In his new book, sociologist Jason Houle reveals how Black borrowers are disproportionately affected by the student loan crisis and shows how this disparity perpetuates social and economic inequality.

It’s more likely than not that you know someone with student debt. After all, student debt has become a crushing burden for households across the United States. But according to two experts, that burden is acutely painful—and carries with it deep and long-lasting repercussions—for the nation’s Black borrowers in particular.

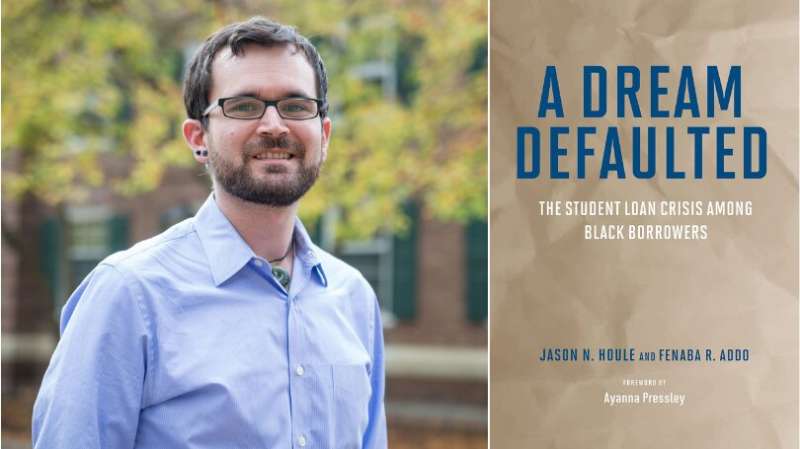

In their new book, “A Dream Defaulted: The Student Loan Crisis Among Black Borrowers,” Dartmouth professor Jason Houle and his research partner, Fenaba Addo of the University of North Carolina, show how Black borrowers are saddled with higher amounts of debt, longer repayment windows, higher default rates, and lower college completion rates than other students—which they argue is both a product of and a contributor to social and economic instability.

“We say that this disparity reflects, and then in turn reproduces and exacerbates, existing racial inequality,” says Houle, an associate professor of sociology.

Here, Houle discusses their research and offers potential solutions to the unequal burden on Black borrowers.

How does the student loan crisis affect Black borrowers differently?

Black borrowers are not only more likely to accumulate much more debt than white borrowers, but they have much more trouble repaying that debt than white borrowers. So you have these two crises—accumulation and repayment—for Black borrowers. And then for Black borrowers, you also see this college completion crisis, too. College completion rates for all students haven’t increased all that dramatically in the past 20 years, yet at the same time a college degree has become far more important than it ever was for entry into what we would think of a stable, middle-class lifestyle.

So we can argue until our face turns blue about whether student debt is a good investment or whether it’s this unacceptable risk, but the question we really need to ask is: who takes on that risk, and for whom does it pay off? And our answer is that there’s this sharp delineation by race. On average, for white kids, student debt is an investment that’s paying off; and for a lot of Black youth, it’s not. It’s creating this rift that is undermining their economic stability—and creating the next generation of the fragile Black middle class, which refers to how much harder it is for Black people to rise up to and remain in middle-class positions

How is student debt contributing to financial instability among Black borrowers?

One thing that happens is when Black and white folks graduate from college, on average, there is a gap. It’s something like $5,000 or $6,000 more that Black borrowers owe than white borrowers when they leave a four-year college. But by 10 years later, that racial disparity has basically tripled. So these big racial disparities just get bigger as time goes on.

Debt ends up being much harder to repay for Black borrowers than white borrowers. It’s a broader story about racism and discrimination in contemporary U.S. society. We have plenty of great data from audit studies that show that a college degree is not enough to protect you from racial discrimination. We see clear racial discrimination in hiring and job promotion and the type of jobs that can be careers. They’re struggling to find their footing economically—maybe they’re helping their family members. And then the student loans come due and they’re like, “I was barely making ends meet as it is.” And for so many of them, programs that are designed to alleviate these issues—particularly income-based repayment programs—are not providing sufficient relief or are too difficult to access.

Part of it is also the student loan repayment system itself, which is hopelessly opaque and confusing. It really is not designed in a way to support Black borrowers who are, to be frank, facing more economic disadvantage coming out of college. Income-based repayment programs are not the plans that people are automatically placed into when they leave college. They’re placed on a standard repayment plan, which makes very different assumptions about their ability to repay.

And, once repayment comes, that debt ends up being a barrier to financial and economic independence. For example, excessive student debt loads are associated with all sorts of issues in young adulthood: mental health, returning back to the parental home, the decision to get married. This is particularly true for Black borrowers, which kind of underscores the idea that student debt is a much heavier burden for this group of borrowers.

How does this contribute to economic inequality?

If you can’t get ahead, that means you can’t save. You probably can’t build up your checking account. You can’t invest. You can’t buy a home. You can’t do all of these wealth-building activities that we tend to do in our 30s and 40s. What we argue is that student loan debt is actually contributing to the racial wealth gap among these 30-something, college-educated folks. White folks are paying down their debt and then accumulating assets, but that’s not happening, in large part, for a lot of our Black borrowers.

If we think of wealth as a “safety net” that you can draw from if times get tough, what this means is that the middle class is a much more fragile and precarious position for Black folks than it is for white folks. Student debt isn’t the only reason for this, obviously, but it’s a part of the story in a world where college is a necessity and costs are high.

You discuss how enrolling in graduate school, particularly unfunded master’s programs, can exacerbate the student debt issue for many borrowers. Why is that?

A lot of this is a story of credentialism. When a lot of folks leave college, they realize that they may not be able to get the dream job they thought they could with their degree. Or they end up in some low-paying job that they feel like they could have gotten without a college degree—both of these scenarios disproportionately affect Black college graduates. So, naturally, people start to think the answer is to get more education—maybe a master’s degree—so they can get that job they want, or get a pay bump at their current job. You see this a lot among teachers, for example. So this isn’t some vanity project where people are going back to school, they’re really just chasing the financial security that their college degree never gave them.

But the problem is many of these programs, especially master’s programs, are unfunded. There is virtually no financial aid, and there are no loan limits for Grad PLUS loans, so it only takes a few years to accumulate six-figure debts. For too long, student debt scholars have ignored debt in graduate school, under the assumption that those who graduate with these advanced degrees will have no problem paying off these eye-popping debt levels. The problem is that for a lot of folks—especially those who go into masters programs—that just isn’t true.

And you also see these massive racial disparities in salaries and the kinds of jobs people are getting after their master’s programs. At the end of the day these students are like, “Was it really worth going into an extra $70,000, $80,000, $90,000 of debt for a $5,000 salary bump?” For a lot of them, the answer was no. And some of them get so disenchanted with the process in the middle of it that they just dropped out of their graduate program, and then they’re left with that massive amount of debt from this unfunded master’s program and nothing really to show for it.

There’s a common argument out there that if young people just had better financial literacy, they wouldn’t get themselves into a crushing debt situation. Is this true?

Both Fenaba (my co-author) and I are very skeptical of financial literacy explanations. It implies that if we just understood more about how to manage our money, that we wouldn’t have a student debt crisis. And even though that’s a popular narrative—and one that borrowers themselves often internalize and in turn blame themselves—it’s just not true. In our quantitative work, we typically adjust for standard measures of financial literacy and risk preference, and find that these constructs are usually unrelated to student debt, and do nothing to explain racial disparities in student debt.

And, when we talk to the people we interviewed for the book, what we saw again and again was that young people were careful planning everything to try to avoid taking on debt—for example, they picked the in-state school over going out of state, so they could get cheaper tuition and live with their parents to save money—and yet, none of these financially savvy strategies could save them from falling into debt. For many of the people we talked to for the book, there were larger external social forces at work that plunged them into debt, and no matter that they tried their best to make the best decisions possible, they could do very little to avoid it.

Here’s another example. If we could boil this down to “bad decision-making,” then we shouldn’t expect to see these big disparities in debt among those groups who “made all the right decisions.” So if you wanted to say this was about making bad decisions, you might hypothesize that racial disparities in student debt could be boiled down to picking the wrong school, or dropping out of college. But that’s not true at all. So if you look at student loan default rates 12 years after college, it’s basically around 3% of white borrowers who have defaulted on their loans–not zero, but basically everyone is able to repay their loans. But when you look at Black borrowers with four-year college degrees, it’s over 20%. And you see this across institutional sectors.

In other words, these are folks who are making all the right decisions—they’re graduating college, they’re going to the right schools—and yet there’s something going on systematically. So one thing we do in the book quite a bit is really try to undermine and reject individual-level solutions to what we view as a dynamic social problem. Because if you have a social problem, individual-level solutions will never be enough. We actually need structural solutions to social problems.

On that note, what might be some structural solutions to this social problem of student debt?

The people who are drowning in debt the most are those who are most disadvantaged in our society, and for whom college is supposed to help the most. To continue with this metaphor, we can think about what we can do to pull people out of the water now—downstream solutions—or we can go to the source and think of upstream solutions. We’re probably going to need both if we’re going to solve this problem in the long term.

I think the most obvious downstream solution is debt forgiveness, barring legal challenges. That’s actually going to help those who are from more disadvantaged backgrounds, especially when you look at the design of the current debt forgiveness program that provides more forgiveness for those from low income backgrounds.

Another simple fix would be, let’s get folks into some payment plans they can afford. Let’s cap interest. Let’s cap their payments based on their income so they’re never paying more than 5% to 10% of their income in a given month. If it survives the legal challenges, the Biden debt forgiveness plan actually does some of this. But we should make income-based repayment an opt-out rather than an opt-in program. Right now, if you want to get into income-based repayment, you need to apply, and have your income verified, and then re-apply every year. This creates a great deal of administrative burden for borrowers.

But it needn’t be this difficult. For example, if everyone were put on income-based repayment when they leave college, and you wanted to “opt out” to a standard repayment plan, you could. And you don’t need to have people verify their income with all this onerous paperwork every year. The IRS knows everyone’s income. This could be automated pretty easily, and we’ve done it for other programs. There’s no need for so much administrative burden to enroll in the repayment program that works best for you.

As for upstream policies, we do need to think about the Federal Pell Grant Program, which has been one of our tools for promoting college access and affordability among low-income youth and youth of color. It has really kind of stagnated in recent years. It used to cover a much larger proportion of college costs than it does now. So increasing the Pell (would help). At minimum, chaining the Pell to inflation would be a big help.

Further, there are ways we can fix financial aid to actually correct the shift from need-based financial aid to more “merit aid,” which is what we’ve seen historically in the last 20 years. But we also could go bolder. There are solutions to try to create free college—a federal free college policy. If you think the root of this problem is that college is unaffordable, well, we have to deal with the root of the problem, right?

I also think that it’s not just tuition. Tuition increases do drive student debt, but one of the big contributors to student debt is cost of living. When you’re at college, you have to live somewhere. You have to eat. And the cost of living is high and rising everywhere, whether you’re staying on campus or you rent an apartment off campus. That’s one of the big contributors to the student loan debt crisis. And we need to address it.

Provided by

Dartmouth College

Citation:

How race matters for the student loan crisis (2022, December 20)

retrieved 20 December 2022

from https://phys.org/news/2022-12-student-loan-crisis.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.