Container rates provide an insight into the dog-eat-dog business that is the world’s shipping industry.

The cost of shipping a 40-foot container from one side of the world to another has soared, then collapsed. Spot rates have been multiples of contract rates and vice versa. Shipping lines and their customers have batted pricing power back and forth. Both sides have been happy to tear up agreements to wield that power.

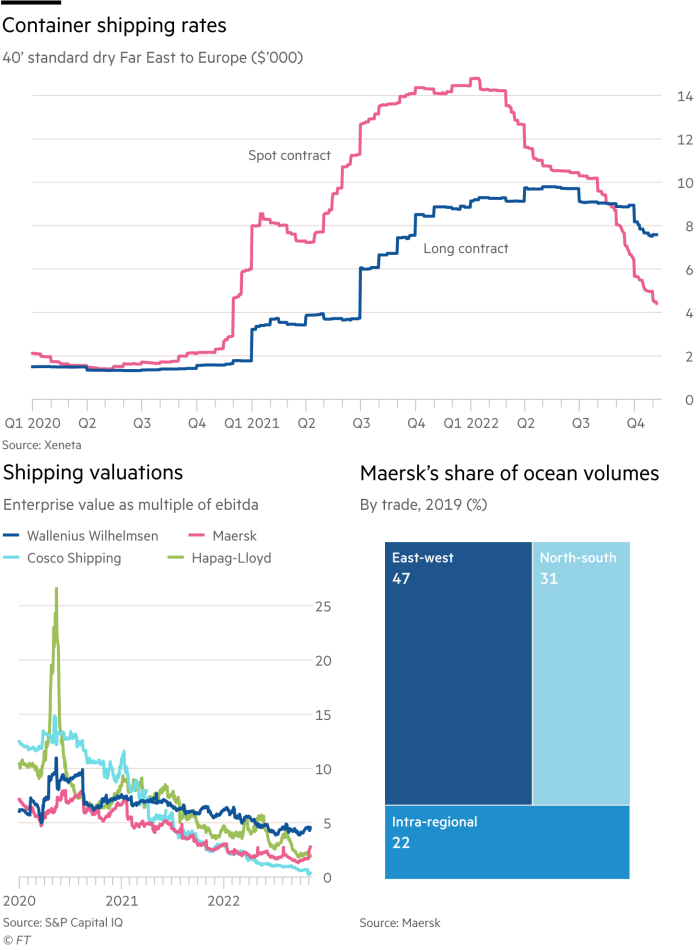

During the pandemic, spot rates jumped as the faster than expected recovery from lockdowns created bottlenecks. The average spot price to ship a container from Asia to northern Europe was less than $1,400 in May 2020, according to Xeneta, a data company. In January this year the average was more than 10 times that amount at almost $15,000.

The average for contract rates, which are agreed in advance, caught up only slowly. They peaked at slightly less than $10,000 for Asia-Europe routes in May.

Until January, shippers were chasing capacity. Even those with contracts saw it evaporate. Shipping companies pushed unlucky clients from contract to spot rates. Xeneta reports that other customers complained of premia of $3,000 to $10,000 per container, on top of contract rates.

Shipping lines were making so much money, they preferred to carry containers empty on some return routes rather than wait for cargo.

Spot rates have collapsed this year, putting the boot on the other foot. Logistics managers have demanded reductions. “Peoples’ jobs are on the line,” says Patrik Berglund, Xeneta’s chief executive.

The shipping companies will not relinquish pricing power for long. The biggest are grouped in three oligopolistic “alliances”. They have withdrawn only limited capacity in recent months as prices have fallen. More capacity will disappear soon as the world economy sputters.

At Maersk, the world’s biggest shipping line by profits, enterprise value to ebitda collapsed from a pandemic peak of more than 6 times in August 2020 to less than 1.5 times this September. The ratio is now back up to 2.8 times. It should rise further in the medium term as shipping companies regain the whip hand.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.