That the FTX bankruptcy filing is only the second-grimmest thing we’ve read today says a lot about how awful the UK’s Autumn Statement is.

The UK budget presented by Chancellor Jeremy Hunt included £30bn of spending cuts and £25bn of tax rises, while the accompanying forecasts from the Office for Budget Responsibility were straight-up miserable. Here are the main headlines from our colleagues over at mainFT:

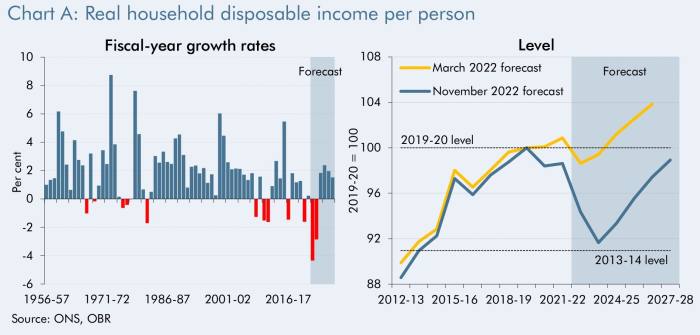

The economy is projected to contract by 1.4 per cent and is not forecast to recover to pre-pandemic levels until the end of 2024. The OBR said that rising prices would erode real wages and reduce living standards in the biggest fall in six decades, down 7 per cent over the two financial years to 2023-24. This would wipe out the previous eight years’ growth, despite over £100bn of additional government support.

FT Alphaville headed over to the OBR’s website to gawp at the full horror show, joined by occasional FTAV contributor Toby Nangle. Here are some of the worst charts we found (by worst, we mean most likely to make you feel queasy, depressed, afraid and likely to put on some Radiohead).

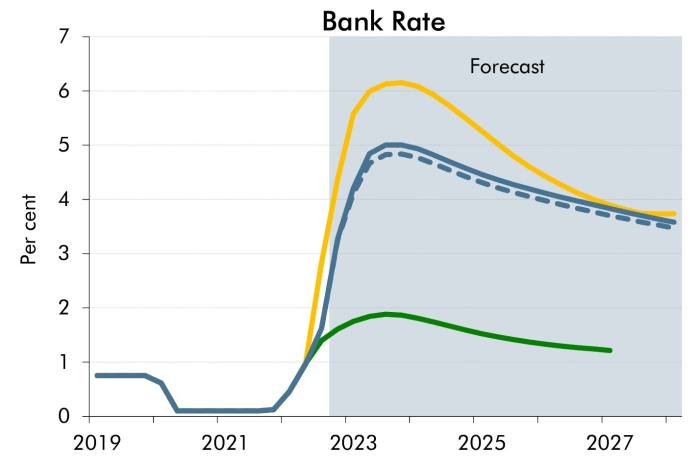

First of all, the Bank of England’s interest rates are still going much higher than previously expected, despite the new dose of austerity . . .

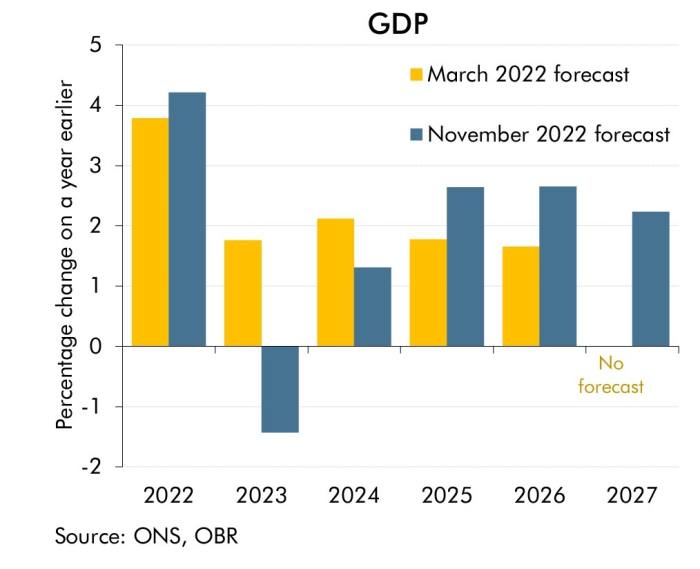

. . . and the economy looking far worse than the OBR forecast in March.

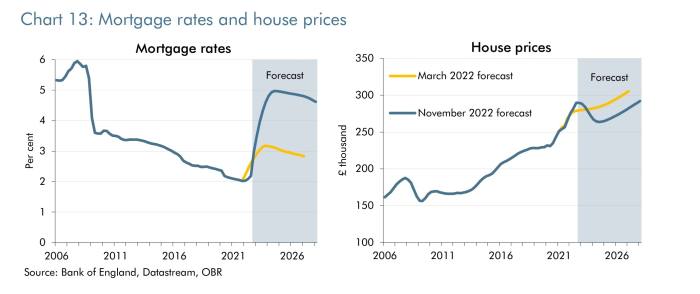

Rising interest rates mean that mortgage rates are going to jump, and house prices will probably tank by about 9 per cent by 2024.

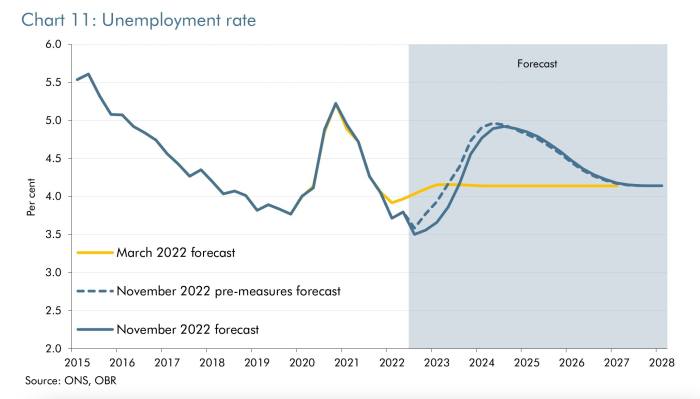

This is not just a mortgage story though. The looming recession means that unemployment is going to head northwards towards 5 per cent, the OBR predicts.

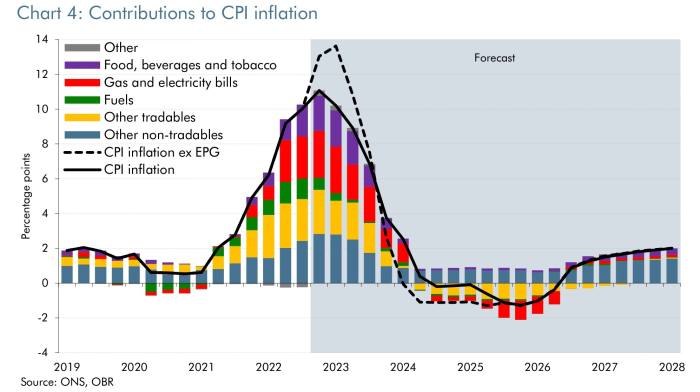

At the same time, inflation is going much higher — peaking at a four-decade high of 11.1 per cent later this year — and staying stubbornly high for longer than the OBR previously expected.

The overall impact of rising rates, rampant inflation and an economic recession on households is expected to be brutal.

Real household disposable income (RHDI) is a pretty good measure of overall living standards. The OBR expects that to fall by 4.3 per cent in 2022-23, which would be the biggest drop since the Office for National Statistics began collecting records in 1956. And RHDI is then expected to fall another 2.8 per cent in 2023-24.

The cumulative shrinkage over the two years basically wipes out an entire decade of gains. Living standards won’t get back to 2021 levels until 2027-28, but even then will remain slightly below pre-pandemic levels, the OBR notes.

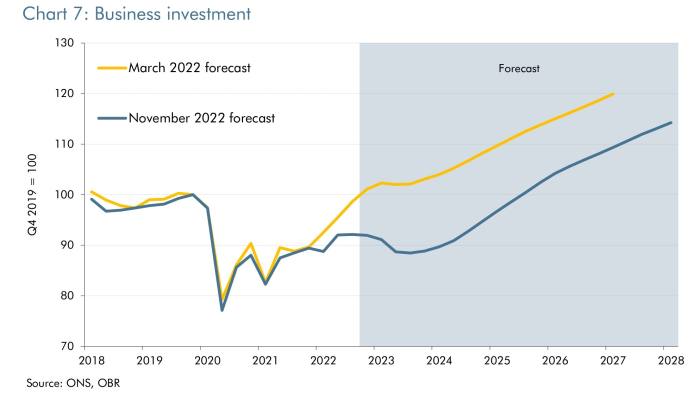

The longer-term picture is also discouraging. Business investment — which Toby reckons the UK will need to shake off its economic torpor — is also looking increasingly dicey.

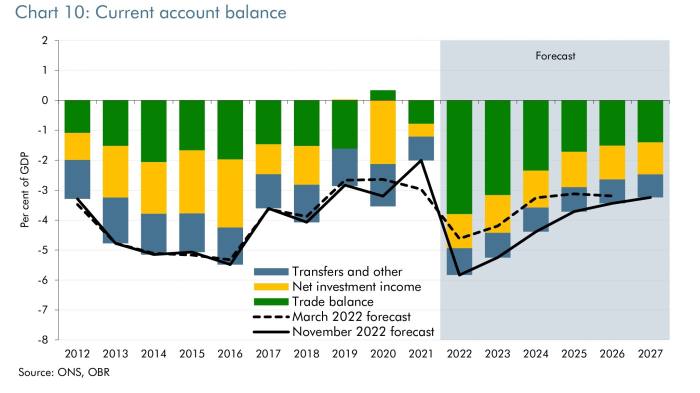

But will the new era of austerity at least ward off the danger that the UK slumps into an EM-style “sudden stop” crisis, as some analysts have been warning?

Well . . .

Despite the painful blows to household finances, the OBR predicts that the UK’s current account deficit is going to remain dangerously wide. As Toby says:

Given that we’re going to be reliant upon the kindness of strangers to buy those gilts now that the Bank has stopped buying and pension funds might become a less important buyer (albeit once they have finished offloading their less liquid assets and filled their boots with physical rather than synthetic duration), this is not great.