Hi, everyone! This is Cheng Ting-Fang from Taipei.

Earlier this week I attended the ceremony for Taiwan’s prestigious Excellent Journalism Awards, where Nikkei Asia made it on to the shortlist in two categories for our supply chain coverage. A lot of entries this year were focused on the Ukraine war and whether Taiwan — a thriving tech economy that Beijing views as part of its territory and has not ruled out taking over by force — could one day suffer a similar military conflict.

Among the winners was Chang Chien-Chi, a veteran photojournalist who has visited Ukraine four times this year.

“I feel I have the responsibility to document the war in Ukraine, where I found injustice,” he said from the stage. “I feel that my home Taiwan could face similar threats.”

His remarks came just after US President Joe Biden and his Chinese counterpart Xi Jinping met in person for the first time since 2017. Taiwan was a key topic of their discussion. Xi told Biden that “the Taiwan question” is at the very core of China’s interests and a red line that must not be crossed, while Biden said the world has an interest in maintaining peace and stability across the Taiwan Strait.

Even though the world’s two top economies are locked in an escalating competition over tech supremacy, the three-hour meeting opened with friendly greetings and went unexpectedly well.

Biden, at least, seemed optimistic, telling reporters afterward, “I do not think there’s any imminent attempt on the part of China to invade Taiwan.”

Deep, deep downturn

Top us memory chipmaker Micron on Wednesday announced an additional 20 per cent cut to all of its Dram and Nand flash memory output starting this quarter in response to deteriorating market conditions and a lacklustre outlook for 2023.

Micron is not alone in trimming output and scaling back capital spending plans, write Nikkei Asia’s Yifan Yu and Cheng Ting-Fang. Such moves indicate the chip market downturn could last much longer than most industry players were expecting as recently as a few months ago.

Wallace Gou, an industry veteran and CEO of chipmaker Silicon Motion, was very candid on the subject. “Let me be frank and straightforward: demand is just not good,” Gou said. “In the best-case scenario, the inventory correction will last till the first half of 2023, and in a more pessimistic scenario, the downturn could last for the full year.”

The slump follows a super cycle that began around the end of 2020, when a swath of industries from consumer electronics and cars to home appliances faced an unprecedented shortage of semiconductor components. This pushed up demand and prices for all sorts of chips. Frantic stockpiling by electronics makers fearful of further supply chain disruption further fuelled demand.

Now, with demand weakening and most companies having ample chip supplies on hand, it seems the earlier boom only planted the seeds for a painfully long downturn.

Jack Ma’s push for funds

Jack Ma’s Ant Group is moving forward with plans to raise capital for its lending arm after a major state-owned asset manager pulled out of an earlier fundraising deal in January.

The deal will bring in Rmb10.5bn ($1.5bn) for Ant’s consumer finance unit, about half of the Rmb22bn that the group had originally hoped to raise last year, write the Financial Times’ Ryan McMorrow and Sun Yu.

Replacing China Cinda Asset Management is a vehicle controlled by the government of Hangzhou, where Ant is based. Hangzhou Jintou Digital Technology will contribute Rmb1.9bn, gaining a 10 per cent stake in the business, which was hived off from Ant last year as part of a regulatory campaign to revamp the company.

The restructuring left Ant with only a 50 per cent stake of the unit responsible for funnelling more credit to consumers than any Chinese bank, and powering about 40 per cent of its sales.

While the capital raise marks progress for Ant’s lending unit, one person close to Ant cautioned that the group still had other hurdles to jump before it was back in Beijing’s good books: Qiantang Credit Rating, which is meant to take over Ant’s user data for commercial use, has yet to receive a business license.

People close to Qiantang said Ant, which has a 35 per cent stake in the company, is competing with the central bank for control of the credit scoring unit.

Back to school

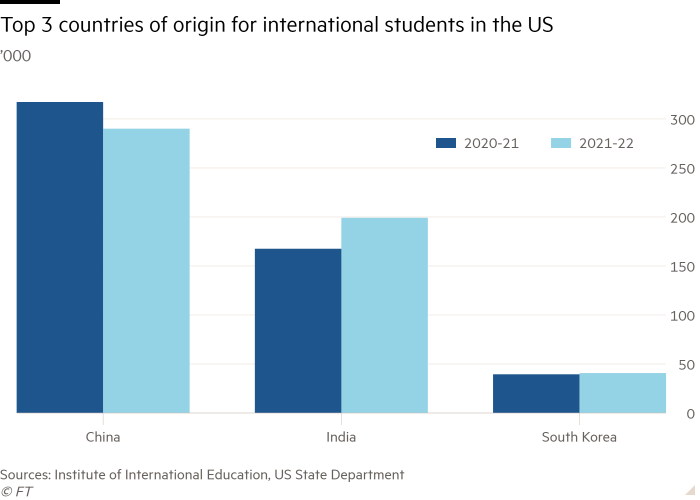

International students are returning to the us following the disruption of the pandemic. But while the number from India and South Korea rose for the 2021-2022 academic year, China logged its second straight year of decline, writes Nikkei Asia’s Yifan Yu.

By absolute numbers, China still accounts for more international students than any other country, but Covid travel restrictions and tensions between Beijing and Washington have taken their toll.

Chinese students in STEM fields — science, technology, engineering, and mathematics — are particularly worried about being able to secure a visa, due in part to a restriction introduced in 2020 by then-US President Donald Trump.

“The Biden administration has been very clear that Chinese students are welcome,” a US State department official said recently. The question is whether Washington can convince Chinese students of that.

Japan’s return to chips

Japan, once a vital player in chips in the 1980s, is getting back in the game, writes Nikkei’s Yoichiro Hiroi. Eight companies, including deep-pocketed players like Toyota Motor, Sony Group and SoftBank, have announced they will set up a new chipmaker dubbed Rapidus to develop cutting-edge 2-nanometre chips with an aim to begin production by 2027.

The world’s top chipmakers TSMC, Samsung and Intel plan to introduce such advanced chips by 2025.

Getting back in the chip race will take time, effort and continuous investment. But it is also Japan’s “last chance to make a comeback,” said Atsuyoshi Koike, president of Rapidus. Koike was formerly the head of memory chipmaker Western Digital Japan.

Even for established players, success in the chip industry requires constantly pushing forward with the latest technology. In the past, Japan failed to keep up with the investment needed to do this and lost ground to Taiwanese and South Korean rivals who poured record amounts of money into their businesses even amid economic downturns.

Suggested reads

-

FTX collapse spells more ‘crypto winter’ pain to come (Nikkei Asia)

-

Top European chip companies seek stability amid US-China dispute (FT)

-

Nvidia revenue hit by us chip curbs, China’s zero-Covid policy (Nikkei Asia)

-

Singapore’s Grab breaks even on deliveries ahead of schedule (Nikkei Asia)

-

Warren Buffett’s Berkshire Hathaway buys $4bn stake in chipmaker TSMC (FT)

-

China’s Great Wall Motor to double Thai EV investment (Nikkei Asia)

-

China’s chip equipment makers struggle to profit at home from US export controls (FT)

-

Japan’s chip equipment makers scale up ahead of TSMC’s arrival (Nikkei Asia)

-

US tries to enlist allies in assault on China’s chip industry (FT)

-

AI is giving insurers godlike powers, says Sompo chief (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at [email protected]