The Bank of England has upped base rate from 3 per cent to 3.5 per cent, in its latest attempt to tame soaring inflation.

Monetary Policy Committee members voted 6-3 to raise interest rates by 0.5 percentage points – taking base rate to its highest level since October 2008.

It is the Bank of England’s ninth consecutive base rate hike in 12 months – taking base rate from just 0.1 per cent to 3.5 per cent today – which has led to a significant rise in mortgage rates and savings rates.

We explain why the Bank of England is raising interest rates and what it means for the economy, mortgage borrowers and savers.

Ninth hike: The Bank of England today upped the base rate from 3% to 3.5%, as it continues to try and bring inflation down

The move by the Bank of England once again mirrors the Federal Reserve in the US, which yesterday announced a 0.5 percentage point rise in interest rates.

The US central bank is also attempting to curb inflation, however, it signalled that the pace of rate hikes may soon slow.

Some predict the UK’s base rate may continue to rise as high as 4.5 per cent or 5 per cent next year.

The rate rises are inflicting pain on many mortgage borrowers, who are seeing the cost of variable deals and new fixed rate deals rise rapidly.

This has now been compounded by further mortgage rate hikes in the wake of September’s mini-Budget.

The successive rises mean that monthly payments will have risen by hundreds of pounds per month for some.

Bank officials said 4 million households would be hit with more expensive mortgage bills over the next year.

However, rising interest rates have been good news for savers, with interest rates paid on accounts rising to levels not seen for more than a decade.

> How much would your costs rise by? Mortgage interest rate rise calculator

Why is the Bank of England raising interest rates?

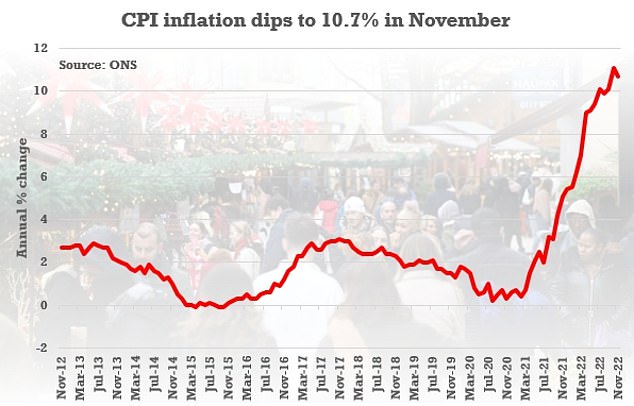

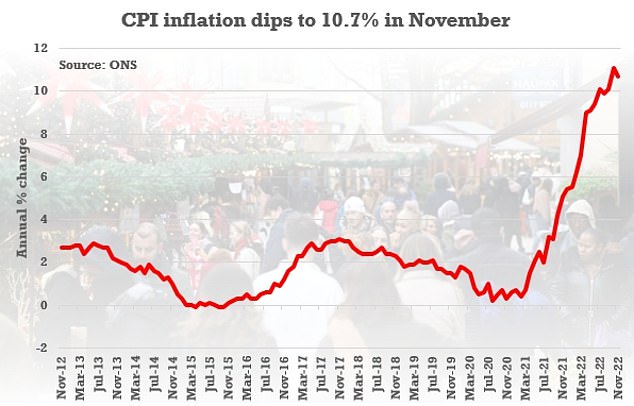

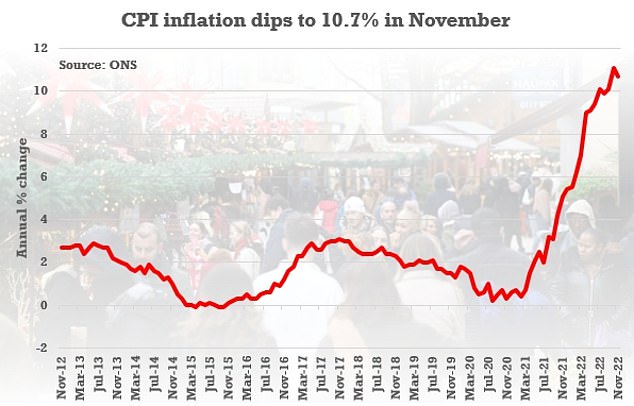

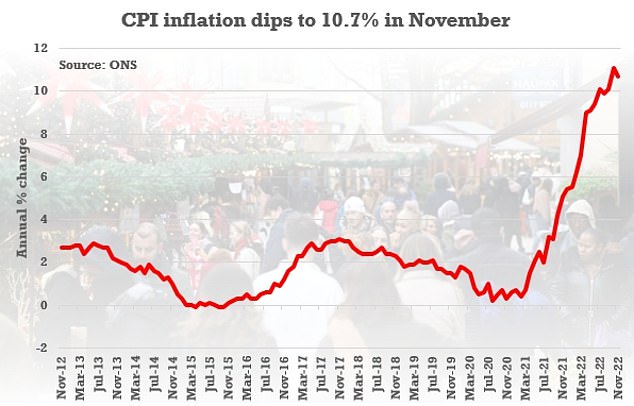

The Bank of England’s key concern is inflation. Last month, annual inflation, as measured by the consumer prices index (CPI), came in at 10.7 per cent. That’s a long way off the Bank of England’s long term inflation target of 2 per cent.

High inflation is a problem because with prices rising at a faster rate than incomes, the spending power of money is being eroded. This makes it difficult for businesses to set prices and for households to plan their spending.

Going down: The headline CPI rate fell from the eye-watering 11.1% recorded in October, and further than the 10.9% analysts had expected

The inflation being seen in the UK has largely been driven by external forces. The disruption of Covid lockdowns and recovery, supply chain issues and a spike in energy, food and oil prices have been exacerbated by Russia’s war in Ukraine.

But the concern is that once inflation gets embedded into household and business expectations it can lead to a vicious circle of wage demands and further price hikes.

While the Bank of England can’t do anything about global supply problems or energy prices, it can change the UK’s single most important interest rate.

The base rate determines the interest rate the Bank of England pays to banks that hold money with it and influences the rates those banks charge people to borrow money or pay people to save.

Raising the base rate, in theory, reduces borrowing demand from consumers, households and businesses, which slows the economy down.

It also makes saving more lucrative, which should encourage people to spend less and save more, effectively help to push inflation down by dampening the economy and the amount of money banks create in new loans.

Victor Trokoudes, co-founder and chief executive of the savings and investment app, Plum, says: ‘Today’s base rate increase of 50 bps comes as no surprise.

‘The UK appears to be aligning itself to the interest rate trajectory of the USA.

‘However, there are potentially dangers with this approach as there is less evidence that the Bank of England is beginning to win the battle against inflation compared to the Federal Reserve.

‘Yes, inflation came down in the latest reading but it still remains at historically high levels in the UK. Let’s hope the peak is now.’

How high will interest rates go?

Little more than a month ago, the common consensus was that the base rate would reach as high as 6 per cent next year, although most economists now believe it will peak at around 4.5 per cent.

The Bank of England is also expecting inflation to fall sharply from the middle of next year.

It predicts inflation to fall to around 5.2 per cent by the end of 2022, then down to around 2 per cent in two years’ time and 0.5 per cent in three years’ time, as energy prices reverse.

If inflation starts dropping off, the Bank of England may begin to change tack, particularly if the economy is in recession.

Movements: The Bank of England expects inflation to fall back next year before ultimately dropping below its 2% target

What does the base rate rise mean for mortgages?

The previous base rate increases since December 2021 have seen the base rate rise from 0.1 per cent to 3 per cent, before the move today.

As a result, the typical cost of a mortgage has been pushed up over the past 12 months by successive base rate rises.

The average two-year fixed mortgage rate is now 5.84 per cent with a five-year fix at 5.67 per cent, according to Moneyfacts. This time last year they were 2.34 per cent and 2.64 per cent respectively.

For many homeowners currently remortgaging or expecting to do so in the near future, they maybe switching to rates two, three or even four times higher than previously depending on when they last fixed.

Homeowners can check the rates they could get based on their home’s value and loan size, using our mortgage finder powered by broker L&C.

>> See the latest mortgage deals and find the right one for you

Rate shocks: Some homeowners may find that their monthly payments have gone up substantially when they remortgage

Fixed mortgage rates are not tied to the base rate in the same way that tracker products are, but lenders have tended to pass on increases in the base rate to customers taking out new fixes over the past 12 months.

The typical two-year fixed rate mortgage has actually fallen from a peak of 6.65 per cent in October to where they are today.

Although rates were already rising due to the base rate hikes, they spiked following the ill-fated mini-Budget announced by Liz Truss’s Government and are now gradually falling from those highs.

Five year fixes followed a similar trajectory, having fallen from a peak of 6.51 per cent in October.

David Hollingworth, associate director at mortgage broker L&C, says: ‘Fixed rates have been coming down after the spike following the mini-Budget, so although higher than the ultra-low rates of recent years they may offer some security at a more manageable rate.

‘It’s an unusual position as fixed rates are falling while variable rates continue to climb but market expectation of where interest rates may need to head has eased back and that is being reflected in fixed mortgage rates.’

During the pandemic house buying boom in 2020 and 2021, interest rates reached record lows with some deals priced at below 1 per cent – but now even the cheapest fixed rate mortgage deals are now charging more than 4.4 per cent.

The average borrower coming off a two-year fix at the moment will see their rate rise from 2.43 per cent to 5.84 per cent when they remortgage.

On a £200,000 mortgage being repaid over 25 years, a typical borrower in this situation will see their monthly repayments rise by £377, from £890 to £1,267. That equates to £4,524 more in mortgage costs each year.

Find out how a rate change would impact you using our calculator:

Interest rate rise calculator

Work out how much extra you would pay each month and year on your mortgage if your lender changes the rate you pay.Put in a negative value to calculate a rate cut, for example, -0.25%.

What about those on tracker mortgages?

Fixed-rate mortgages are the most popular choice for homeowners in the UK, with around three quarters of borrowers opting for the product.

Those already on a fixed rate mortgage will not immediately feel the effect of the rise, as they are locked into their existing rate until the term ends.

While most borrowers prefer the certainty of fixed monthly payments, around a quarter of UK mortgages are on variable deals.

Variable rate mortgages include tracker rates, ‘discount’ rates and also standard variable rates, and monthly payments on them can go up or down.

With future mortgage rate movements uncertain, some borrowers may still prefer to go for a tracker mortgage instead of a fixed rate for now, especially if there are no early repayment charges.

Trackers follow the Bank of England’s base rate minus a certain percentage, while discount rates are linked to the lender’s standard variable rate.

>> Should you consider a tracker mortgage?

Mortgage holders on a base rate tracker product will therefore see their payments increase immediately to reflect the rise.

Those on a variable discount rate or who have fallen onto their lender’s standard variable rate, will go on to a rate chosen by their lender. However, in all likelihood they will see rates edge up over the coming weeks.

According to Moneyfacts, the average standard variable rate is now at 6.4 per cent, up from 5.86 per cent last month and from 4.4 per cent a year ago. This means that since December last year, the average standard variable rate has risen by 2 per cent.

Standard variable rates are now often reaching 6.5 per cent or more with some in excess of 7 per cent – borrowers should really review their position

David Hollingworth, L&C Mortgages

On a £200,000 mortgage on a 25-year term, a rise of 0.5 per cent on the current average SVR of 6.4 per cent would add approximately £1,509 onto total repayments over two years.

Hollingworth adds: ‘Variable rate borrowers will be the ones that will be watching most closely as any further increase is likely to feed through to their monthly payments.

‘Trackers give complete transparency in how they will move as they are directly pegged to the base rate and existing borrowers will usually expect to see that reflected from the following month.

‘Standard variable rates may also see the rate increase passed through although it is up to the lender how they react.

‘Many of the major lenders have tended to pass rate rises through and standard variable rates are now often reaching 6.5 per cent or more with some in excess of 7 per cent.

‘That’s a substantial margin over the better fixed, tracker and discounted rates on offer so SVR borrowers should really review their position.’

How long should you fix your next mortgage for?

Ultimately, predicting where mortgage rates will be in two, five or 10 years is still not an easy task.

Homeowners will need to consider their own goals and expectations when it comes to choosing the fixed duration on a new deal.

There is some expectation that the spike in inflation could be short and sharp, but it’s impossible to predict where rates may head over the next two years.

For those prepared to sit on a variable or tracker deal, they need to accept the risk that rates could go higher.

If they can’t afford to take that risk – whether for peace of mind or financial reasons – they may be better off fixing for five or even 10 years.

Hollingworth adds: ‘Borrowers now have the age-old dilemma of whether to opt for a variable deal that could look cheaper initially but has the potential to increase or whether the safety of a fixed rate may win them over despite rates which could be a little higher.

‘The important thing is to keep the mortgage under review. If peace of mind is the priority then it’s possible to secure a fixed rate now without being completely committed to it if rates do come down further.

‘However others are feeling that the base rate may not need to rise as far as many predicted only a couple of months ago and there’s even potential for rates to drop back if inflation eases but we are in recession.

‘That could lead them to be attracted to base rate trackers which could be lower now and could drop back if base rate did reduce in future.

‘Of course we don’t know how rates will shift so it’s important to be able to deal with any increases and to have the flex in the monthly budget to cope.’

Some tracker deals also carry no early repayment charges. These are proving popular according to Hollingworth as they at least offer a ‘get-out’ if rates have moved against them or if they decide the time is right to fix.

Of course if rates have climbed quicker than expected then fixed rates will already reflect that sentiment.

Higher or lower: By shortening or lengthening the mortgage term you alter your monthly repayments. This could save you money in the short term but cost you more in the long run

What to do if you are struggling with your mortgage

Ultimately, borrowers coming toward the end of a fixed rate won’t be able to outrun the change in the rate environment.

For those who feel they may be unable to cope, one last ditch solution may be to see if they can increase the mortgage term.

Someone with a £200,000 mortgage on an initial two-year fix, being repaid over 25 years with an interest rate of 5.84 per cent, will pay £1,269 per month.

But if they extend their term to 35 years, their monthly repayments will drop by £150 to £1,119. Over the course of a year, that’s a total saving of £1,800.

For someone with a £400,000 mortgage on an initial two-year fix, being repaid over 25 years, a 5.84 per cent rate will cost £2,538 a month. Extend the term to 35 years and their monthly costs fall by £300 to £2,238 – an annual saving of £3,600.

It’s worth pointing out that whilst taking out a longer mortgage term will reduce the monthly costs, it will ultimately mean paying interest for a longer period of time and therefore paying more in the long run.

>> Finding it hard to meet your monthly mortgage payments? Here’s what to do

For example, someone with a £200,000 mortgage paying 5 per cent interest over 25 years would face monthly repayments of £1,169, paying a total of £350,754 over the lifespan of the mortgage.

Conversely, someone with a £200,000 mortgage paying the same interest rate over a 35-year term would face monthly repayments of £1,009.

However, they would pay £423,937 over the lifespan of the mortgage: £73,183 more than on a 25 year term.

It makes sense for borrowers to try and revert back to a shorter term as soon as they can which can make significant reductions in the total interest.

‘Some may consider lengthening the term when they remortgage to a higher fixed rate in order to mitigate the increase in the monthly payment and give a little additional breathing space,’ says Hollingworth.

‘This isn’t a decision to take lightly though as in the longer run it can cost thousands more in interest.’

What does the rate rise mean for my savings?

While it is potentially bad news for mortgage borrowers, the base rate rise will once again be welcomed by savers.

Banks and building societies may choose to up their savings rates due to the base rate increase, although they are unlikely to directly pass on all the rise to savers.

Anna Bowes, co-founder of Savings Champion says: ‘Another base rate hike is great news for savers and they should expect to see an increase to the rate of any variable rate accounts that they hold, but it might not happen immediately.

Good news: Savings rates have shot up since the base rate started increasing

‘Often rates increase in the month following a base rate rise. Nevertheless, with nine base rate hikes in succession, those who have not yet reviewed their savings accounts should do so, as they could find that switching to a new account or provider could be an easy way to earn more interest, which is more important than ever during the current cost of living crisis.’

Since the base rate began increasing in December 2021, many larger banks have failed to pass on much of the uptick onto savings rates, with most of the competition being driven by smaller challenger banks.

>> Check the latest rates on our independent tables

Even so, were savers to see a 0.5 percentage point rise passed onto them, someone with £20,000 put away would receive £100 more per year.

The previous base rate rises have seen rates improve across most providers over the past year.

However, in many cases savers will not have seen the full 2.9 percentage point base rate rise passed onto them in full.

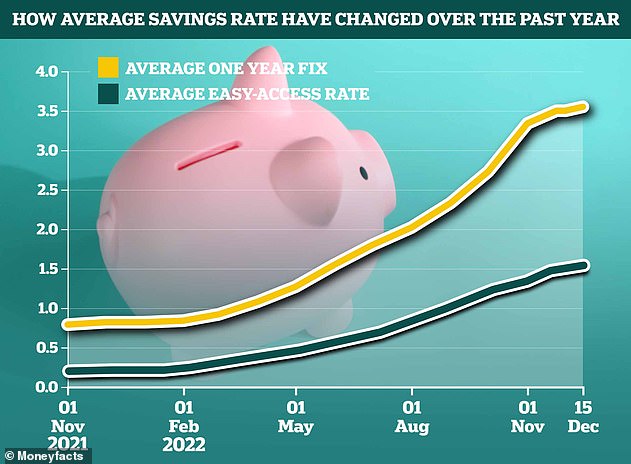

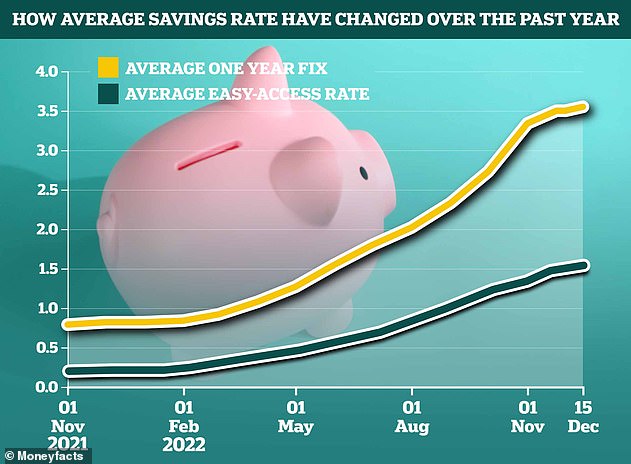

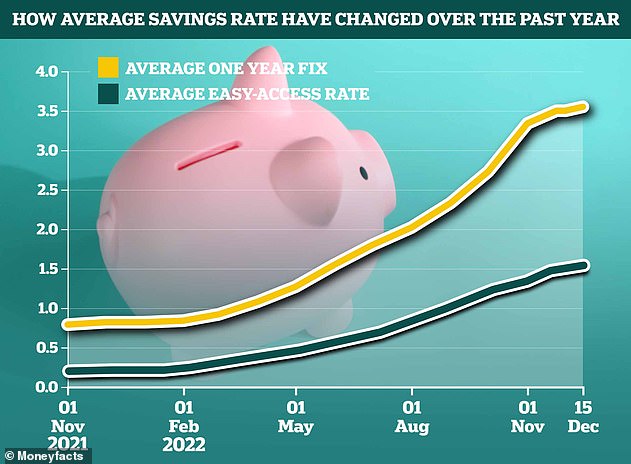

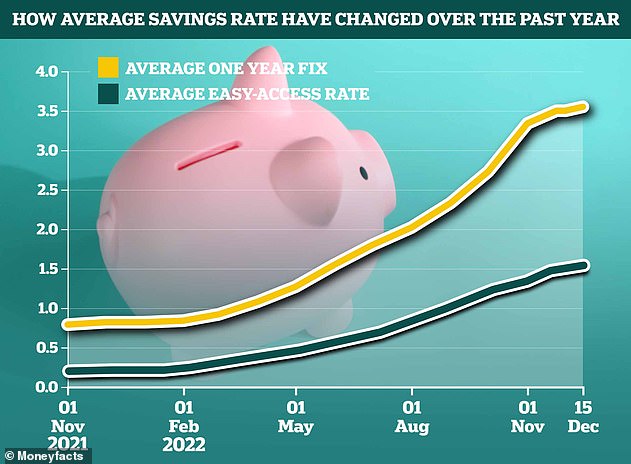

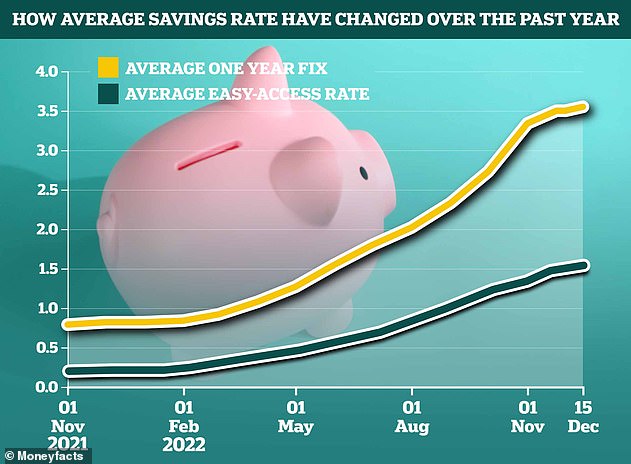

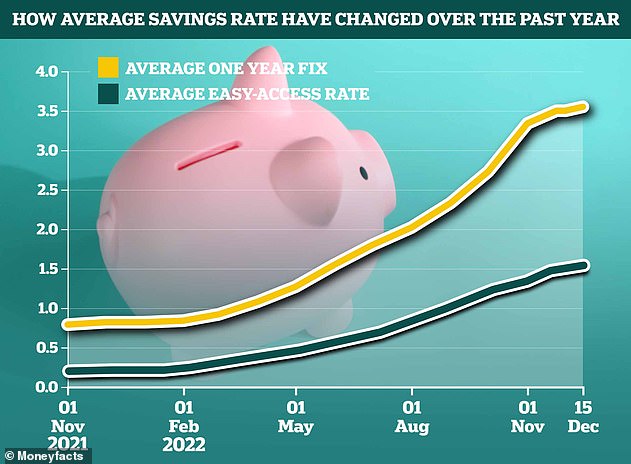

This time last year, the average easy-access rate was paying just 0.2 per cent, according to Moneyfacts.

Now it has risen to 1.53 per cent. That’s an average of 1.33 percentage points passed onto savers.

That said, the top of This is Money’s best buy tables have been a hive of activity, with new market-leading rates to report almost every week.

The best easy-access deal now pays 3 per cent, and there are now a number of providers that pay 2.5 per cent or more.

However, it is a very different story for those with easy-access savings with the worst paying providers – namely the high street banks.

It has been clear from the first base rate rise back in December last year, that many of the big banks have no inclination to pass on the base rate rises to savers.

Since the base rate started to increase, so too have savings rates – although at hugely different rates.

Since December, Barclays Bank has upped its Everyday Saver from 0.01 per cent to just 0.5 per cent, while Santander’s Everyday Saver has risen from 0.01 to 0.4 per cent. That’s just £4 back after one year on each £1,000 saved.

Rachel Springall, finance expert at Moneyfacts says: ‘There is never a guarantee for the base rate to be passed on to savers, so they could well find their loyalty is not being rewarded.

‘In fact, the majority of the biggest high street banks have failed to pass every Bank of England base rate rise to easy access accounts over the past year, with one bank passing on just 0.39 per cent since December 2021.’

How high will rates go and what should savers do?

Looking ahead, savers can expect easy-access rates to continue to rise. However, fixed rate savings may have already peaked with much of today’s base rate rise will have already been factored in by savings providers.

Interest rates on the best fixed savings deals have been falling back in recent weeks, after reaching highs not seen for more than a decade.

At the start of November, the best one-year rates were as high as 4.65 per cent. Now the best deal pays only 4.32 per cent.

A spokesperson for the Savings Guru said: ‘Fixed rates will fall back from current levels, because the market is now expecting Base Rate to peak around 4.25 or 4.5 per cent so we expect longer term fixed rates to fall back particularly but generally expect that fixed rates peaked in 2022.

‘On easy-access rates, it is a different matter and we expect the best buys to hit 3 per cent by the end of this year and go north of 3.5 per cent during the year.

‘There’s a chance we might even get 4 per cent. This will be highly likely if the Base rate goes to 4.5 per cent or beyond.’

The advice therefore to savers looking for the best fixed rate is to avoid further delay.

Given the cost of living squeeze, it’s all the more important to have some easily accessible money to act as a financial cushion to deal with unforeseen events.

Easy-access accounts will likely be best for such circumstances and most of these allow savers to add and withdraw money as and when they wish, which means changing to another provider won’t be a challenger if rates improve.

In terms of easy access rates, Yorkshire Building Society is the best buy paying 3 per cent, albeit only on balances up to £5,000.

For those looking to put away more, they can either opt for Coventry Building Society’s Limited Access Saver paying 2.85 per cent, or try the savings app, Chip,* which is currently paying 2.9 per cent and has no restrictions.

For a higher rate taxpayer who already has significant savings, a cash Isa deal may make sense to avoid having to pay tax on the interest earned.

The best one-year cash Isa deal pays 3.78 per cent whilst the best easy-access cash Isa deal pays 2.8 per cent.

As for those with savings they can afford to stash away for a year or more. Fixed rate bonds offer the highest returns.

The best one-year fixed rate deal pays 4.32 per cent, courtesy of Shawbrook Bank whilst the best two-year fix pays 4.6 per cent – a rate available with both Beehive Money and Cynergy Bank.

Someone depositing £10,000 into the best two-year fix could expect to earn £941 in interest during that time.