Gilts and sterling rallied on Monday following Boris Johnson’s exit from the race to become the UK’s next prime minister, as investors bet that his rivals were more likely to stick with the economic policies that have calmed markets in recent days.

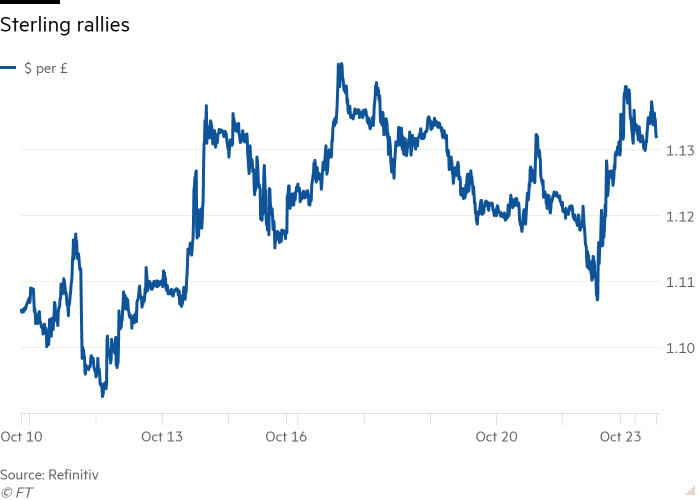

The 10-year gilt yield sank 0.24 percentage points to trade at 3.81 per cent early on Monday, reflecting a sizeable price rise. The pound climbed by as much as 0.9 per cent against the dollar in early trading before trimming its gains to trade 0.4 per cent higher at $1.1350.

The departure of Johnson from the Conservative party leadership contest brought relief to markets that had wobbled on Friday at the prospect of the former prime minister’s return to Downing Street. Rishi Sunak, the favourite to succeed outgoing prime minister Liz Truss, is seen by investors as far more likely to back the fiscal plans of the new chancellor Jeremy Hunt, which helped to restore order to the gilt market.

“Rishi Sunak stands a much better chance of bringing stability to government,” said Derek Halpenny, head of research for global markets at MUFG. “He will not have a privileges committee investigation into lying to parliament that Boris Johnson has and will command credibility from financial markets given his strong opposition to the economic policies of Liz Truss.”

Ten-year yields remain above levels of roughly 3.5 per cent seen prior to Truss’s ill-fated “mini” Budget last month, which sent gilts and sterling into a nosedive, triggering a liquidity crisis at pension funds and prompting the Bank of England to step in with an emergency bond-buying programme.

Investors had also bet that the BoE would be forced to raise interest rates rapidly to prop up a falling pound and offset the inflationary effects of £45bn of unfunded tax cuts.

Interest rate expectations had begun to fall back down following Hunt’s announcement last week that he would scrap most of Truss’s tax-cutting measures.

They moderated further on Monday. Traders expect BoE interest rates to rise to 5 per cent by next summer, compared with 5.25 per cent last week.

The move comes after Ben Broadbent, the Bank of England’s deputy governor for monetary policy, last week cast doubt on market expectations that rates would need to rise to more than 5 per cent to bring down inflation.

Two-year gilt yields, which are highly sensitive to rate expectations, fell 0.22 percentage points to 3.40 per cent.