This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Festive greetings from London and the final Friday newsletter from Lex in 2022. I don’t know about you but I’m still waiting for these supposed Roaring Twenties to get started. A century ago, post-pandemic cultural life meant flappers and Art Deco. Instead, we get Avatar sequels and Elon Musk picking fights on Twitter.

Musk’s meltdowns stepped up a notch this week. As Lex noted, the US entrepreneur managed to secure $13bn of debt and billions of dollars of promised equity for his $44bn Twitter purchase because he claimed he could turn it into a vastly more profitable company.

With typical bombast, he said that it could one day be the most valuable company in the world. The fact that he managed to turn electric car company Tesla into a trillion-dollar stock gave weight to his words. Perhaps under Musk, Twitter would cut costs, raise subscription revenue and eventually become an “everything app” downloaded on to billions of phones.

Now that he owns the company, the prospect of this occurring grows more distant with every ill-thought-out tweet and haphazard content moderation decision. If users and advertisers disappear, Twitter’s $1bn or so annual interest expense is going to be hard to cover. Nor does it help the fortunes of Tesla or rocket company SpaceX, both of which are tied to Musk’s reputation. As one Lex reader and Tesla investor put it: “Please Elon — settle down.”

Musk needs to install competent chief executives at both Twitter and Tesla — and perhaps think about putting his phone away. This week, he sold another $3.6bn of Tesla shares. Lex suggests he sell more and buy out Twitter’s debt. It will not solve every problem facing the company but it’s a start.

State of rates

Tesla investors should also be aware that rising interest rates will have an impact on consumer demand for cars. British retailer Currys expects the ripple effect to reach televisions and other consumer appliances. This week, it marked down its annual profit forecast. On the same day, the Bank of England and the European Central Bank raised interest rates to their highest levels in 14 years.

US banks should be celebrating the prospect of more rate rises. Not so fast. Lex points out that customers have started to move their money into higher-paying accounts. Funding costs are on the rise. Lex suggests investors factor deposit rates into the metrics they use to assess bank performance.

Savings accounts with high rates make crypto look like an increasingly poor choice. Why risk your money? Particularly now that the FTX house of cards is tumbling down. It turns out Sam Bankman-Fried’s strategy of giving multiple media interviews and claiming incompetence was not a very good one. SBF is being charged with one of the biggest financial frauds in US history.

Is this the end of FOMO-driven investment? Lex thinks not. Look at China, where investors are racing to apply it in equity markets in the belief that prices will rise with the end of zero-Covid policies.

We are very interested in what happens to the rest of the big dealers in crypto. Binance, for example, is suffering billions of dollars of outflows and facing a criminal investigation over compliance with US money-laundering and sanctions laws.

Priced for imperfection

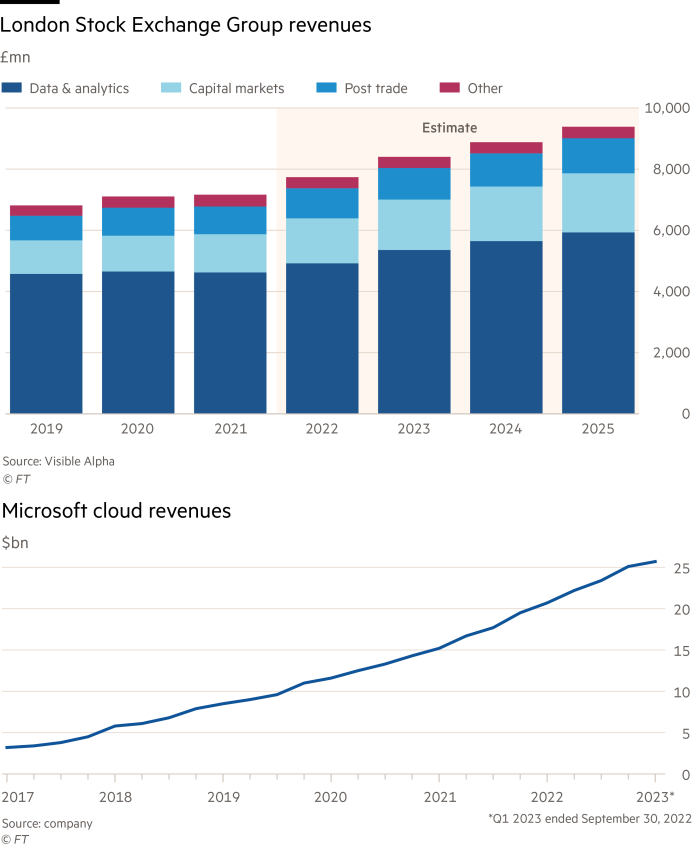

Microsoft followed in the footsteps of Amazon and Google this week by announcing a cloud computing partnership with an exchange. The deal with the London Stock Exchange Group looks like a neat swap. LSEG wants to shift further into data services and Microsoft wants long-term contracts. For a 4 per cent investment that costs about £1.5bn ($1.8bn), it gets minimum cloud-related spend of $2.8bn over 10 years.

Spending on cloud computing is expected to hold up but sky-high valuations for software companies have crashed. Technology private equity specialist Thoma Bravo has bagged US software company Coupa at an enterprise value of $8bn — 70 per cent below its record high in 2021.

US biotech company Amgen did not get the same sort of bargain when buying Ireland-based drugmaker Horizon Therapeutics for more than $28bn, including debt. But it is worth paying to improve the pipeline for new drugs.

Get a deal wrong and it can cost you your job. This week, Gold Fields chief executive Chris Griffith resigned shortly after failing to secure a takeover bid for Canada’s Yamana Gold. Some shareholders thought it too pricey. Lex, ever the optimist, thinks gold is poised for recovery.

Things I enjoyed this week (yes it’s all tech-related but I’m usually based in San Francisco and it’s all we care about over there):

-

The FT has a good Big Read on why Big Tech is obsessed with investing in exchanges.

-

Somehow, my appetite for reading about the chaos within Musk’s Twitter continues — this Bloomberg long read is full of funny details.

Are you reading Lex Populi, our new column in FT Money? Read it in FT Weekend and then tell me why anyone would join a five-year waiting list for a watch.

See you in the new year,

Elaine Moore

Deputy head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here