Is the party over for Cognac maker Rémy Cointreau? Its shares are down by a quarter this year, after falling 6 per cent on Tuesday. That was after the French premium drinks maker said consumption trends would return to normal in the second half, on the heels of two “outstanding” years.

So far, demand for the strong stuff has held up remarkably well. Organic sales rose by a fifth in the first six months, on top of an increase of more than a half for the same period in the previous year. But lower demand is inevitable. The pandemic boost was driven by stuck-at-home consumers with limited spending opportunities.

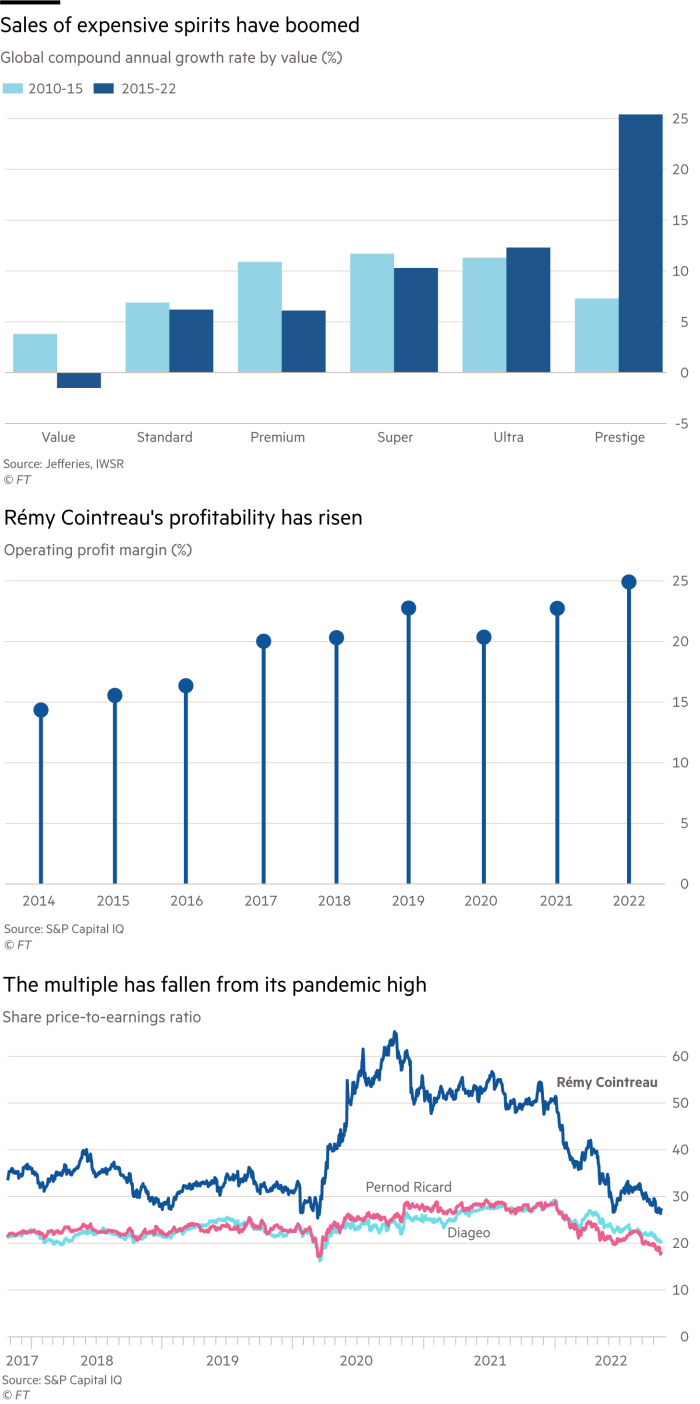

Now leisure opportunities abound and the economic outlook is deteriorating. But that cyclical phenomenon overlays a secular trend for a growing demographic of better-off people with money to spend on fancy drinks. Rémy Cointreau may be able to contain damage from the first shift by exploiting the second.

Sales were hard hit in the global financial crisis, dipping 13 per cent in 2009. Rémy Cointreau dismisses talk of a big decline this time. It thinks sales will settle at a “new normal” levels well above pre-pandemic levels. Its marketing machine is focused on five top global brands. Higher-priced spirits proved more resilient in the financial crisis than cheaper brands.

Boss Eric Vallat reckons the company is on course to push up operating profit margins by nearly a third to 33 per cent by 2030. Input cost inflation is not a big threat, with gross margins close to 70 per cent. Its rising profitability helps explain why the shares trade on a price/earnings ratio that is more than a third higher than peers Pernod Ricard and Diageo.

As the maker of brands such as Louis XIII, which can sell for up to $30,000 a bottle, Rémy Cointreau has something in common with luxury goods makers. As strong results from handbag maker Hermès exemplified last week, wealthy shoppers are still splashing the cash. That cachet should help fortify Rémy Cointreau against the downturn.

If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline.