This article is an on-site version of our The Future of Money newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday.

Welcome readers, to the final Future of Money. I don’t want to be mawkish, but I’ll miss the chance to write this newsletter and cover stories that might not get into the paper otherwise. It’s been a bit over a year since I took over the role alongside Imani (who’s now off writing brilliant stuff at the Wall Street Journal), and it’s been an excellent chance to discover a whole lot of new topics.

I also want to say a huge thanks to Emily Goldberg, who has probably spent more time editing than I have writing and has helped to sharpen up the newsletter immensely, as well as Sarah Ebner, Jonathan Moules and every one of the writers who contributed to FintechFT.

I’m staying on the fintech and banking beat, and I look forward to chatting and hopefully meeting lots of you in the new year. As I said last week, please do sign up for some of our other newsletters — Cryptofinance, headed by Scott Chipolina, is a particular favourite.

Thank you all for your emails and thoughts, and as ever, you can reach out to me at [email protected]. Happy reading, a merry Christmas and a happy new year!

Best wishes,

Sid

Latest news

-

Checkout.com, Europe’s most valuable fintech group, has slashed its internal valuation to about $11bn, reports Ivan Levingston. This figure is some way from the $40bn tag on which investors settled in January, but still reflects the turbulent times ahead for high-flying payments companies.

-

What would you buy with $1mn? And what if you were Sam Bankman-Fried, crypto’s most reviled (former) executive? Louis Ashworth dives into the companies which his empire funded, including a platform for drop shippers, a handful of NFT services and a Swiss crypto bank.

-

Exchange traded funds are going big on the metaverse, writes Steve Johnson. A total of 35 metaverse-badged funds have launched globally since June 2021, despite the lack of clarity around the latest hype word related to blockchain.

The BNPL boom, subprime credit and the legacy of 2008

With Christmas less than a week away, this final newsletter is looking at a legacy of the great financial crisis — the wariness among high street banks to take on customers with anything other than “prime” credit records.

The resulting wave of demand for nonprime lending generated the first generation of fintechs — payday lenders such as Wonga, which were able to use tech to quickly make loans to customers. Despite the criticism they received in later years, these companies were seen as disrupters as late as 2011, when the Guardian named Wonga its digital entrepreneur of the year.

“Payday lenders were ruthless at using tech and data to exploit consumer behavioural biases,” said Mick McAteer, director at the Financial Inclusion Centre and a former board member of the Financial Conduct Authority and its predecessor, the Financial Services Authority.

“It was only the price cap on payday loans [introduced by the FCA in 2015] which meant the models didn’t stack up any more,” he added. Wonga itself survived another four years before a surge of complaints drove the venture-backed lender to collapse.

The broader high-cost credit market — sometimes known as non-standard credit — has also faced tough years, shrinking significantly over the past five years. Since the start of the pandemic, the number of active firms has fallen by around a third.

Provident Financial closed its doorstep-lending unit last year, after more than 140 years in operation. Guarantor lender Amigo Loans received FCA approval to restart lending in October, almost two years after the company froze new lending. It is currently in a trial period with FCA supervision, said chief executive Danny Malone.

“We’re making sure that all the policies and the processes work as expected,” he said. “We’re not trying to run before we walk.”

That lending gap has largely been filled by ‘buy now, pay later’ products, said Sharon McPherson, chief executive of Scotcash, a kind of non-profit lender called a community development finance institution. A growing number of customers were also racking up debt across multiple providers.

“Usually in these circumstances, they’re already too over-indebted to lend to responsibly,” said McPherson. “We’re seeing some people running out of road in terms of their credit options — once they’ve exhausted ‘buy now, pay later’, they look for other alternatives.” In many cases, the only option left standing is an illegal money lender or loan shark.

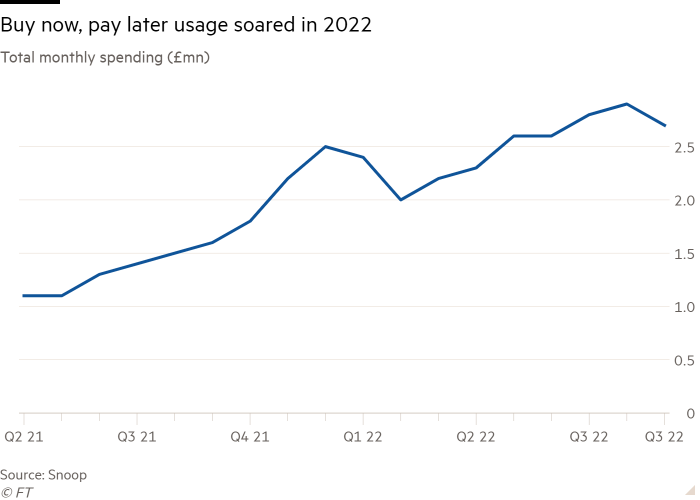

Data from fintech Snoop also points to a boom in ‘buy now, pay later’ demand this year, even as regulators prepare to tighten their scrutiny of the sector. But the speed of legislative action means another disrupter will have emerged by the time that the sector has a clear rule book, said McAteer.

“By the time the FCA clamped down on Wonga, ‘buy now, pay later’ was on the scene,” said McAteer. “The FCA will clamp down on BNPL, but someone else will emerge.”

Quotable

“Community development financial institutions don’t just improve their customers’ financial situations: almost uniquely among credit providers, they are able to help people who apply to strengthen their finances, even if they cannot offer them a loan” — Theodora Hadjimichael, chief executive of Responsible Finance

The not-for-profit world of CDFIs does not have the same rock star glam as consumer fintechs valued into the billions of dollars. But they play a vital role in supporting consumers who are unable to find credit from other sources.

But their role goes beyond this. Unlike their private sector counterparts, CDFIs provide services such as benefits checkers. Six big CDFIs reported that, in November, they were able to provide personal financial support to more than 30,000 applicants, a significantly larger figure than the 4,302 to whom they were able to grant loans.

The number of private fintechs serving this aspect of financial literacy and inclusion remains low — Gretel, which helps search for lost shares, is one of the closest. Not-for-profit CDFIs will remain central to helping those most at risk through the tough years ahead.

Further reading

How do start-up valuations really work? Amy O’Brien at Sifted digs into the wacky world of valuations, explaining terms and what investors are looking for at different funding rounds.

Monzo wins case against snack bar In lighter news, the digital bank with coral-coloured cards went up against Monzo Closet which operates a London-based snack bar, writes Daniel Lanyon at AltFi. Monzo won the brand protection case.

UK releases update on open banking entity Finextra reports on the latest news on the successor to the Open Banking Implementation Entity, which led the first part of the rollout for the system. Open banking allows users to share their financial data with trusted third parties.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here