Cost cuts have helped online electrical retailer AO World weather a difficult market, with its shares rising sharply on Tuesday despite a widening of losses.

AO, one of the UK’s biggest sellers of large domestic appliances, said it would hit the top end of revised profit forecasts for this year as lower costs started to take effect.

“Despite a very challenging wider market, what we’re demonstrating is a real underlying resilience to our core profitable UK-focused business”, said chief executive John Roberts.

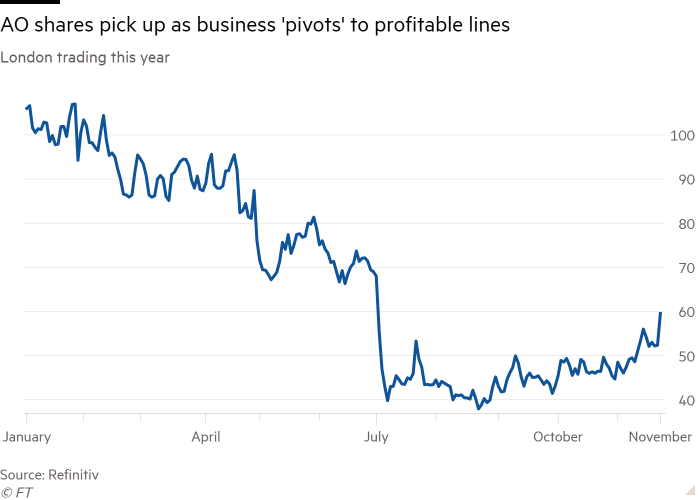

The company’s share price rose 15 per cent in early trading on Tuesday, although it was still more than 40 per cent down from the start of this year.

AO’s pre-tax loss tripled to £12mn in the six months to September 30, from £4mn a year earlier, owing to supply chain problems and the cost of living crisis. It lowered its net debt to £18.6mn, from £32.8mn on March 31. Revenues dropped 17 per cent to £546mn.

The white goods retailer said it had been “rationalising, simplifying and refocusing” its operations to focus on profitability.

AO performed well during the pandemic as consumers in Britain and Germany switched to online shopping.

But since pandemic restrictions have eased it has struggled as consumers have returned to in-person shopping, while others are cutting back on discretionary spending in the face of a looming recession.

In its full-year earnings report in August, AO guided to adjusted earnings before interest, taxation, depreciation and amortisation within the range of £20mn to £30mn. It now expects to be at the top end of that bracket.

Roberts said the company was not considering any further international expansion, and was focusing on “UK growth, profit and cash generation”.

AO has introduced cost cuts that will save at least £30mn in 2024, compared with 2022.

In June it shut its German division “quickly and efficiently”, at a cost of “around zero”, against estimates of up to £15mn.

AO said the electricals market was tougher compared with a year earlier but its medium-term outlook remained unchanged. The company is seeking to achieve an average revenue growth of more than 10 per cent a year.

“We’re really focusing on the core underlying resilient business, selling our products that are pretty focused on distress rather than discretionary spend”, said Roberts.

The chief executive said that amid the cost of living crisis, some consumers had been “trading up” to buy more premium energy-efficient appliances.

Analysts from Jefferies said: “The recent pivot in strategy has seen the business focus firmly on profit over growth at all costs.”