This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. We will know a lot more about the state of the corporate world and indeed the economy by the end of this week. Everyone from Big Tech to chipmakers to staples companies to homebuilders is set to report results. Unhedged is optimistic. You? [email protected].

US stocks are not just a Fed story

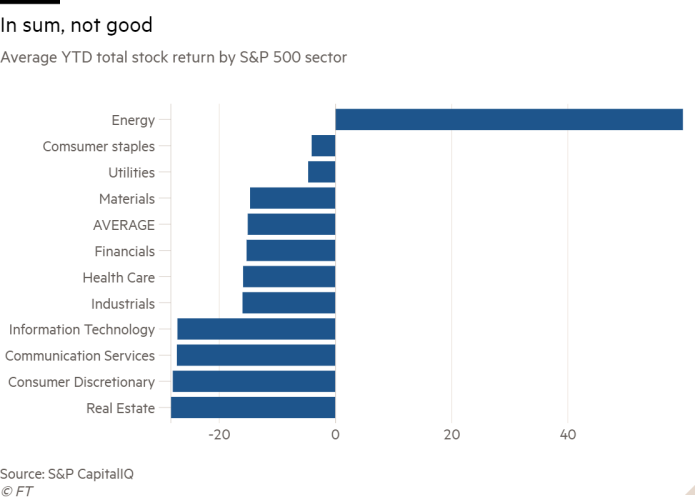

It’s been painful to own stocks in 2022, but what kind of stocks one owns has mattered. We all know the three basic themes of the year: energy good, defensive good, speculative tech bad. But a more granular look is useful, if we want to think about what might work well for the rest of the year and into 2023. The most powerful determining factors may be inflation, Fed policy and GDP growth, but that is not the whole story.

Here is the average performance of stocks in the S&P 500’s ten sectors (note this is not capitalisation weighted; each stock in the index contributes the same amount to these averages; I’m trying to get at what has worked and not from the point of view of individual stock selections).

As you can see, there have been four basic performance buckets that the sectors fall into: very good performance (energy); slightly bad performance (staples, utilities, materials); bad performance (materials, financials, healthcare, industrials); and very bad performance (tech, communications, discretionary, real estate). Below, some distinctions and tough questions for each sector.

Energy

-

Key distinction: it has been hard to pick a loser in the energy sector this year. For the past 12 months, the average revenue growth for the 23 energy companies in the S&P is 89 per cent. But don’t be fooled by the apparently low valuations of energy companies when commodity prices are high. The single-digit price/earnings ratios of big energy companies from ConocoPhillips to Valero tell you more about (unsustainably?) high earnings than low stock prices.

-

Hard question: The downside scenario is a positive supply shock (some sort of settlement in the the Ukraine war, say) and a simultaneous demand-killing recession. Most US energy stocks are 50 per cent or more above their pre-pandemic, pre-invasions levels. How much of that must they give back in a reversion to the geopolitical mean?

Staples

-

Key distinction. The outperformance of staples stocks has not been spread evenly, even among defensive names. While companies like Hershey, Campbell Soup and Kellogg have had monster years, there are companies with solid growth historically, such as Constellation Brands, Tyson and Church & Dwight, that have sold off with the market. Staples as a group look peaky and expensive, but it still looks possible to bargain hunt.

Utilities

-

Hard question. Utilities are safe. People will keep using power, water and the like. But they are also, traditionally, bond substitutes. The average dividend yield among S&P 500 utilities is 3.5 per cent, according to CapitalIQ. A riskless five-year Treasury is paying 85 basis points more than that. Which do you like better?

Materials

-

Key distinction. S&P materials stocks have not done nearly as well as averages would suggest. Only six of the 27 stocks in the group have positive returns. Four of there are agriculture chemical stocks (CF, Mosaic, Corteva, FMC) and one produces lithium for electric cars (Albemarle). The rest of the group have all acted like pure cyclicals, which most of them are. Buying the materials sector is timing the global recovery and/or the China reopening.

Financials

-

Hard question. This group’s performance would look a lot worse were it not for insurers, which have done well of late. Banks have been beat up. Bank investors have prayed for years that interest rates would rise and take lending margins with them. That’s happened, but recession fears have come along to ruin the party: banks are not just rate sensitive but growth sensitive as well. The great hope? If we do have a recession and no major banks blow themselves up, the banks’ valuations may revert from their current lowly state (single-digit PEs, 1.5ish times book value or less) towards their pre-financial crisis levels. Can investors trust banks again?

Healthcare

-

Key distinction. This is not really one sector, but two. Big-cap, defensive healthcare from distributors (McKesson, Cardinal) to pharma (Merck, Lilly) have done well. Anything that is either speculative scientifically, a growth story, or depends on discretionary spending by consumers or providers has been whacked (Illumina, Intuitive Surgical). Maybe a third of big healthcare stocks trade like staples, another third like tech. Both will follow the inflation/Fed/growth story. Between those two is a place for stock pickers.

Industrials

-

Hard question. It is only a slight exaggeration to say that only one kind of company in the S&P 500 industrials has worked this year: defence companies. Northrop Grumman, Huntington Ingalls, Lockheed Martin, General Dynamics, and L3 Harris have risen 37, 36, 31, 19, and 18 per cent, respectively. Here is a nice macro trade that doesn’t boil down, as many do, to a bet on inflation: do you think global tensions will get worse from here? If so, owning these stocks will keep making sense.

Info tech

-

Hard question. The two best performing S&P tech stocks this year? Jack Henry, which helps banks process payments, and IBM, which is IBM. Boring has been good. But an interesting question now is when formerly high-flying software companies like Salesforce, ServiceNow, Adobe and Intuit become attractive. They have fallen well more than the market, their price/earnings ratios have been cut in half, and they all have a history of 20 per cent(ish) annual revenue growth. At some point cheap is cheap enough. Is it when the Fed pauses? I’m not sure, because I don’t buy the identification of growth stocks and duration risk.

Communication services

-

Key distinction. This is effectively the internet, entertainment and telecoms group. The first two categories are beat up almost across the board, leaving investors with a tricky job. Which business models have really run out of gas, growth-wise, and which have simply tarred with the same bush as those busted stories? Unhedged thinks that Netflix and Facebook (sorry, Meta) and Match are in the former category, and Disney and Alphabet have tons of juice left in the tank to go with newly attractive valuations.

Consumer discretionary

-

Key distinction. The macroeconomic data tells us that demand for goods is falling, while demand for services is still booming. That’s how you split up this group. Whirlpool? In trouble until the recovery is in view. Home Depot and the homebuilders? Ditto. Restaurants like McDonald’s, Yum and Starbucks are less of a straight bet on the economy, but unfortunately they look expensive.

Real estate

-

Hard question. The most interesting stock in this group, which has been savaged by higher rates, is Boston Properties, which has been savaged by working from home, too. It is the biggest of the office REITS, and is down by half since the pandemic hit. Because of long-term lease agreements, the office building value car-crash is playing out in slow motion. Boston Property’s occupancy rate was 89 per cent in the second quarter. It operates in big, prosperous cities with big name clients. But Unhedged’s utterly unscientific guess is that downtown office buildings are maybe a third below full occupancy at present, and won’t recover. Given that — is falling by half enough?

The stock market, looked at from a mile high, looks like a casino in which we gamble on the future of inflation and monetary policy. Looked at close up, it’s a subtler game.

One good watch

Anyone who does not yet understand what an economic disaster Brexit has been for the UK should watch Daniel Garrahan’s outstanding if heartbreaking FT film on the topic. British politics will not get out of the mess it is in now until the “conspiracy of silence” around the Brexit mess is broken.

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here