This article is an on-site version of Martin Sandbu’s Free Lunch newsletter. Sign up here to get the newsletter sent straight to your inbox every Thursday

Ah, the memories a good bank run can bring back. I was in Brussels earlier this week, and enjoyed reminiscing with veterans of the global financial crisis and the eurozone debt crisis over FT front pages plastered in downward-pointing charts and pictures of worried traders. For a moment, it felt like 2008 (or 2009, or 2010) all over again.

Hopefully, the fallout from the Silicon Valley Bank collapse will not come anywhere near that, although as Credit Suisse’s troubles show, nervousness has already crossed the Atlantic. At least one difference from 15 years ago is that we gained quite a lot of understanding from how those crises unfolded. Nevertheless, the SVB story tells me that we did not fully learn the lessons from last time. In fact, we are still not in agreement on what those lessons are.

For some — including, it seems, the US government — the lesson was that nobody should ever lose any money they deposit in a bank, even if the “somebody” is a sophisticated midsize business and the amount is far above the deposit insurance limit. For me, the lesson was that we must have a financial system where private banks can never blackmail governments into bailing them out, lest panicked depositors bring the whole economy down.

As Matthew Klein so memorably puts it, banks are “speculative investment funds grafted on top of critical infrastructure. This structure is designed to extract subsidies from the rest of society by threatening civilians with crises if the banks’ bets are ever allowed to fail. [The SVB bailout] is a reminder that those threats usually work.” The policy challenge has always been to end this state of affairs.

I’m with former US regulator Sheila Bair, who slams her successors for ruling the SVB situation a risk to the entire US financial system: “Is that system really so fragile that it can’t absorb some small haircut on these banks’ uninsured deposits?”

But even if you agree with retroactively guaranteeing SVB’s uninsured depositors, you must admit it reflects a policy failure. If all bank deposits should always have the government’s backing in full, then why didn’t we abolish outright the deposit insurance limit of $250,000, which is now presumably only notional? (It is €100,000 in Europe, which means the question there is even more pressing.)

Note, by the way, that no one has questioned the wisdom of the part of the US bank resolution system that has worked as it is supposed to: unsecured bondholders in the failed banks will be written down — depositors, even uninsured ones, come first. Back in the eurozone crisis days, such “depositor preference” was seen as anathema, and as a result, a lot of Irish taxpayers are still shouldering the burden that the eurozone made Dublin take off the backs of Irish banks’ bond investors.

The real question SVB throws up is one that has received far too little attention in the debate since the crisis broke. Do we need our financial system to offer an instrument where anyone can store any amount of money with absolute safety (in nominal terms)? That is what guaranteeing deposits in full amounts to.

There are reasons why such guarantees have been kept limited — although the limits have been increased in crises. It gives banks an incentive to be prudent if they know they will not be bailed out. It provides incentives to bank customers too. As Bair points out: “The uninsured depositors of SVB are not a needy group.” It is obvious why individuals and households need a safe place to receive their salaries, manage their spending and hold an amount of liquid savings. But their need is met by the existing insurance schemes. The question is whether it is necessary to provide medium-sized businesses that need to keep millions in cash buffers with the same safety.

Even for those of us who are sceptical of the SVB bailout, it is not obvious how such businesses should go about managing their liquidity needs. The current model requires companies either to take a forensic look at their bank’s balance sheet — essentially treating a deposit as the unsecured loan it really is — or to spread their cash buffers across dozens of banks so as to stay below the limit everywhere. Neither is particularly practical. And many businesses’ exposure to bank deposits could be indirect: the Washington Post’s blow-by-blow account cites the case of a payroll processor that used SVB for helping its client companies pay about 1mn employees.

Once we start thinking about this, it becomes hard to see how a banking system designed along current lines could ever address this problem. That is why I think the main criticisms SVB has triggered — of management failure and regulatory failure — are legitimate but somewhat beside the point.

SVB had a lot of bonds on its balance sheet of the type that are ultra-safe (US government and agency debt), but not if you have to sell before maturity, in which case the price you get depends on current interest rates. Since the Federal Reserve has raised interest rates drastically in the past year, selling its bonds would have wiped out SVB’s equity cushion. Not hedging against this risk was the management failure. The regulatory failure was in letting this go under the radar, after all, but the biggest banks a few years ago were spared the stress tests required by the hard-won Dodd-Frank rules imposed after the global financial crisis.

Both accusations have merit but miss the bigger point. After all, Treasuries and US agency bonds are the most liquid assets you can invest in, and as guaranteed as anything ever gets to pay out its promised value in full. If even this is problematic from the point of view of banks’ ability to offer safe homes for large depositors, what about their supposed function of channelling savings to things such as mortgages and business loans, which are much riskier and much harder to liquidate? SVB’s critics say they should have bought hedging instruments that eliminated the interest rate risk in case of having to sell their assets before maturity. But that is essentially saying that banks should refrain from their other traditional function of maturity transformation — pooling immediately redeemable deposits against investments locked up for the long term.

Ultimately, then, the SVB crisis should make us ask: what is the point of banks? If providing safe storage of money for business depositors requires them to hold riskless assets with no effective duration, they may as well simply hold central bank reserves. Or — what amounts to the same thing — be promised access to cash from the Fed against the full value of government bonds, which is what the central bank’s latest emergency programme offers. But these are very roundabout ways to secure economic stability, which we now seem to say require completely safe business deposits in arbitrary amounts. If we need those deposits to be backed by central bank reserves or something very much like them, what is gained by interposing private banks out to make profits on the intermediation?

Which is why, in Brussels this week, I asked Paschal Donohoe, the president of the eurogroup of finance ministers, and Paolo Gentiloni, the EU commissioner for the economy, whether they and the assembled ministers had drawn the link between the SVB crisis and the project for a digital euro, which was also on their agenda. Because a central bank digital currency would provide precisely what seems to be missing today: a means by which businesses could keep cash completely safe, without any need for banks.

If a CBDC is issued by the European Central Bank, which could be decided this year, any business with liquidity buffers greater than the deposit insurance limit should see the interest in keeping those buffers in digital euros. Here is an answer to those who dismissively ask what the use case is for a CBDC: it would eliminate the type of systemic risk identified by US regulators in which ordinary business depositors doubt the safety of their deposits. But it would only do so if users are allowed to hold more than the very low limits the ECB is at present contemplating.

From Donohoe’s and Gentiloni’s answers, it is clear that ministers have not drawn this link. I rather suspect that they will have to think about it soon.

Other readables

My colleague Richard Milne takes a deep dive into the industrial adventure that is Northvolt, the Swedish battery manufacturing start-up.

Can Europe’s start-up sector innovate its way out of a plastic bag? A new Sifted report gives some answers on how we might get to a post-plastic future.

Numbers news

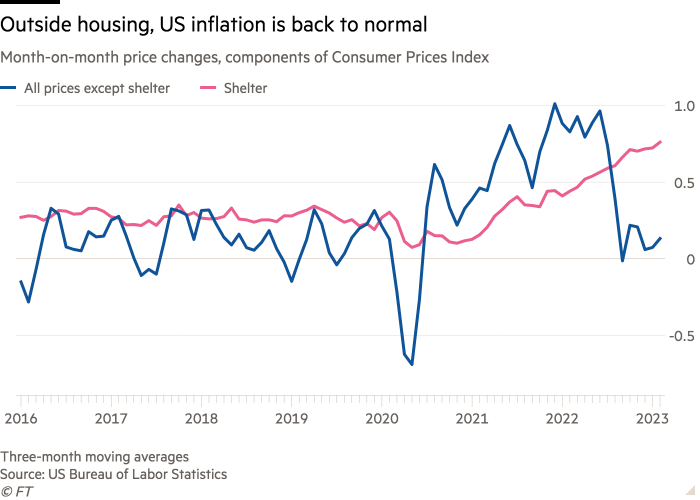

The latest US inflation numbers — with stubbornly high month-on-month consumer price increases — were taken as bad news for the Federal Reserve. I disagree. There is only one sector where inflation is misbehaving, and that is shelter — outside of housing, inflation has been back to normal since last summer.

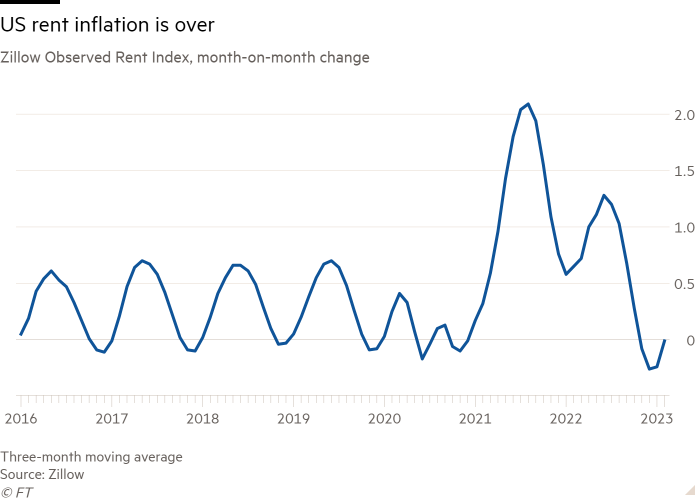

But for shelter prices, then, we would declare the inflation danger over. And we know that the CPI measure of housing costs is backward-looking — it reflects changes that have already happened. This means current movements in shelter prices will show up in the CPI measure over the next year. So this component should fall too. If you look at a private rent index such as the Zillow Observed Rent Index, you find that rental prices have hardly moved since September.

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here