Jeremy Hunt finally unleashed his Scrooge-like Autumn Statement, adding to the financial gloom of millions of Britons with a swathe of tax rises.

The average family is likely to be more than £800 a year worse off after he unleashed an expected wave of tax changes designed to rake in £24billion for the Treasury.

Under plans announced today he will increase the income tax burden on millions of workers.

He also set the stage for massive increases in council tax bills by easing the rules for local authorities to rake in cash to pay for services.

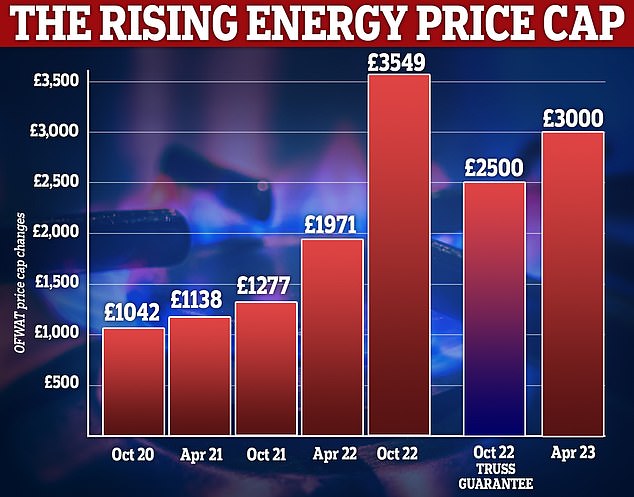

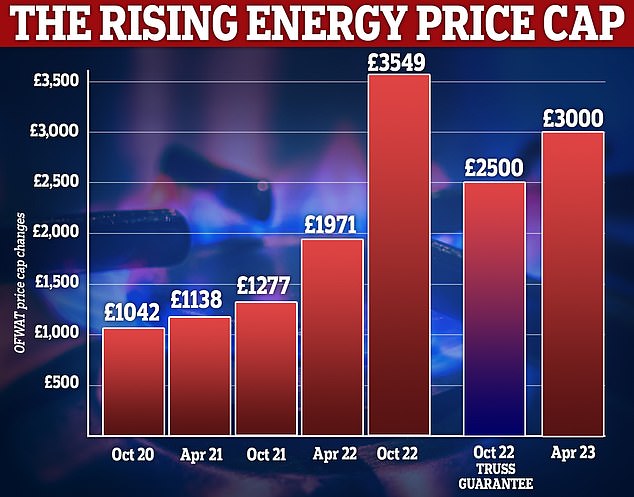

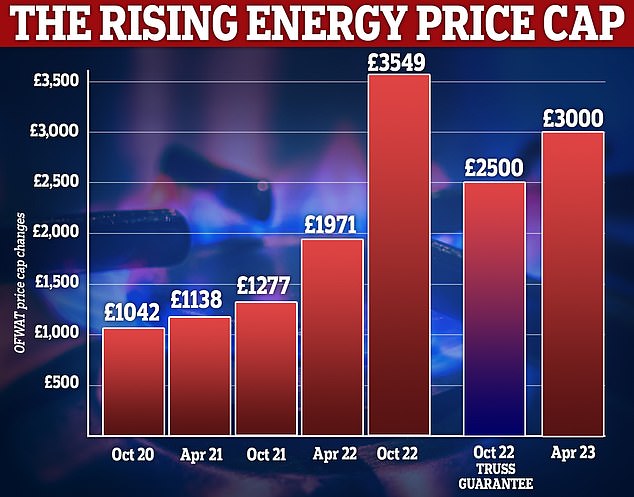

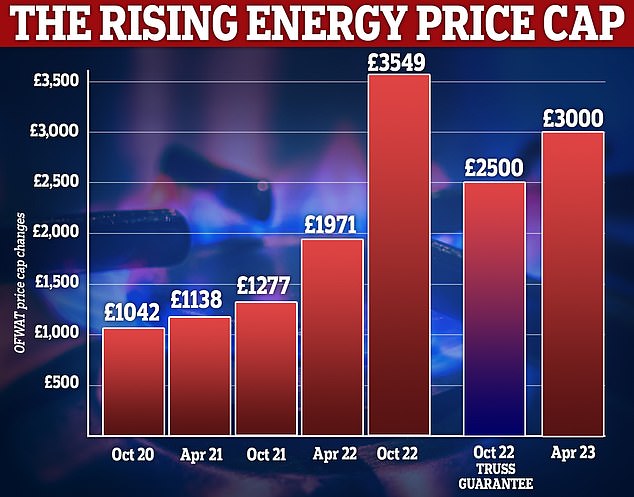

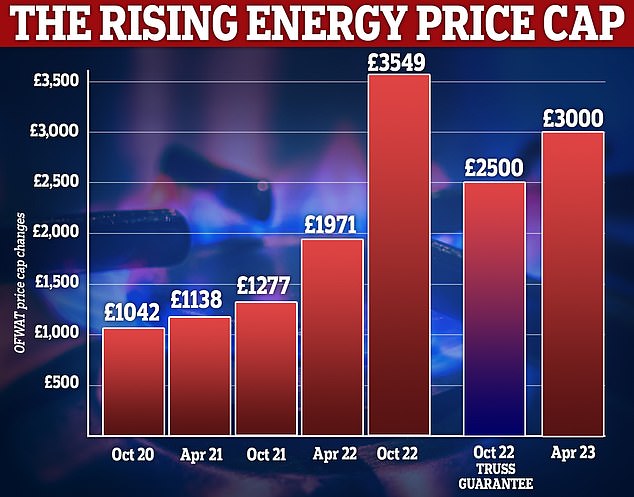

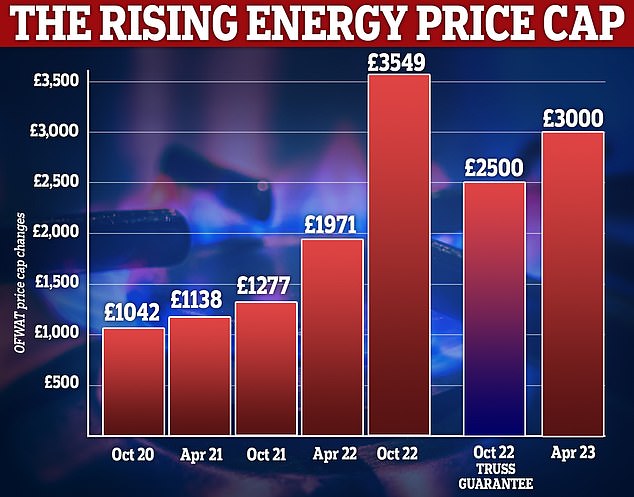

At the same time he confirmed that help with soaring energy bills is due to be reigned in. Liz Truss’s plan to underwrite all bills for two years will end after just six months and be replaced with targeted, cheaper, assistance aimed at those least able to pay.

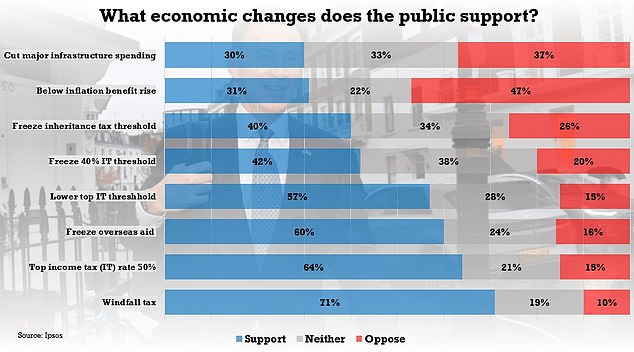

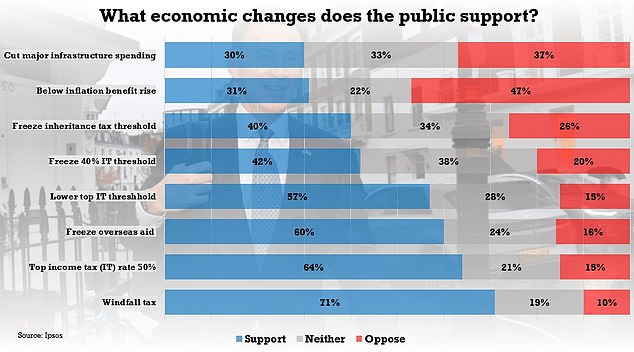

It means families will be paying £1,000 extra by next spring. But he also unveiled moves to make the moist well-off pay more tax, a move broadly supported by the public according to a poll this week.

He also confirmed that pensions and benefits will rise in line with September’s inflation rate of 10.1 per cent.

Addressing the Commons today Mr Hunt said his statement amounted to ‘substantial tax increases’, adding: ‘Anyone who says there are easy answers is not being straight with the British people.’

And in a swipe at predecessor Kwasi Kwarteng he added: Mr Hunt said: ‘I understand the motivation of my predecessor’s mini-budget and he was correct to identify growth as a priority. But unfunded tax cuts are as risky as unfunded spending.’

Here we look at how different groups will fare in the coming months:

It means families will be paying £1,000 extra by next spring. But he also unveiled moves to make the moist well-off pay more tax, a move broadly supported by the public according to a poll this week.

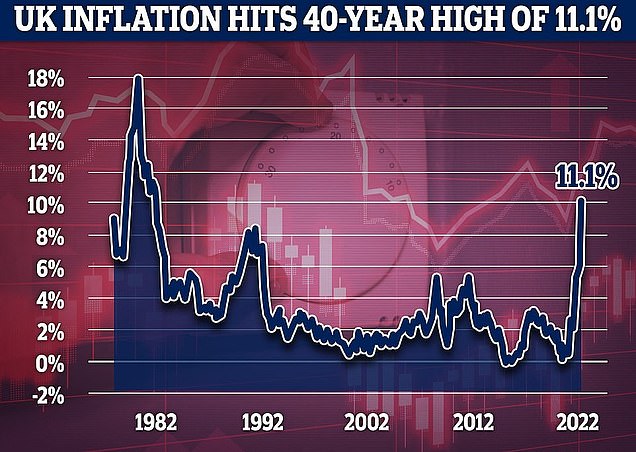

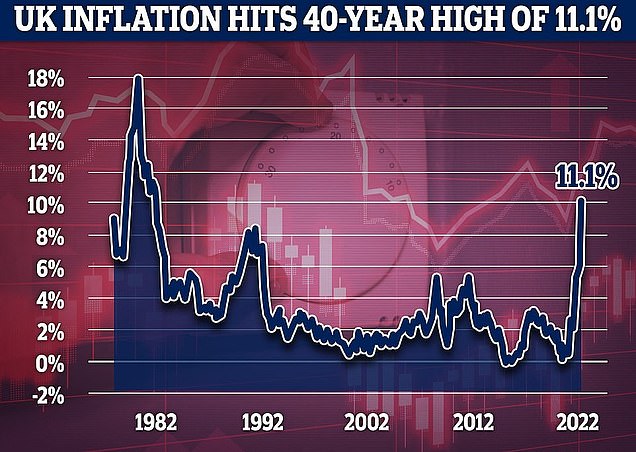

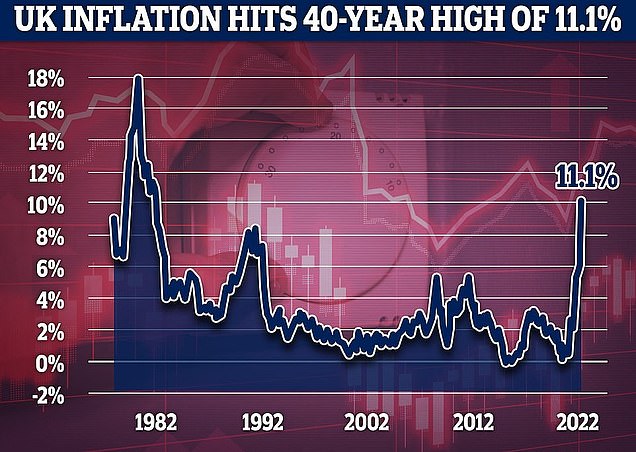

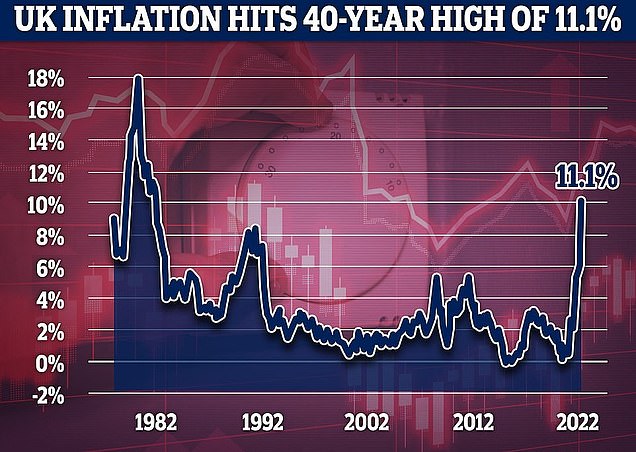

Inflation in the UK hit 11.1% earlier this week – the highest level in more than 40 years

WORKING-AGE HOMEOWNERS HIT BY PERFECT STORM OF TAX RISES AND BILL INCREASES

Middle income families with mortgages were hit by the forecast perfect storm of tax rises – personal and probably on their homes – alongside an energy bill increase and cuts to child benefits.

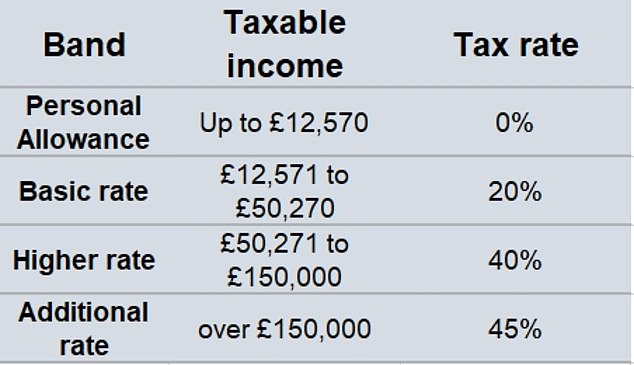

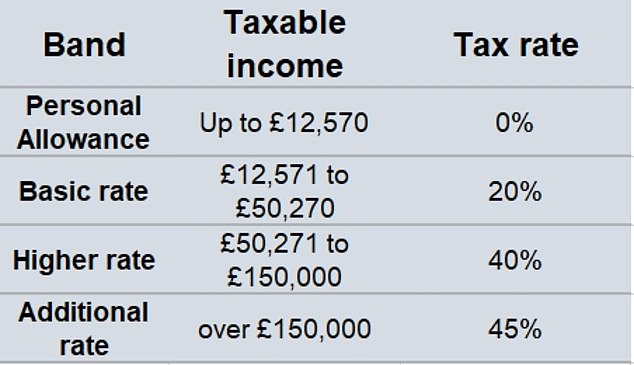

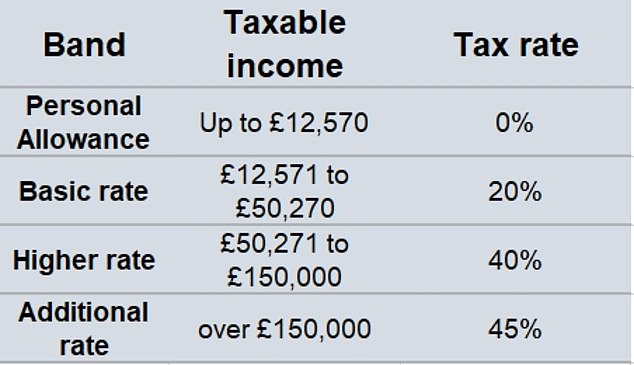

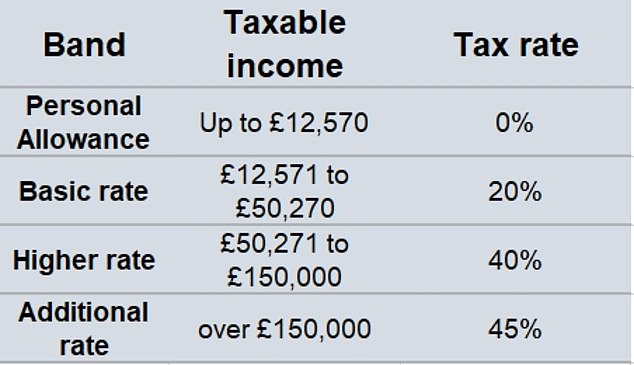

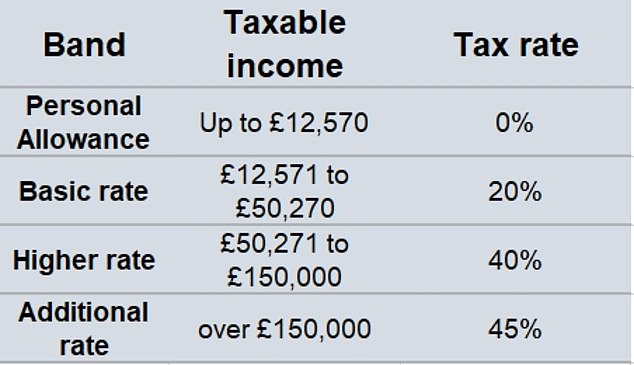

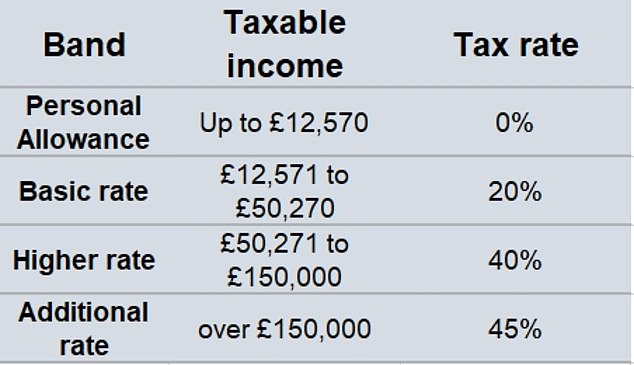

The three main tax rates – 19p basic, 40p higher and 45p additional rate – will not change, as that would be politically dangerous.

But it is the thresholds at which rate kicks in that are expected to be where workers lose out – as many as three million of them.

Currently workers earning between £12,570 and £50,270 pay the basic rate of income tax. But wage inflation is currently running at 6 per cent.

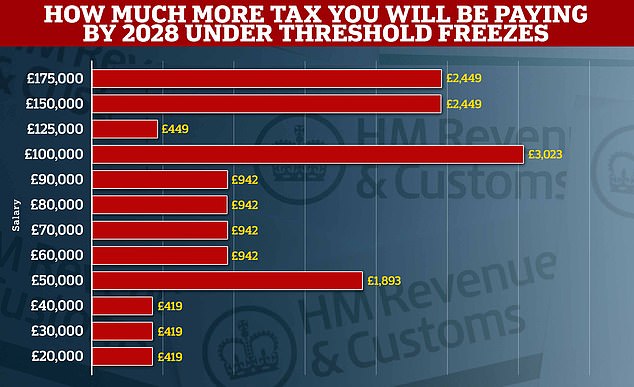

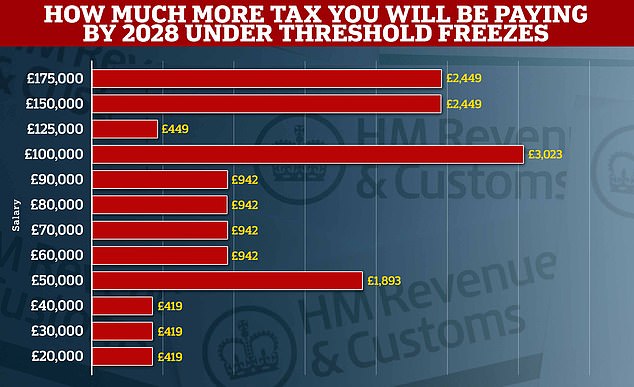

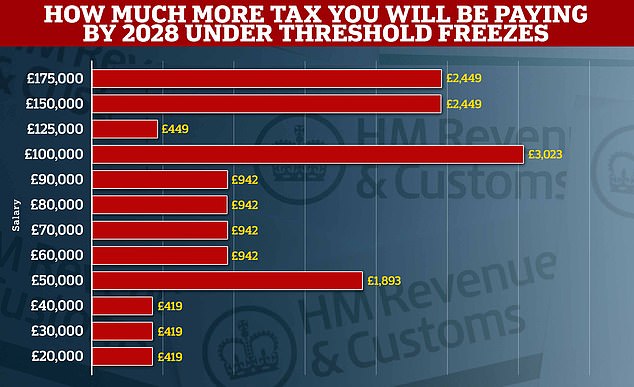

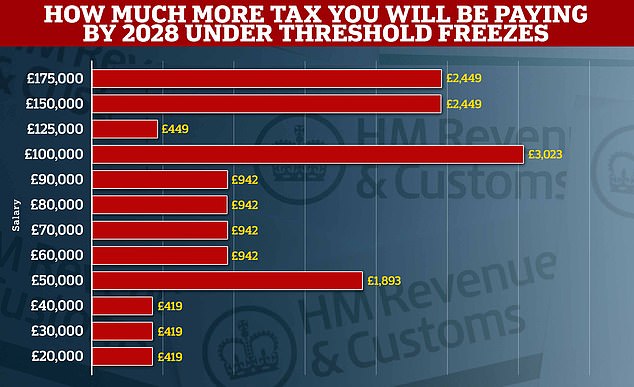

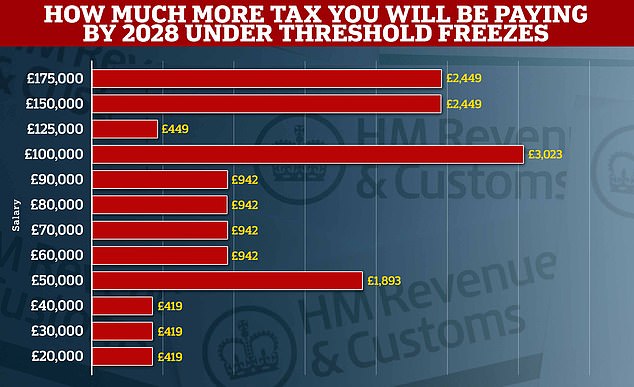

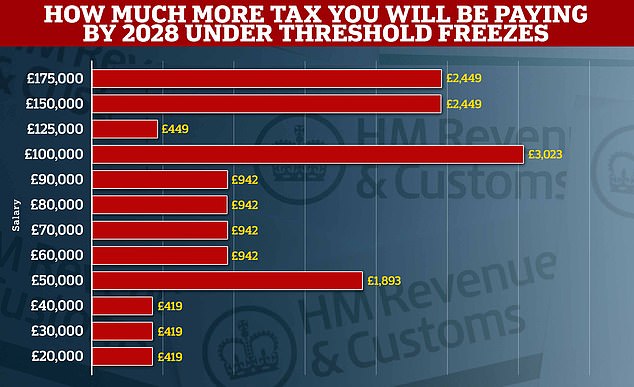

Extending the freeze on tax thresholds to 2028 will drag all workers deeper in the system, meaning they pay more

The tax thresholds are currently frozen until 2026, but Mr Hunt is expected to extend this until 2028.

This means that as wages rise to deal with increases in living costs (CPI inflation is currently at 10.1 per cent) more middle income workers will be dragged into the 40p rate bracket.

The tax thresholds were frozen until 2026, but Mr Hunt extend this until 2028. It is expected to cost someone on £50,000 an extra £1,893 a year by the time the freeze comes to an end.

Mr Hunt also took more proactive action to increase the tax bills of higher earners, to make the Statement seem fairer.

He abandoned plans to reinstate Labour’s 50p top tax rate – but will still hammer higher earners by reducing the income level at which the top 45p rate kicks in from £150,000 to £125,000, dragging more people into the tax bracket.

Anthony Whatling, tax partner at wealth manager and professional services firm Evelyn Partners, said: ‘In 1990 only 1.7 million people paid 40 per cent tax, with the figure rising to 2.1 million when Tony Blair came into power in 1997.

‘HMRC estimated the number of people being drawn into the higher rate band to have surged by nearly 44 per cent since the 2019/20 tax year to 5.5 million this year.

‘At these rates of increase, and given that earnings are rising quite rapidly, it is probable that the number of people subject to 40 per cent income tax will exceed eight million under this prolonged freezing of allowances until 2028. That will be double the number of higher rate taxpayers when the initial freeze was announced by Sunak in 2021.’

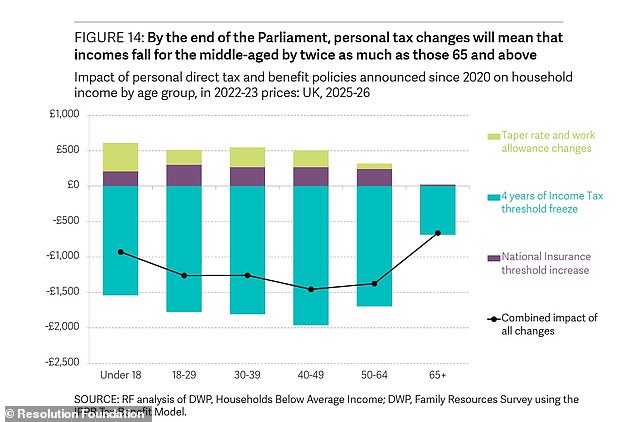

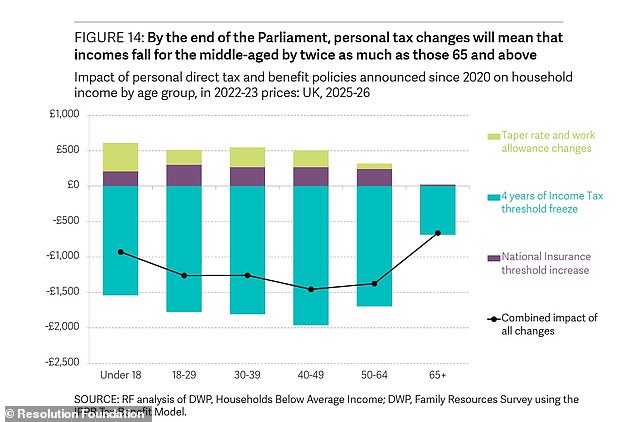

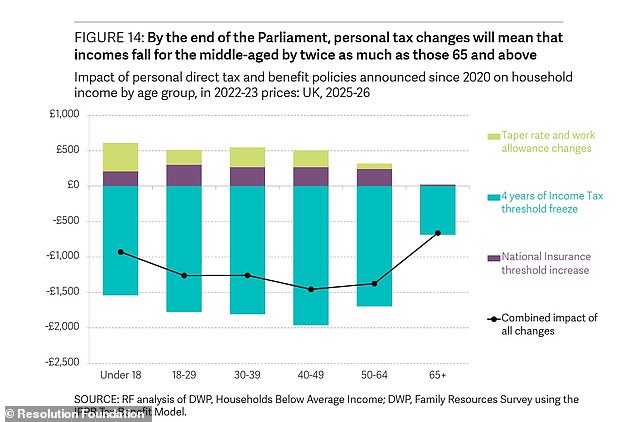

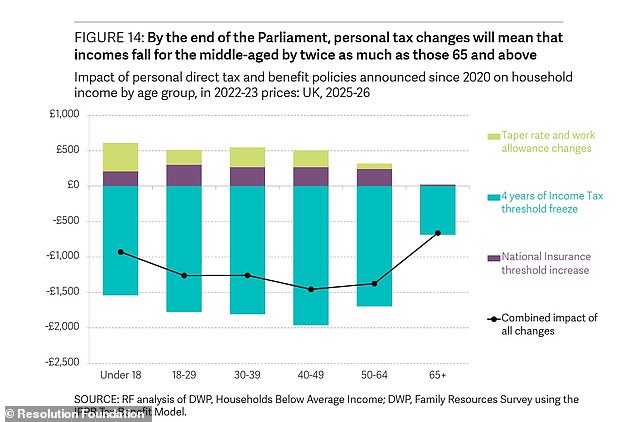

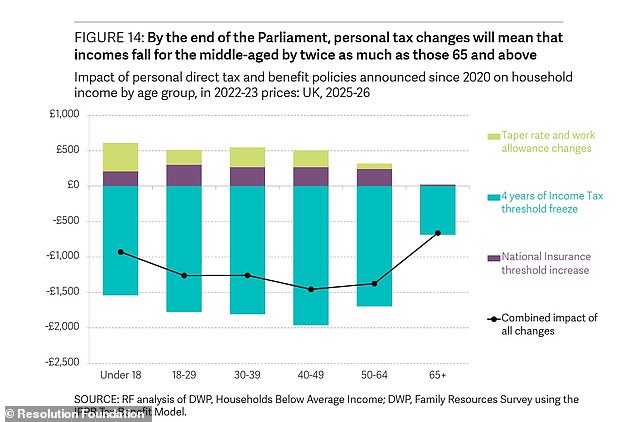

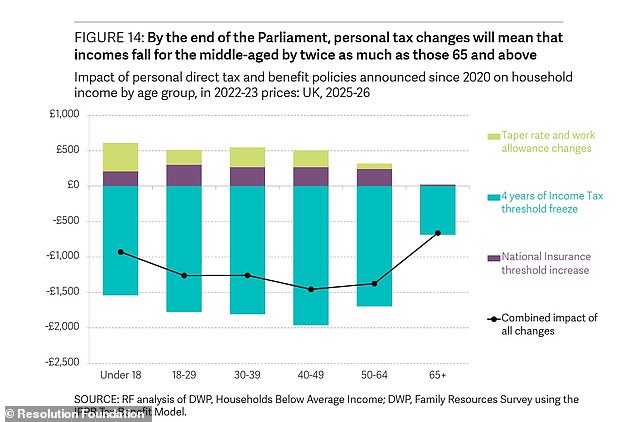

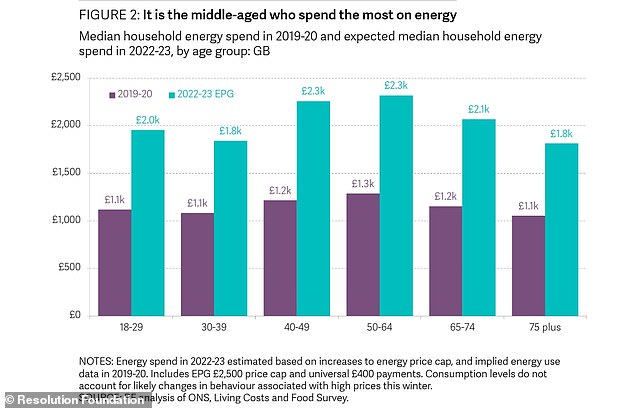

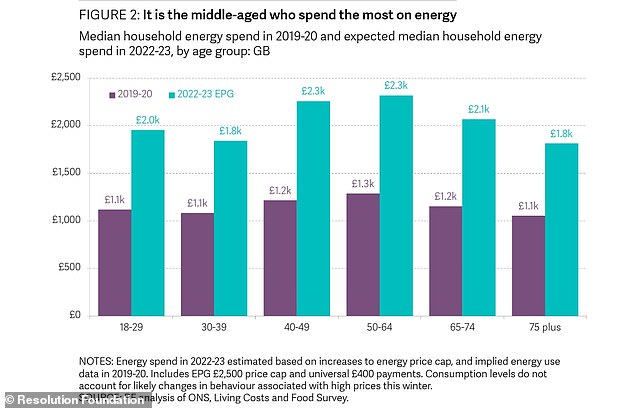

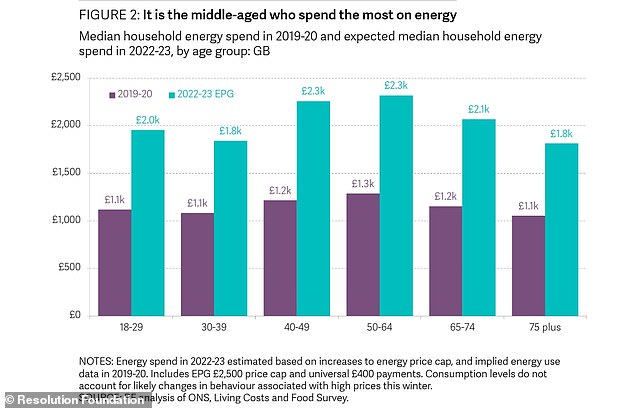

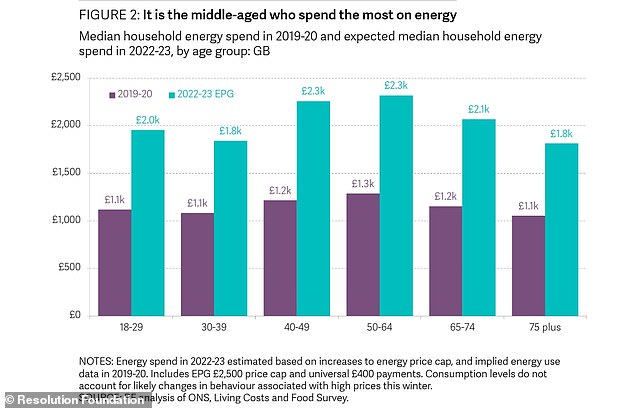

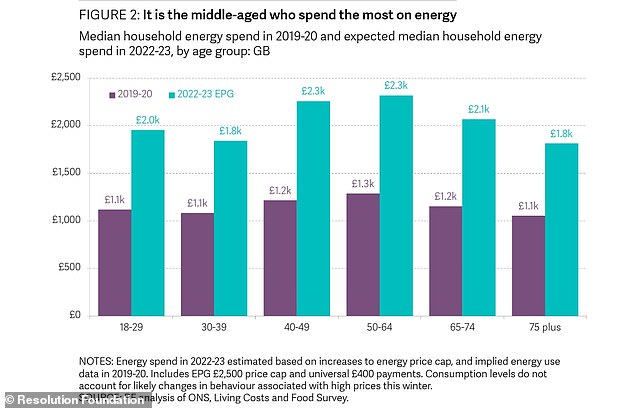

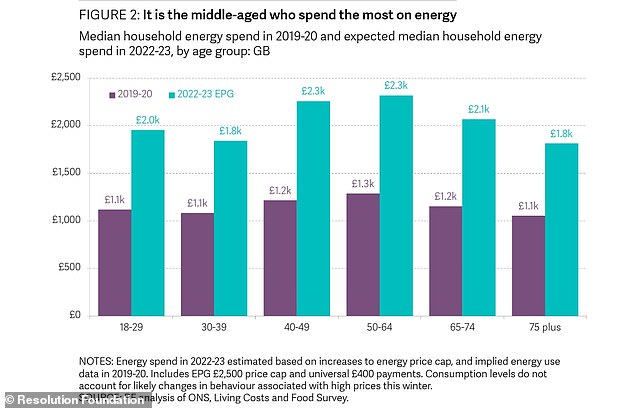

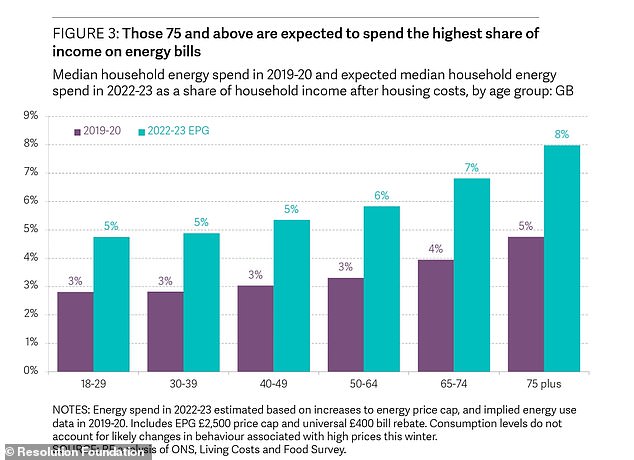

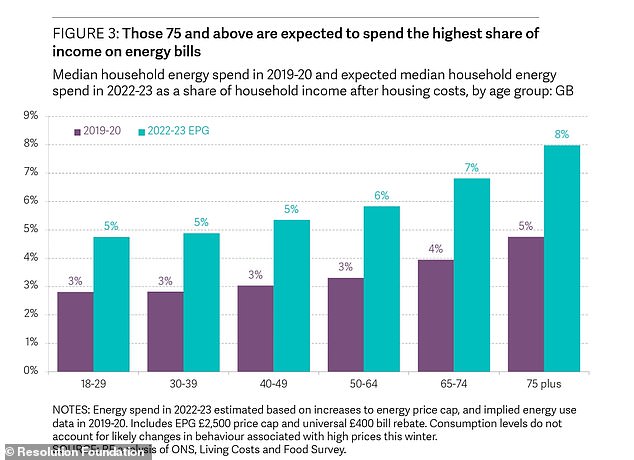

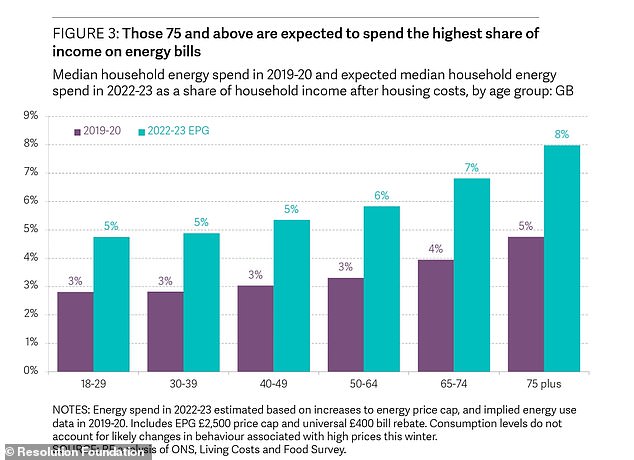

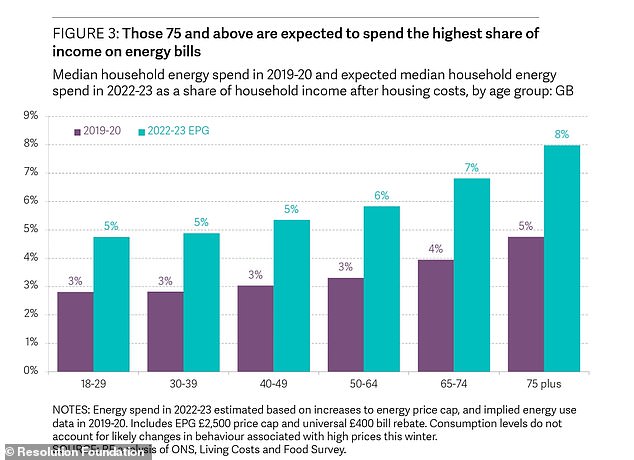

Middle-aged households – ranging from 40 to 64-year-olds – will also see the largest increases in their energy bills.

Typical charges will rise by over £1,000 on pre-crisis levels, to between £2,200 and £2,400.

A Resolution Foundation report found that even with Government support, the typical household energy bill will be 83 per cent higher in 2022-23 compared to pre-crisis levels.

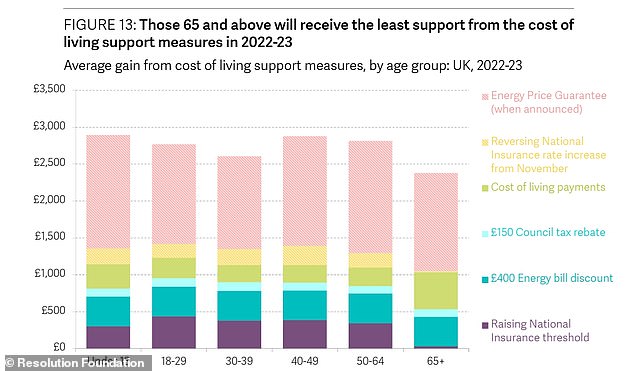

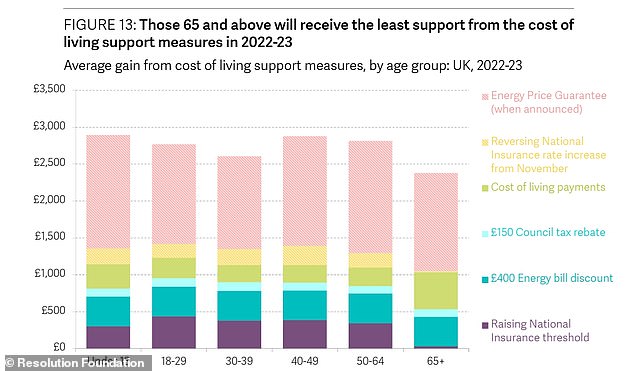

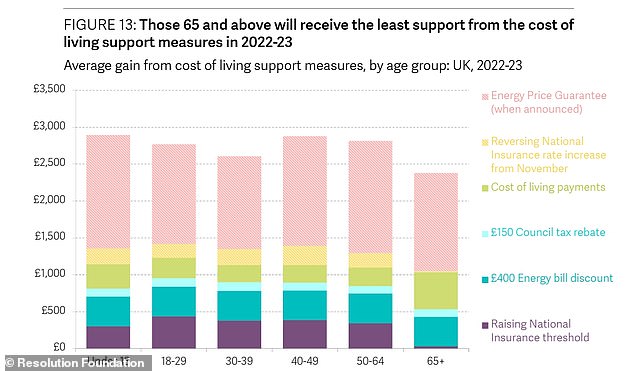

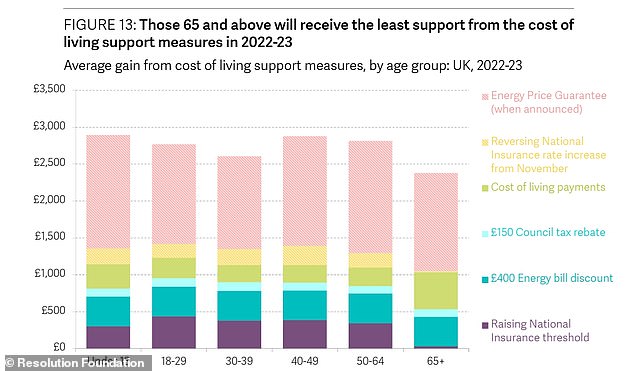

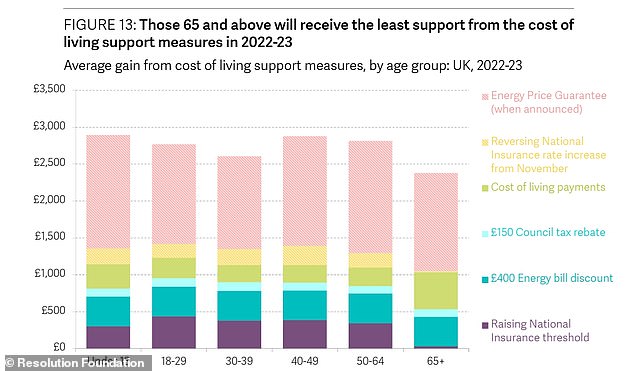

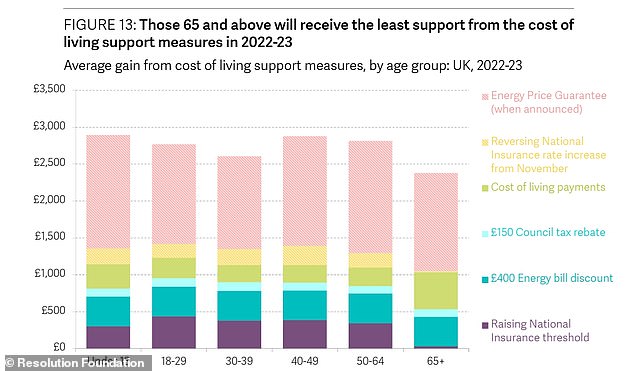

But those aged between 40 and 64 are set to benefit the most from cost-of-living support measures announced this year because cuts to national insurance contributions do not benefit those over the state pension age.

Thresholds for National Insurance, inheritance tax and tax-free pension savings will also be frozen, while the threshold for paying capital gains tax will be halved to £6,000.

Electric car owners will have to pay road tax for the first time to plug a projected £7billion shortfall in road tax as the switch to electric vehicles gathers pace.

But it is likely to prove controversial as it will act as a disincentive to motorists thinking of going green, at a time when soaring energy prices are already undermining the financial case for switching to electric.

Also, the stamp duty cuts announced in the mini-budget will remain in place but only until March 31 2025.

The Chancellor told the Commons: ‘The OBR expects housing activity to slow over the next two years, so the stamp duty cuts announced in the mini-budget will remain in place but only until March 31 2025.

‘After that, I will sunset the measure, creating an incentive to support the housing market and all the jobs associated with it by boosting transactions during the period the economy most needs it.’

The Chancellor said he would add an extra £6 billion of investment in energy efficiency from 2025 to help meet a new ambition of reducing energy consumption from buildings and industry by 15 per cent by 2030.

PENSIONERS GET OLD-AGE BENEFIT BOOST – BUT COULD FACE A LONGER WAIT FOR THEIR MONEY ALONGSIDE COST-OF-LIVING PAIN

Rishi Sunak this week talked the talk by saying pensioners were ‘at the forefront of my mind’ and Jeremy Hunt today walked the walk as he protected age-related benefits from inflation.

The Chancellor confirmed that the ‘triple lock’ that links the state pension rate to the highest out of three values: inflation, wage increases and 2.5 per cent, would be retained.

With inflation currently at an eye-watering 11.1 per cent that means that keeping the lock will cost billions in extra payouts for the elderly.

But alongside this carrot he also announced a review of the current state pension age of 66.

Members of Mr Sunak’s Cabinet including Michael Gove have previously warned against going back on the manifesto commitment, which could have been unpopular with older, predominantly Tory voters.

State pensions increased by 3.1 per cent this year, after the triple lock was temporarily suspended for a year.

However it is not all good news for pensioners. Along with working age homeowners they face an increase in energy bills, set to rise from an average of £2,500 to £3,000 in April as Government aid is tapered off over the course of a year.

That is almost treble the £1,042 average bill in April 2020, which has been sent rocketing by the impact of the war in Ukraine on gas supplies.

Additionally, a universal one-off payment of £400 this winter will not be repeated, meaning millions will be an average of £900 worse off in total.

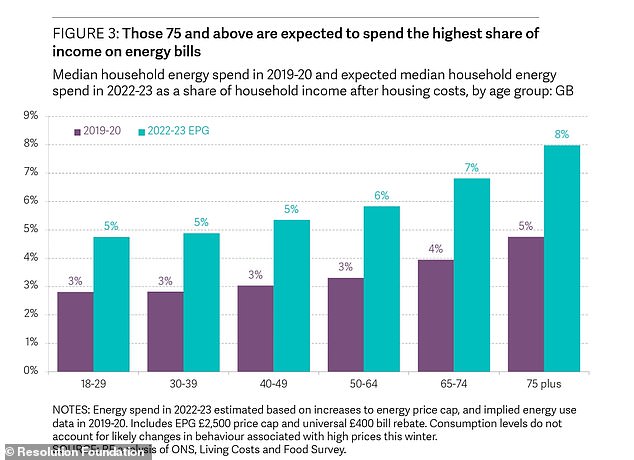

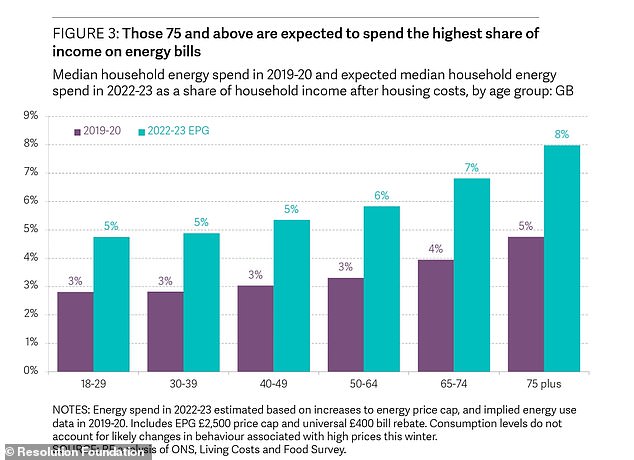

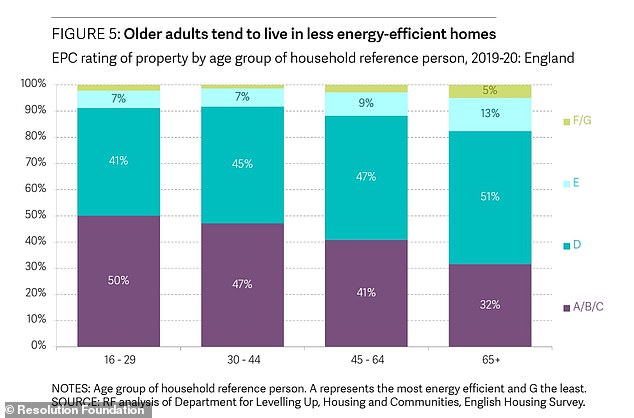

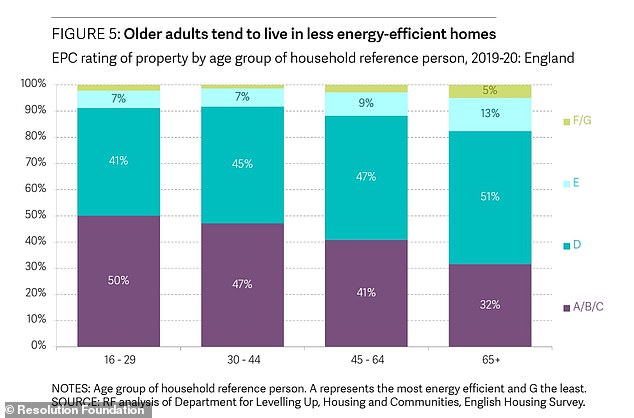

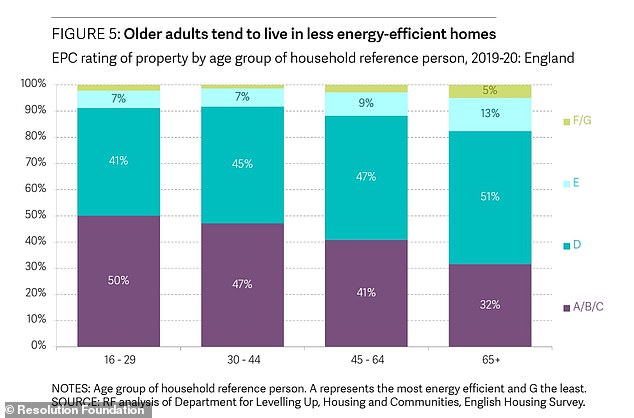

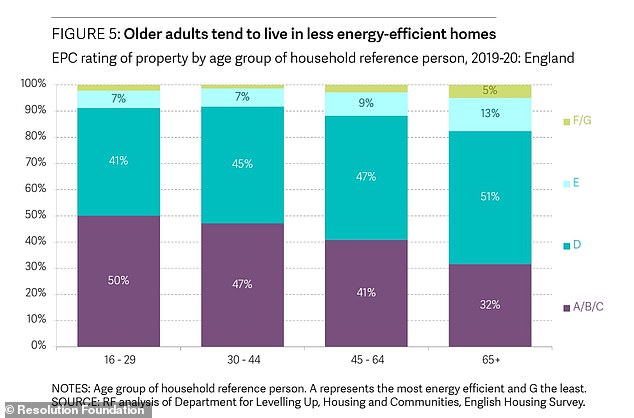

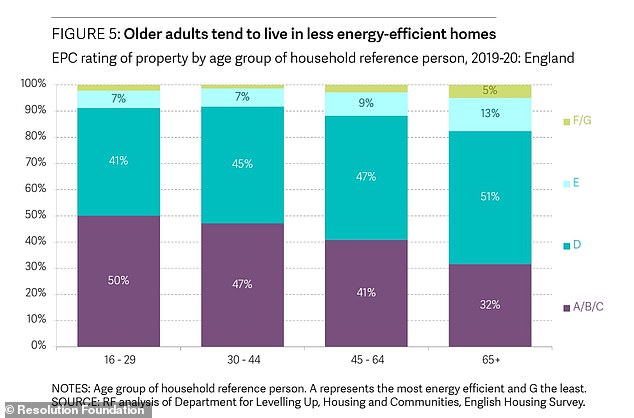

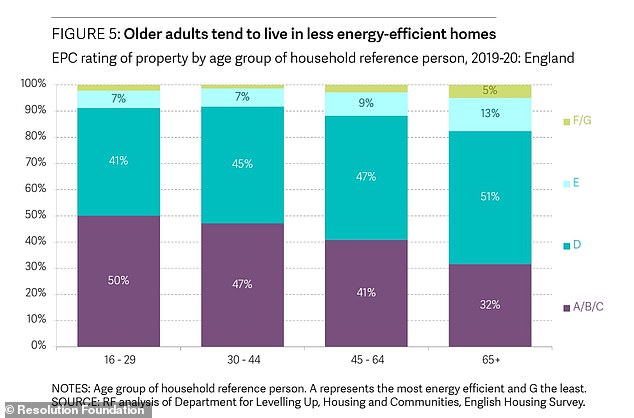

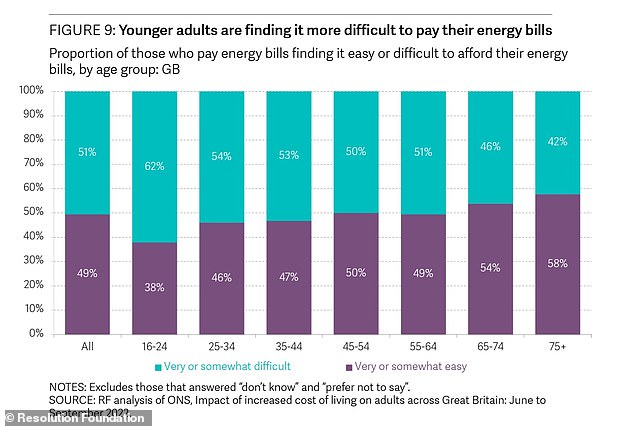

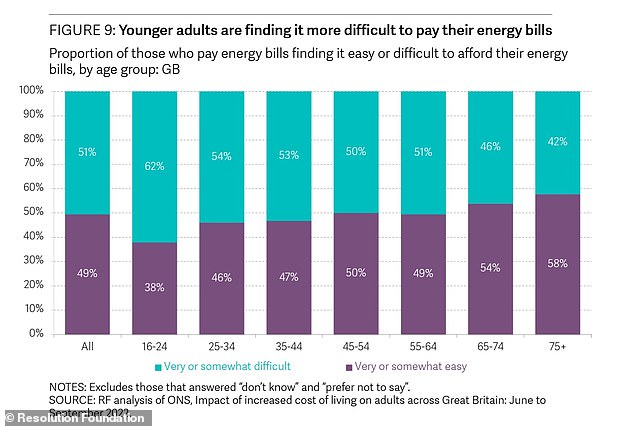

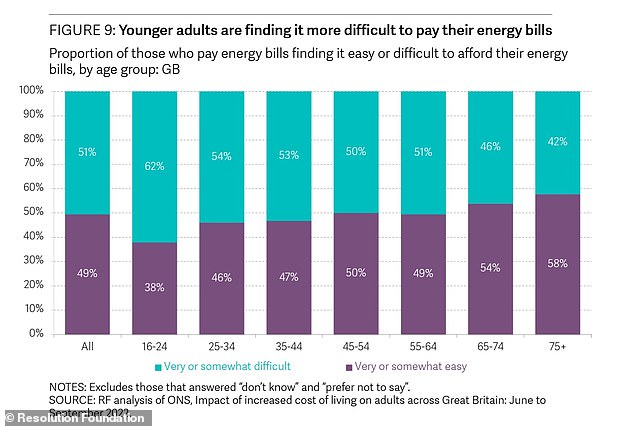

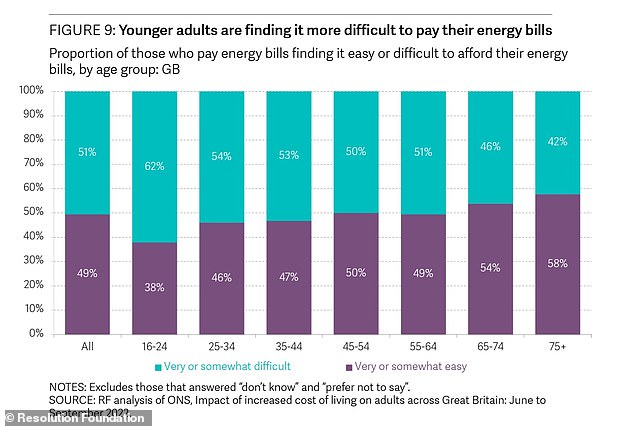

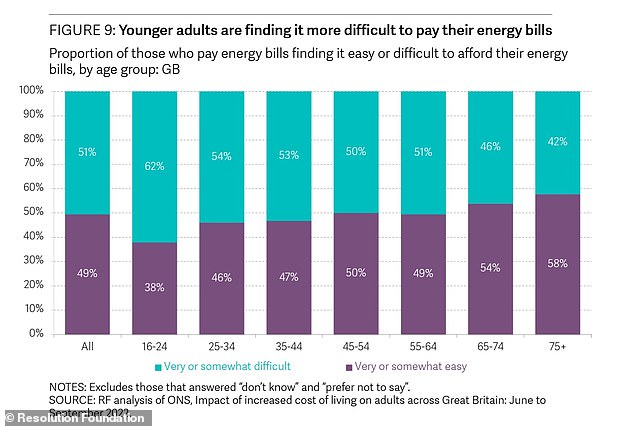

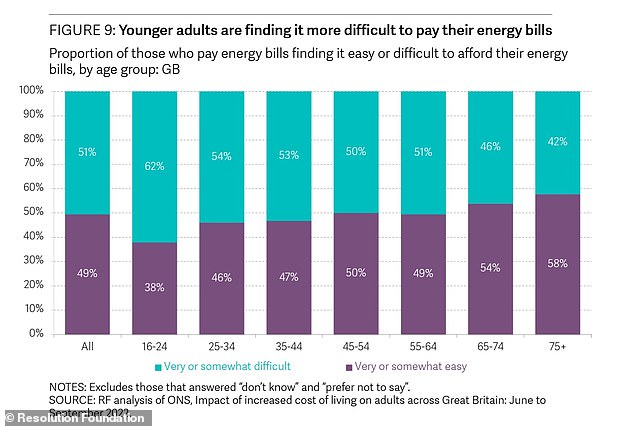

The Resolution Foundation’s Intergenerational Audit concludes over-75s are expected to spend 8 per cent of their total household income on bills as they are more likely to live in larger and energy-inefficient homes.

YOUNGER RENTERS WILL STRUGGLE MOST WITH BILLS

There was little good news for younger renters in the statement either.

They will be affected by income tax rate threshold freeze the same as everyone else of working age. And they are likely to bear the brunt of changes to energy bills help.

Increases to council tax will also affect them, both directly, and indirectly if landlords factor rises into their rent.

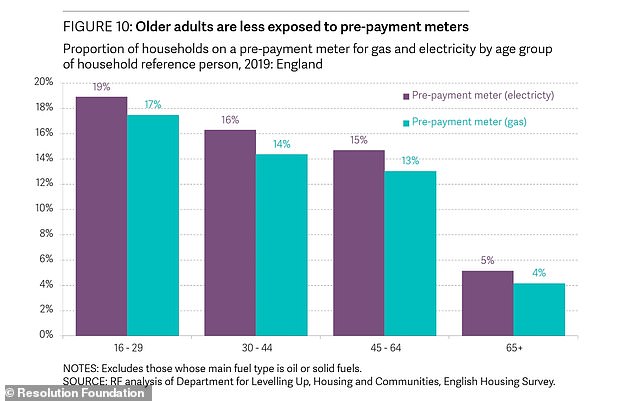

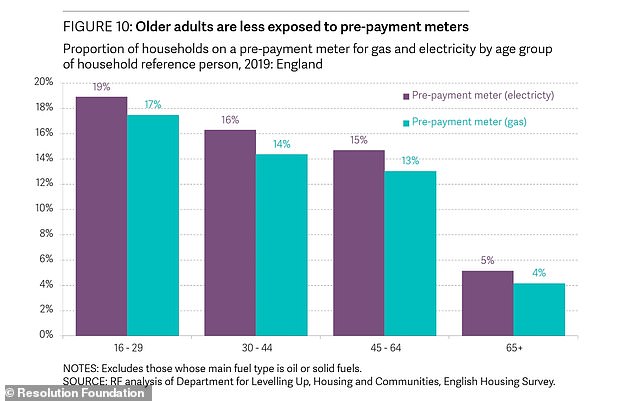

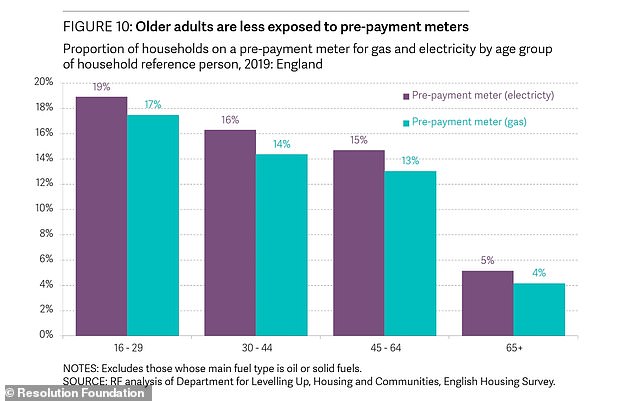

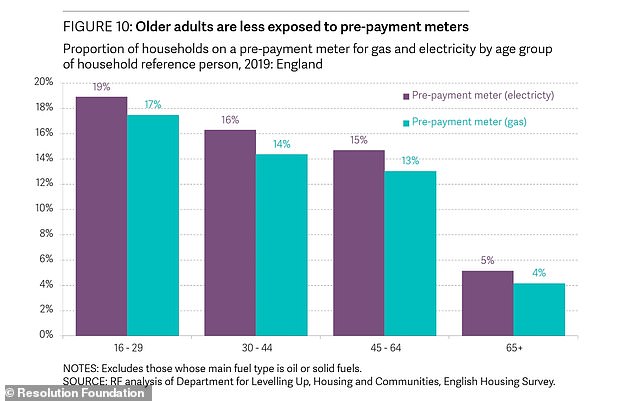

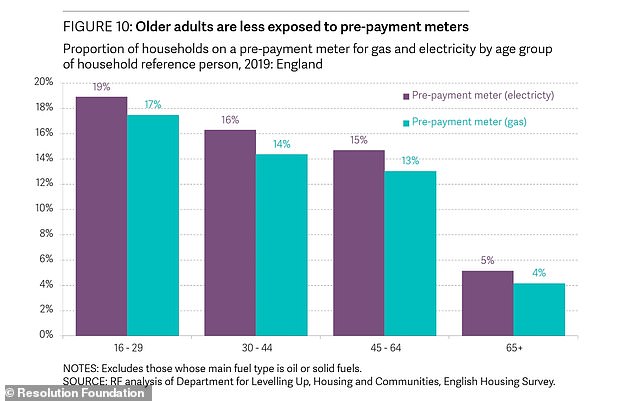

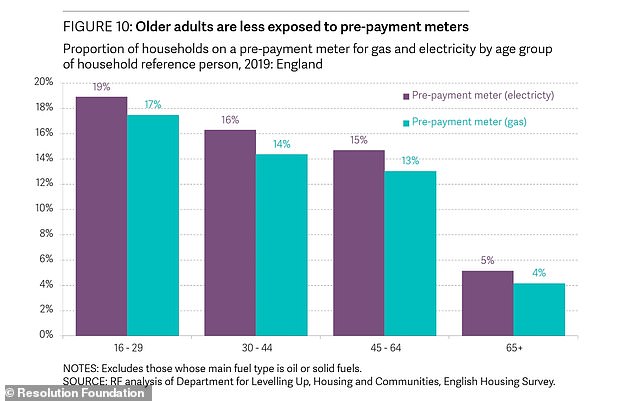

The Resolution Foundation’s Intergenerational Audit found that younger generations, who have seen years of stalled pay growth and high housing costs, will struggle the most as they are four times more likely to be on pre-payment meters and are less likely to have assets and savings that could see them through.

Molly Broome, of the Resolution Foundation, said: ‘All generations are facing difficulties from the growing cost-of-living crisis – but different generations are experiencing it in very different ways.

‘Energy bills are set to rise by over 80 per cent this winter, compared to pre-crisis levels.

‘The middle-aged will face the largest bill rises and older generations will see the greatest squeeze on their incomes due to their larger and less energy-efficient homes.

‘But it’s younger people who are most likely to struggle to pay rising bills, because they are less likely to have savings to fall back on – and will therefore be forced to either rely on older friends or family members, or potentially go without heating during the coming cold weather.’

BENEFIT INCREASE AND MINIMUM WAGE RISE FOR THE LOWEST EARNERS

Ministers had faced pressure to make sure that the Autumn Statement is fair and does not leave the poorest the worst off. So several measures were introduced to help though at the bottom to help both with the cost of living and the Tories’ own political crisis.

The first was a decision to raise benefits in line with inflation, so they rise by 10.1 per cent, the inflation rate in September.

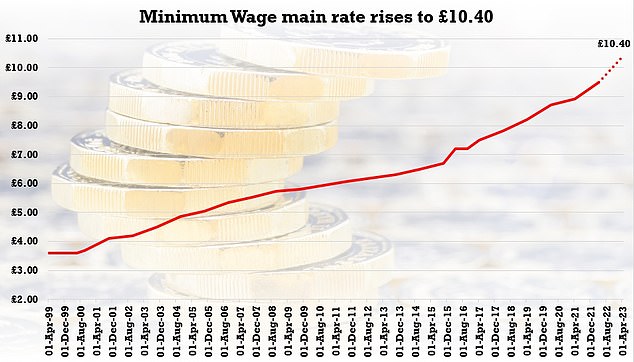

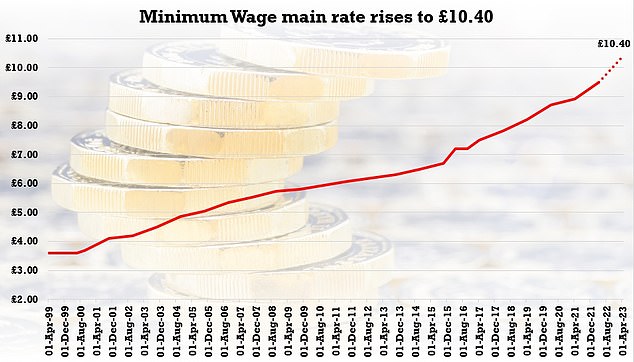

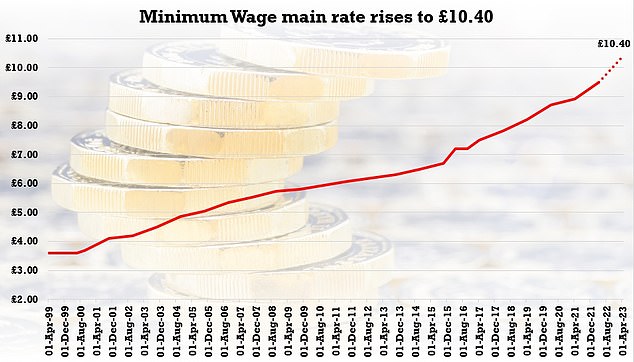

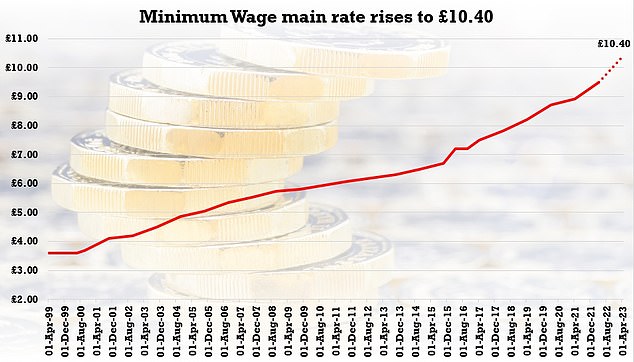

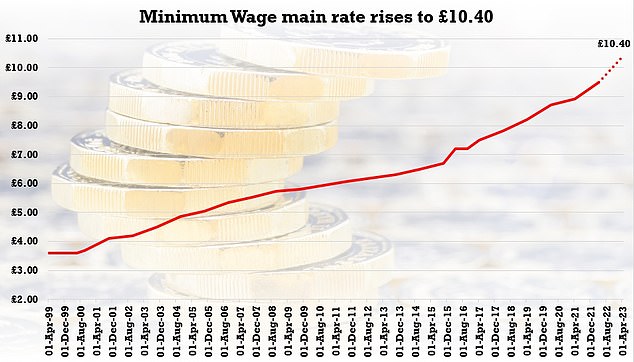

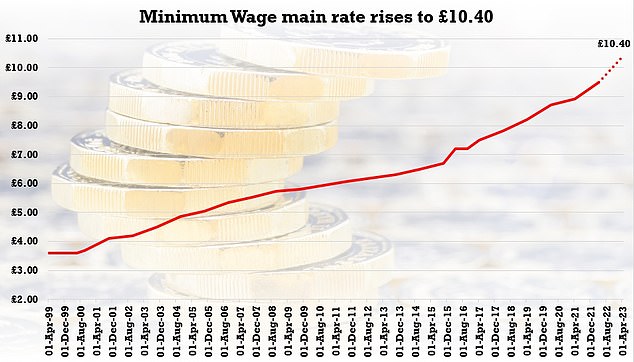

There is also a significant increase in the national living wage – from £9.50 an hour to £10.42 – meaning a pay rise of around £1,600 per person.

He also confirmed cost-of-living payments to around eight million households on means-tested benefits.

Those on universal credit could receive £650, disability benefit recipients £150 and pensioner households £300 – with some people able to claim all three.

More than four million children are living in families which receive Universal Credit, latest figures suggest.

Some 4,030,796 children were living in households receiving the benefit as of August, according to data from the Department for Work and Pensions (DWP).

This is up from 3,906,325 children in May. Overall, the number of children living in families which get Universal Credit has risen by 250,000 in six months, between February and August this year.