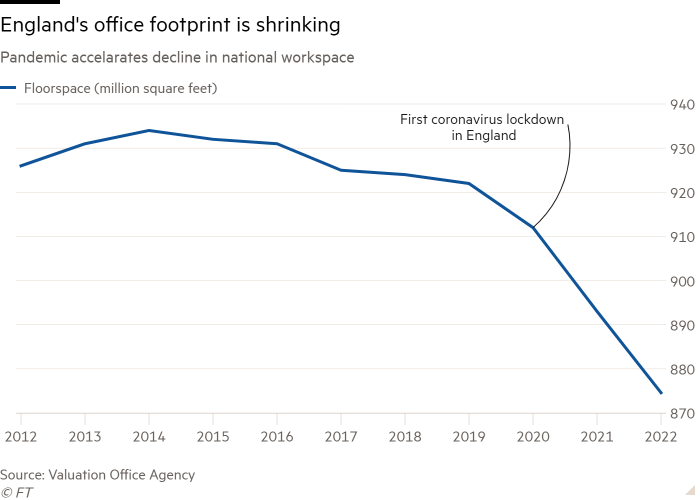

England’s stock of office space is falling at the fastest rate for 20 years, as new construction slows and employers cut back on offices that remain only half full because of homeworking.

Close to 20mn sq ft of workspace was lost to use in the year to the end of March — just over 2 per cent of the total market — according to an analysis of business rates data by law firm Boodle Hatfield.

That is the biggest annual drop since this data was first collected in 2001.

The contraction comes as employers consider how much space they need in the post-pandemic world and accelerates a trend that has seen overall floorspace decline by more than 6 per cent since 2014.

Occupancy rates in UK offices gradually increased after pandemic restrictions were dropped this year, but have plateaued at roughly half pre-Covid levels, according to real estate consultancy Remit Consulting.

Nationally, occupancy is stuck at around 30 per cent, said the company, compared to typical levels of around 60 per cent before 2020, according to the British Council of Offices.

Having waited to assess how working patterns would change after the pandemic, many employers are now acting.

Last week, law firms Clifford Chance and Reed Smith both confirmed plans to move, agreeing deals for smaller buildings with better environmental credentials — a growing consideration as new emissions regulations are phased in.

“Customers are leasing space for their working patterns of tomorrow, not yesterday,” said Toby Courtauld, chief executive of London developer GPE, which will be Clifford Chance’s new landlord after it completes the firm’s new headquarters in 2025.

“When Clifford Chance originally leased up in Canary Wharf 20 years ago, the methods of office use were totally different, things have moved on,” he added.

The amount of available office space in Canary Wharf has increased sharply during the pandemic, from around 2.3mn sq ft to closer to 3.5mn sq ft, according to property data company CoStar.

Clifford Chance’s move to the City will leave the Canary Wharf Group with another 500,000 sq ft to fill.

Developers in the capital are increasingly pessimistic about the strength of demand, and expect office space requirements to fall at least 10 per cent as a result of the shift to hybrid working, according to a survey published by Deloitte on Monday.

Falling demand, coupled with higher development and borrowing costs, have caused developers to delay new projects across London, according to Deloitte.

That will cut supply but there will still be a lot of surplus space as businesses retrench. The government has encouraged the conversion of unused office space into homes but there is scepticism in the industry.

“My observation would be that it can be easier said than done,” said Margaret Doyle from Deloitte.

“There can be practical difficulties that make it less of a silver bullet than one would like. It can look like a very elegant solution to a housing shortage and a change in working patterns, but it would require a fall in values and people being happy to live in an office park.”