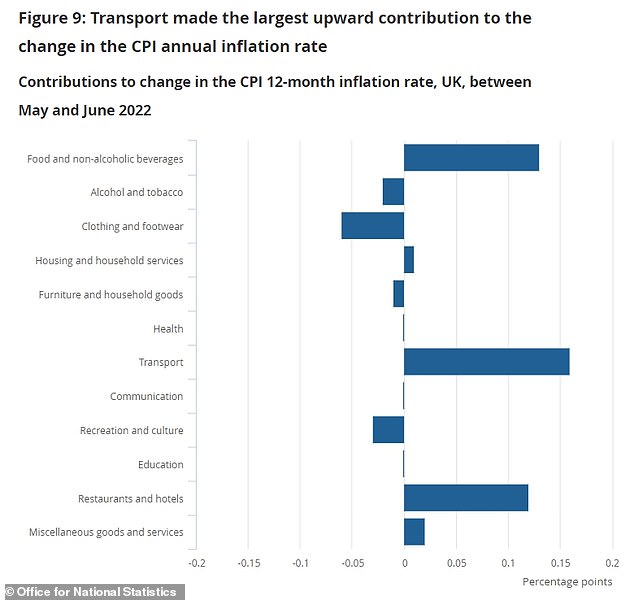

‘The increase was driven by rising fuel and food prices, these were only slightly offset by falling second-hand car prices.

‘The cost of both raw materials and goods leaving factories continued to rise, driven by higher metal and food prices respectively.

‘These increases saw raw materials post their highest annual increase on record, with manufactured goods at a 45-year high.’

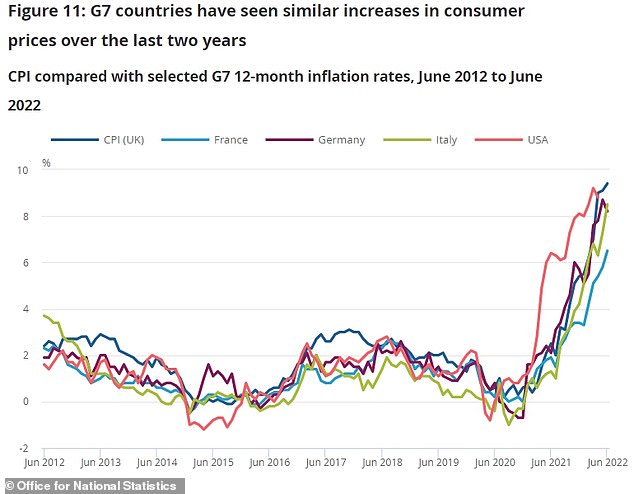

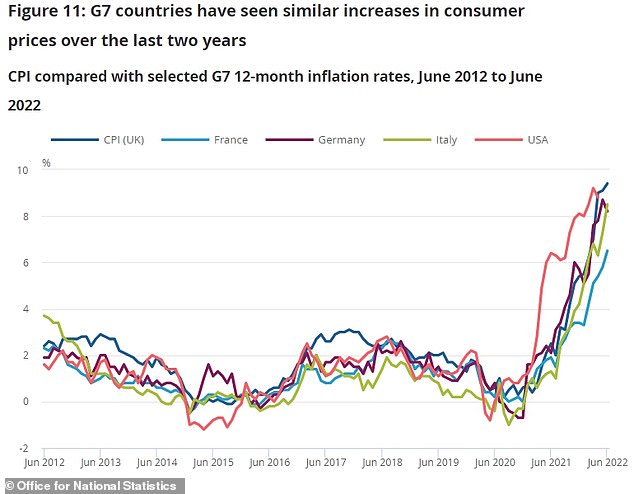

Chancellor Nadhim Zahawi said: ‘Countries around the world are battling higher prices and I know how difficult that is for people right here in the UK, so we are working alongside the Bank of England to bear down on inflation.

‘We’ve introduced £37billion worth of help for households, including at least £1,200 for 8million of the most vulnerable families and lifting over 2million more of the lowest paid out of paying personal tax.’

Shadow chancellor Rachel Reeves said the inflation figures showed there was a need for more than just ‘sticking plasters’ to fix the economy.

‘The cost-of-living crisis is leaving families more worried every day, but all we get from the Tories is chaos, distraction and unfunded fantasy economics,’ she said.

‘Rising inflation may be pushing family finances to the brink, but the low-wage spiral facing so many in Britain isn’t new.

‘It’s the result of a decade of Tory mismanagement of our economy meaning living standards and real wages have failed to grow.’

Anna Leach, deputy chief economist at the Confederation of British Industry warned inflation was likely to remain high for the rest of the year ‘severely eating into strained household incomes’.

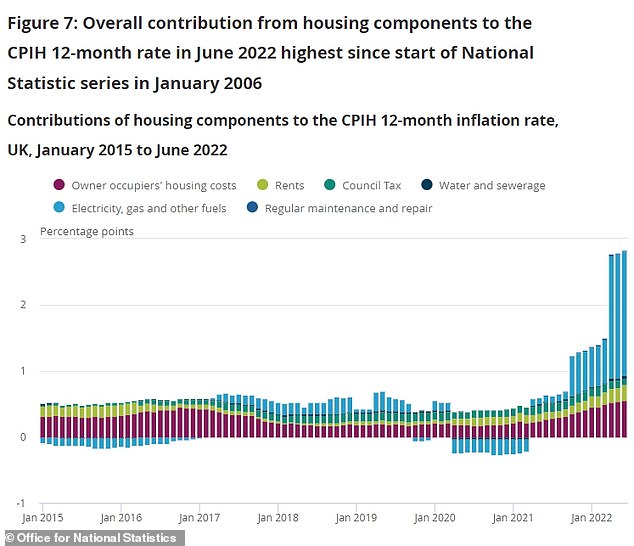

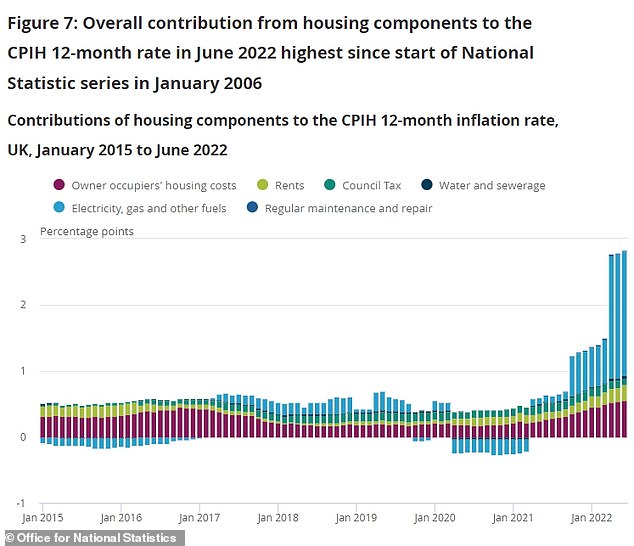

She said: ‘This data underscores the need to give people more control over their energy bills: through speeding up planning decisions for electricity infrastructure and creating a national effort to help households better insulate their homes.

‘But to build resilience to price shocks over the longer-term, the Government needs to focus on boosting the economy’s supply potential.

‘Incentivising investment through a permanent successor to the super deduction and supporting the development of green infrastructure are crucial first steps.’

Bank of England Governor Andrew Bailey has hinted at a 0.5 percentage point rate increase

It comes after the Bank of England hinted at the steepest interest rate rise in nearly 30 years last night.

Governor Andrew Bailey said a 0.5 percentage point rate increase, to tackle soaring inflation, would be ‘on the table’ when the Bank’s monetary policy committee meets in two weeks.

That would be the biggest rise since 1995 and take rates to 1.75 per cent, the highest since December 2008.

Mr Bailey said the Bank would ‘act forcefully’ if it saw signs of inflation embedded in the economy.