European companies face a dilemma over their hybrid bonds, as sky-high interest rates make businesses wary of dipping back into the €175mn market.

Borrowers are expected to repay about €11bn in these instruments — which are considered part equity and part debt by rating agencies — in the coming six months. Typically they would do just that — handing money back to investors in a process known as calling, and then borrowing fresh funds to replace it.

In theory, companies can just leave the debt in investors’ hands. This option has rarely been used by companies, because they hope to keep debt investors on side.

Companies that decide not to call a hybrid would “certainly annoy investors . . . and put pressure on the ability of that credit to come back into the hybrid market in the future”, said James Vokins, an investment grade portfolio manager at Aviva Investors.

But in a new era of sky-high interest rates, borrowers may want to avoid issuing new hybrids to avoid paying hefty yields.

Hybrids allow businesses to raise cash without damaging their credit rating or diluting shareholders’ stakes in businesses. Their flexible nature also means they offer higher yields than normal credit, which is attractive to investors.

They have routinely been used by large utilities and telecoms groups to bolster their balance sheets without weakening their credit rating. But they have become popular among other companies, including in the real estate sector, as low interest rates have encouraged companies to borrow.

Volkswagen and EDF have led the way, with more than €15bn and €13bn in hybrids outstanding each, according to calculations by a European bank.

Companies issued hybrids at low yields in recent years but they will struggle to price new hybrids at this level, now that higher interest rates have made the cost of borrowing more expensive.

For this reason, “the correct economic decision will be not to roll them over [rather than recall them and issue fresh hybrids]”, said Gordon Shannon, a portfolio manager at TwentyFour Asset Management.

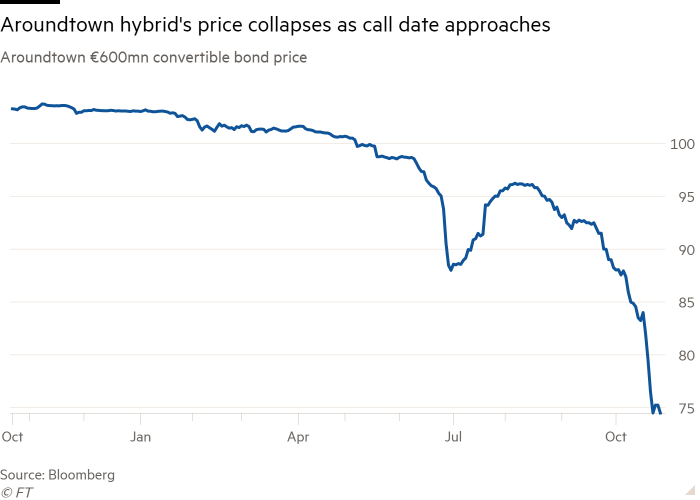

The prospect of taking a hit on hybrids is particularly worrying for companies that are vulnerable to the economic downturn, such as real estate groups. Hybrids at risk of not being called have traded well below face value in recent months.

Decision time for issuers

Aroundtown, a Luxembourg-based real estate business, is being closely watched by investors as its hybrid matures in January.

Oschrie Massatschi, its chief capital markets officer, recently told investors that Aroundtown was “still observing the market situation before taking a decision on the treatment of our January hybrids”, indicating that the high borrowing costs of calling its hybrids would weigh on the company’s decision.

But market watchers expect many large borrowers to call their hybrids to keep their investor base on side. Earlier this month, Spanish utilities group Naturgy announced it would call its €1bn hybrid, due on November 22.

The price of the instrument had fallen to 97.55 cents before the update but shot back to face value after the news, offering reassurance to investors who had closely watched the company.

Energy companies that have benefited from high oil prices and Volkswagen, flush with cash from the initial public listing of Porsche, could also choose to buy back their hybrids without reissuing. French utilities group Engie said on October 12 that it would buy back a tenth of its hybrid bonds.

Investors will watch businesses with outstanding hybrids closely because there is a risk of a “knock-on effect”, where one company or several companies deciding not to call hybrids could pave the way for others to follow suit, said Aviva’s Vokins.

This would leave investors nursing losses and stuck with an unwanted asset.

Alberto Gallo, co-founder of Andromeda Capital Management, said “many bond structures” are negative for investors at present. “Low-coupon hybrids and [convertible bank bonds] sold over the past few years are the worst, potentially leaving investors with [an asset] yielding below inflation,” he added.