Beer and football cannot be rent asunder. That, at least, is the opinion of fans in the UK and many countries besides. Budweiser owner AB InBev, the brewing behemoth that paid $75mn to sponsor the 2022 World Cup, probably feels the same way. But the sentiment is not universally shared, as those travelling to Qatar have discovered. The World Cup host nation has banned beer from its stadiums. Alcohol will still be available in hospitality suites and designated areas.

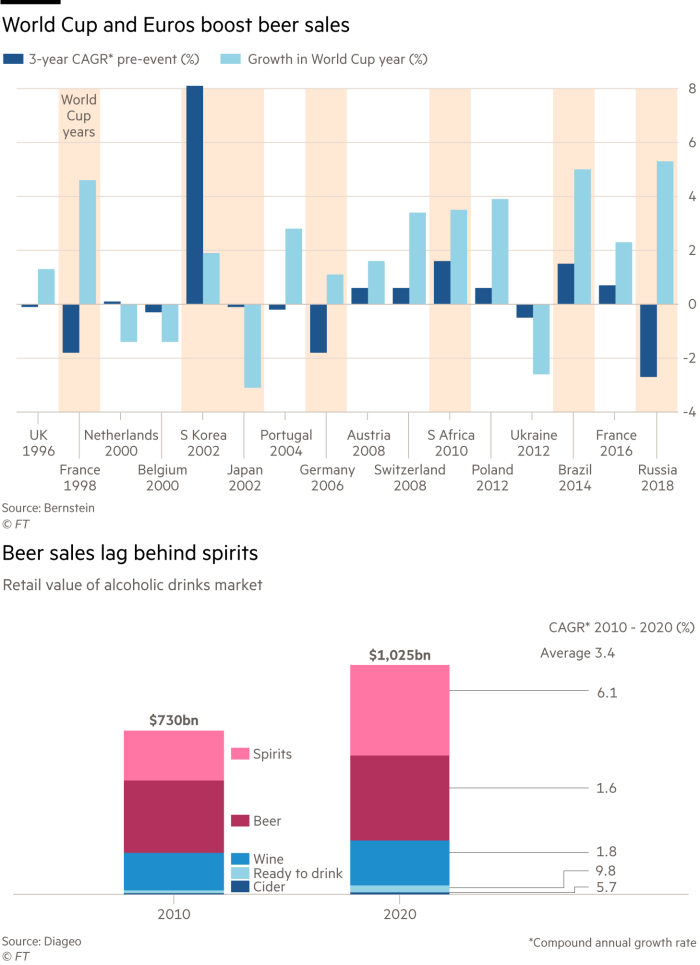

The association between sporting events and beer has traditionally been strong. Hosting a big tournament typically adds an average of 1.4 per cent to the host country’s beer sales, according to Bernstein analysis. Not this year. As a Muslim country, Qatar does not have a drinking culture. And past experience suggests that there is no beer dividend in spectator countries — even those with a strong football and pub culture such as the UK.

There are other clouds on alcohol’s horizon, too. In countries where drinking is deeply ingrained — France, Germany and the UK — consumption declined between 2012 and 2019. The trend was more pronounced in the first half of the period and may have reversed in the pandemic.

As for future demand, drinks companies watch the behaviour of Generation Z with some apprehension. They may be a more sober bunch than their predecessors. In the US, the proportion of teetotal college-age adults has climbed in the last decade, according to University of Michigan research.

But it is by no means doom and gloom for the beverage giants. Spirits have been a bright spot, led by the baijiu market in China and trendy tequila in the US. UK-listed drinks giant Diageo has decent brands in this segment, ranging from Johnnie Walker whisky to Smirnoff vodka. And these big brands have pricing power. Despite rising input costs and straitened consumer finances, Diageo is set to raise its return on equity by 9 percentage points to 57 per cent by 2025, on Barclays’ estimates.

Beer is the traditional drink of men with tough physical jobs, a declining demographic. Consumption has declined in the US. But here, too, drinkers are trading up. AB InBev reported that sales of its “above-core” portfolio, which includes Corona, Stella Artois and Budweiser, grew by almost 13 per cent in the third quarter.

All this helps explain why both Diageo, on 21 times forward earnings, and AB InBev, on 19 times, are trading at a premium to the wider market. A dry World Cup is not going to change that.