COP27 host Egypt has thrown its weight firmly behind green ammonia, signing eight framework agreements to build billions of dollars of plants. The pungent compound makes for an unlikely decarbonisation hero. Yet it could play a key role in the energy system of the future. Even better, high gas prices mean that, in some use cases, green ammonia is already competitive today.

There is not a lot to love about ammonia, a toxic mix of hydrogen and nitrogen used to make fertilisers. But it is reasonably energy dense, packing quite a lot of energy into a small space. So it is a good way to turn hydrogen — which is really hard to compress — into something that one might transport over long distances via the tanks of a ship.

That makes ammonia very useful for countries that have a lot of wind and solar potential, but are far away from places they might want to sell this to. Australia, home to renewables-to-hydrogen-to-ammonia champion Fortescue Future Industries, has been an early proponent. Saudi Arabia is also keen, alongside African nations such as Namibia, Mauritania and South Africa. Egypt is ideally positioned too, with ample sun, wind and proximity to shipping through the Suez Canal.

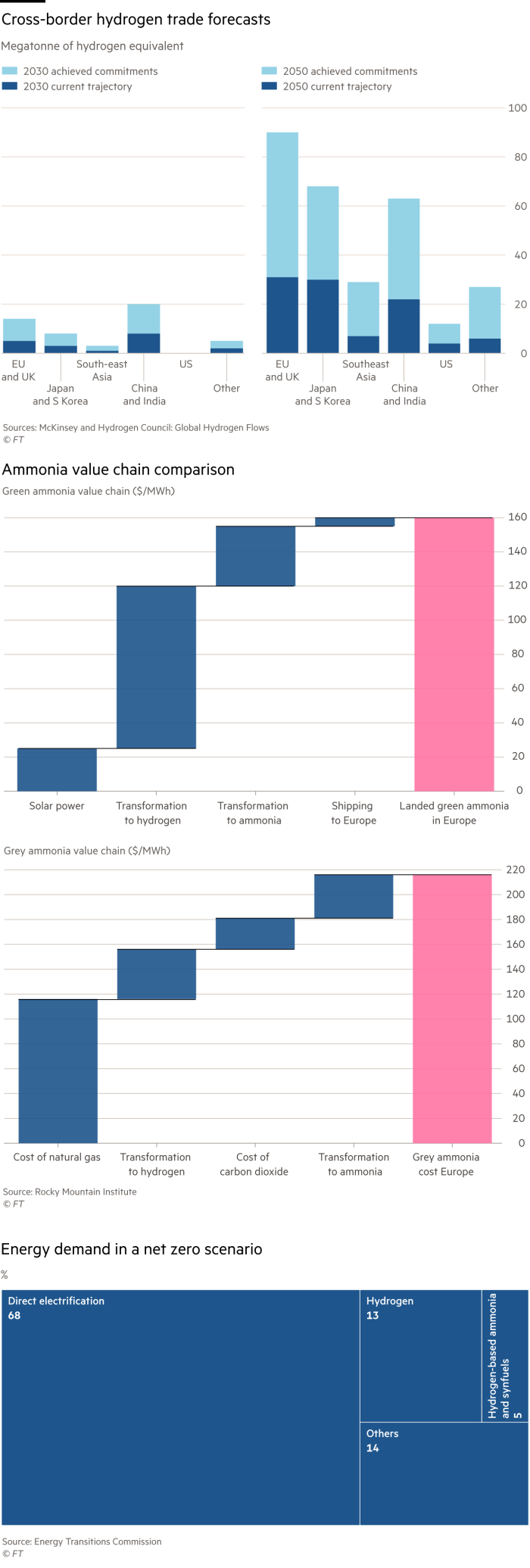

Futuristic visions will have some value. But, on paper at least, green ammonia is competitive already. High European gas prices have driven up the cost of traditional ammonia — which uses methane as a feedstock — to above $200/MWh in energy terms. That’s some four times historical levels.

No wonder 50 per cent of Europe’s total ammonia capacity was curtailed this summer, according to CRU Group. If one could make ammonia in Africa today, assuming solar costs at $25/MWh and a conservative approach to the value chain costs, one might get the compound into Europe for something like $160/MWh, suggests Thomas Koch Blank at energy non-profit RMI.

Of course, this price differential may not last. European gas prices will retreat as new supplies come online. And even at $160/MWh, ammonia would be historically pricey. Producers might reasonably shutter or move production to take advantage of lower gas prices elsewhere.

Yet the fact remains that if green ammonia were around today it would be cheaper than the fossil alternative. That highlights how the current energy crisis could boost the green transition.

If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline.