This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. We were happy to see Harvard and Yale Law pull out of the US News law school rankings yesterday. As graduates of Cornell (rank 17) and Wesleyan (unranked), we say death to college rankings. Email us: [email protected] and [email protected].

Retailer results, the US consumer, and the Fed

Target is a very big retailer. It operates almost 2,000 stores in the US, selling over $100bn in groceries, clothing, home goods and what have you. Its shares fell 13 per cent yesterday, after it said sales trends slowed notably as the third quarter progressed, and that same-store sales in the Christmas quarter would fall.

The chief executive, Brian Cornell, attributed the problem to a faltering US consumer:

Consumers are feeling increasing levels of stress, driven by persistently high inflation, rapidly rising interest rates and an elevated sense of uncertainty about their economic prospects . . .

Many consumers this year have relied on borrowing or dipping into their savings to manage their weekly budgets. But for many consumers, those options are starting to run out. As a result, our guests are exhibiting increasing price sensitivity, becoming more focused on and responsive to promotions and more hesitant to purchase at full price . ..

We faced an unexpected gross margin rate headwind from a higher-than-expected mix of promotional sales as guests moved away from full price purchases.

From an investor point of view, laments like this one are bad/good. They are bad if you hold assets whose value varies with US consumer demand, and hold them at prices that imply demand will be strong. At the same time, high inflation and rising interest rates diminish the value of almost all risk assets, inflation will only come down if demand falls back in line with supply, and customers getting picky about what they buy at Target is evidence that this is finally happening.

So, do we buy Target’s story about the US consumer? Unhedged is sceptical. Fortunately/unfortunately, Target appears to be an outlier, for now. The US consumer is still robust.

Other retailers’ performances have been much better than Target’s. The obvious if imperfect comparison is Walmart, which reported earlier in the week and had a solid quarter. Like Target, Walmart made some noises about customers becoming more price sensitive and accompanying margin pressure. But Walmart put a different spin on the point. Chief executive Doug McMillon noted that “with the cost of everyday items still stubbornly high in too many categories, more customers and members are choosing us for the value and assortment we’re known for”. Furthermore, the chief financial officer added,

We’ve continued to gain grocery market share from households across income demographics, with nearly 3/4 of the share gain coming from those exceeding $100,000 in annual income. This quarter, our private brand penetration in food categories increased about 130 basis points.

Target’s median customer is richer than Walmart’s, and it sells fancier stuff, in general. So it could be that these are just harder times for Target than Walmart. But this explanation won’t quite do, as Rahul Sharma of Neev Capital argued to us. Walmart reported that US same-store sales grew at a muscular 8.2 per cent last quarter and would grow again in the fourth quarter. If the US consumer is in anything like the kind of shape the Target executives said, this just would not happen. A bit of a slowdown? Fine. Options starting to run out? Nope.

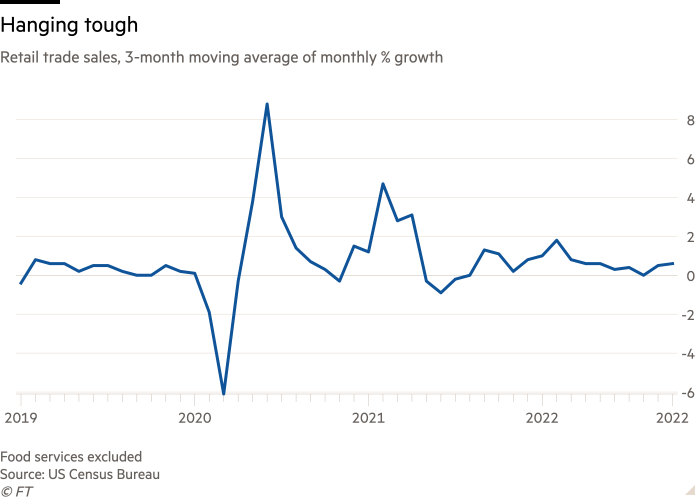

Retail sales are slower than during the post-coronavirus pandemic excitement but are within their long-term trend:

Walmart is not the only consumer brand that is doing just fine. Results at Home Depot, Lowe’s and TJX had some puts and takes, but were basically solid. Looking more broadly at corporate results, packaged food and drink companies, restaurants, airlines and hotels have been able to pass through stiff price increases without hurting volumes. Higher interest rates will sting the US consumer eventually, but it ain’t happening yet.

So what was the problem at Target? On the company’s conference call, one analyst, Simeon Ari Gutman, asked a very sharp question:

You took a lot of markdowns and some inventory was released to the market. Walmart had the same . . . Why couldn’t this environment just be off-price having a lot of inventory and the market is just stuffed and that could be part of this weakness, and it’s going to take some time for that to clear as opposed to the consumer really weakening in fundamentals?

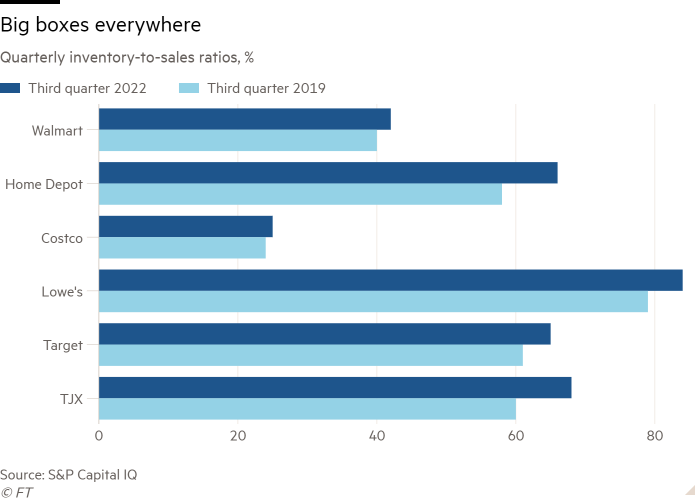

In response, a Target exec cited some not particularly convincing industry data. But most retailers bought too much of the wrong kinds of inventory during the pandemic goods-buying bonanza, and our guess is that Target is having more trouble working down the excess than its peers. Here are current and pre-pandemic inventory-to-sales ratios at the largest US retailers:

The higher inventory is tough for the retailers, but it is good news from the point of view of inflation. Discounting is what brings inventory down, and goods prices are starting to fall. Core goods prices (ex food and energy) declined 0.4 per cent in October, after averaging 0.3 per cent monthly growth throughout 2022.

Heading into this holiday season, the US consumer remains strong. We are seeing a bit of goods disinflation, partly because of bulging inventories. A Morgan Stanley survey found that 70 per cent of consumers plan to wait for holiday discounts; holiday shopping may be backloaded as a result.

Most companies have been able to handle this so far. Margin compression has been mild. Next Christmas is a trickier question. Partly because the US consumer continues to spend, the Fed cannot back off. Demand has to come down. Retailers better fix their inventory problems soon. (Armstrong & Wu)

One good read

Sam Bankman-Fried is doing just fine.

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here