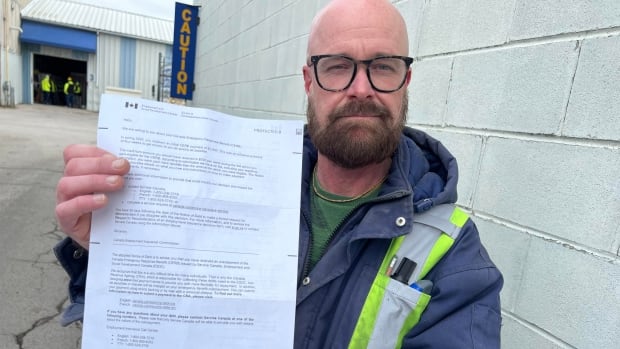

Like thousands of Canadians, Randy Helsdon’s employment dried up during the dark days of early 2020 as the first wave of COVID-19 threw a chill over the global economy.

At the time, Helsdon, 54, was working in the shipping and receiving department of a London glass company.

COVID-19 restrictions put a crimp in the company’s business, and Helsdon was laid off.

“We go into people’s homes to install things, and we weren’t allowed to do that anymore, so the company didn’t need a second shipper-receiver,” he said.

That was when Helsdon, who has an eight-year-old child, decided to become one of almost nine million Canadians who opted to accept government help in the form of the Canada Emergency Response Benefit (CERB).

Through the program, the federal government offered support payments to people whose employment was disrupted by the pandemic. Most who signed on received a $2,000 initial payment, which the government describes as an “advanced payment” against future $500 weekly benefit cheques.

Helsdon said all the information he received at the time was that the money came without strings attached to help people through the pandemic.

“If we were told we’d have to pay it back, I would have just sent it back to them immediately,” he said.

In February of this year, Helsdon received a letter from Service Canada informing him that he’d been paid more in CERB benefits than he qualified for. The letter said he would have to pay back $2,000 and that the repayment can happen in increments of $200 a month.

He’s since received four other letters asking for repayment, the last one telling him: “‘This is your final notice.'”

Helsdon, who is now working for a company that sells doors and custom trim products for homes, says he doesn’t have the money and continues to struggle with inflation now hitting him hard.

“With the cost of groceries and everything, I don’t have an extra $200 a month right now,” he said.

“All I’m asking is to continue to let us try to tread water instead of pushing us under. I’m hoping they just go back and cancel the repayments.”

So why are people getting debt notices?

According to the federal government, about 1.8 million Canadians received notices of debt related to CERB payments they didn’t fully qualify for.

In a statement to CBC News, a spokesperson for Employment and Social Development Canada said the $2,000 initial payment sent to CERB recipients in the spring of 2020 was essentially an advance on subsequent support payments and a way to get money into the hands of Canadians quickly as the economy shut down.

However in many cases, recipients failed to qualify for enough weeks of benefits by the summer of 2020 to cover that initial payment because they either went back to work or didn’t stay on CERB long enough.

The government provided details to CBC News about Helsdon’s specific case with his permission.

They say he applied for employment insurance on April 7, 2020, which was processed as a CERB payment. He received seven weeks of benefits from Service Canada and then, on April 13, 2020, received his $2,000 CERB “advance” payment before returning to work on June 1.

“The client returned to work and did not collect CERB from Service Canada long enough to reconcile the advance payment; therefore, was among those who received a notice of debt,” the statement reads.

Helsdon doesn’t dispute the statement but says the government’s wording around the payments at the time was confusing.

“If our government actually cares about what the average Canadian, the average voter, is going through, they will cancel this clawback,” he said.

Helsdon also admits he didn’t contact Service Canada or Canada Revenue Agency (CRA) to get clarification about his debt.

Michelle K. Statz is a licensed Insolvency Trustee at Bromwich and Smith.

She agrees the details around the CERB payments were confusing for many. She encourages anyone who received notices of debt to contact CRA and not to ignore the notices and hope they go away.

“By engaging with them, a recipient may find there was information the government didn’t have that could improve their case,” she said. “The more you communicate with CRA, the more they’re going to be willing to work with you.”