Cathie Wood has strong views on INNOVATION. Earlier this year she launched the ARK Venture Fund to invest in both public and private technology companies, “doubling down on innovation” as she told CNBC at the time.

Fundraising has been tepid, with the fund only managing $8.3mn at the end of October. Ark Invest’s Hall-of-Fame capital incineration doesn’t seem to have put off investors — the flagship ETF kept attracting masochists punters this year in spite of a 61 per cent drawdown — so it might be the 2.74 per cent management fee (!) and the 4.22 per cent overall expense ratio (!!) that’s holding back asset gathering.

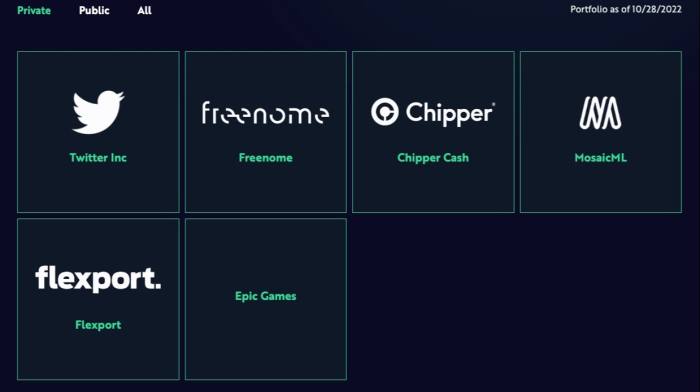

Anyway, Ark Invest remains admirably transparent about what it’s doing. The latest factsheet reveals an interesting joint-top holding (aside from cash and alongside Freenome, a private UK biotech company):

Presumably, the ARK Venture Fund picked this $1mn Twitter stake up at some point between launch on September 23 and the end of October.

Over that period Twitter went from trading at around $41 a share to over $52 on October 4, when Elon Musk finally stopped trying to sink his own takeover offer, and $53.70 on October 27, when the offer became effective. (The shares will be officially delisted from NYSE on November 8.)

Was this an arbitrage play based on Wood’s conviction that her pal Musk would eventually stop horsing around? If she bought the Twitter shares before October 4, Ark would certainly have made a nice profit on the bet.

But we’re not quite sure that M&A arb around a 16-year old Silicon Valley heavyweight is quite the “democratisation of venture capital” that Wood has promised investors.

The ARK Venture Fund’s own website now lists Twitter under its private investments, suggesting that Wood acquired the stake with a view to rolling it into the private company alongside fellow backers Prince Alwaleed bin Talal and Jack Dorsey (though their stakes dwarf that of Ark’s $1mn punt).

Wood also seems to have bought into Musk’s vision of Twitter as an “everything app”, akin to Tencent’s WeChat in China. Here, according to CNBC, is what she said at a conference in Portugal yesterday:

”Remember [Musk] started in the payments industry . . . he sold his company to PayPal,” Wood said. “He and [Twitter co-founder] Jack Dorsey working together, I think, could turn this into a super app.”

Still, we’re not sure either that getting involved in a mammoth leveraged buyout falls under democratising venture capital. Or maybe Twitter introducing a $8-a-month blue tick counts as “doubling down on innovation”?