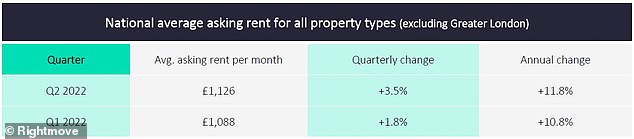

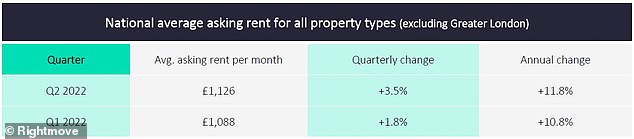

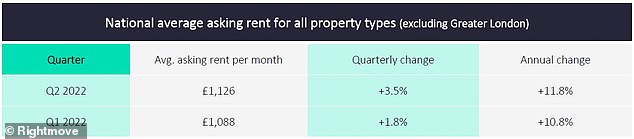

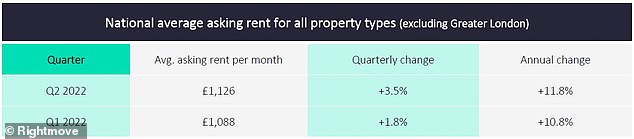

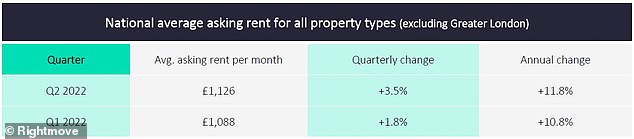

Rents outside of London have increased by £177 since the start of the pandemic to reach another new record of £1,126 a month.

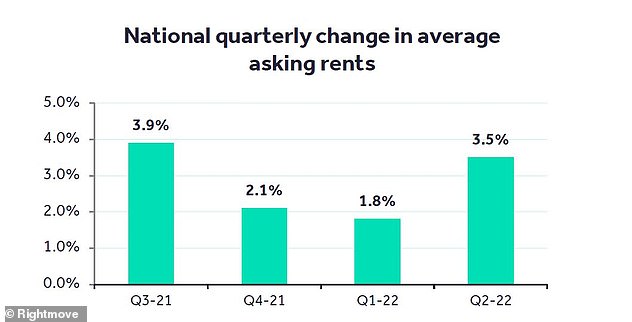

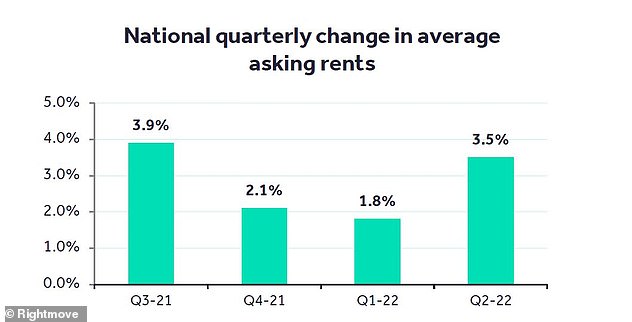

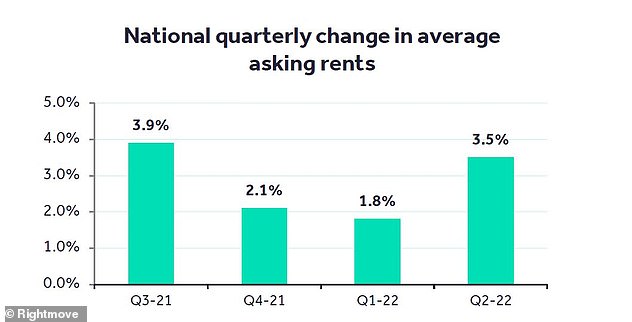

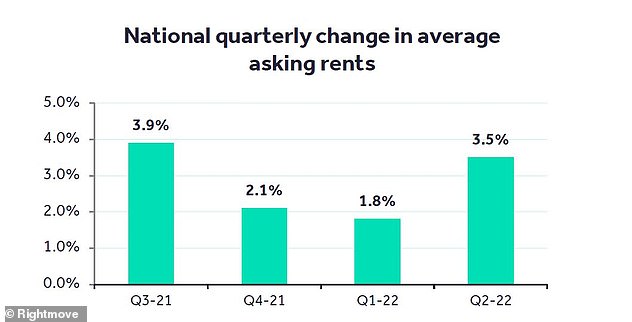

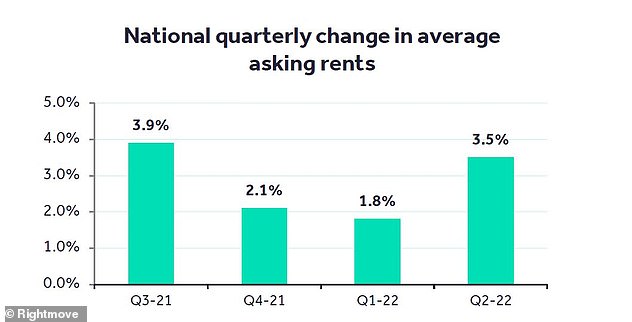

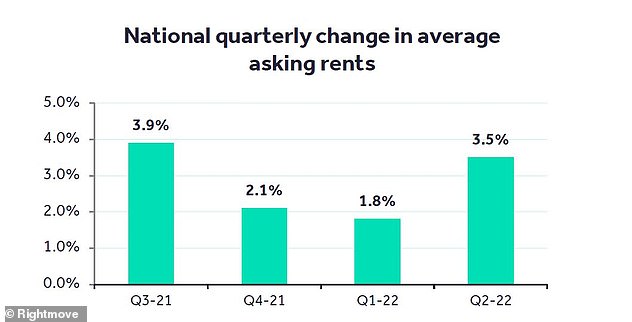

Average monthly rents are up 3.5 per cent from last quarter and are 11.8 per cent higher than last year, the figures from Rightmove show.

It means they are now rising at the highest annual rate since its records began 16 years ago. Rents are up 19 per cent, the equivalent of £177, since March 2020.

Rent increases are being attributed to a shortage of rental homes combined with high demand from tenants

Rental prices have soared during the past two years. It took eight years to reach the same level of growth before the pandemic struck.

This quarter’s 3.5 per cent jump is the second highest quarterly rise in ten years, Rightmove said. It based its analysis on asking rents.

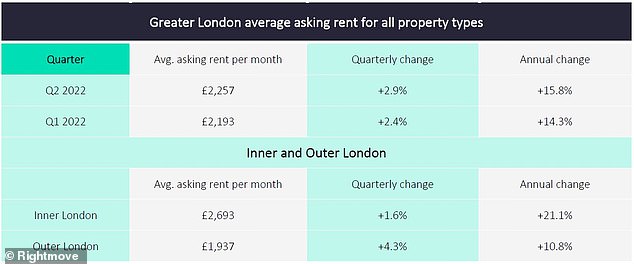

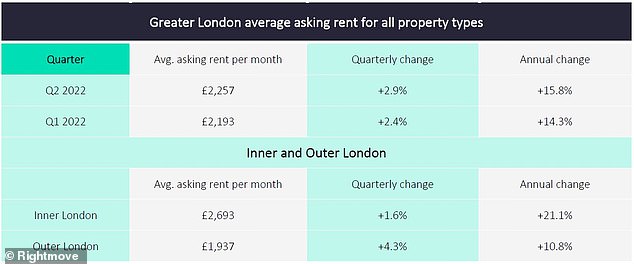

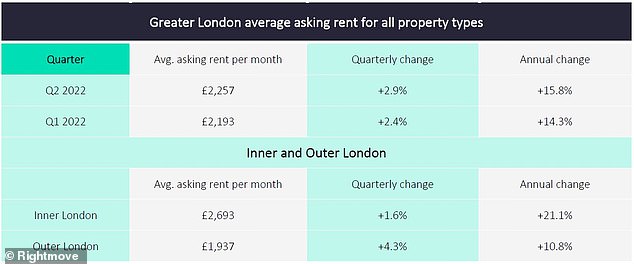

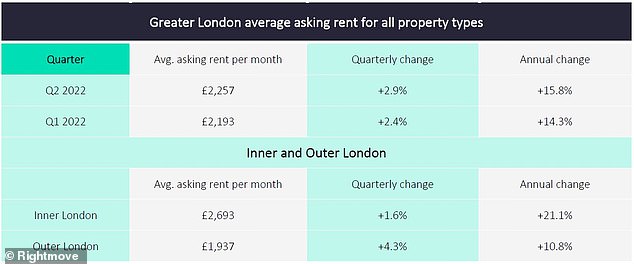

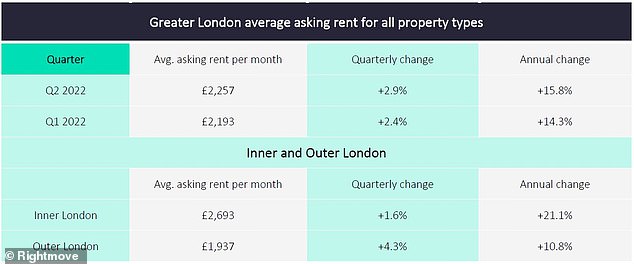

Rents in London also continue to rise, reaching a new record average of £2,257 a month this quarter.

Annual growth in asking rents in London is now at 15.8 per cent, the fastest ever rate of any region.

The increases are being attributed to a shortage of properties to rent combined with high demand from tenants.

However, Rightmove said that while there is still a shortage of available homes to rent, there continues to be signs of improvement.

Rightmove says average monthly rents are up 3.5 per cent from last quarter and are 11.8 per cent higher than last year

Annual growth in asking rents in London is now at 15.8 per cent, the fastest ever rate of any region

The number of new rental listings is up 8 per cent since the beginning of the year. June saw the highest number of new rental listings coming to the market of any month this year so far.

Despite these encouraging signs, available rental stock is still down 26 per cent compared to last year’s levels, while demand is up 6 per cent, which means competition between tenants remains extremely fierce.

While high tenant demand continues to overtake last year’s exceptional levels, and available rental stock is slow to recover, Rightmove expects average asking rent growth to reach 8 per cent by the end of the year, up from 5 per cent predicted at the start of the year.

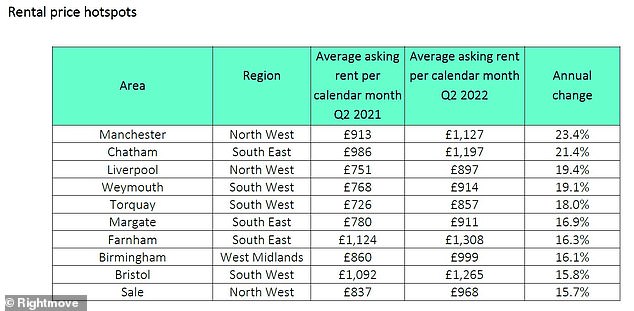

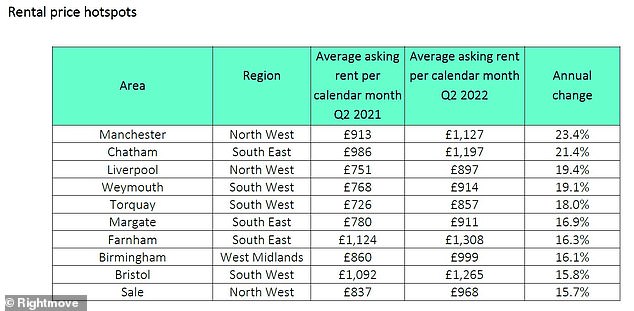

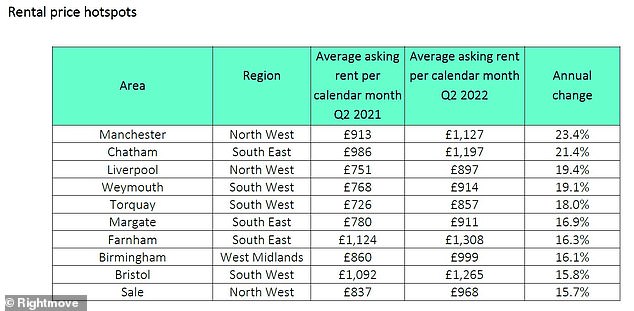

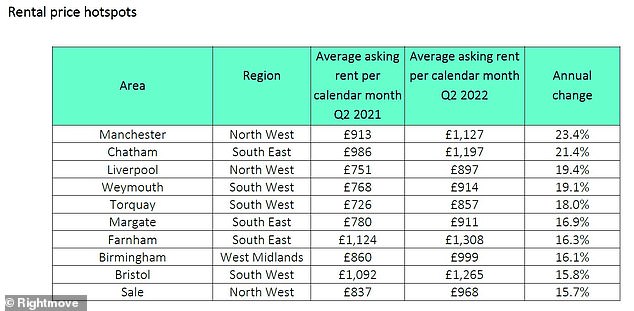

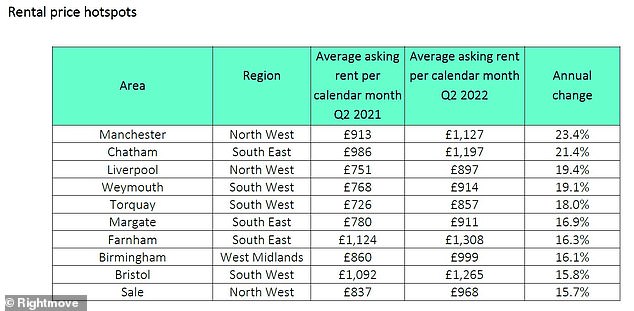

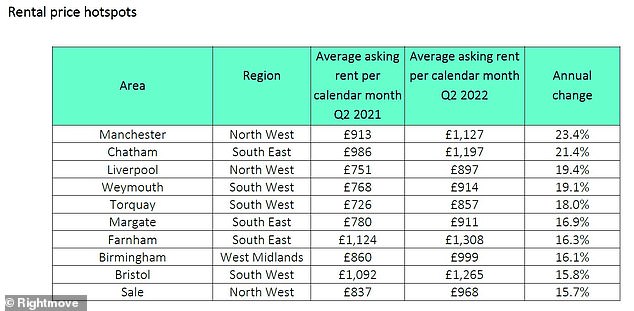

Top of the list of rental hotspots is Manchester (pictured) which has seen annual growth of 23.4 per cent

The top rental price hotspots around the country have been revealed by Rightmove

Rightmove went on to reveal the rental price hotspots with Manchester seeing the highest rate of annual change in rents at 23.4 per cent.

Other rental hotspots include Chatham at 21.4 per cent annual growth, Liverpool at 19.4 per cent, Margate at 16.9 per cent, and Birmingham at 16.1 per cent.

Rightmove also looked at the affordability of renting and buying a home. It found that due to historically low interest rates, average mortgage payments on properties with two-bedrooms or fewer have risen by 13 per cent in the last ten years.

It compares to equivalent rental payments on the same properties rising by 40 per cent.

Rightmove also claimed that more landlords are planning to expand their portfolio than reduce it.

It described this as a sign of confidence in the market despite challenges such as legislation changes and potential updates to EPC requirements.

A total of 34 per cent of landlords recently surveyed said they plan to expand their portfolio during the next 12 months compared with 11 per cent who plan to reduce the number of homes they rent out.

The rental hotspots also include Bristol (pictured) which has seen annual growth of 15.8 per cent

Rental hotspots include Torquay (pictured) which has seen annual growth of 18 per cent

Rightmove’s Tim Bannister said: ‘The story of the rental market continues to be one of high tenant demand but not enough available homes to meet that demand.

‘Last year we saw exceptional numbers of tenants looking to move and this year we have seen no let-up in this trend.

‘While stock levels are beginning to improve, with June seeing the highest number of new rental listings coming to market so far this year, the wide gap that has been created between supply and demand over the last two years will take time to narrow.

‘Until then, this imbalance will continue to support asking rent growth. This has led to our revised forecast of an 8 per cent rise in asking rents by the end of the year up from 5 per cent.’

Rental hotspots include Farnham (pictured) which has seen annual growth of 16.3 per cent

Lettings agents confirmed the data, saying rental prices were increasing sharply.

Nicola Fleet-Milne, of lettings agent FleetMilne in Birmingham, said: ‘The second quarter this year has seen a sharp increase in rental prices in Birmingham City Centre – a hangover of the stifled growth throughout the pandemic.

‘Couple this with a lack of good quality stock, and the result is an applicant base looking for homes six to 10 weeks in advance of their need. This is a huge increase from 2021 where applicants typically searched around four to six weeks in advance of their need.

‘Older stock is falling dramatically behind the standards of the new units coming through, and while initially, they may demand similar rents, as more developments complete, the older stock may be relegated to a markedly lower price band.’

And Richard Davies, of lettings agent Chestertons, said: ‘Throughout the second quarter of this year, London’s rental market has seen continuous growth in tenant enquiries as well as in the number of tenants extending their rental agreements.

‘Those who secured a property at a discounted rental rate during the pandemic are keen to hold on to this deal as long as possible, particularly in the face of rising living costs.

‘With the return of office workers, international students and corporate tenants alike, London’s rental market has also seen an unprecedented corporate demand that is outstripping supply. This has created an extremely competitive market for tenants where many offer landlords over asking price in order to secure a property.’

#fiveDealsWidget .dealItemTitle#mobile {display:none} #fiveDealsWidget {display:block; float:left; clear:both; max-width:636px; margin:0; padding:0; line-height:120%; font-size:12px; width: 100%;} #fiveDealsWidget div, #fiveDealsWidget a {margin:0; padding:0; line-height:120%; text-decoration: none; font-family:Arial, Helvetica ,sans-serif} #fiveDealsWidget .widgetTitleBox {display:block; float:left; width:100%; background-color:#B11B16; } #fiveDealsWidget .widgetTitle {color:#fff; text-transform: uppercase; font-size:18px; font-weight:bold; margin:6px 10px 4px 10px; } #fiveDealsWidget a.dealItem {float:left; display:block; width:124px; margin-right:4px; margin-top:5px; background-color: #e3e3e3; min-height:200px;} #fiveDealsWidget a.dealItem#last {margin-right:0} #fiveDealsWidget .dealItemTitle {display:block; margin:10px 5px; color:#000; font-weight:bold} #fiveDealsWidget .dealItemImage, #fiveDealsWidget .dealItemImage img {float:left; display:block; margin:0; padding:0} #fiveDealsWidget .dealItemImage {border:1px solid #ccc} #fiveDealsWidget .dealItemImage img {width:100%; height:auto} #fiveDealsWidget .dealItemdesc {float:left; display:block; color:#e22953; font-weight:bold; margin:5px;} #fiveDealsWidget .dealItemRate {float:left; display:block; color:#000; margin:5px} #fiveDealsWidget .dealFooter {display:block; float:left; width:100%; margin-top:5px; background-color:#e3e3e3 } #fiveDealsWidget .footerText {font-size:10px; margin:10px 10px 10px 10px;} @media (max-width: 635px) { #fiveDealsWidget a.dealItem {width:19%; margin-right:1%} #fiveDealsWidget a.dealItem#last {width:20%} } @media (max-width: 560px) { #fiveDealsWidget #desktop {display:none} #fiveDealsWidget .widgetTitleBox {background-color:#e3e3e3; } #fiveDealsWidget .widgetTitle {color:#000} #fiveDealsWidget #mobile {display:block!important} #fiveDealsWidget a.dealItem {background-color: #fff; height:auto; min-height:auto} #fiveDealsWidget a.dealItem {border-bottom:1px solid #ececec; margin-bottom:5px; padding-bottom:10px} #fiveDealsWidget a.dealItem#last {border-bottom:0px solid #ececec; margin-bottom:5px; padding-bottom:0px} #fiveDealsWidget a.dealItem, #fiveDealsWidget a.dealItem#last {width:100%} #fiveDealsWidget .dealItemContent, #fiveDealsWidget .dealItemImage {float:left; display:inline-block} #fiveDealsWidget .dealItemImage {width:35%; margin-right:1%} #fiveDealsWidget .dealItemContent {width:63%} #fiveDealsWidget .dealItemTitle {margin: 0px 5px 5px; font-size:16px} #fiveDealsWidget .dealItemContent .dealItemdesc, #fiveDealsWidget .dealItemContent .dealItemRate {clear:both} }