Former Volkswagen chief Herbert Diess was once asked privately which carmaker he feared most.

Instead of Tesla, the Californian pioneer of electric cars, or one of his traditional rivals in Europe or the US, he chose BYD — a Chinese carmaker, little known among western consumers.

The Warren Buffett-backed group is one of nearly a dozen Chinese brands preparing to use electric cars to storm Europe’s market.

Their ascendance, said industry leaders and analysts, will reshape the continent’s automotive landscape over the next decade.

“The market is wide open to the Chinese,” said Stellantis chief executive Carlos Tavares, in a warning to established carmakers in Europe.

He was speaking last week at the Paris Motor Show, where BYD and Great Wall each erected large stands directly opposite the exhibition’s French stalwarts Renault and Peugeot.

Great Wall’s Ora brand aims to break into the bottom of the market with its £30,000 Ora Funky Cat model and the premium sector with its Wey nameplate.

BYD prices its cars at the same level as VW’s battery models, but says its range of services on its three new vehicles will set it apart.

The company also makes everything in its vehicles except the tyres and glass, preventing it from falling into the same supply chain trap that has snared most other manufacturers.

“In order to be a global player, we have to win in terms of our quantity,” Great Wall’s European president Meng Xiangjun told the Financial Times. “The priority for us now is to enter the European market.”

BYD’s Michael Shu, who leads its European rollout, said the company has not set sales targets, but focuses exclusively on customer satisfaction.

“We believe that is the core to help the business for us,” he said.

“It doesn’t matter about the politics, doesn’t matter there is a lot of competition, doesn’t matter there is the earthquake from the energy prices going up. We focus on customer satisfaction, that is our major focus.”

Michael Dunne, a former General Motors executive in China who runs the ZoZoGo consultancy, said: “To triumph, they must win trust on two fronts: Customers unfamiliar with their brands. And political leaders wary of China’s master plans.”

Shanghai’s SAIC has swerved the brand issue by buying MG, which is already the top selling electric brand from a Chinese company in the region.

But the political hurdle will be harder to clear.

Stellantis’s Tavares warned that the new Chinese companies, some of which are backed by the state, will sell their vehicles at a loss in order to undercut European brands and grow market share.

“We don’t want to have Chinese neighbours that sell at a loss in Europe, and then put the automotive industry on their knees,” he said, calling for the EU to impose tariffs on cars imported from China.

Nio chief executive William Li said he was not concerned by political opposition, pointing out that many US car buyers opted for Japanese brands during the height of a trade war in the 1980s.

The company will focus “on user interests” that will outweigh “any potential trend against the brands for China”, he told the FT.

Europe is no stranger to the breakthrough of Asian brands, having witnessed the arrival of Japan’s Toyota, Nissan and Honda in the 1990s, and then Korean labels Hyundai and Kia since 2000.

For years, China’s own carmakers were confined to their home market, and even there struggled to compete with western or Japanese brands with petrol engine models.

But the advent of electric vehicles has given the brands their first shot at dominance — not just in their own market, but finally on the international stage.

“Chinese carmakers, once having been the butt of all automotive jokes following failed crash tests and poor quality standards, now feel confident enough to give it another shot with a fully-charged line-up,” said Matthias Schmidt, an independent car analyst. “The class of 2022 is almost unrecognisable from those models arriving 15 years ago.”

He also forecasts that traditional carmakers will limit electric sales before 2025, when CO₂ targets in the region tighten, in order to eke out as many higher margin petrol or diesel sales as possible.

This, he said, presents an opportunity for the Chinese brands.

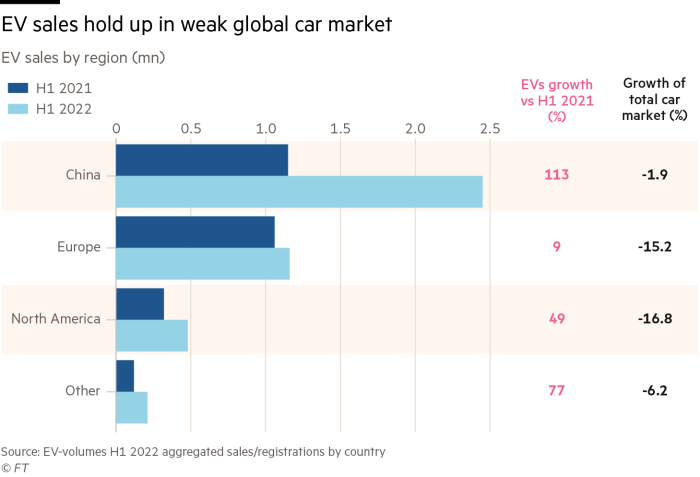

Already, with little fanfare, China’s carmakers have built a toehold in the European market.

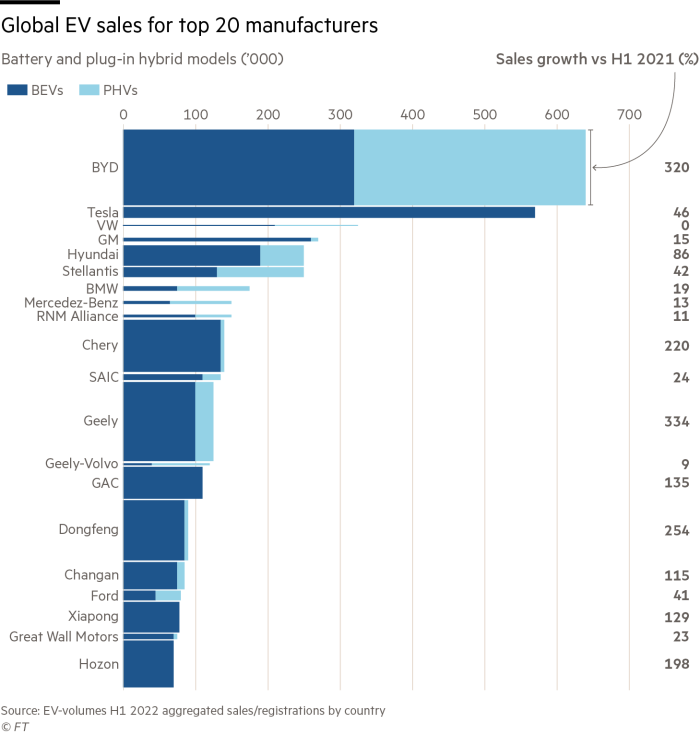

One in 20 electric vehicles sold in the region in the first six months of 2022 were Chinese owned brands, led by SAIC’s MG, and Polestar, backed by Geely.

But this is just the start.

BYD will begin selling its three new models before the end of the year, premium brand Nio has recently announced its plans to sell outside European EV outlier Norway, and Aiways, a mass-market brand backed by Jiangling Motors, claims to have orders for 10,000 vehicles.

Transport and Environment, a green lobby group, expects the Chinese share of Europe’s fast-growing battery car market to grow to one in six cars by the middle of the decade.

“If Europe wants to maintain the competitiveness of its car industry, the EU must introduce a strong industrial policy of its own to match the Chinese and Americans’ muscular support for EVs,” said Julia Poliscanova, director at the agency.

A wave of factories are likely to follow sales, as was the case with both the Japanese and then Koreans, as they establish production closer to their customers.

BYD is already in talks with several countries, including the UK, according to two people, about setting up a factory making both batteries and vehicles. The company will decide how many plants it needs based on its sales, Shu said, while declining to comment on its possible locations.

Nio, which launched in Germany, Denmark, Sweden and the Netherlands and will enter the UK next year, expects to build a site once it passes 200,000 sales, said Li.

Great Wall is preparing to build the next version of the electric Mini through a joint venture with BMW in China. The company is also looking to secure a European site in time.

Henrik Fisker, a former BMW and Aston Martin executive who runs the start-up electric vehicle company Fisker, said eventually the quality of the products will win over new customers.

“I think the ones that are under the most threat are probably the mass-market brands in Europe” he said, while sitting in the new Fisker Ocean manufactured by Magna Steyr in Austria.

“Quite frankly, I think, yeah, some of [the Chinese EVs] are pretty nice electric cars.”

European carmakers face rough road in China

China’s car industry leads the world in sales of electric vehicles, leaving foreign companies at risk of being left behind.

“Among the top 15 EV producers in China, only four can be considered to have foreign ownership,” according to a new report by Berlin-based think-tank Merics. “In 2021, BMW and Mercedes-Benz had market shares of less than 0.3 per cent in China’s EV market, having sold fewer than 10,000 units each in a market of 3.3mn units.”

Volkswagen fared better but still had only a 3.7 per cent share of the EV market, compared with 11.3 per cent of the overall market, it added.

The German carmakers have deepened their investment in China to try to catch up with local rivals. In June this year, BMW opened its fourth factory in the country, while Audi’s new joint venture with FAW broke ground on a plant in Changchun, a city in the north-east, this year.

China is also one of the largest profit pools for the German car groups, which makes them reluctant to comment publicly on the nation.

Only Carlos Tavares, the Stellantis boss whose brands include Germany’s Opel, has warned about the need to cut reliance on China as a market. His company, which has struggled there, recently pulled out of its Jeep factory in China, and is considering closing its Peugeot and Citroën plants in the country as well, he told an audience at the Paris Motor Show last week.

James Kynge and Peter Campbell

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here