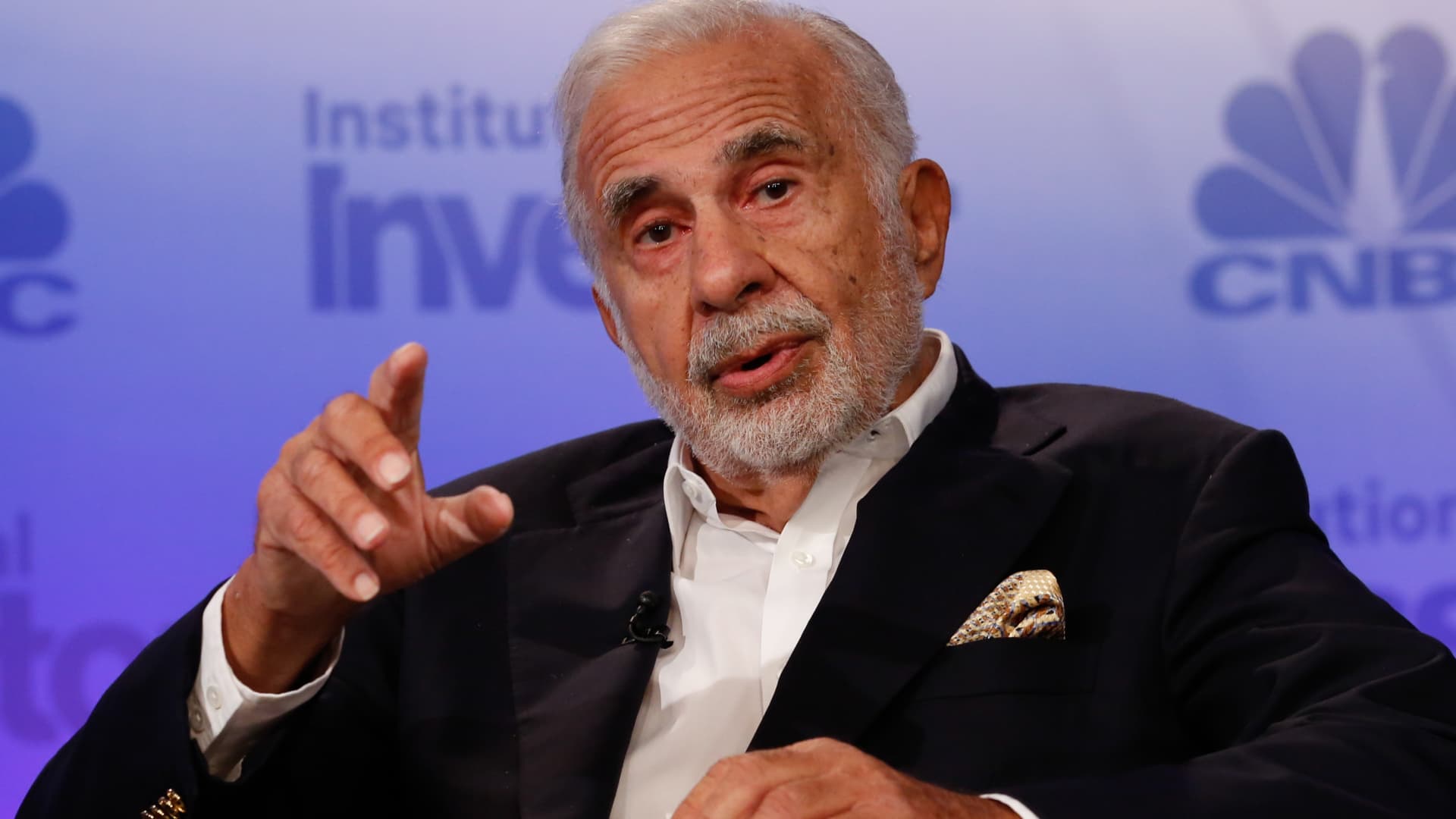

Carl Icahn speaking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Carl Icahn blasted Illumina for nearly doubling its CEO’s pay last year despite a dramatic drop in the biotech company’s market value since closing a controversial deal.

“I’d find it comical, if it wasn’t so reprehensible that ILMN’s share price is down 63% due to CEO Francis deSouza making such an absurd and questionable purchase,” Icahn said in a statement to CNBC.

“And what is really funny is the idea that it is hard to find good CEOs in this area,” the activist investor added. “I guess it would be hard to find someone who could lose $50 billion of shareholder value in a matter of months yet still get paid 87% more for a grand total of $26.8 million in 2022.”

Illumina did not immediately respond to a request for comment.

DeSouza stepped in as CEO in 2016 after serving as the DNA sequencing company’s president for almost three years. He was awarded nearly $26.8 million in total pay last year, nearly double the $14.3 million he received in 2021, according to a preliminary proxy statement Illumina filed Thursday.

Part of deSouza’s pay bump is a special grant of stock options worth $12.5 million, which Illumina called a “meaningful retention incentive in a highly competitive talent environment.”

DeSouza’s pay increase follows a rocky 18 months for San Diego-based Illumina. The company’s market value has fallen to roughly $35 billion from about $75 billion in August 2021, the month it closed its acquisition of cancer test developer Grail.

Rafael Henrique | Lightrocket | Getty Images

The $7.1 billion Grail deal is the focus of a proxy fight between Icahn and Illumina, who have been trading jabs for nearly a month.

Icahn, who owns a 1.4% stake in Illumina, is seeking seats on the company’s board. He is also trying to push Illumina to unwind the Grail acquisition, which he has called “disastrous” and “a new low in corporate governance.”

He has repeatedly slammed Illumina’s board and management team, saying earlier this week that the company should bring back former CEO Jay Flatley to “fix the situation.”

Illumina on Thursday urged shareholders to reject Icahn’s three nominees to its board of directors and continued to defend its management team’s decision to acquire Grail.

The company also claimed Icahn had more favorable things to say about its current CEO before launching the proxy fight.

Icahn told Illumina last month that he intended to make board nominations despite believing deSouza “had done a good job” managing the company, Illumina said.

The activist investor also said he was “supportive” of deSouza’s actions as CEO during another meeting earlier this month, but noted he would not repeat those comments publicly, according to Illumina.

Part of Icahn’s opposition to the Grail acquisition stems from Illumina’s decision to close the deal without approval from antitrust regulators. The company prevailed over the U.S. Federal Trade Commission’s opposition to the deal in September, but is still fighting for approval from European regulators.

The EU’s executive body, the European Commission, last year blocked Illumina’s acquisition of Grail over concerns it would stifle innovation and hurt consumer choice. The commission also unveiled details of a planned order that would force Illumina to unwind the deal.

Illumina said earlier this month that Grail has “tremendous long-term value creation potential.”

Grail says it offers the only commercially available early screening test that can detect more than 50 types of cancers through a single blood draw. The test generated $55 million in revenue in 2022 and is slated to rake in up to $110 million this year, according to Illumina.