Bond fund managers struggling through one of their worst years in decades say the tide is turning as they position to woo investors attracted by higher yields.

Nearly $480bn has flowed out of US fixed income mutual funds since the start of the year, according to the Investment Company Institute. While some money moved into exchange traded funds, the majority reflected retail investor flight during a period when bond prices fell sharply.

However, outflows have slowed significantly in the past few weeks and even started to reverse in some areas, as investors began to hope that inflation will ease and the US Federal Reserve will stop increasing interest rates. Thursday saw the sharpest rise in prices for two-year Treasury notes, which are particularly sensitive to interest rates, since October 2008.

That has raised fund managers’ hopes that investors will feel the lure of bond prices that are significantly lower than a year earlier.

“We are seeing a lot of renewed interest in our income strategies,” said Dan Ivascyn, chief investment officer at Pimco, the world’s largest bond-focused manager. “We’ve seen inflows in certain categories and a stabilisation in outflows . . . We’re seeing growth in our active funds.”

The calculation is simple. Existing bond investors lost big this year as rising interest rates drove down the value of their holdings and cast doubt on fixed income as a hedge against volatile stocks. But for new investors, these products can now offer the highest yields in years.

“The environment for fixed income investors today is dramatically different to any that we have seen for quite some time,” said Marilyn Watson, who heads a global fixed income strategy team at BlackRock. “Investors can now achieve attractive levels of income in a risk-controlled manner, particularly in front-end, high quality credit.”

Stephanie Butcher, chief investment officer at $1.3tn asset

manager Invesco, said: “The fixed income team is now as upbeat as I’ve seen them for a long time because the aggregate yields available both in investment grade and high-yield credit are the highest we’ve seen in years. Finally you’re being paid to take some risk.”

That has fund managers salivating over the prospect that both institutional and retail investors might be open to trying different managers and products as they return to the debt markets.

“Money is in motion,” said Jason Brady, chief executive of Santa Fe based Thornburg Investment Management. “There’s a big opening.”

ETFs have been growing in popularity: BlackRock has seen net inflows of $100bn into its bond ETFs this year despite the industry wide outflows. High-yield bond funds experienced net inflows of nearly $8bn in October, the most this year, according to Morningstar Direct. And those managing active portfolios hope to capitalise by promising investors higher yields with lower risk.

“Now bonds are useful again,” said Peter Van Dooijeweert, head of multi-asset solutions at Man Group.

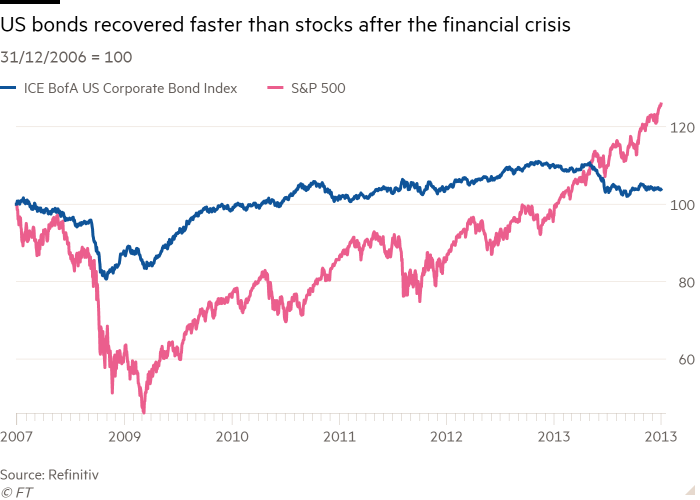

There is precedent for a rapid recovery, said Gershon Distenfeld, co-head of fixed income at AllianceBernstein: corporate bond prices rebounded faster than stocks after the 2008 financial crisis. “Asset managers are anticipating flows will come back hard into fixed income and they are jockeying for position,” he said. “Everybody’s waiting for the Fed to stop [raising rates] and people are going to pile into fixed income when it does.”

Despite the rising enthusiasm after last week’s lower than expected inflation numbers, some economists and fund managers warned that difficult times for fixed income may not be over.

“Maybe there is some light at the end of the tunnel. But this is going to depend a lot on what the Fed does,” said Sean Collins, the ICI’s chief economist. “We’ve been having these overly optimistic surges about the Fed for months now.”

Many economists are now predicting a recession, which would put strains on borrowers and increase the risk of default.

“Investors want to be cautious in the most economically sensitive areas of the market,” Pimco’s Ivascyn said. “The opportunity set is sufficiently high in the higher quality areas.”

And Thomas Digenan, who heads Investment Solutions at UBS Asset Management, cautioned that forecasters are having a difficult time figuring out what to expect: “Normally the differentials between our different scenarios are not as great as they are today — uncertainty is much higher.”

Still, Mike Gitlin, head of fixed income for Capital Group, which has seen small net inflows into its bond offerings this year, is optimistic. “I think we’ll look back and see 2022 as the year of losses and disinvestment, and 2023 as the year of opportunity and reinvestment.”

Additional reporting by Nicholas Megaw in New York and Harriet Agnew in London