Anyone fooled twice proverbially must accept some blame. Investors trapped in illiquid British property funds should then expect little sympathy. Gates that descended during the financial crisis and post the Brexit vote slammed shut again during the recent pensions debacle. Locked-in shareholders, including pensions, must await liquidations to get their money back.

As forced sellers abound, fears of a commercial property fire sale are rising, the FT reported on Tuesday.

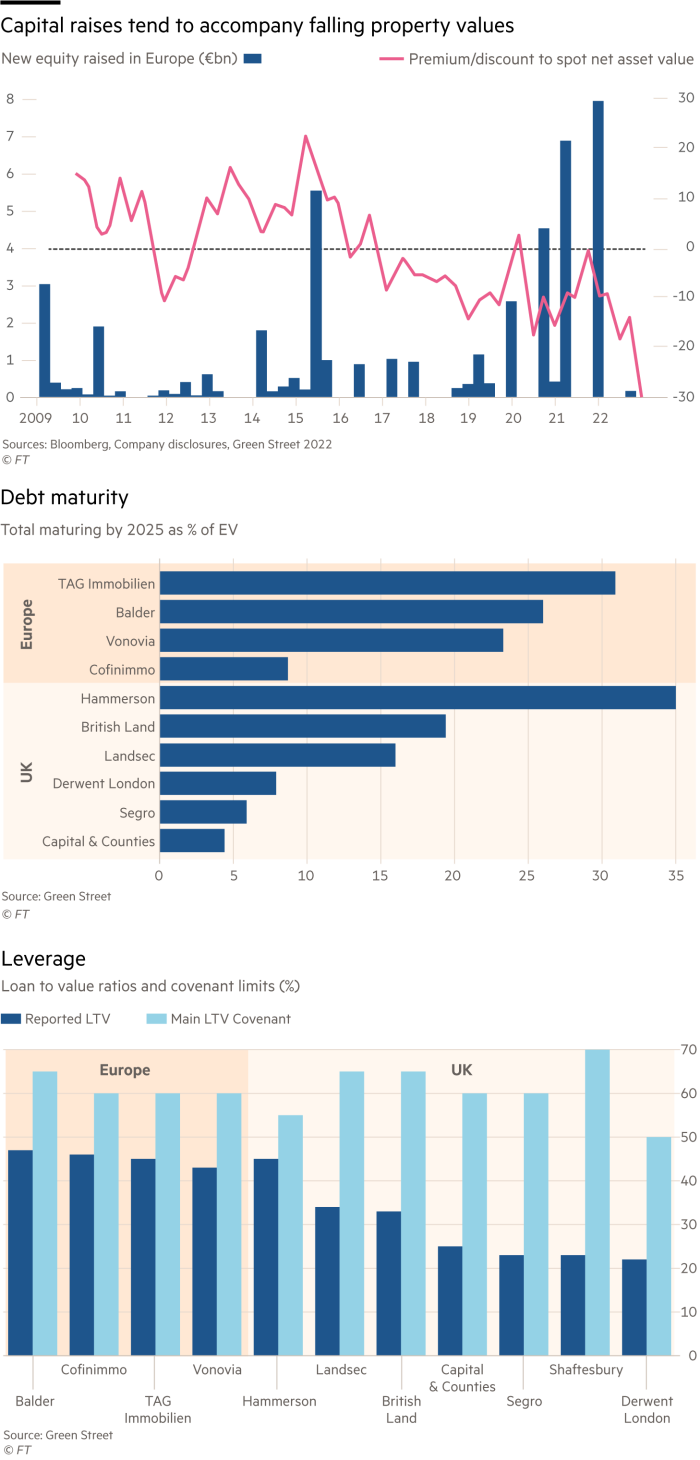

Property valuations already compressed by rising borrowing costs should suffer further. Public markets have reflected this pessimism. Real estate share prices have dropped about 40 per cent since the start of the year. Steep discounts to reported net asset values signal the risk that shareholders will need to open their purses to provide support.

Any immediate risk to UK investors had seemed to diminish. Lockdowns forced many of the most distressed borrowers to raise capital, admittedly with debt, during the pandemic. Average loan-to-value ratios in the UK are only 28 per cent, about 10 percentage points lower than European peers.

Overall UK landlords have reasonably conservative balance sheets with debts equal to 11 per cent of enterprise value maturing to 2025. On the continent the proportion is double that.

More worrisome is a capital shortfall for those developers with approaching debt maturities, thinks Peter Papadakos of Green Street Research. As rates rise, lenders are tightening financial conditions. LTV covenants for new borrowing has fallen from around 50 and 60 per cent to the 40s.

Meanwhile, lending rates have doubled to around 7 per cent today. Stagnating rent income will erode interest cover ratios. New equity might then be needed to patch over any financing gaps. London-listed shopping mall operator Hammerson has some of the largest exposure with debts worth almost £1bn, nearly 35 per cent of its EV, maturing by the end of 2025, according to Bloomberg. Plans that rely on further asset sales next year will be tested.

Never mind the blame game, short term pessimism in the sector is duly warranted.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here.