Not one single new apartment was sold last week at a marquee 800-flat project in Hong Kong in a sign of the sagging real estate market that is forcing some of the city’s tycoons to do property fire sales.

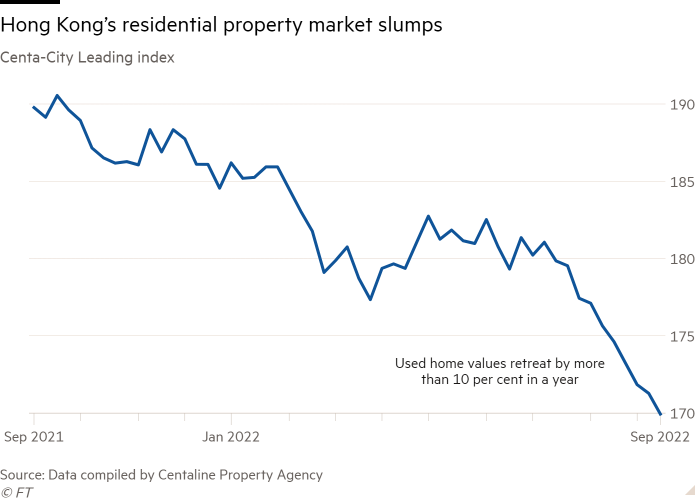

Private home prices plummeted to the lowest level since February 2019, according to the latest government data. The value for resale flats fell more than 10 per cent in a year, according to Hong Kong property agency Centaline.

Analysts and insiders are expecting home prices to drop 10 per cent or more this year, despite the Chinese territory finally scrapping tough mandatory hotel quarantine requirements last month.

“Now is definitely winter for the property market,” said Sammy Po, chief executive of Hong Kong-based Midland Realty’s residential division. “Prospective buyers prefer a wait-and-see attitude.”

Po said that in the latest batch of 139 new apartments put on offer at residential project South Land, developed by Hong Kong-listed MTR Corporation and Road King Infrastructure, not one flat has been sold since the latest round of sales began on September 20. The project has a total 800 apartments.

Even incentives such as HK$12,000-worth of coupons at Michelin-starred restaurants for each of the first five buyers were unable to generate interest. In contrast, its previous round of sales last year saw strong demand with more than 2,200 people vying for 160 flats.

At Miami Quay, an ambitious real estate project in a redeveloped urban area in Kowloon — jointly built by some of the most powerful Hong Kong family-owned property conglomerates including Henderson Land Development and New World Development — property agents said only two out of 139 units were sold on the first day of sale last month.

Pandemic restrictions under the zero-Covid strategy have made travelling to Hong Kong difficult for mainland Chinese investors, while Beijing’s imposition of a national security law has led to an exodus of residents. Interest rate rises coupled with a weak economy in the territory have further hit sentiment.

Charles Chan, Hong Kong-based managing director of valuation and professional services at real estate agency Savills, forecast an up to 15 per cent drop in home prices this year, which he said would be the worst performance since the Sars epidemic hit the city in 2003. The downward trend could extend into next year, Chan added.

Citigroup analysts said Singapore’s private residential market was expected to see a rise of another 5 per cent in 2022, to a total gain of 9 per cent this year. The city state and rival hub of Hong Kong had eased Covid-19 measures much earlier than the Chinese territory.

Developers have been doing fire sales to shore up revenue. Billionaire Li Ka-shing’s developer CK Asset Holdings made a rare move by agreeing to sell in bulk 152 new residential units in the luxury mid-levels district for HK$21bn ($2.6bn).

The deal prices the flats at around HK$62,000 ($7,900) per sq ft, about a quarter lower than the average sq ft price of HK$84,000 that the project’s other units were sold for over the past year. One unit previously broke a record in Asia with a purchase price of HK$459mn, or HK$136,000 per sq ft.

Li’s CK Asset was likely preparing for a “worsening outlook” in the property market by choosing to sell in bulk rather than offloading the units to individual buyers which could take months, said Eric Wong, managing director of private equity firm Bricks & Mortar Management.

New World Development chief executive Adrian Cheng struck a more positive note.

The group’s revenue from property development in Hong Kong fell to HK$5.8bn in the year to June from HK$7.8bn the previous financial year. But Cheng said at an annual results briefing on Friday that demand for residential flats would return in the longer run.

Additional reporting by Hudson Lockett in Hong Kong