It’s amazing how what data actually matters to investors can rapidly and radically change with the market regime.

For ages, no one cared about monthly inflation prints — everyone knew central banks were going to keep policy easy no matter what. Now even Spanish data can make the FT splash.

And in the US, two recondite data sets suddenly matter a LOT.

The Federal Reserve’s weekly H.4.1 shows usage of the US central bank’s liquidity facilities, while the H.8 release details the assets and liabilities of US commercial banks. They have suddenly taken on mammoth significance as weekly gauges of stresses in the banking industry, and the sellside is on it.

The H.8 data is released late on Friday afternoons, but the H.4.1 was published last night, and luckily it showed a slight downtick in Fed facility usage, indicating that the crisis may be moderating. Here’s Krishna Guha of Evercore ISI:

The Fed’s weekly H. 4.1 balance sheet release showed Fed lending to banks starting to fall off, if only very slightly so far. This does suggest that the extent of acute problems in the banking sector is moderating some, even if a subset of banks remain very stressed and the credit impact of the recent shocks remains very unclear.

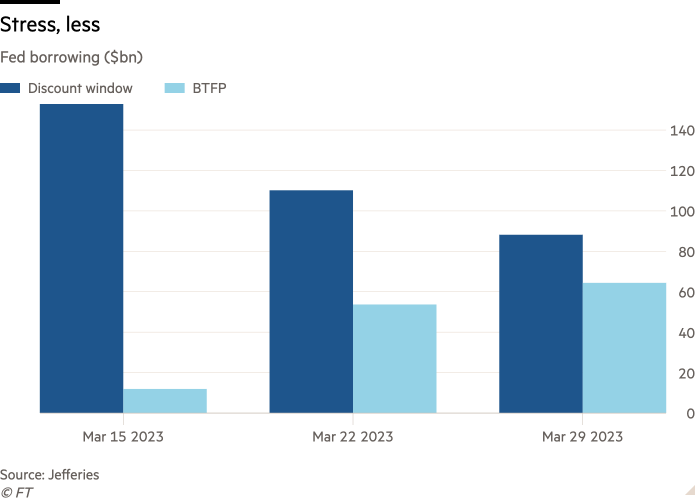

Discount window usage declined by $22.1bn to $88.2bn. This was partially offset by an increase in the more attractive if still-novel bank term funding program which saw uptake rise from $53.7bn to $64.4bn.

The large (presumably single counterparty) user at the foreign official repo facility (FIMA) saw its demand decline slightly from the user maximum of $60bn to $55bn EOP (the weekly average suggests it was maxed out until dropping to $55bn on Wednesday).

Flows into money market funds over the past week came in at a still large $66bn but slowed notably from the prior week’s pace.

Here is the breakdown of the last few weeks of data via Ken Usdin at Jefferies. The net decline over the two facilities this week is about $11.4bn.

Usdin notes that declining usage of the classic discount window and the uptick in the Buy Them at Fucking Par, sorry, the Bank Term Funding Program banks are probably rotating from the former due to the latter’s better terms.

The borrowing costs have been consistently lower lately — on March 30 the discount window was at 5 per cent versus 4.79 per cent for BTFP — and you can famously pledge Treasuries as collateral at par value, rather than their current rate-shocked market value. On the other hand, the discount window accepts a much wider range of collateral, so the usage between the two facilities may ebb and flow.

Now, roll on the H.8 data that will be published at 4.15pm ET today, and show us US banking deposit movements between March 16 and 22. 🍿