And now for a quick break in your normal Fed-and-jobs-week programming . . .

It’s very good news that Ukraine’s grain shipments are resuming, because the US midwest is grappling with a drought. That has made parts of the Mississippi River too shallow for the normal pace of barge traffic transporting grain from the Illinois breadbasket to the Gulf Coast for export.

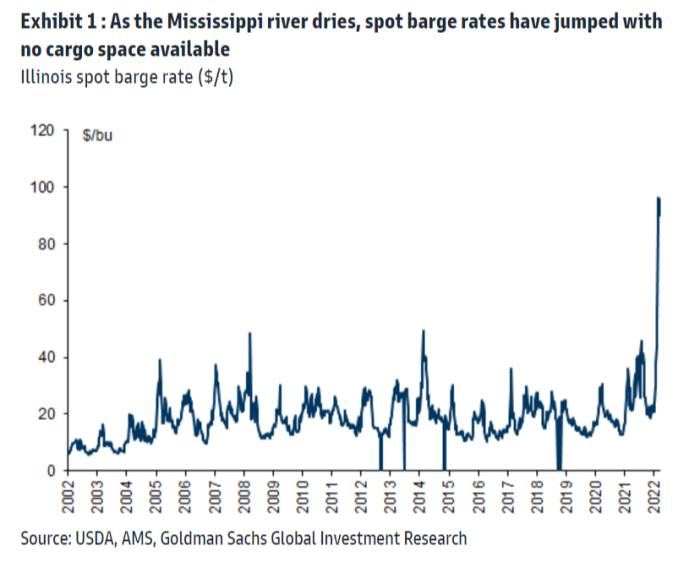

Spot rates for river barges have soared to the highest level in decades, according to a note from Goldman Sachs:

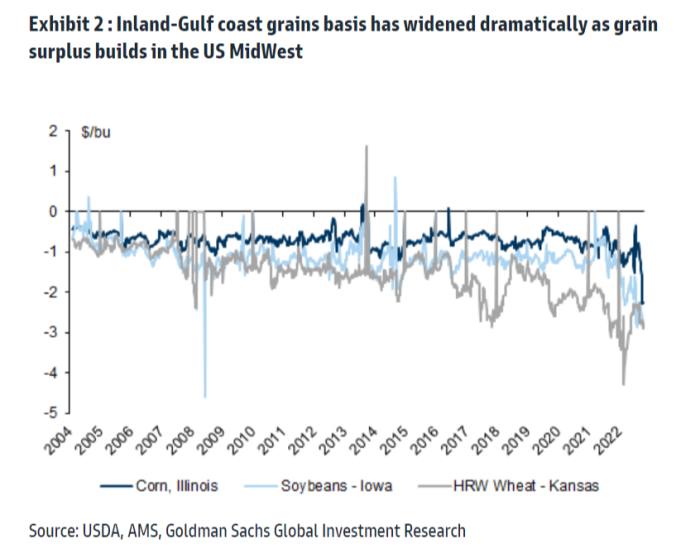

And the prices of grain crops (corn, soyabeans and wheat) are relatively low inland compared to the gulf coast:

This is one of a couple of events that have unexpectedly added friction to the export of certain US commodities this year.

Goldman Sachs argues that the drought probably won’t have a lasting impact on global demand for US grains. First, global demand for grains (other than soyabeans) has also fallen this year, so buyers won’t be forced to seek out new sources. Second, the drought has also affected the supply of grains, so the back-up on the Mississippi isn’t comparable to the containership jams that have periodically occurred outside of major US ports this year.

None of this seems like especially good news for global food prices! But at least the Midwest can get their bread hard winter wheat for cheap, as shown in the chart above.

Unfortunately, the Mississippi River drought also could slow exports of another important commodity that makes its way down to the Gulf Coast from Illinois: thermal coal. Illinois’ thermal coal exports are mostly used in Europe for heating.

This constitutes 0.6% of total seaborne coal exports, and is expected to have limited impact. The European benchmark for thermal coal, API2, actually sold off by $19 last week at $239/t, as European storage remains at healthy levels. This dynamic can also be observed in the still wide open $140 spread between API2 and Newcastle coal prices . . . Should the disruptions be sustained, there could be a marginal rerouting to the domestic market, but it remains too early to observe it. The domestic market should also stay mostly unaffected, as only 2 power plants were receiving coal by barges, and both have rail delivery alternatives available.

Luckily European coal stores haven’t been drawn down much yet, thanks to an unusually warm autumn. But we are left hoping that the Midwest gets its much-needed rain before the euro zone starts to get colder.