If investors have learnt one thing from the Ukraine War, it is that energy security merits a premium. But the premium accorded to Ithaca Energy is still less than its owners had hoped for.

The North Sea oil and gas producer is pricing its upcoming UK initial public offering at the lower end of the range on Monday. That would give it a capitalisation of up to £2.7bn ($3.1bn). Despite high oil and gas prices, the market remains down on companies that get hydrocarbons out of the ground.

Even as recessionary fears in the west grow, Brent crude remains elevated at almost $100 per barrel. The market is still grappling with lower forecast supply from Russia and OPEC.

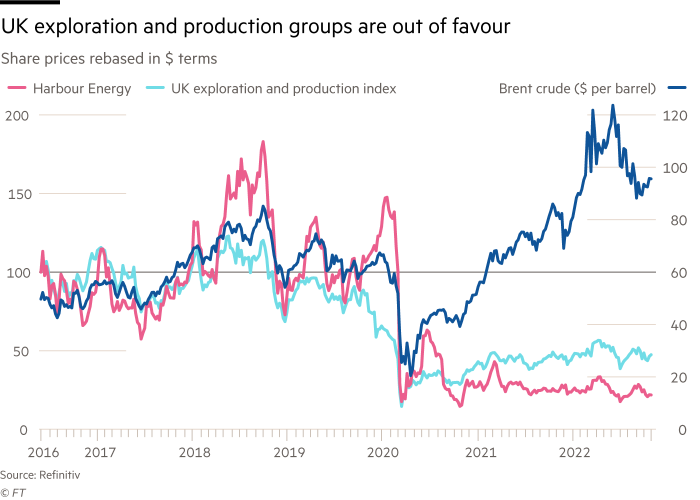

But capital markets meanwhile remain fixated on the longer-term reality that fossil fuels are on the way out. This is reflected in record low valuations for UK E&P groups which are also facing windfall taxes. The sizeable dividend promised by Ithaca was supposed to help investors look past that.

Israeli E&P Delek acquired Ithaca from the London market in 2017. It has since featured as a North Sea consolidator, acquiring Chevron’s assets there for $1.7bn in 2019. Ithaca completed a $1.5bn acquisition, including a majority in the Cambo field, with private equity groups Blackstone and Bluewater this year. Total production might hit 80,000 barrels daily of oil equivalent next year, with a target of 100,000 expected in the medium term.

Even so, on a reserves basis, its shares look fully valued. An enterprise value of $4bn equates to $16 per barrel of oil equivalent that is proven or probable. Its UK peers are a third cheaper on average. Harbour Energy, the UK’s largest explorer producing mostly gas, trades at around $11.

Ithaca does expect lucrative cash flows; dividends of $400mn are slated for next year. A yield of 14 per cent is double the current forward yield for the UK sector.

But financing remains key. Equity investors are not the only ones that have gone cold on oil and gas. Ithaca must refinance $625mn of 2026 notes to free itself of payout restrictions. With financial conditions tightening across the world, that task will make tapping oil wells look like the easy bit.