Oatly slashed its annual revenue forecasts and revealed a plan to cut its workforce after it posted a wider than expected quarterly loss, sending shares in the group tumbling.

The New York-listed oat milk group blamed the performance on a combination of factors including Covid-19 restrictions in Asia and production challenges in the US.

The company is now forecasting revenues of $700mn to $720mn, down from its earlier prediction of $800mn to $830mn, because of “inflation, rising interest rates, and the impact on consumer behaviour, as well as updated foreign currency exchange rates”, it said in a statement.

Sales for the three months to September rose by 7 per cent to $183mn, but that was $28mn short of consensus estimates. Gross profit was $5mn during the same period, down from $44.9mn a year ago, while the group recorded a net loss of $107.9mn, or 18 cents a share, wider than the loss of $41.2mn, or 7 cents a share.

Oatly’s disappointing results follow that of plant-based meat group Beyond Meat, which earlier this month reported a 22 per cent decline in sales and negative gross profit margins for the third quarter, reflecting the struggle that plant-based protein companies face as consumers rein in spending and costs rise due to high inflation.

Toni Petersson, Oatly’s chief executive, said the figures were “below our expectations”.

The company, which employed about 1,280 people in 2021, said it was targeting costs savings worth $25mn annually from the “reorganisation”, which will take effect from the first quarter of next year. It did not disclose the number of jobs that would be affected by “executing an overhead and headcount reduction”.

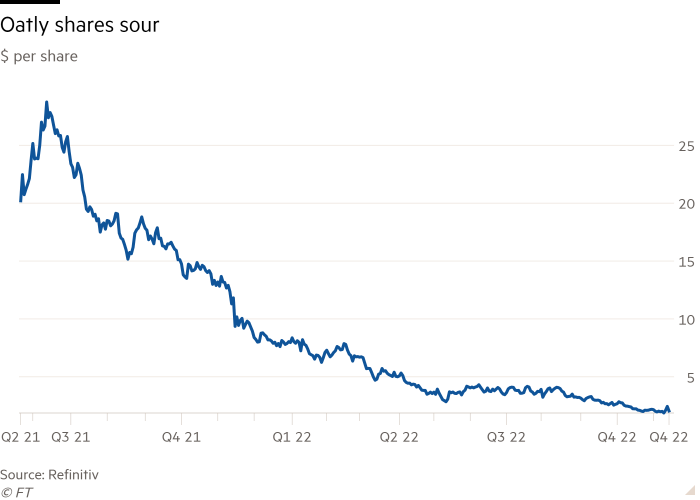

Oatly shares, which rose to a high of $29 after its initial public offering in 2021, were trading at $1.9 in early morning New York trading.

Nik Modi, analyst at RBC Capital Markets, said in a note that while several packaged food companies faced similar issues around rising ingredient costs and retail pricing pressures, Oatly’s results showed the difficulty of operating as a relatively small participant in a challenging environment.

While the fall in the shares could make them attractive to investors, in the short term the company continued to run “into various delays and challenges causing significant volatility in their quarter-to-quarter results,” Modi added.