This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Before getting started, a quick plug for Lex Populi, our new column in FT Money, this week on short selling. Targeted at private investors, the column aims to demystify, inform and entertain. I hope you enjoy it.

Dear reader,

Highlights of the World Cup have so far included Marcus Rashford’s dual triumph for England against Wales and Cristiano Ronaldo apparently claiming credit for a goal he did not score.

Like grand opera, top-flight football is a weird mixture of the magnificent and the ridiculous.

It is also a big money activity and therefore the subject of a couple of Lex notes this week. To comment on this, or any other aspect of our coverage, please email me at [email protected].

Football is a different sport to the one I learnt about as a kid via comic strip striker Roy Race. He only transferred away from home club Melchester once. The contrast is with Ronaldo. Theoretically unemployed at present, the Portuguese striker has switched sides four times for a total value of €247mn, according to Transfermarkt, a website.

Belgian Romelu Lukaku leads its ranking at €330mn. Brazilian Neymar comes second thanks to a €222mn transfer fee paid in 2017 by Paris Saint-Germain. No one can be surprised that the club is running at a loss. People unfamiliar with the beautiful game might however wonder why PSG has a mooted valuation of €4bn.

Juventus is another lossmaking side. The Italian club paid €100mn for Ronaldo in 2018, though he later transferred to Manchester United.

The entire board of Juve, majority-owned by Italy’s Agnelli power family, resigned this week. Prosecutors allege that the club swapped assets (players, in this case) at inflated values with other industry participants to create accounting gains.

That could never happen in any area of financial services. Private equity, for example.

Lex questioned whether football clubs belong on public markets. You might equally ask whether football is a real business. Like banknote printing and German local lending, many participants benefit from capital whose owners do not care about profits.

You can invent a shaky case for rising football club prices based on returns from television rights. But the cruder reality is that when there are several whales in an auction room, they bid ever higher because they like to win.

You can summarise the situation as follows. I think of it as “Neymar’s Constant”: Ambition of fans x pricing power of talent > revenues – administrative expenses

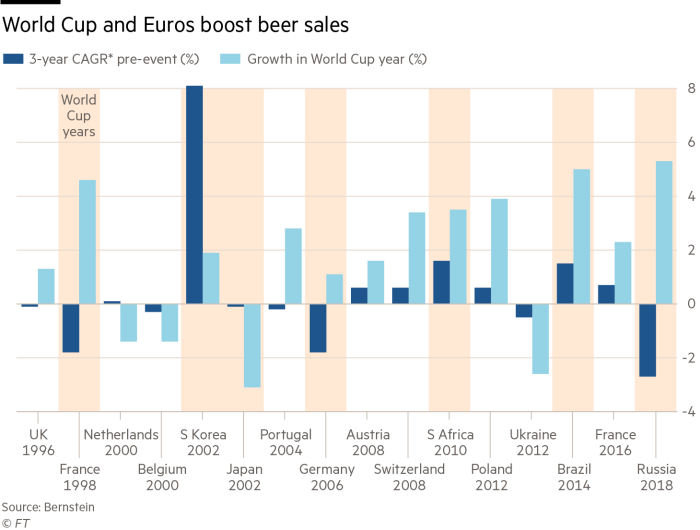

In the era of Roy Race, attending football was a primarily male, working-class activity such as beer drinking. The latter recreation is on the back foot at the World Cup because Muslim Qatar has restricted availability and, beyond that, because lifestyles have changed. Spirits, made by the likes of Diageo, have become more popular. Brewer AB InBev is attempting to push brands upmarket.

Unlike beer, football has extended its franchise. International football clubs are now positional goods for the world’s ultra-wealthy. Local factory owners no longer have enough funds to buy them.

Debtor vetting

There have always been doubts about whether Twitter is a real business. These are deepening under the ownership of Elon Musk.

The biggest financial danger stems not from the possibility that low-drama Apple boss Tim Cook will permanently stop advertising on Twitter. It is that Apple drops an unmoderated Twitter from its App Store because toxic content is proliferating.

If that happens, Twitter’s business prospects would look even weaker. Lex believes Musk should sell an additional $10bn of Tesla shares as a precaution. Twitter has debts of $13bn and is distracting the tycoon from running his other businesses.

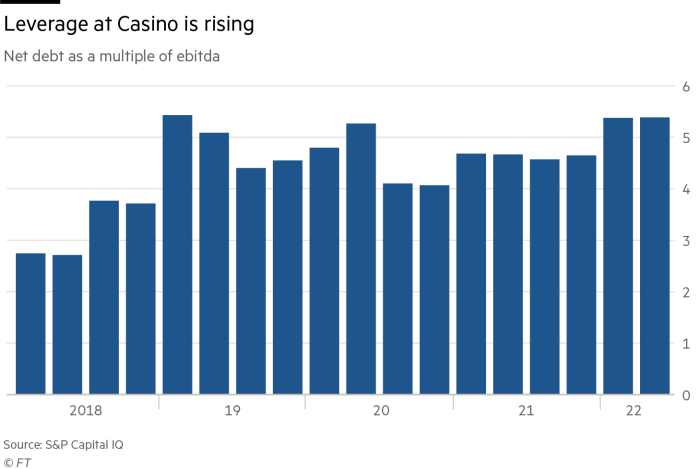

Jean-Charles Naouri is another high roller with debt issues. The French entrepreneur controls the appropriately named supermarket chain Casino. He does so through a system of leveraged holding companies common in France known as “Breton Pulleys”.

Casino group net debts were €7.5bn at the end of the second half of the year compared with a market worth of just over €1bn.

Casino this week began disposing of shares in Brazilian subsidiary Assai for target proceeds of about €500mn. But Lex reckons it will struggle to pay its debts without selling more assets or more groceries.

The cost of Casino’s five-year credit default swap has, by the way, halved since October, according to Refinitiv, but still signals severe strain at €2,500.

Sweden has been sending up distress flares of its own. The real estate sector is overleveraged and prices have been slumping. Big property group SBB is 18 times geared, according to Bloomberg data, for example.

SBB this week sold a minority stake in a school portfolio to Brookfield. Lex calculations suggest that the Canadian alternatives giant got a bargain. North American distressed asset buyers will be busy in Europe, we reckon.

Denmark’s central bank warned this week of contagion to its lenders from loans they have made in Sweden. The risks of a domestic house price crash are lower in Denmark because of lending curbs and modest exposure to floating rate debt.

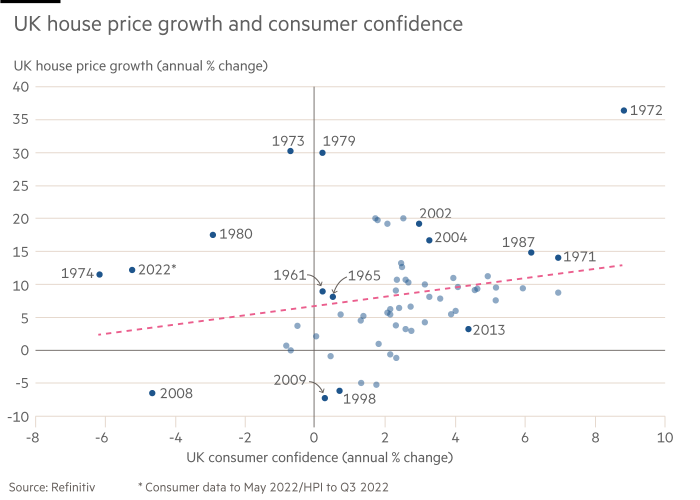

The UK housing market boasts similar protections. This week, property website Zoopla said demand had fallen by half since Liz Truss’s disastrous “mini” Budget in September. But we reckon talk of a housing price crash is overblown because prices have not motored up as much as in previous asset bubbles. They are falling now. But we do not expect the recurrence of the 20 per drop after the great financial crisis.

Eternal sunshine of the collective mind

Our relative optimism on UK house prices shows that contrary to urban legend, Lex is not uniformly pessimistic. We would also like to cite in evidence our bullish write-up of Wise, a UK-listed money transfers business. The shares are pricey, but the business has bags of momentum. We are obliged to the invisible hand of the market for finally valuing the company at a capitalisation — something more than £6bn — in line with our numbers just before listing

Lex has been persistently and correctly bearish on most China stocks since government meddling in business became widespread. However, we do like Chinese insurance shares with exposure to life and health cover, notably Sunshine Insurance Group. This is listing in Hong Kong at a valuation of about $3bn.

State healthcare is inadequate, as demonstrated by the official failure to control coronavirus. That points to a big private sector opportunity.

We also see opportunities in UK renewables fund managers such as Foresight. The market is undervaluing these.

Stuff I enjoyed this week

-

The movie She Said. Scoops from New York Times writers Jodi Kantor and Megan Twohey exposed criminal abuse by movie mogul Harvey Weinstein. It is a great story of newsroom endeavour. And I always like the way actors are so much better at journalism than people that do it professionally.

-

This FT Big Read on India’s attempt to rival China’s Belt and Road programme. I am still struggling to work out whether to cheer or not. An overseas infrastructure push by India would counterweight China’s soft power expansionism. But it comes from Narendra Modi, an authoritarian leader whose party encourages communal distrust.

-

A British Museum exhibition about the decoding of hieroglyphics. Ancient Egyptian scribes sometimes jammed chunks of guff into inscriptions to hit their target wordage, just like sellside analysts and . . . er, OK, you got me — journalists.

Enjoy your weekend, whatever language you are most comfortable communicating in.

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here