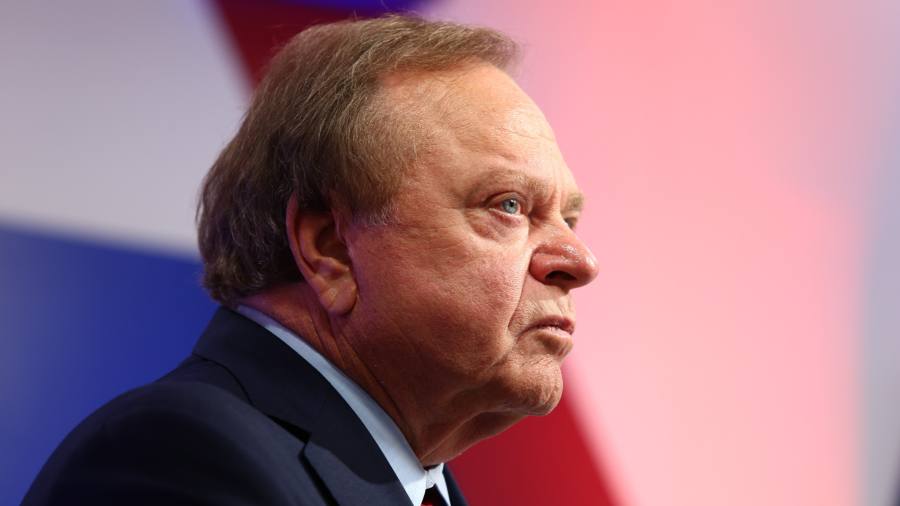

Shale billionaire Harold Hamm has reached a deal to buy Continental Resources in its entirety, valuing the equity of the US oil producer he founded at about $27bn.

The move to fully privatise Continental marks an effort by one of the most influential figures in the US energy industry to break free of pressures from Wall Street and begin pumping more oil.

“We have all felt the limits of being publicly held over the last few years, and in such a time as this, when the world desperately needs what we produce, I have never been more optimistic,” Hamm said in a note to staff.

The shale tycoon said privatisation would give the company “freedom to explore” for more oil and grow “as we do our part to help secure America’s energy independence without any encumbrances”.

The transaction would give Hamm and his family full ownership of Continental, which he founded in 1967 and took public in 2007 as the Oklahoma City-based company emerged at the forefront of the US shale energy revolution.

Continental is the largest oil producer in the Bakken shale fields in the US states of North Dakota and Montana and in the past year has expanded into Wyoming and the Permian Basin of Texas and New Mexico.

Hamm agreed to pay $74.28 a share in cash to buy the 17 per cent of Continental that his family does not already own. The $4.3bn offer announced on Monday represents a 13 per cent premium on Continental’s closing price in mid-June, before he made a first bid for the company at $70 a share. Continental shares were up 8.5 per cent to about $74 a share at midday in New York.

However, the transaction will be entirely financed with Continental’s existing cash on its balance sheet and debt, which means Hamm will not be spending any additional money of his own.

The deal was approved by Continental’s board but drew immediate opposition from a leading shareholder who said Hamm’s new price was tantamount to “stealing” the company’s assets.

Cole Smead, president of Smead Capital Management, Continental’s biggest shareholder after the Hamm family, told the Financial Times the new offer still undervalued the assets and said the board’s approval looked like a “backdoor deal”.

“It’s like playing an away game in basketball in a small town in the middle of nowhere,” Smead said. “None of the calls are going your way because the refs aren’t on your side. Where I come from, we call these ‘homers’. I assume they call them the same in Oklahoma.”

Hit hard by collapsing oil demand in the early days of the coronavirus crisis in 2020, Continental’s fortunes have since soared as energy consumption has recovered and crude prices have gained since Russia’s invasion of Ukraine. In June, Hamm said it was in the best interests of Continental to be delisted.

Analysts said Hamm’s expansion and take-private move also reflected his view that oil demand would keep rising despite mounting environmental concerns and investor scepticism about fossil fuels’ longevity.

“Hamm is just acting on his conviction that the energy transition is going to be slow and oil shortages from war and politics don’t align with Wall Street’s desire for shale producers to keep holding back,” said Andrew Gillick, strategist at consultancy Enverus.